JOLTs Job Openings Drop Despite Odd Jump In Federal Openings; Hires Hit 5 Month High

One month after we got a “goldilocks” JOLTS report which showed an unexpected increase in job openings, hires and quits, moments ago the BLS reported that the US labor market reverted to its deteriorating trendline in February when the US had 7.568 million job openings, a drop from the 7.762 million in January (revised from 7.740 million), down 877,000 from a year ago, and below the 7.655 million estimate.

According to the BLS, the most notable monthly change was the drop in job openings decreased in finance and insurance (-80K), although as shown in the table below, there were also sizable declines in job openings in trade/transportation/utilities (down 163K), in Private education/health (down 33K) and leisure and hospitality (down 61K). These were partially offset by a 134K increase in professional/business service job openings.

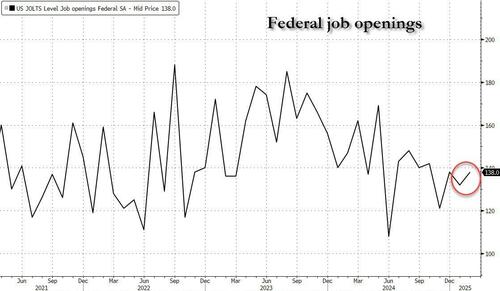

Yet, as always, there is a reason to doubt this particular set of numbers – just as there was reason to doubt every set of numbers from Biden – because according to the February JOLTS report, the number of Federal Government job openings was essentially flat both sequentially and YoY.

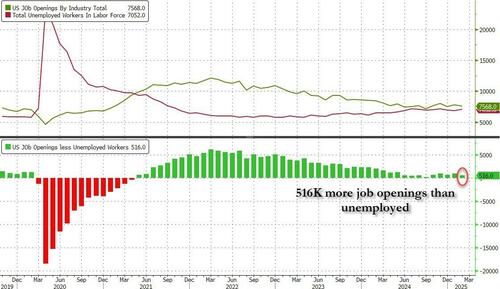

In the context of the broader jobs report, in February the number of job openings was 516K more than the number of unemployed workers (which the BLS reported was 7.052 million), down from 913K the previous month, and one of the lowest differentials since the covid crash.

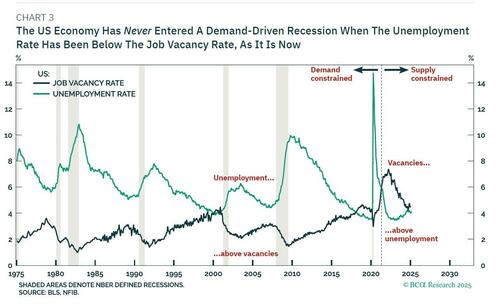

Still, as noted previously, until this number turns negative, the US labor market is not demand constrained, and a recession has never started in a period when there were more job openings than unemployed workers.

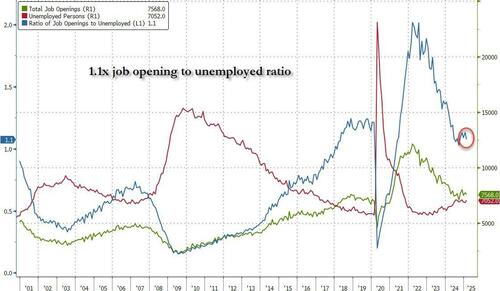

Said otherwise, in January the number of job openings to unemployed rose modestly to 1.1, the highest since last May if on the low end of the pre-covid range in 2018-2019.

While the job openings data was a drop, miss and reversal of last month’s surprise increase, what softened the blow is that the number of hires unexpectedly rose to 5.396 million from 5.371 million, the highest since last October, and hardly screaming collapse in the labor market. Meanwhile, after surging in January, the number of workers quitting their jobs – a sign of confidence in finding a better paying job elsewhere – dropped slightly to 3.195 million from 3.256 million.

How to make sense of this modest drop in the labor market?

It’s possible that after surprising the market last month when we saw one of the a sizable increase in the number of job openings, Trump got the tap on the shoulder that the US market should probably continue shrinking slowly but surely, if his plan is to (still) blame Biden for any imminent recession, and so he sent a memo to the BLS to make sure that the numbers aren’t in freefall, but dropping more gradually.

Then again, with markets now focused almost exclusively on the global trade wars which they are convinced (at least for now) will be far more negative for the US than anyone else, no amount of pig lipstick on hard data will offset the fact that the global trade war has become the Elephant Bear in the china shop, and until there is some clarity on that front expect most if not all rallies continue to be sold.

Loading…