Global stock markets slide days before Trump tariffs take effect – live updates

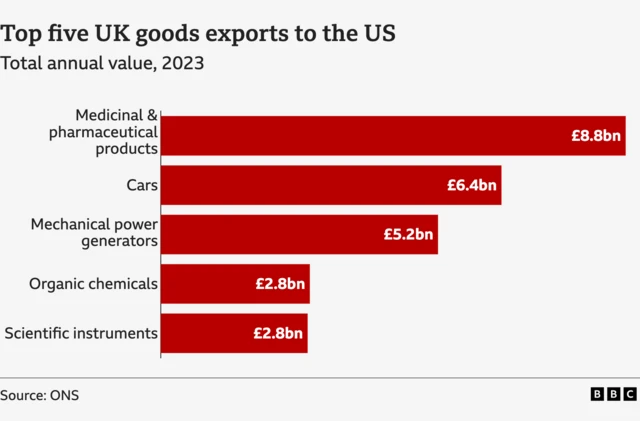

UK locked in talks with US about tariffs exemptionpublished at 11:47 British Summer Time

With just two days to go before the tariffs come into force, the UK is still locked in talks with the US about an exemption.

On Sunday, Downing Street said Prime Minister Sir Keir Starmer had “productive negotiations” with Trump in a phone call, adding that talks would “continue at pace”.

The call came after sources at No 10 said the government was prepared to retaliate against US trade taxes if needed.

British negotiators are trying to win a last-minute exemption ahead of Trump’s 25% levy on car imports, which is expected to come in on Wednesday.

Starmer has previously said he does not want to jump into a trade war with the US.

But the PM has also said the UK “reserves the right” to introduce reciprocal tariffs on the US if a deal to exempt the UK cannot be reached.The government has argued the UK has a relatively equal trading relationship with the US, compared to its other partners.

What causes stock markets to move?published at 11:36 British Summer Time

Mitch Labiak

Business reporter

It is impossible to be sure any given event has caused ashare price to move — because correlation is not causation — but as a generalrule share prices move based on new information.

An investor who owns shares in a company does so based on how much they thinkthat company is worth, and they do this using whatever information they can gettheir hands on.

If they like what they learn, investors will buy shares,causing prices to rise. If they don’t, they will sell shares, causing prices tofall.

Usually, information comes directly from a company’sfinancial results and its own predictions about its performance, butoccasionally the information will come from beyond the company itself.

US President Donald Trump’s tariff announcements are the second kind ofinformation. And they appear to be having a big impact.

Markets stalked by uncertainty as questions linger over Trump’s tariffspublished at 11:22 British Summer Time

Dharshini David

Dharshini David

Deputy economics editor

Stock markets are having a bumpy start to the weekahead of President Trump’s “Liberation Day” tariffsannouncement.

They’re plagued by concerns about the impact thosecould have.

And the answer: Nobody knows

Given the twists and back peddling we’ve seen sofar, its hugely unclear what the president will unveil. And who willretaliate with their own tariffs

And even when we do get that announcement, it is unclearwhat the impact will be: Will the importers affected try to absorb the taxesalong the supply chain or pass on to customers?

Will affected exporters simplytry to divert their goods elsewhere? Will consumers swallow higher prices orsimply switch to other, cheaper products?

All of those reactions will influencehow prices, profits, jobs and growth are impacted – and how much PresidentTrump actually raises through these taxes.

All of these are impossible to pinpoint,policymakers’ claims may be wide of the mark. In the meantime, themarkets will be stalked by their nemesis: Uncertainty.

Tariffs and how they work explained in 80 wordspublished at 11:05 British Summer Time

Tariffs are taxes charged on goods imported from other countries.

Those announced so far target products including cars, aluminium and steel, and goods from Canada, Mexico and China.

Typically, tariffs are a percentage of a product’s value. For example, a 25% tariff on a $10 (£7.76) product would mean an additional $2.50 charge.

Companies that bring the foreign goods into the country have to pay the tax to the government.

Firms may choose to pass on some or all of the cost to customers.

