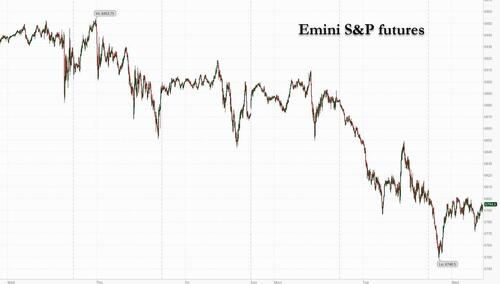

Futures Rebound From Session Lows As Government Shutdown Becomes Longest Ever

Welcome to day 36 of the government shutdown which officially makes it the longest shut down in history. Futures are trading moderately lower, following weaker Asian and European sessions, but well off session lows as Japan retraced nearly 50% of its losses during the session. As of 8:00am ET, S&P futures are down 0.2% having earlier slid far more following Tuesday’s 1.2% slump as technology shares dragged stocks lower globally; Nasdaq futures are down 0.1%, also recovering most of their losses. In premarket trading, Mag 7 stocks are mixed with Semis weaker. Confirming just how dented upward momentum is, many of the larger Tech companies that reported last night are weaker this morning. Both Cyclicals and Defensives are mixed without reflecting which will outperform today. According to JPM, so far yesterday’s price action has yet to spill over to the US session and the view that a valuation-induced sell-off with Tech underperforming was a narrative that was forming. It may be the case that as the market looks to remove froth that we see Mag7 outperform the higher beta segments of TMT / AI. In overnight news, China banned foreign-made chips in state-funded data centers. Bond yields are unchanged, erasing an earlier and the USD is also flat. Commodities are poised for a rebound with WTI, Precious Metals, and Ags all higher. Today’s macro data focus is on ADP and ISM-Srvcs. With the shutdown in Washington leaving a vacuum in official data, the private ADP employment numbers out today will get more attention than usual.

In premarket trading, Magnificent Seven stocks are mixed (Tesla +1.2%, Meta +0.3%, Apple -0.05%, Microsoft -0.1%, Alphabet -0.1%, Amazon -0.2%, Nvidia -0.7%)

- AMD (AMD) falls 4% after the chipmaker reported its third-quarter results and gave an outlook. While analysts are broadly positive, they note some issues with margins and the outlook. The stock has more than doubled this year.

- Arista Networks (ANET) slides 10% after the company’s forecast for adjusted gross margin in the fourth quarter fell short of the average analyst estimate.

- Axon (AXON) drops 18% after the Taser maker reported disappointing third-quarter adjusted EPS and agreed to buy emergency-tech company Carbyne in a deal valuing the company at $625 million.

- Biohaven (BHVN) tumbles 44% as TD Cowen calls the FDA’s Vyglxia Complete Response Letter as “highly disappointing” amid broader concerns over its impact on the firm’s R&D spending.

- Clover Health (CLOV) sinks 20% after the health insurer cut its adjusted Ebitda guidance for the full year, following third-quarter adjusted Ebitda results that fell short of expectations. The company notes high medical costs in the quarter pressured margins.

- Humana (HUM) falls 5% after the health insurer reaffirmed its forecast for medical costs for the full year, with the outlook below the average analyst estimate. The firm also reported higher medical costs for the third quarter than analysts anticipated.

- Kennedy-Wilson (KW) surges 26% after receiving a buyout proposal letter from CEO William McMorrow and Fairfax Financial Holdings to acquire all outstanding common stock.

- Kratos (KTOS) falls 8% after the defense contractor forecast revenue and adjusted Ebitda for the fourth quarter that missed the average analyst estimate.

- Mosaic (MOS) shares are up 5% after the agricultural chemicals company reported adjusted earnings per share for the third quarter that beat the average analyst estimate.

- Pinterest (PINS) is down 18% after the search platform gave a revenue outlook that is weaker than expected.

- Super Micro Computer Inc. (SMCI) falls 7% after the server maker missed reduced estimates for first-quarter sales and profit and gave a disappointing earnings forecast for the current period, reinforcing concerns about its ability to capitalize on demand for AI equipment.

- Toast (TOST) gains 3% after the restaurant software company reported third-quarter results that beat expectations and raised its full-year forecast for adjusted Ebitda.

