Trade War Treachery: 3rd Qtr Economic Update, Pt. 3

Adrian Spitters, Bryce Wade

Mainstream media has been obsessed with the trade war between America and China, but the reasons for that war are not what you’re being told.

In this, part three of our 2025 3rd Quarter financial update, Will is joined by Adrian Spitters, a personal financial consultant who correctly predicted the stock market crashes of 2000 and 2008, and Bryce Wade, of New World Precious Metals to reveal what is coming and when, and what you can do to profit while others lose everything.

LINKS:

Buy precious metals at wholesale prices right here in Canada:

https://info.newworldpm.com/154.html

Get Sound Financial Advice:

Adrian Spitters, Private Wealth Advisor, Author, President, Performance Financial Consultants Ltd.

aspitters@pfcwealthsolutions.com

T: (604) 613-1693

Get Sound Financial Advice: adrian@itstartswithgold.com

Take back Canada! Find and Join your LOCAL Freedom Community FREE. https://freedomcoms.org

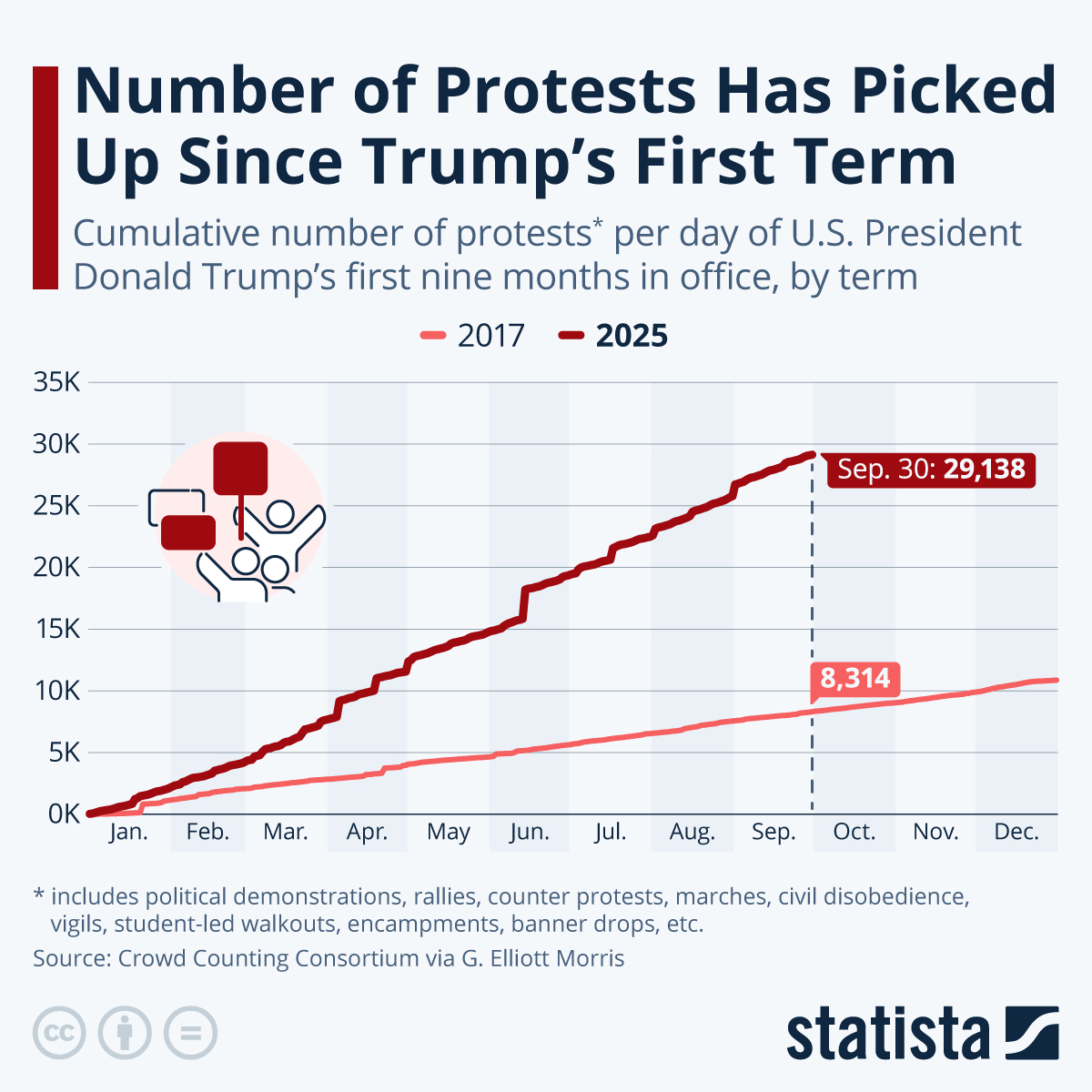

(0:00 - 0:32) Mainstream media has been obsessed with the trade war between America and China, but the reasons for that war are not what you're being told. The global economic system is in a managed decline, orchestrating a slow collapse by 2030, driven by unsustainable debt and deficits. By 2030, pension funds, healthcare and insurance systems will face insolvency due to insufficient reserves and an ageing population, leaving individuals with no assets, no protection, and no recourse. (0:33 - 1:19) At the same time, global governments are buying up gold in record amounts, preparing for a revaluation that will wipe out most of their debts, while the average citizen loses everything, their former wealth transferred to the hands of the rich and powerful. And the trade wars are nothing less than the battleground to determine which superpower will control the global economy after that planned collapse. In this, Part 3 of our 2025 Third Quarter Financial Update, I am joined by Adrian Spitters, a personal financial consultant who correctly predicted the stock market crashes of 2000 and 2008, and Bryce Wade of New World Precious Metals, to reveal what is coming and when, and what you can do to profit while others lose everything. (1:29 - 1:38) Gentlemen, thank you so much. We're back for Part 3 of this quarterly update. We've covered some amazing ground, talking about real estate, talking about digital currencies. (1:38 - 1:56) Now we're going to get into trade wars and all the things that circle around that, and what impact that's going to have. This time around, Bryce, we're going to have you start. Awesome. So there's a couple, kind of two big pillars that I'm going to talk about. One is the burgeoning trade war with China that already started earlier this year. Thank you, Mr. Trump. (1:56 - 2:12) But also with the de-globalisation. So Peter Zion, he's a geopolitical strategist, and he's not always as accurate as he thinks he is. I like the guy for a couple reasons, but he's made some pretty inaccurate predictions as well. (2:13 - 2:29) But one of the things I do like him for is the idea of the bifurcation and the balkanisation of global trade. And the reason for this is a couple different things. So one of the big ones is that the way that the global economy functions is through shipping. (2:29 - 2:54) There is a fantastic channel on YouTube called What's Going On With Shipping. Now, the reason that this is important is because when we face a recession or lots of trade, you can tell what's coming down the pipeline by the basis of what is happening with shipping. Because the way that our global economy functions is, it has to get from one place to another. (2:54 - 3:12) And the way that you do that is through shipping. And so the shipping industry is a canary in the coal mine for what's happening in the future. So when the Houthis did their thing in the Middle East for a couple years, it rerouted a whole bunch of things through the global supply chains, which affected us here. (3:13 - 3:20) That means there are shortages. That means things take longer to arrive. That means the whole supply chain that is globally integrated is being reorganised. (3:20 - 3:33) And this is one of the things happening right now. Now, this is basically a preface for one of my other points here, which is the trade war with China. Now, what is happening with that? Why is it important? So last week, and so this is like hot off the press information. (3:33 - 3:49) So last week, this is what China did. So typically, when you have an export, you say, I'm going to give you money, you give me the thing, and you send it to me, and I take it, I use it for whatever I want. So there's a transaction, and that transaction is over because I paid you money for it. (3:49 - 3:57) You don't have any authority. You don't have any control. You don't have any say or thoughts about what I do with the thing that I bought from you, right? Transaction over. (3:58 - 4:46) Well, China just basically threw that idea out the window and said, listen here, my friend, if you have any amount of our rare earths in your product, that could be magnets, that could be tools, that could be a car, could be anything, up to 0.1% of the total amount of the asset or the thing that you're building, you have to get an export licence from us. So this is what this means, right? So they're effectively saying, if you build a computer, if you create a magnet, if you do a doohickey or a whatchamajigger or a what'samahoozit