Watch: What is a tariff? The BBC’s Adam Fleming explains

‘You’d start with all countries’: What Trump said about broadening tariffspublished at 10:48 British Summer Time

As we’ve been reporting, new comments from Donald Trump that he could broaden tariffs this week have rattled global stock markets today.

The US president suggested that new tariffs he is set to announce this week will hit all countries, not just those that have the biggest trade imbalances with America.

“You’d start with all countries,” Trump told reporters on Air Force One. “Essentially all of the countries that we’re talking about.”

But he said his administration would be “far more generous” and “kinder” than the countries had been to the US.

The measures would come on top of tariffs already imposed by Washington on aluminium, steel and vehicles, along with increased levies on all goods from China.

What tariffs has Donald Trump announced?published at 10:30 British Summer Time

Before taking office in January, Donald Trump suggested tariff is “the most beautiful word in the dictionary”.

That belief has now started to play out in his policies.

Last week, the US president announced new import taxes of 25% on cars and car parts coming into America.

This is set to come into effect on the 2 April, joining an array of other taxes already announced by Trump:

- A 20% tax on all imports from China that is already in place

- 25% tariffs on imports from Mexico and Canada that Trump enacted earlier this month – though energy from Canada is charged at a lower 10% rate, and there is an exemption for goods shipped under the US-Mexico-Canada agreement (USMCA)

- A 25% tariff on all steel and aluminium imports into the US – active since earlier this month

Trump announces 25% tariff on cars ‘not made in the United States’

Investors concerned over impact of broader tariffspublished at 10:17 British Summer Time

Theo Leggett

Theo Leggett

International business correspondent

The Trump administration has already announced tariffs on a range of goods from Canada, Mexico and China.

Further levies have been placed on imports of steel and aluminium, while a tax of 25% on cars is due to come into effect this week, with major car parts also becoming subject to charges at a later date.

The administration has dubbed Wednesday “Liberation Day”, and the president is expected to broaden the tariff net considerably.

In comments to reporters on Air Force One on Sunday, Trump suggested they would apply to goods from “all countries”.

Fears about the economic impact of such measures, and the possibility of retaliation by other countries has raised concerns among investors.

Uncertainty over whether or not the administration will actually impose the measures it announces has also been undermining confidence, analysts say.

How the markets are faringpublished at 10:07 British Summer Time

Theo Leggett

Theo Leggett

International business correspondent

Image source, EPA

Image source, EPA

South Korea’s benchmark share index, Kospi, ended down 3% on Monday

Stock markets in Europe fell in early trading, following on from steep falls on some Asian markets overnight.

The declines came amid growing speculation that new tariffs, or import taxes, to be introduced by the Trump administration could be much broader than previously anticipated.

In Frankfurt, the DAX index was down more than 1% in the first hour of trading.

In Paris, the CAC40 was down by a similar margin. In London, the FTSE 100 was also down.

This followed a sharp 4% decline on Japan’s Nikkei 225, with carmakers Toyota and Nissan among the biggest fallers.

South Korea’s Kospi was down 3%.

Global shares slide as Trump tariffs loompublished at 10:03 British Summer Time

Adam Goldsmith

Adam Goldsmith

Live reporter

Image source, Reuters

Image source, Reuters

Stock markets have fallen in Asia and Europe after President Donald Trump suggested that new tariffs he is set to announce this week will hit all countries, not just those that have the biggest trade imbalances with the US.

On Wednesday, which Trump has dubbed America’s “Liberation Day”, he will unveil a swathe of import taxes, on top of tariffs already imposed by Washington on aluminium, steel and vehicles.

But concerns about a trade war are unsettling markets and creating fears of a recession in the US.

Japan’s Nikkei 225 benchmark share index closed more than 4% lower today, while the Kospi in South Korea ended down 3%.

In the UK, the FTSE 100 index was down about 0.8% in morning trade, while Germany’s Dax index and France’s Cac 40 were both down 1%.

Stay with us as we bring you analysis and updates on the markets, plus all the latest on Trump’s tariffs and their potential impact.