Money | U.S.

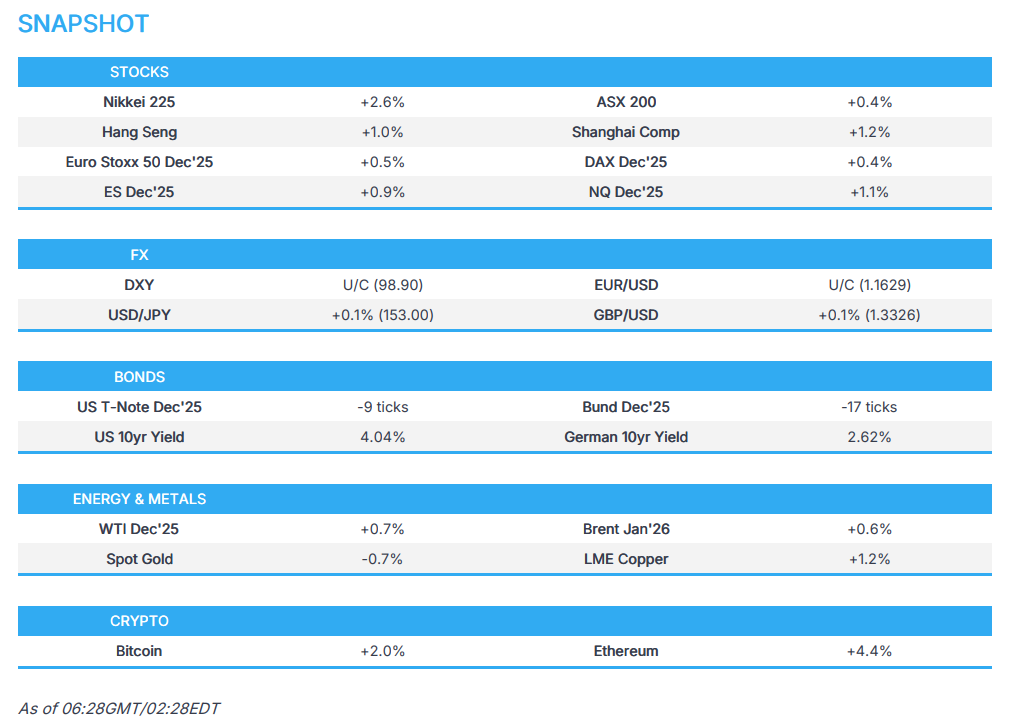

US-China trade talks positive, increasing market sentiment; Eurostoxx 50 future firmer by 0.6%.- Newsquawk European Opening News

3 hours ago

Originally posted by: Zero Hedge

- US and China reached a framework for Trump-Xi talks this week. US tariff increase on China averted, China was said to have agreed to delay a new rare earth exports licensing regime for a year.

- The US is to immediately raise tariffs on Canada by another 10%.

- APAC stocks are mostly higher, ES is up by the best part of 1%, Eurostoxx future firmer by 0.6%.

- DXY flat with the USD showing a mixed performance vs. peers; softer vs. risk-sensitive currencies, firmer vs. havens.

- US President Trump said he won’t meet with Russian President Putin until he thinks they have a peace plan.

- Moody’s maintained France’s rating at Aa3, but revised the outlook to negative from stable.

- Looking ahead, highlights include German Ifo (Oct), EZ M3 (Sep), Dallas Fed (Oct). Suspended Releases: US Durable Goods (Sep), Atlanta Fed GDPNow. ECB’s Elderson.

- UK clocks moved back an hour during the weekend and reverted to GMT, which means there will just be a 4-hour time difference between London and New York for the week ahead until US clocks change on Sunday 2nd November.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed in the green on Friday and were buoyed by a soft US CPI report, which did little to alter money market pricing into the upcoming Fed meeting in the week ahead, whereby a 25-bps cut is a near certainty. Sectors were predominantly firmer, with Technology and Communications outperforming, although Energy lagged, while participants also await a deluge of key earnings, with 5 out of the Mag-7 reporting.

- SPX +0.79% at 6,792, NDX +1.04% at 25,358, DJI +1.01% at 47,207, RUT +1.24% at 2,513.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump announced the US is to immediately raise tariffs on Canada by another 10% because of the fraudulent ad misrepresenting Ronald Reagan’s view on tariffs. Trump said Canada has been ripping the US off for a long time, and they’re not going to do it anymore

- US President Trump said he expects a very fair meeting with Chinese President Xi and he is optimistic about a China deal, while he said he will do some good business with Chinese President Xi and that he has a lot to talk about with Xi.