or whatever you build, if it has our rare earths in it, up to 0.1% of the total amount of the thing that you build, you have to get an export licence from us. That means that they are trying to control the manufacturing process. (4:46 - 5:09) That means that even if a company in a different country imports that material to build the thing that they're building, they have to go and apply for an export licence from China. So the reason that they're able to do this right now is that they have a functional monopoly on two things, which is the rare earth production. So the mining of rare earth, it's a very dirty industry, and China doesn't care too much about that. (5:09 - 5:31) So they just dig up everything that they can at whatever speed that they can and then sell it. And the second part is the refining, which is also very dirty, which is why a lot of the refining is in China, because they don't care about the environment as much. And so what this effective monopoly has allowed them to do is say, hey, everybody, if you want to work with us, and you want to build the things you want to build, you better bow down and give us the export licence that we want. (5:31 - 5:47) And we have to look at your business model. In my mind, this is industrial espionage, like steroids, because then they look at your whole business model and say, hey, how do you build this thing? Well, if it's 1.2%, let's say, well, show me the whole thing. This is personally what I think is happening. (5:47 - 6:07) But the reason that this is important is that because this is a trade war, with the US, and so the response to this was an instant 100% tariff on China. So the quelling or the stabilisation of global trade with China that was going back and forth at the beginning of the year, when this was happening, has now reignited. Now, we don't really know what's going to happen. (6:08 - 6:18) And Adrian's going to dive deeper into this. But I just want to set the stage for this. This is a major, again, sea change in how things function, because this is an unheard of policy. (6:18 - 6:48) Nobody in all of human history has ever said, hey, other person in another country that you bought something off of me for, for the thing that you're going to build, you now need an export licence of your entire business model and the thing that you build for me to accept me selling this to you. And so what we're going to now see, and it should be noted too that Canada, here in Canada, we have a lot of rare earth minerals that we could be mining and be selling on the world markets, just saying. And what this is going to lead to is another reorganisation of global trade. (6:48 - 7:23) And so there's going to be a bifurcation of the trade lanes from east to west, right? And the Eurasia, basically the continent of the east, has the majority of the global population. So the Western-led world, which is Europe and North America and South America to some degree, and pieces of Asia, like Japan and some of the, like Australia, obviously, and some of the intermediate countries and the Asian countries, that is the Western-led world. And so if you want to work, you're going to be, basically we're coming to a point where you're going to have to make a choice. (7:23 - 8:06) Are you with those guys or are you with these guys, right? And this bifurcation is a precursor to what could be a lot worse, right? So a trade war is still a type of a war, right? And the kind of the fallout from this, I guess, will be, again, how do you do transactions, right? So to bring this all back to gold and silver, and the reason why I was bringing this up, is that the ability for you to settle transactions, right, is required if you want to do a transaction at all. So like when you go to somebody and say, hey, I will buy the thing from you, they say, well, where are you going to pay me, right? And if you don't have something that they will accept, they're not going to sell it to you. And so this is why on a nation state level too, we have an inordinate amount of demand. (8:07 - 8:50) So India and South Korea this year banned the sale of precious metals, silver specifically, but they've also been making massive purchases for this reason, to make sure that they can make transactions. So like Russia, they bought a huge amount of gold so that they could buy things that they wanted without not being under the Western dollar system. And so China is trying to do the same thing, and now we're seeing that this great power competition, if you will, that's happened many times throughout history, and that chart that I showed you earlier, well, this is one of the reasons that that type of thing happens, is because when you get into those great power competitions, well, there's a competition for what? For real things, right? And if you want real things, you need real minerals to build real things. (8:51 - 9:35) And so the commodity super cycle that Adrian's now going to talk about, this is one of the preeminent things that has been fuelling this trajectory, is that this great power competition is now going to the next level, and China's policy of doing this is unheard of. And to summarise, just before we switch to Adrian, because what you've just said is very important, Bryce, for people out there who have been looking at the tariffs from America onto China and thinking that what's going on here is just between America and China. No, what Bryce has just explained, this is a global thing, because what's happening here is that China, as Bryce explained, with these export