U.S. | Money

Pronounced risk off into ‘Liberation Day’, though crude remains underpinned on US-Iran relations – Newsquawk US Market Open

March 31, 2025

Originally posted by: Zero Hedge

NS

NS

- US President Trump is said to be pushing senior advisers to go bigger on tariff policy as they prepare for ‘Liberation Day’ on April 2nd; reportedly revived the idea of a flat universal tariff single rate on most imports.

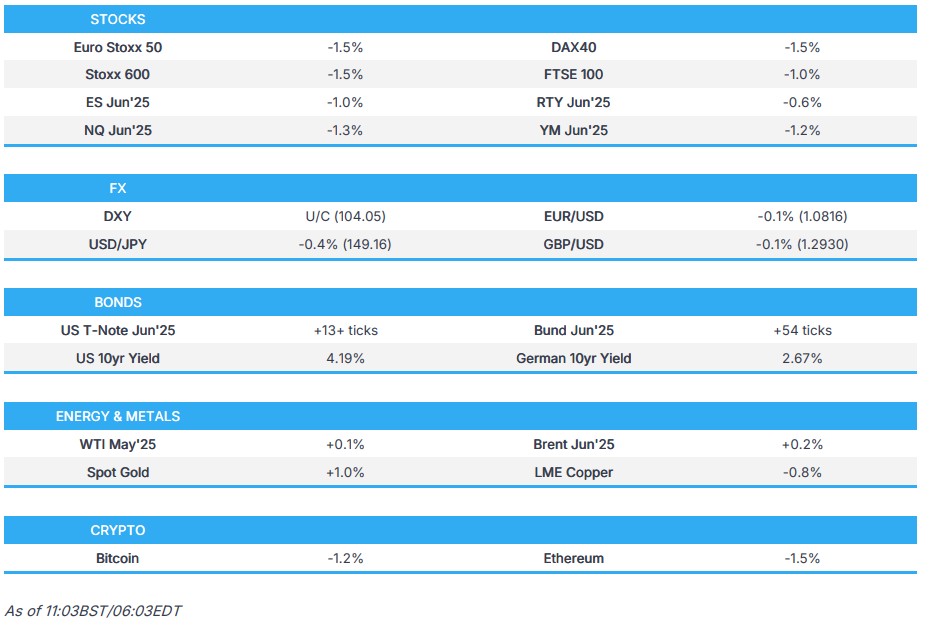

- European bourses and US futures in the red given the above and into month & quarter end, Euro Stoxx 50 -1.5%, ES -1.0%; NQ -1.3% with NVDA pressured.

- DXY has been on either side of the unchanged mark throughout the morning, EUR and GBP flat/slightly softer while USD/JPY hit a 148.71 low as the Nikkei 225 entered correction territory.

- Fixed benchmarks bid on the broad risk tone, German State CPIs sparked a fleeing move lower into the mainland figure, JGBs slipped as the BoJ cut its bond purchase amounts.

- Crude firmer as geopolitical tensions outweigh the macro tone following reports around Trump on Iran, XAU at a fresh record high, base metals dented.

- US President Trump threatened to bomb Iran if a nuclear deal can’t be reached, while he also warned of secondary tariffs on Russian oil.

- Looking ahead, highlights include US Chicago PMI & Trump’s executive orders.

- Note: UK clocks changed from GMT to BST on Sunday which means the London to New York time gap returned to five hours.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

UPDATES FROM THE US

- US President Trump said he will hit essentially all countries that they’re talking about with tariffs this week and commented that there will be a deal on TikTok before the deadline, according to Reuters.

- US President Trump is said to be pushing senior advisers to go bigger on tariff policy as they prepare for ‘Liberation Day’ on April 2nd and reportedly revived the idea of a flat universal tariff single rate on most imports, according to Washington Post. It was also noted that the option viewed as most likely, publicly outlined by Treasury Secretary Bessent this month, would set tariffs on products from the 15% of countries the administration deems the worst US trading partners which account for almost 90% of imports.

- US President Trump’s closest allies including Vice President Vance, Chief of Staff Wiles and cabinet officials have privately indicated they are unsure exactly what President Trump will do during the April 2nd announcement of global tariffs, according to Politico.

- US President Trump’s recent 25% auto tariff announcement made no mention of USMCA trade deal side letters shielding Canada and Mexico from potential auto tariffs which showed Canada and Mexico were each granted annual duty-free import quotas of 2.6mln cars and unlimited light trucks if Trump imposed global tariffs.