- Trex (TREX) sinks 33% after the maker of decking products forecast net sales for the fourth quarter that fell short of the average analyst estimate.

- United Parcel Service Inc. (UPS) slips 1.8% after one of its freighter jets crashed and exploded shortly after takeoff on Tuesday from Louisville, Kentucky, killing three crew members and at least four people on the ground.

- Upstart (UPST) falls 13% after the AI lending marketplace reported third-quarter revenue that missed expectations and lowered its full-year revenue forecast.

In corporate news, Google and Fortnite game maker Epic Games reached a settlement in their long-running antitrust fight over how developers distribute and monetize apps on Android phones. A UPS freighter jet crashed and exploded shortly after takeoff from Louisville, Kentucky, killing at least seven people. Toyota’s annual profit guidance disappointed investors, a sign that the impacts of US tariffs are still weighing on its bottom line. Amazon.com is suing Perplexity AI to try and stop the startup from helping users buy items on the world’s largest online marketplace.

The VIX jumped to 19 on Tuesday but there’s no sign of panic so far in derivatives markets with the gauge holding under 20, with some 25/30 call spread buying, a likely hedge into year-end playing a moderate rise in volatility.

“There has been way more nervousness than usual during the last rally, and that’s not a good sign,” said Alexandre Baradez, chief market analyst at IG in Paris. “The market was priced for perfection so that explains why emerging questions about rate cuts, liquidity, and valuations are having such an impact.”

Crypto markets offered an early warning signal on the recent liquidity rush, with Bitcoin about 20% below a record high reached a month ago — before paring some of those losses in Wednesday trading. Holders of the cryptocurrency have offloaded around 400,000 Bitcoin over the past month, an exodus of about $45 billion that’s left the market unbalanced.

Meanwhile, the US government has reached a major milestone of dysfunction, with the federal shutdown now the longest in history — and economic pain is deepening. The CBO estimates 4Q growth could be cut by as much as 2 percentage points if the impasse continues for eight weeks.

In politics, Democrats landed a series of local election wins. Zohran Mamdani was elected the 111th Mayor of New York, and his proposals and inexperience — he’s sponsored only a handful of bills while serving three terms as a state assemblyman — is said to have unnerved business leaders and real estate groups.

ADP jobs data today comes in the face of recent corporate cutbacks which economists fear may be a warning sign, with companies such as Starbucks, Target, and Amazon making significant job cuts.

Turning to earnings, by Tuesday night, three-quarters of S&P 500 companies had reported results this season with a positive surprise ratio of 82% — similar to 2Q, which was the highest beat percentage since the third quarter of 2021. Price reaction to AI-related earnings remains volatile, with AMD falling despite lifting guidance, perhaps reflecting elevated buyside expectations. Other AI-related names to fall on results include Tempus AI, Super Micro Computer and Arista Networks.

Emerson Electric, FIS, Humana, McDonald’s, Unity Software and Zimmer Biomet are among companies expected to report results before the market opens. Sales growth at McDonald’s is expected to accelerate to 3.6% from a 1.5% drop last year, as its enhanced value offerings resonate with consumers. Earnings from AppLovin, DoorDash, ARM, Duolingo, Figma, Fortinet, Robinhood, Qualcomm and Lyft follow later in the day.

European stocks fall for a second day, though with less severity than seen earlier in Asia. Stoxx 600 down by 0.5% with tech stocks underperforming on a drag from ASML. That followed weakness in chip stocks in the US and drops for the tech-heavy Nikkei 225 in Japan and Kospi in Korea. Here are some of the biggest movers on Wednesday:

- Barry Callebaut climbs as much as 7.8% following results on Wednesday, with analysts noting its “sober” outlook, but Vontobel saying the chocolate product manufacturer is at least setting more realistic goals.

- Vestas gains as much as 15% after the Danish wind-power manufacturer reported a strong set of earnings, with analysts highlighting outperformance for its Power Solutions division, with a new and unexpected buyback program welcome.

- Aixtron shares climb as much as 7.6%. Demand for power from AI infrastructure could drive growth at the semiconductor equipment manufacturer, according to Barclays, which upgraded the stock to overweight from equal-weight.