licences, they are actually exerting control over what you can do with those rare earths. (9:35 - 9:55) And because those rare earths are so very important in so many technologies and products, that's a great deal of control on the global market. The US is therefore fighting back with 100% tariffs to try to stop them from doing that. But now on top of that, we've got China's road and... I'm sorry, Belt and Road Initiative. (9:55 - 10:00) Belt and Road Initiative, thank you. I was trying to think of that. Where they've already got their hooks into a whole bunch of different countries. (10:00 - 10:16) There's a lot of control there. So this is China really trying to expand their global control and America trying to push back against it with their own hegemony, as you pointed out. And so regardless of how this battle plays out, it is going to have an impact on the rest of the world. (10:16 - 10:26) And it's definitely gonna have an impact on us here in Canada. Adrian. We're all talking about gold and 2030 and why 2030 is a deadline. (10:27 - 10:41) And it's the managed decline of the West. Now gold is the signal that the trust is failing. It raises when governments lose credibility and paper promises break. (10:41 - 10:48) The search in gold tells us that the world is not fixing the crisis. It is a managed decline. And what we're going through right now is a managed decline. (10:49 - 11:06) The powers that be, they know that the systems are collapsing. And what they're doing is orchestrating a slow, slow decline. And they're putting in rules and regulations to prevent a total collapse. (11:06 - 11:26) By 2030, United Nations agenda aligns every major institution towards digital identity, programmable money and climate link control. Western nations are hitting a fiscal wall where debt, interest and entitlements exceed what taxpayers can cover. When that happens, governments will reach it for private wealth. (11:27 - 11:49) That is what's really happening is that you're gonna see pension funds are not gonna be able to maintain their obligations and pension payouts. It doesn't matter what kind of return you're gonna get on your pension assets, CPP, OAS. There's not enough new money coming in to meet the demand for retirees. (11:50 - 12:16) So they are gonna hit a fiscal wall that even pension funds are unsustainable. Healthcare, they have not been building up enough capacity in the hospitals and in the medical system to even take care of the wave of boomers that are getting to that age where they need care. So everything is running at a point that it's not sustainable anymore. (12:16 - 12:46) Pension funds, insurance annuities, they're reaching a point where there's not enough money in reserve to pay out annuity payments. It's not the death benefit that they're concerned about because when they insure somebody, they will buy a bond or they'll buy an asset that will be worth equal to the predictable death benefit when that person is predicted to die actuarially. So their insurance is covered by they're buying an asset to offset it. (12:47 - 13:08) But annuities are where the real problem is for insurance companies. By 2030, they're gonna be bankrupt. David Martin did a presentation a few years back during COVID and he was talking about Manulife and how they predict that they're not gonna be able to sustain their annuity payments by 2030. (13:09 - 13:29) So that's what's happening. Everything is gonna start hitting the wall by 2030 where nothing is sustainable and that's why they're pushing us into digital assets, digital control. So that's really why 2030 is the deadline is because there is no return from that point. (13:30 - 13:52) And I would add to that that I've been thinking along those lines myself for some time in terms of central bank digital currencies or whatever digital currency they end up putting on. Obviously, they have multiple plans for that. They have been propping up the current system until that new system is ready and they will continue to do that until the new system is ready. (13:52 - 14:13) And then when they feel they have a system that they can put into place very quickly to give them that level of control that CBDCs would give them, they will collapse the current financial system. And that's why the stock markets have not collapsed just yet because the financial media is bought. They are pumping stories basically to keep the market prop. (14:14 - 14:36) Don't look here, look here while we do this and everything's good. And so even though the tech AI stocks are gonna crash because what happens in a bubble like this is the stocks that lead a technology are not the ones that benefit down the road. When the tech bubble happened in 2000, the dot-com stocks, all of them went bankrupt. (14:36 - 14:53) A whole new breed of companies that nobody knew about came out of it. And it's the ones that were quietly doing the same thing but not getting the glory wound up buying the assets and were the ones that survived and became the powerhouses today. So the same thing is gonna happen. (14:53 - 15:03) All these big AI companies that are being pushed are not gonna be the ones that survive. Their valuations are way too high. They're not generating enough revenue to justify those valuations. (15:04 - 15:12) But it's the story that's keeping the market going. So- You've got a term for those, the big seven or something like that. The magnificent seven. (15:12 - 15:22) Magnificent seven, yes. Now maybe a company like Apple, which is sitting on cash, it's not gonna go bankrupt. But