- US President Trump’s Trade Adviser Navarro said auto tariffs will raise about USD 100bln and the other tariffs are to raise about USD 600bln a year, according to a Fox interview.

- US White House has reportedly discussed providing support to farmers as the President escalates the trade war, according to NYT.

UPDATES FROM OTHER NATIONS

- Canada said it fully expects the US to honour the 2018 tariff pledges and it reserves the right to take retaliatory measures, while Mexico is evaluating the legal implications of the agreement on Trump’s ‘Section 232’ auto tariff probe.

- UK PM Starmer spoke with US President Trump on Sunday evening in which they discussed productive negotiations between their respective teams on a UK-US economic prosperity deal and agreed that these will continue at pace this week. It was also reported that UK Home Secretary Cooper refused to rule out retaliating to US tariffs on cars and steel, according to Bloomberg.

- French Ministry of Foreign Trade said France and Europe will defend their businesses, consumers and values, while it added that US interference in the inclusion policies of French companies is unacceptable. Thereafter, the French Commerce Minister reiterated that France would implement reciprocal tariffs if the US goes ahead with its tariff measures this week. Hoping to avoid a trade war.

- German Chancellor Scholz said they stand by Canada’s side and that Canada is not a state that belongs to anyone else, while he added that Europe’s goal is cooperation but the EU will respond as one if the US leaves them with no choice such as with tariffs on steel and aluminium.

- Brazil’s President Lula said he will negotiate on tariffs before retaliating, according to Bloomberg. It was also reported that Brazil’s Finance Minister Haddad said the country is in a privileged position to withstand the trade war with the commodity exporter’s links to China, the US and the EU to shield it from protectionism, according to FT.

EUROPEAN TRADE

EQUITIES

- European bourses began the week on the backfoot into month & quarter end, the looming April 2nd ‘Liberation Day’, and ongoing geopolitics; Euro Stoxx 50 -1.5%.

- Sectors in the region are broadly in the red, Basic Resources lag with Autos a close second. Basic Resources have failed to lift amid demand/growth concerns, despite gold prices surging to USD 3,100/oz for the first time. Chinese PMIs inched higher, though CapEco sees slower Chinese GDP growth in Q1.

- Stateside, futures are entirely in the red, ES -0.8%, as we count down to Liberation Day and after Trump upped the ante around it over the weekend; the NQ -1.2% lags on reports that test samples for NVIDIA’s (-3.4%) GB300 may not be sent until the end of 2025, meaning it is likely that mass production will be delayed until next year.

- Goldman Sachs says its new 12-Month S&P target is 5900, amid higher tariffs, slower growth, and rising inflation. Implies index levels of 5300 and 5900. Lowers its EPS growth forecasts to +3% in 2025 (from +7%) and +6% in 2026 (from +7%), with new EPS estimates of USD 253 and USD 269 – below both top-down and bottom-up consensus.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY has been on either side of the unchanged mark throughout the morning, began on a softer footing but the USD managed to claw back some losses vs. most peers to a 104.06 high for the index. As it stands, it is just below the mark and marginally into the red but comfortably clear of the session’s 103.74 base.

- The main focus has of course been the tariff agenda, with EUR initially firmer despite this but succumbed into the red when the USD picked up and has remained there since. Limited reaction to the morning’s state CPIs from Germany or Italian metrics. EUR/USD at the mid-point of a 1.0806-1.0849 band.

- USD/JPY retreated below the 149.00 handle by haven flows given the pressure seen in APAC trade, the Nikkei 225 entered correction territory. Went as low as 148.71 overnight, to the lowest since March 21st when 148.58 printed.

- Sterling flat with UK-specific newsflow light aside from UK PM Starmer speaking with US President Trump on Sunday evening. Cable at the bottom-end of a 1.2923 to 1.2972 band.

- Antipodeans softer given the broad risk-off price action and despite encouraging Chinese official PMIs. AUD also awaits the RBA with just a 17% implied probability of a 25bps cut currently. AUD/USD at a 0.6254 session low.

- PBoC set USD/CNY mid-point at 7.1782 vs exp. 7.2593 (Prev. 7.1752).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Firmer given the macro risk tone. USTs bid by over 10 ticks but just off the earlier 111-22+ peak, having ground higher from a 111-09 open which is also the session low. If the move continues, then resistance comes in at 111-25 from 11th March before the figure and then 112-01 from 4th March; the latter is the YTD high.