- US President Trump said they might sign a final deal on TikTok on Thursday; received provision approval from Chinese President Xi.

- US Treasury Secretary Bessent said China is ready to make a trade deal and that they have a framework for Trump-Xi talks, while he added that US President Trump and Chinese President Xi will make the final decisions. Bessent separately commented that the tariffs increase on China was averted and that China agreed to delay a new rare earths export licensing regime for a year. Bessent also stated that he expects the Chinese to be making substantial purchases of US soybeans again soon and that US soybean farmers will feel good about coming soybean seasons for several years when the Trump-Xi trade deal is announced, as well as noted that the details of the TikTok deal are ironed out with Trump and Xi able to consummate that transaction in South Korea on Thursday.

- China’s top trade negotiator Li said they reached a consensus with the US and talked about tariffs and export controls, while he added they will enhance communication with the US and talked about 301 port fees, trade expansion and fentanyl.

- Chinese Vice Premier He said they should jointly implement the consensus reached with the US, while he added that China and the US should find ways to properly address each other’s concerns through equal dialogue and consultation.

- USTR said on Friday that they initiated a trade investigation of China’s implementation of the Phase One agreement with the US. It was also reported that China’s embassy to the US said regarding the USTR investigation that China opposes false accusations related to investigation measures and that US actions have done serious damage to US-China ties as well as economic and trade relations, while it urged the US to promptly correct wrong practices.

- US and Vietnam announced a framework for an agreement on reciprocal, fair and balanced trade, while the deal will provide both countries’ exporters unprecedented access to each other’s markets. The joint statement noted that the US will maintain a 20% tariff on Vietnam but will identify products and potential tariff adjustments for aligned partners to receive a 0% reciprocal tariff rate.

- US signed a trade deal with Thailand, Cambodia and Malaysia in which the US would maintain a tariff rate of 19% on exports from all three countries under the deals, while the deal with Malaysia enhances US access to rare earths.

- US and Malaysia joint statement noted that Malaysia has committed to provide significant preferential market access for US industrial goods exports and committed to address non-tariff barriers that affect bilateral trade in priority industrial areas.

- US and Thailand joint statement noted that the US will maintain a 19% tariff on Thailand, but will identify products and potential tariff adjustments for aligned partners to receive a 0% reciprocal tariff rate.

- US and Cambodia joint statement noted that Cambodia commits to eliminating tariffs on 100% of US industrial goods and US foods and agricultural products exported to Cambodia.

- US President Trump said that they are going to make a deal with Brazil, while he also commented that they may reduce Brazil’s tariffs and are pretty close on a South Korean deal.

- South Korean President Lee said South Korea and the US trade talks are still deadlocked over USD 350bln investment in the US, while a South Korean presidential advisor said they find it difficult to reach a tariff agreement between South Korean President Lee and US President Trump during the APEC period.

- Brazil’s President Lula said decisions against Brazil by the US are wrong, but noted he had a very good impression at the meeting with US President Trump, while he added that he respects Trump and Trump respects him, and he handed Trump a written agenda. Furthermore, Lula said they will reach a deal with the US and that Trump was the most enthusiastic in the meeting, while he is convinced in a few days they will reach a solution and is sure everything is going to work out well.

- Brazil’s Foreign Minister Vieira said US President Trump and Brazilian President Lula had a happy conversation and the meeting was positive, while he stated that Trump gave the instruction to start a bilateral negotiation process. Furthermore, he said they will have conversations targeting a tariffs suspension, and the first step of negotiations was with USTR Greer, Commerce Secretary Lutnick and Secretary of State Rubio on Sunday.

- Chinese Premier Li met with European Council President Costa and said China is willing to work with the EU to keep bilateral relations on the right track, according to Xinhua. It was separately reported that Costa said he shared a strong concern with Li about expanding export controls on critical raw materials, and urged Li to restore as soon as possible fluid, reliable and predictable supply chains. Furthermore, he expressed expectations that China helps to put an end to Russia’s war against Ukraine and stressed the need to make concrete progress as a follow-up to the EU-China summit.

- UK Chancellor Reeves is to hold Gulf trade talks in a push for pro-growth policies with Reeves to conduct trade talks in Riyadh on Monday, according to FT

NOTABLE HEADLINES

- US Treasury Secretary Bessent said overall inflation has come down since President Trump took office and he is confident that inflation will fall further towards the Fed’s 2% target, while Bessent also said that the government shutdown is starting to eat into the muscle of the US economy.