NVIDIA and some of the other companies, the valuations don't justify their earnings. (15:25 - 15:34) So AI, there's gonna be a whole turnover. And what is the leaders today are not gonna be the leaders going forward. So there's gonna be a massive crash in that segment. (15:34 - 15:54) And that's gonna drag the market down with it when it happens. But they don't want the market to really crash until they got everything in place so that they can then either, like Bryce was saying, maybe 2026, July 4th, that'd be when they reset gold. And that might be the trigger for everything. (15:55 - 16:14) But at the end of the day, everything basically needs to be set up where everybody is trapped in either crypto, or sorry, crypto, CBDCs or stable coin. So they want you in a digital asset so that they can allow everything to collapse. And then they can now control your spending so they can control the decline even further. (16:14 - 16:32) Because now they can control your spending habits to control commerce. They can control everything. And at the same time, they've pulled the rug out from under what has been for 100 years, the main source of wealth for the middle class, their property, their home. (16:33 - 16:49) By tokenising the mortgage, tokenising the title, so that once it's all digital, they can just crash the whole thing and you can wake up one morning and find out that you don't own anything. And that's why they're going after pensions. That's why in the first segment, we talked about the boomer homes. (16:49 - 17:09) There's a tonne of money sitting there that they want to touch. And they know that the boomers are going to lose their homes, that they can't sell it and they're going to be forced selling it. And that's why they're going to be putting on home equity tax, because they want to start taxing your wealth. (17:09 - 17:40) I just saw a video the other day, which I didn't talk about in the first segment, about now that if you own a rental home, they're planning on saying, well, you're in the business of renting, so your home is no longer a principal residence. Even though your home is not part of that business, they're going to say that you're in the real estate business, so you might lose your home personal residence exemption. And that just aligns with what Carney's doing with going after capital gains. (17:41 - 17:53) Exactly, exactly. And I'm going to talk about the farmers down the road, which is a massive, massive tax bubble that's coming. And I think that's going to come into play as well. (17:53 - 18:06) So in this slide here, Trump sees trade as an invasion. The new American trade doctrine. Trade has become a battlefield in 2025. (18:06 - 18:30) The United States redefined trade as a matter of nationalist defence, not just economics. Imports are now treated as security threats, and tariffs have become weapons in a global struggle for sovereignty. A new reciprocal tariff regime set a 10% baseline on nearly all imports rising much higher on strategic goods from China, the message is clear. (18:30 - 18:43) Economic dependence is now viewed as vulnerability. This shift marks the end of free trade era. Supply chains are the new front lines, and families will feel it through higher costs for food, fuel, housing. (18:44 - 18:59) In this new world, strength means independence, and survival means owning real, tangible assets like gold. So basically, trade tariffs are going to rule the day going forward. It's become the artillery. (18:59 - 19:09) It is the new battlefield. It is the new, no longer are we going to be shooting bullets and bombs. We're basically going to be just firing off trade tariffs. (19:09 - 19:33) And we just saw that recently with China and the 100% trade tariff as a retaliatory measure. So we're just going to see trade as a means of changing the direction of trade, basically. Yes, and it's really what you're talking about here, I believe, Adrian, is a virtual battlefield where wars in the past have always been about power, money, control. (19:34 - 19:51) Now, in the digital world, well, why bother doing that if all the wealth is controlled digitally? You don't need a physical war to control everything, to enrich yourself, to bankrupt your enemy. That can all be done in a digital battlefield. Yep. (19:53 - 20:05) Okay. I've been following the story, maybe you probably have too, about the ostrich farm. And my real interest in that is because of the bogus H5N1 bird flu. (20:05 - 20:16) They're trying to push that as the next pandemic. And the ostriches have completely got in the way of that. So I think right now, I've been watching closely. (20:16 - 20:25) They've had 400 birds. Now they're people with drones and going on top of mountains or counting the birds. There's only roughly 250 birds left. (20:25 - 20:43) Even though that there's a court order stay on the execution of the birds, CFIA is already there quietly killing the birds. That's what they think is happening. And they have video and photographic proof of it. (20:44 - 21:00) And the police are standing by CFIA. They're not doing anything about it. So the thing that angers me is where is PETA? Where is the animal rights activists standing up for this? Right? I would guess they've been bought off too, Adrian. (21:01 - 21:08) They've been bought off too. So the next pandemic is on hold until these ostriches are killed off. I think that's what's coming. (21:08 - 21:24) So anyway, the ostrich call in Canada sparks a battle over property rights and global trade. The ostrich call in British