- Amidst this, yields are lower across the curve and the 10yr is below 4.20% with 4.17%, 4.15% and then the 4.10% YTD low from 4th March. Fed pricing has moved dovishly, the odds of a cut in May over 20% with 80bps of easing seen by end-2025. As a point of comparison, around this time on Friday (pre-PCE) roughly 63bps was implied by end-2025.

- Bunds on the front-foot, given the above, hit a 129.59 peak before paring off best into and retreating further to a 129.04 session low on the first few German State CPIs coming in hot. However, the skew of all the states was in-line/mixed vs the prior readings which allowed Bunds to lift back to the midpoint of the day’s range.

- Gilts gapped higher by 37 ticks and then extended to a 92.10 peak as the tone sullied. Specifics for the UK light aside from the discussed Starmer-Trump call, though Home Secretary Cooper refused to rule out retaliation to US tariffs on autos and steel.

- JGBs came under some modest pressure as the BoJ adjusted its purchase plan for the next quarter while OATs were unphased by Le Pen being found guilty as we continue to await details and whether she will be banned from the 2027 Presidential election.

- BoJ cuts the purchase size across all main tranches (incl. the super-long) in its quarterly plan, frequency maintained.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are firmer despite the broad risk off tone. Strength which comes from geopolitics. Recent reports that US President Trump threatened to bomb Iran if a nuclear deal can’t be reached, while he also warned of secondary tariffs on Russian oil but later stated that he is not putting on oil sanctions right now.

- WTI May currently trades in a USD 68.81-70.10/bbl while its Brent counterpart resides in a USD 72.28-73.51/bbl parameter at the time of writing.

- Gas is firmer following APAC weakness, whilst the end of the heating season has reduced demand, shifting market focus to inventory refilling for next winter.

- Metals diverge with precious counterparts leading, base peers in the red. XAU at a fresh record high on the open and has since extended to a USD 3128/oz peak, benefitting from the risk tone. Base metals unsurprisingly dented by latest tariff updates, though encouraging Chinese PMIs have perhaps limited the losses.

- Slovak gas importer SPP says Gazprom is to substantially increase gas supplies to Slovakia through TurkStream from April; adds, “we will not have a problem filling storage this year”.

- Oman’s OSP for May calculated at USD 72.51/bbl (77.63/bbl in April), via GME data cited by Reuters.

- US is to revoke authorisations to foreign partners of Venezuela’s PDVSA that allowed them to export oil, according to sources cited by Reuters.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Lloyds Business Barometer (Mar) 49 (Prev. 49)

- UK Mortgage Lending (Feb) 3.287B GB vs. Exp. 3.55B GB (Prev. 4.207B GB, Rev. 4.229B GB); Approvals (Feb) 65.481k vs. Exp. 66.0k (Prev. 66.189k, Rev. 66.041k)

- German Retail Sales YY Real (Feb) 4.9% vs. Exp. 3.1% (Prev. 2.9%); MM Real (Feb) 0.8% vs. Exp. 0.2% (Prev. 0.2%)

- German Import Prices YY (Feb) 3.6% vs. Exp. 3.1% (Prev. 3.1%); MM (Feb) 0.3% (Prev. 1.1%)

- German State CPIs: Initially metrics came in hotter-than-expected with the available core measures also on the hawkish side of things. However, as all the states reported this moderated and the overall skew is in-line/mixed vs the prior readings; mainland consensus is for a Y/Y moderation and the M/M to remain at the prior rate.

- Italian Consumer Price Prelim YY (Mar) 2.0% vs. Exp. 1.6% (Prev. 1.6%); MM (Mar) 0.4% vs. Exp. -0.1% (Prev. 0.2%)

- Italian CPI (EU Norm) Prelim YY (Mar) 2.1% vs. Exp. 2.0% (Prev. 1.7%); MM (Mar) 1.6% vs. Exp. 1.4% (Prev. 0.1%)

NOTABLE EUROPEAN HEADLINES

- Dutch pension funds are set to invest EUR 100bln into risky assets boosting Europe’s defence efforts, according to FT citing APG Asset Management’s chief executive.