- US Transportation Secretary Duffy warned that travellers will face more flight delays and cancellations in the coming weeks amid the continuing shutdown, according to Bloomberg.

- Fed proposed changes to boost bank stress test transparency on Friday, with the Fed to disclose and solicit feedback on stress test models and scenarios for the first time under the new proposal. Fed Vice Chair for Supervision Bowman said the changes would improve bank capital planning, while Fed’s Barr objected to the proposed changes and warned that it would weaken the test and lower bank capital.

- European rating agency Scope downgraded the US credit ratings from AA to AA-; outlook revised to stable from negative.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher amid trade-related optimism after the US and China reached a framework for Trump-Xi talks this week, with the US tariff increase on China averted, while China was said to have agreed to delay a new rare earth exports licensing regime for a year.

- ASX 200 gained as strength in tech, financials and industrials led the upside seen in most sectors, while defensives lagged.

- Nikkei 225 rallied to above the 50k level for the first time ahead of US President Trump’s visit to Japan, where the sides are expected to ink a tech-cooperation MOU covering areas, including bio, quantum, nuclear fusion energy and space.

- Hang Seng and Shanghai Comp benefitted amid hopes of improving US-China ties, with the sides said to reach a consensus ahead of the Trump-Xi meeting on Thursday, while Industrial Profits data from China showed the fastest growth in two years.

- US equity futures (ES +0.9%, NQ +1.1%) climbed at the open as markets reacted to the positive trade developments from over the weekend, while participants also await a slew of major risk events this week, including central bank policy decisions and mega-cap earnings.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.6% after the cash market closed with gains of 0.1% on Friday.

FX

- DXY eked marginal gains in rangebound trade despite the US reaching a consensus with China ahead of Trump-Xi talks on Thursday and with the US inking several trade agreements with South East Asian partners during President Trump’s visit to the region including a rare earths deal with Malaysia, while Trump now heads to Japan where he is set to meet the Emperor later today before meeting PM Takaichi on Tuesday. Nonetheless, there remains a non-committal tone in the FX space ahead of this week’s major key events, including central bank rate decisions from the Fed, BoC, BoJ and ECB.

- EUR/USD lacked firm direction with ECB’s Escriva suggesting the current level of interest rates is appropriate, while a report suggested that delays in the wealth tax vote and possible budget debate compromise raise the threat of a government collapse in France.

- GBP/USD eked slight gains after its recent rebound from a brief dip beneath the 1.3300 handle, but with the upside capped by light pertinent news flow.

- USD/JPY oscillated around the 153.00 level with price action indecisive as tailwinds from the positive risk sentiment were offset following firmer-than-expected Services PPI data from Japan.

- Antipodeans mildly outperformed due to their high-beta statuses and China exposure amid the US-China trade optimism, while the PBoC also set the strongest USD/CNY reference rate setting in just over a year.

- PBoC set USD/CNY mid-point at 7.0881 vs exp. 7.1146 (Prev. 7.0928)

FIXED INCOME

- 10yr UST futures declined at the reopening following reports of US and China reaching a framework for Trump-Xi talks, while participants also braced for a busy week of risk events with several key earnings releases and central bank decisions due this week, including from the Fed.

- Bund futures extended on declines after last week’s drop to sub-130.00, and with German IFO data due later.

- 10yr JGB futures retreated with prices dragged lower following firmer-than-expected Services PPI data from Japan, while Japanese Finance Minister Katayama commented over the weekend that if needed, the government must obviously come up with means to fund an increase in defence costs, when asked whether Japan could issue deficit-covering bonds.

COMMODITIES

- Crude futures mildly gained but are off the early highs that were spurred by US-China trade optimism.

- At least 5 workers were seriously injured in an oil pipeline fire in Iraq’s Zubair oilfield, while the fire has not affected production from the oilfield, which stands at 400k bpd.

- US Energy Secretary Wright said the US is to double natural gas exports in the next five years, and could double it again in another five to ten years if demand is there.

- TotalEnergies (TTE FP) is ready to restart the USD 20bln Mozambique LNG project four years after it was halted due to a terrorist attack, according to FT.

- Spot gold retreated with havens pressured after the US and China reached a consensus ahead of Trump-Xi talks.

- Copper futures rallied as trade optimism regarding the world’s two largest economies spurred risk appetite, which lifted LME copper futures to their highest since May last year, above the USD 11k per ton level.

- White House announced a proclamation on regulatory relief for certain stationary sources to promote American mineral security, while the proclamation noted that certain stationary sources are exempt from compliance with the copper rule for two years.