Columbia is no longer just about biosecurity. It's become a warning of how global trade compliance now overrides national sovereignty and the basic rights of ownership. (21:24 - 21:52) The Canadian Food Inspection Agency ordered the destruction of an $8 million flock not because of a proven illness, hypothetically, but to preserve Canada's disease-free trade status under the foreign aligned agreements. The farmers argued that birds were healthy, yet Ottawa acted to protect its export reputation, not its citizens. Compliance with trade rules now trumps the rights of individuals, families, and property owners. (21:53 - 22:32) Economic obedience has replaced freedom in the new standard of legitimacy. Through trade frameworks, climate policy, and biosecurity mandates, global governance is tightening its grip, quietly extending control over our food, land, and the very means of production. Okay? Now, an interesting thing is just recently, not only is, are they, you know, trying, CFIA has to kill the birds to justify that H5N1 is a legitimate disease, right? Right now, these birds are like 280 days disease-free or symptomatic-free. (22:32 - 22:43) I think I have to throw this in because I know you know this, but maybe the viewers don't. There has yet to be a single death in North America from H5N1 in a human being. Exactly. (22:44 - 23:21) They're trying to make a case for it, and it hasn't happened, right? So, but here's an interesting thing. I've written a number, or we've, Peter and I've written a number of articles on the DRIPA and UNDRIP and the native claims on unceded land, and there was the Haida Gwaii case where property owners lost their rights to their property. They can still use it, but the likelihood of them being able to sell their property is pretty remote because the natives now control it. (23:21 - 23:57) This has now also happened with the Cowichan ruling in Richmond where it's mostly industrial park, but there are people that in townhouses now, they can't sell their townhomes because they don't know what the future lies for those, so that now they're in trouble. And then just recently, the native bands in the area of Edgewood declared that the ostrich farm is on unceded territory. This land now belongs to the natives and that they made a declaration that CFIA cannot do anything without the approval of the local native band. (23:57 - 24:23) So they're now using this as another way of bringing in UNDRIP, more control of the land. So we're going to start seeing more and more cases where the natives are going to come in and declare that this land belongs to them, that this is unceded territory and all decisions must be made for them. And I need to interject again because the whole UNDRIP and DRIPA and the residential schools narrative is something else that I've spent a lot of time interviewing people on. (24:24 - 24:33) So for viewers who don't know, when Adrian says the natives, it's not really the natives, it's the people- It's the United Nations. Right. It's the people controlling the natives. (24:33 - 25:02) And if you have any doubt of that at all, please go and read Professor Frances Widdowson's excellent 2008 book, Disrobing the Aboriginal Industry, and you will understand what is happening to the billions of dollars every year that's supposedly going to our Aboriginal peoples. No, they're not. And this whole UNDRIP, DRIPA is just the next step in that to give globalists, the UN, whatever, control over our lands and resources. (25:03 - 25:11) The natives are not the problem. They're simply being manipulated. I just got to throw in a case happened next door to my place. (25:11 - 25:42) There was a major develop called Weetown, 40,000 high-rise developments right here in town, like a 15-minute city, self-contained. There's a farmer, a family, one of the legacy families in Alastair that basically owns McKee Mountain, McKee Peak, and it's ranch land. And it's also a major biking, what do you call it, mountain biking, because people turn it into mountain biking trails. (25:42 - 26:07) But they wanted to develop that mountain for subdivisions and for that development. And I was at a town council meeting on that two years ago, and the local natives declared that this hearing needs to be stopped because we're on unceded land and this land belongs to the natives and no decision on this development can go forward without their approval. So they shut it down. (26:08 - 26:27) So town council recognised the natives and they said, okay, we're going to reconvene after we've had a discussion with the natives on this subject. So they're exerting their powers right now, and they're getting encouraged to stand in front of everything that's being done. And so there's going to be more and more cases coming. (26:27 - 26:34) I know this is a little bit aside from the trade situation, but this is all coming into play. It's not. That's the point I'm raising. (26:34 - 26:52) It's not aside from the trade association, because as we've already covered, the whole trade war thing is a global war. And the United Nations or the globalists, and I use the term globalists very broadly, but the forces that are behind UNDRIP and DRIPA, it's the same people. Yep. (26:53 - 27:14) Yep. Exactly. So again, what's happening here is the ownership of farmland is under threat, even though we're fighting this H5N1 and CFIA is trying to assert their authority that these birds have to die because this so-called disease is legitimate. (27:14 - 27:28) And if these birds weren't killed, then they