- US President Trump had an informal meeting with Finland’s President Stubb and said they look forward to strengthening the partnership between the US and Finland which includes the purchase and development of a large number of badly needed icebreakers for the US.

- ECB’s Lagarde says Europe must take better control of its own destiny. Almost at the inflation target.

- ECB’s Panetta says fight against inflation cannot be considered to be over; must monitor all factors that could hinder a return to the 2% target.

- Germany’s CDU/CSU and SPD have reportedly agreed to demand that the EU withdraws funds and suspend voting rights from countries that violate key principles, via Politico citing a draft; Politico frames this as a “thinly veiled reference to Viktor Orbán”.

- French RN official Le Pen has received an electoral ban, judges yet to state if the ban is to be implemented immediately or not.

- BoE PRA proposes increasing the FSCS deposit protection limit to GBP 110k (current 85k). If taken forward, the new limit would apply to firms that fail from 1 December 2025.

NOTABLE US HEADLINES

- US President Trump is scheduled to sign executive orders at 13:00EDT/18:00BST and at 17:30EDT/22:30BST on Monday.

- US President Trump wouldn’t rule out seeking a third term and said there are ways to do it, according to NBC. However, it was later reported that President Trump commented that he does not want to talk about a third term now.

- White House reportedly plans to kill the funding in a new budget for a Boeing (BA)-built rocket designed for NASA to take astronauts to the moon and beyond, while terminating Boeing’s Space Launch System could reportedly free up billions of dollars which SpaceX officials said could be reallocated for NASA’s Mars efforts, according to WSJ.

- Some large cloud customers are reportedly slowing down their spending on AI services through cloud providers such as Microsoft (MSFT), Google (GOOG) and Amazon (AMZN) as prices of AI drop, according to The Information.

GEOPOLITICS

MIDDLE EAST

- IDF began ground activity in an area inside Rafah to expand the security zone in southern Gaza, while Israel reportedly sent a counter-proposal on the Gaza deal, according to Bloomberg.

- Hamas political chief Khalil Al-Hayya said Hamas agreed to a ceasefire proposal they received two days ago, while he stated that Hamas will not disarm as long as the Israeli occupation exists.

- US President Trump said US and Iranian officials are talking, while he threatened a “bombing” and secondary tariffs on Iran if Tehran does not make a deal on a nuclear program with the US, according to an NBC interview. It was separately reported that Iran said it rejected direct US talks in a reply to Trump’s letter, while Iranian sources cited by Tehran Times stated the Iranian army has built up missile bases and prepared them for launch after recent Trump threats, according to Asharq News.

- Iran’s Supreme Leader Khamenei says US will receive a blow if they act on US President Trump’s threats.

RUSSIA-UKRAINE

- US President Trump said he plans to speak with Russian President Putin this week and warned he will put 25%-50% secondary tariffs on all Russian oil if they are unable to make a deal on Ukraine. Trump also said he was very angry when Putin criticised Ukrainian Zelensky’s credibility and noted that Putin’s comments on Zelensky were not going in the right direction. Furthermore, Trump separately commented that Zelensky wants to back out of the critical minerals deal.

- Ukrainian President Zelensky said it is impossible to ignore nearly daily mass Russian drone attacks and Ukraine expects a strong response to these attacks from the US, Europe and others. Zelensky added that Ukraine is maintaining active measures on the front line and inside Russia to ensure no Russian troops can enter the Sumy and Kharkiv regions.

- Ukraine was reported on Sunday morning to have destroyed 65 out of 111 drones launched by Russia.

- There are reportedly serious preparations underway for Ukrainian President Zelensky to run for the presidency a second time and he is said to have tasked his team with organising a vote after a full ceasefire, aiming for summer 2025, according to The Economist. It was separately reported that Kyiv is to seek more US investments in talks over an economic deal.

- Russian Defence Ministry said Ukraine has continued attacks against Russian energy infrastructure in violation of the limited ceasefire agreement and attacked power grids in the Belgorod region leaving 9,000 residents without power. Russia’s Defence Ministry also said it has completed the liberation of the town of Zaporizhzhia in Ukraine’s Donetsk region, while it was also reported that Russian forces took control of Veselivka in Ukraine’s Sumy region.

- Moscow and Washington started talks on rare earth metals and projects in Russia, according to RIA citing Russian Sovereign Wealth Fund chief Dmitriev.

- Russia’s Defence Ministry says Ukraine continues attacks on Russia’s energy infrastructure, according to IFAX.