CRYPTO

- Bitcoin gained overnight in a somewhat choppy fashion and returned above the USD 115k level.

NOTABLE ASIA-PAC HEADLINES

- Almost two dozen world leaders are visiting the Malaysian capital of Kuala Lumpur for the 47th ASEAN summit, which takes place from Sunday to Tuesday.

- US President Trump posted “Just leaving Malaysia, a great and very vibrant Country. Signed major Trade and Rare Earth Deals, and yesterday, most importantly, signed the Peace Treaty between Thailand and Cambodia. NO WAR! Millions of lives saved. Such an honor to have gotten this done. Now, off to Japan!!!”

DATA RECAP

- Chinese Industrial Profits YY (Sep) 21.6% (Prev. 20.4%)

- Chinese Industrial Profits YTD YY (Sep) 3.20% (Prev. 0.90%)

- Japanese Services PPI (Sep) 3.0% vs Exp. 2.8% (Prev. 2.7%)

GEOPOLITICS

MIDDLE EAST

- Israel’s military said it conducted a targeted strike in central Gaza.

- US President Trump said on Saturday that Hamas must start returning the bodies of hostages and that they will be closely watching over the next 48 hours.

- US Secretary of State Rubio said the US team is working on a possible UN resolution or international agreement to authorise a multinational force in Gaza.

RUSSIA-UKRAINE

- US President Trump said he won’t meet with Russian President Putin until he thinks they have a peace plan.

- Kremlin said Russian armed forces will respond harshly in the event of strikes deep inside of Russia. It also stated that it is wrong to talk about the cancellation of the Putin-Trump summit and there is an understanding between Russia and the US that it would not be good to delay the meeting, according to RIA.

- Russian President Putin said Russian forces conducted training live launches of all three components of the strategic nuclear forces drill, while the strategic nuclear forces drill confirmed the reliability of Russia’s nuclear shield.

- Russia’s General Staff of the Armed Forces head Gerasimov said Russian forces are advancing in Ukraine’s Dnipropetrovsk and Zaporizhzhia regions, while he also stated that a successful test of the Burevestnik missile with a nuclear power unit was conducted on October 21st, according to Interfax.

- Russian President Putin’s special envoy Dmitriev said on Friday that Russia-US dialogue is vital for the world and must continue with full understanding of Russia’s position and respect for its national interests. Dmitriev said dialogue between Russia and the US is continuing despite recent ‘unfriendly steps’ from Washington, and such dialogue is only possible if Russia’s interests are treated with respect, while he added that various forces, mainly the UK and Europeans, are trying to derail direct dialogue between Putin and Trump.

- Ukrainian President Zelensky called for sanctions on all Russian oil companies, the shadow fleet and oil terminals on Friday.

- UK PM Starmer said on Friday that the coalition of the willing is determined to go further than ever to ratchet up pressure on Russian President Putin, while he stated the meeting was clear that work on using frozen Russian assets needs to come to fruition quickly.

OTHER

- US President Trump responded that they will see, when asked about strikes in Venezuela. Trump also commented that he has a lot of respect for Taiwan, while he is not sure if he will meet with North Korean leader Kim during his Asia trip, but added that he likes Kim personally. It was separately reported that North Korea may possibly be preparing for a Trump-Kim meeting, although a South Korean presidential adviser said that they don’t see a meeting between US President Trump and North Korea leader Kim likely to happen.

- US President Trump said he would like to meet North Korean leader Kim Jong Un, if the North Korean leader would like to meet; would extend his trip if it was possible to meet with the North Korean leader

- North Korea’s Foreign Minister is to visit Russia on October 26th-28th.

- US Secretary of State Rubio said Taiwan should not be concerned about US-China talks, while he added the US is not going to walk away from Taiwan in return for trade benefits with China.

- Thailand and Cambodia signed a peace deal on the sidelines of the ASEAN Summit in Kuala Lumpur, according to Nikkei.

EU/UK

NOTABLE HEADLINES

- UK was reported on Friday to be considering shorter IPO times to boost UK listings, according to Bloomberg.

- French lawmakers refrained from voting on a Socialist proposal for a wealth tax on Saturday, delaying a possible compromise in a budget debate which risks collapsing the fragile minority government, according to Bloomberg.

- ECB’s Escriva said the ECB is communicating in its statements after each meeting that inflation is truly at the target of 2% and they think it is a good time to look ahead and consider the current level of interest rates appropriate.

- Moody’s maintained France’s rating at Aa3, but revised the outlook to negative from stable.

Loading…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.