would lose all credibility and the H5N1 narrative would die or potentially be damaged greatly. So there's a lot at stake. And even though there's a stay, they're already busy killing birds. (27:30 - 27:48) And if anybody is following the Canadian Business Farm Alliance, I'm posting everything I find on the subject on that and what's going on in Edgewood. So we're going to lose our property rights in addition to this whole pandemic being moved forward because the birds are being killed. Yes. (27:50 - 28:12) All right. This is a ticking time bomb where I think CRA or Carney is going to extract a lot of money and why we're seeing global interest coming in waiting to buy up farmland. One of the things that... I've been in this business. (28:12 - 28:31) I've been dealing with farm succession planning, rollovers and advising farmers. You can roll over your farm tax-free to the next generation and you work with special accountants who are able to do this. But what I didn't realise throughout my career is that I was helping build a ticking time bomb for farmers. (28:33 - 28:45) Farm rollovers is a hidden tax bomb. Farm rollovers are not new, but they've become a ticking time bomb. Ottawa knows that the deferred taxes buried in family farms represents billions of unrealized revenue. (28:46 - 29:03) As debt climbs and deficits expand, the government is quietly preparing to harvest those taxes as farmers are pushed into insolvency. This collapse will not happen in isolation. It will coincide with the global commodity super cycle where demand for food, fertiliser and farmland skyrockets. (29:03 - 29:23) As farmers go bankrupt, global investors and state-backed funds will move in buying Canadian farmland at deep discounts. The result is a double win for global interest and government coffers. Ottawa collects long deferred capital gains while foreign buyers gain control of the very asset that feeds the world. (29:23 - 29:46) The next trade war will not be fought over tariffs, but over ownership of the soil itself. Okay, the farm rollovers. What that is is if you're farming and you buy a farm and now you're ready to retire and then your kids take over the farm, there's a rollover provision that you can roll over the value of the farm tax-free. (29:46 - 30:00) So your original adjusted cost base, let's say 50 years ago, you bought a farm for $100,000. Okay, that's a lot of money back then and it's worth $10 million today. Your ACB is $100,000. (30:01 - 30:22) The rest is all capital gains. So subsequent generations, all they do is roll over from one generation to the next generation, to the next generation. Now we're dealing with farmers in the Fraser Valley that are four generations long that the current children that own the farm have a tax bill from what their parents paid for the farm. (30:22 - 30:35) Now there's farm improvements. They bought more land along the way, but those original purchase prices are still the ACB or the adjusted cost base of the farm. The value today far exceeds what they paid for it. (30:35 - 30:59) That difference is a huge capital gain. Now what's happening is farmers are being forced into bankruptcy through all rules and regulations and conditions so that a lot of the children, maybe they're not going to go bankrupt right now, but the children says, I don't want to farm. The regulations, I had one chicken farmer saying, it takes me more time to keep up with the regulations than I'm managing my farm. (30:59 - 31:06) So it's becoming onerous. So this next generation of farmers don't want to farm. It's too much work. (31:06 - 31:17) And it's being done intentionally. So now, go ahead. Being done intentionally to push them out so the global corporations can come along, as you say, and buy them up at a discount and control the food supply. (31:18 - 31:28) So the kids don't want to farm. So now they're not going to preserve the wealth to the next generation as a farm rollover. They're now going to sell it as a deemed disposition. (31:28 - 31:36) So all those unrealized gains from four or five generations of farmers show up now. And that's a massive tax bill for CRA. Yes. (31:37 - 31:51) And I think they're doing this knowing that they're going to crystallise, especially on the farmers, fishermen. Those unrealized gains are going to come forward. So that is a major, major push. (31:51 - 32:00) And that's playing into farm commodities and the ability... Because the global interest now want to buy the commodities. They want to buy the grains. They want to buy the fertiliser. (32:00 - 32:15) They want to buy the assets that the farmers are controlling. Now, the next few slides, I'm just going to talk about how my clients can actually benefit from the super cycle. We talked about the commodity super cycle. (32:16 - 32:40) If you have large tax breaks or a large taxable income or large capital gains that you want to offset, there is a way to take advantage of the super cycle in commodities by owning what's called flow-through shares. And I'll just quickly explain that. As the next global commodity super cycle unfolds, the real winners will be those who own resources that the world needs most. (32:41 - 33:10) While government's tax productivity expands debt, investors who redirect those taxes into Canadian resource sector are turning liabilities into assets. Flow-through investing allows Canadians to convert income taxes into ownership of gold, copper, and critical minerals, building equity instead of paying it away. In a world where trade wars are reshaping supply chains