OTHER

- US Defence Secretary Hegseth said Japan is an indispensable partner in deterring China and the US will sustain a robust presence in the Indo-Pacific, while he added the US military needs expanded access to Japan’s southwest islands and has started upgrading its military command in Japan. Furthermore, Japan’s Defence Minister said they have agreed with the US to accelerate efforts to jointly air-to-air missiles and will look at the possibility of joint production of SM6 surface-to-air missiles.

- Chinese military said it conducted a routine patrol in the South China Sea on Friday, while it added the Philippines has frequently enlisted foreign countries to organise so-called joint patrols and created destabilising factors in the South China Sea.

- Greenland’s PM said that he wants to make it clear the US won’t get control of Greenland.

CRYPTO

- Elon Musk commented that there are no plans for the government to use Dogecoin, according to Bloomberg.

- Japan’s Financial Services Agency plans to revise the Financial Instruments and Exchange Act to officially recognise crypto assets as financial products, according to Nikkei.

- US President Trump’s sons, Eric and Donald Trump Jr., are investing in a Bitcoin-mining company, according to WSJ; move will add to the Trump family’s expanding portfolio of crypto businesses.

APAC TRADE

- APAC stocks were pressured heading into month- and quarter-end amid tariff concerns as Trump’s April 2nd Liberation Day drew closer, while geopolitical risks lingered after US President Trump voiced anger towards Russian President Putin for comments about Ukrainian President Zelensky and Trump also threatened to bomb Iran if a nuclear deal can’t be reached.

- ASX 200 declined with all sectors in the red and underperformance in the mining, resources and materials sectors, while participants also await tomorrow’s RBA rate decision where the central bank is widely expected to remain on hold and with the focus to turn to if there is any change to the cautious message regarding future rate cuts.

- Nikkei 225 suffered heavy losses and slipped beneath the 36,000 level amid the tariff concerns and with notable weakness seen in tech stocks, while the selling is also exacerbated heading into fiscal year-end and amid yen strength.

- Hang Seng and Shanghai Comp conformed to the downbeat risk tone after failing to sustain the early resilience seen in the mainland following encouraging Chinese PMI data and reports that China’s Finance Ministry is to inject USD 69bln into four large Chinese banks, while there was also a slew of earnings releases including from most of the big 4 banks.

NOTABLE ASIA-PAC HEADLINES

- China’s Commerce Minister held talks on Friday with the visiting EU Trade and Economic Security Commissioner.

- China unveiled a plan to ramp up high-standard farmland development to ensure food security.

- China’s Finance Ministry will inject USD 69bln into four of the nation’s largest state banks via their share placements with the Finance Ministry to be the top investor in planned private placements by Bank of Communications, Bank of China, Postal Savings Bank of China Ltd. and China Construction Bank Corp. to raise up to a combined CNY 520bln or around USD 72bln through additional offerings of mainland-traded stocks, according to filings on Sunday. It was later reported that China will issue CNY 500bln in special treasury bonds this year to support bank capital replenishment, according to the Finance Ministry.

- PBoC said it punished two internet users who spread rate-cut rumours to gain attention and attract online followers, according to Bloomberg.

- Chinese state media said the CK Hutchison (1 HK) port deal does not conform to business logic and involves major national interests, while it added that selling the port is equal to handing a knife to the opponent and the Co. should carefully handle deals that may harm national interests.

- South Korean Finance Minister Choi said the government will submit a KRW 10tln supplementary budget to respond to wildfires and slumping growth.

- South Korean, Japanese and Chinese trade ministers agreed to strengthen cooperation on stabilising the supply chain and enhancing predictability in a trade environment, while they also agreed to closely cooperate on a trilateral free trade agreement and promote regional trade.

DATA RECAP

- Chinese NBS Manufacturing PMI (Mar) 50.5 vs. Exp. 50.5 (Prev. 50.2); Non-Manufacturing PMI (Mar) 50.8 vs. Exp. 50.5 (Prev. 50.4)

- Chinese Composite PMI (Mar) 51.4 (Prev. 51.1)

- Japanese Industrial Production MM (Feb P) 2.5% vs. Exp. 2.3% (Prev. -1.1%)

- Japanese Retail Sales YY (Feb) 1.4% vs. Exp. 2.0% (Prev. 3.9%, Rev. 4.4%)

Loading…