and global powers are competing for control of raw materials, this strategy offers both tax reduction and wealth creation. (33:11 - 34:01) If you're interested in learning more how to invest in and reducing your taxes and benefit from the commodity super cycle, you can contact me in the show notes. Really what's happening is our government is encouraging taxpayers to invest in flow-through shares of gold mining companies, uranium mining companies, all commodities, and you get massive tax breaks initially on real assets, gold, et cetera, mining companies. There's 100% tax break on that, and then there's other tax breaks of 30% and 40% on dollars invested in different commodities so that by the time you invest in these commodities, only 25%, roughly 20% of your money is at risk in the commodities. (34:01 - 34:28) Now, not only did you now just get the tax break, you're buying into a commodity super cycle if you saw from that slide that Bryce showed earlier that you're buying at the very bottom of a long-term cycle. There are ways that you can capitalise on owning the very assets, get the tax breaks at the same time so not only are you benefiting from the tax break, but now you own an asset that's going to participate in a major upside cycle. There's an opportunity to reduce your taxes and participate in that. (34:29 - 35:04) Any comment on that, Bryce or Will? I don't. Yeah, as Adrian was saying, and as I've reiterated many times, and this will, I think, be my closing argument here, is that the amount of changes that we're seeing in the economy are not decelerating, they're accelerating. When you look into the future and you say, where am I going to position myself? How am I going to do that? This is one of the core things that I think everybody needs to understand, is that you need to protect yourself and your family. (35:04 - 35:18) Gold and silver is one of the things that allows you to do that, and it should be a part of everybody's portfolio. All of the things that we've talked about today is fully illustrated for everybody. And I'm not only saying that because I sell gold and silver, I've believed this for a long time. (35:20 - 35:29) But the sea change that we're seeing, you are in a position. Is it a good position? Yes or no. If it's not, you've got to change your position. (35:29 - 35:44) If it's a good position, double down on that because it's a good position. And the amount of changes that we're seeing are going to be accelerating more. We've already seen a whole bunch of stuff, now there's going to be more coming. (35:44 - 36:01) It's really hard, even for you, Will, I'm sure this is difficult, to keep up with all of the things that are changing on a regular basis. We used to say that sometimes there's weeks without news and sometimes weeks worth of news happens in a week. Weeks of news happens in one week or something to the effect of that. (36:01 - 36:29) The point that I'm making with that is that when you have more things happening and you have... The idea of game theory is like a small change can make a big change because everything's connected. And when you have massive amounts of big things happening, we're really into uncharted territory, both in the history of civilisation but specifically financial history. We're really living through a new regime, if you will. (36:29 - 36:38) And a transition to something new. Now, is that new transition going to benefit us? I don't know. Probably not. (36:39 - 36:59) But what I do know and what I think is really important is that gold and silver is going to hold a really important position regardless of what happens. So best case scenario, none of the bad stuff we talked about today happens. You know, DJT solves world peace and everybody high fives and sings Kumbaya around the fire and everything. (36:59 - 37:30) We go into space, loving each other and high-fiving all the way to the moon. Or we don't. And in any of those cases, from anything in between to good, bad, ugly or otherwise, you're going to have to make a determination of where am I going to be? What am I going to do? How am I going to protect myself? Who am I going to work with? Who am I going to collaborate with? And what do I spend my time, energy and effort on? And the more options that you have to facilitate the best position you think, you should be in, the better. (37:31 - 37:40) And one of the things that we've seen a lot recently is there's a lot of people migrating all over the planet. There's a lot of people immigrating here. It's a lot of people emigrating out of Canada. (37:40 - 37:59) There's a lot of people moving around to reposition themselves, their financial situation and their families for what they see happening in the future. And I think it's really important, especially right now, to make sure that you have the best possible chance of protecting yourself and your family. And one of the things that we recommend to do that is gold and silver. (37:59 - 38:20) As I've reiterated many times, I think that the window for doing this isn't closed, not by a long shot, but there's only, like I've said before, there's only so much out there, right? And you want to make sure that you have a handful of it in your possession, as well as protecting some of your larger amounts of wealth. We've had a lot. We actually had a record month here at the company. (38:21 - 38:39) We've done a lot of sales this month. Me personally, some of the other brokers, like there's a lot of people calling us up. There's a lot of people that are looking for, hey, how do I move my money out of the markets? How do I move my money into something safer? How do I move my money out of the banks? How do I move my money to somewhere safer, just in general, right? There's a lot of people that are just asking us all these questions. (38:40 - 38:53) We regularly do presentations on this. And you can, if you click on the link that's attached to this video, you can get connected with us. You can set up a meeting with us to discuss this or Adrian. (38:53 - 39:06) But we also, if you just want to come and learn about gold and silver and all this doom and gloom is like, hey, I just want to learn more about gold and silver itself. We can do that as well. We do regular presentations almost on a biweekly basis pretty much now. (39:06 - 39:42) So I just want to leave everybody off with the idea that this isn't a done deal, right? This isn't a certain destruction of anything. This is a time of volatility and you can position yourself in a way that you capitalise on this or you can be positioned in a way that you suffer from this, right? And we want as many people as possible at New World Precious Metals to benefit from what's happening, not be wiped out by it. And if that's something that you're interested in doing, you know, come and talk to us and we're happy to help or explain this in gory and great detail and as much as you want. (39:42 - 39:59) We spent a lot of time with a lot of the clients that we have because we're a very hands-on company. And we believe that everybody should have a piece of their portfolio, if not a significant amount of their portfolio in precious metals because of all the things that are happening right now. So, as always, Will, appreciate the time, man. (39:59 - 40:02) Thank you, Bryce. Adrian, you have a few more notes for us. (40:02 - 40:07) Yeah, I just got one more slide to talk about. I just want to come back to the commodity thing. (40:08 - 40:29) When we talk about, you know, the Magnificent Seven is basically taking over the market. When they crash, you got to remember that the commodity stocks have underperformed. What's going to happen is when those Magnificent Seven stocks crash, the portfolio managers start rotating out of those stocks and start buying the undervalued stocks. (40:29 - 40:44) And those commodity stocks are grossly undervalued right now. So a lot of that money that when the market crashes is going to actually support the commodity stocks. And we're going to see, just like I saw back in 2000, when the tech stocks blew up, where did that money go? It bought precious metals resource stocks. (40:45 - 40:59) I think the same cycle is going to happen. So even though the market's going to crash, the commodity stocks are not going to crash. They're going to see the money that they weren't getting during this AI cycle. (40:59 - 41:17) So it's a safe haven in one way that when the market does collapse, they're going to see that flow of money. So not only are you going to get that tax break, for those who have major tax issues, you can get that tax break, but you're setting yourself up to be where the money is going to flow when the market does crash. So that's one thing. (41:18 - 41:32) And the final trade thing is that farmers in Canada right now are buying their fertiliser from the United States. They ship their natural gas to the US. They then manufacture urea and they manufacture nitrogen fertilisers. (41:33 - 41:48) And then they ship it to Canada at world prices. And now there's a company that we're working with that is actually building a fertiliser plant in Belle Plain, Saskatchewan. And they have railway lines. (41:48 - 42:27) They have the natural gas pipes right there. They have everything they need to build the facility and the government backing and institutional backing to build a fertiliser plant that the farmers, even though they're going to be buying the fertiliser at market price, they're going to get a refund that translates into a major, major discount for Canadian farmers. And in a sense, they're buying into a ownership share of this company, but there's an opportunity for investors to participate where you're going to be getting, you can buy shares of this company and participate in the profits. (42:27 - 42:49) And the price difference between what they can produce it and what the world price is, it's significant. And this is much needed right now because the actual plants that are in Canada right now are very old and they're at the end of their cycle. And if there's no new plants coming in, we're going to see natural gas, or sorry, fertiliser prices even go higher. (42:49 - 43:05) So this is sort of a way where we're taking control of the nitrogen supply chain. So there's another opportunity for higher net worth investors to profit from this potential strategy. So I just want to leave it with that. (43:06 - 43:10) All right. Thank you so much. Gentlemen, thank you again for your time. (43:10 - 43:28) As always, folks, you see these interviews spread out over days, but in actual fact, we record them all in one day. So these two gentlemen have just gone through a four-hour marathon to provide us with all this information. Both of you, thank you so much, Bryce, for your information with New World Precious Metals, Adrian for your expert advice. (43:28 - 43:40) And as always, folks, you will find links beneath this interview where you can contact both New World Precious Metals or Adrian for their financial advice or to find out more about precious metals and invest in them. Thank you all.