- Ahold Delhaize shares rise 4.6% as the retailer reported adjusted operating profit for the third quarter that beat the average analyst estimate.

- Demant gains as much as 7.6%, despite the firm saying it now expects full-year organic sales growth to come in toward the lower end of its existing 1%-3% guidance range.

- Novo shares fluctuate in morning trading before rising as much as 2.7%. The Danish drugmaker narrowed its sales guidance for the year, while its commentary around negotiated US Medicare pricing was better than expected, according to analysts.

- Ambu slumps as much as 19%, the most in three years, after the Danish health-care equipment company reported its latest earnings. JPMorgan sees a miss to 4Q estimates, and new 2026 guidance implies large cuts to Ebit consensus expectations.

- Siemens Healthineers falls as much as 13%, the most on record, after the German health-care equipment group reported earnings which analysts describe as a disappointment.

- Pandora shares fall as much as 5.2% after the jewellery manufacturer lowered guidance for 2025 like-for-like growth and its 2026 EBIT margin target, and reported revenue for the third quarter that missed the average analyst estimate.

- Nexi shares fall as much as 9.9% after the third-quarter operating revenue of the payment services provider missed estimates.

- Qiagen drops as much as 4.4% in Frankfurt as Morgan Stanley says the German life science and diagnostics firm’s fourth-quarter growth outlook potentially overshadows decent third-quarter results.

- Evotec shares fall as much as 12% after the German company reported results RBC called “dismal” with revenue and Ebitda significantly below consensus estimates.

Earlier in the session, Asian stocks fell, weighed by a selloff in tech shares amid mounting concerns over excessive valuations. The MSCI Asia Pacific Index dropped as much as 2.3%, before trimming some losses on dip-buying. Tech heavyweights TSMC, SoftBank and Samsung Electronics were among the biggest drags. Most markets were in the red, with Japan and South Korea leading the losses. The selloff follows Wall Street chiefs’ warnings about an overdue correction, while fading expectations for Federal Reserve rate cuts and the prolonged US government shutdown also contribute to the risk-off sentiment. South Korea’s equity benchmark Kospi Index finished 2.9% lower — narrowing earlier losses of as much as 6.2% — marking its steepest daily decline since August. Japan’s blue-chip Nikkei 225 gauge also pared a plunge of 4.7% to close 2.5% lower, while the broader Topix Index fell 1.3%. China’s benchmark CSI 300 Index reversed early losses to end the day in the green, helped by solid gains in solar stocks. Indonesia also posted mild gains. Markets in India were closed for a holiday.

In FX, the Bloomberg Dollar Spot Index is in a narrow range but has reversed an earlier decline. Sterling an outperformer, Swedish krona in the middle of the pack in the G-10 after the Riksbank held rates at a three-year low.

In rates, we are seeing muted moves in bond markets, with US Treasury yields little changed amid similarly muted price action in German bonds, while long-end gilts underperform slightly. US 10-year is lower by less than 1bp near 4.08% with German counterpart similar and UK’s lagging by around 1bp. Treasury 5s30s curve is around 1bp steeper on the day. Focal points of US session focus include October ADP employment change and services PMIs, as well as Treasury quarterly refunding announcement at 8:30am New York time. For the US Treasury’s quarterly refunding announcement, dealers expect two- to 30-year auction sizes will be unchanged during the November-to-January period

IG dollar issuance slate includes at least two offerings so far. Three borrowers raised a combined $2.85b Wednesday. Issuers paid about 12bps of concession on deals that were 2.9 times covered.

In commodities, gold is higher by $34 to around $3,964/oz. Oil prices up, Brent futures heading closer to $65/barrel. Bitcoin briefly fell below $100,000, though is now holding just above that level.

US economic calendar slate includes October ADP employment change (8:15am), October S&P Global US services PMI (9:45am) and October ISM services index (10am). Fed speaker slate empty for the session

Market Snapshot

- S&P 500 mini -0.2%

- Nasdaq 100 mini -0.1%

- Russell 2000 mini little changed

- Stoxx Europe 600 -0.4%

- DAX -0.7%

- CAC 40 -0.2%

- 10-year Treasury yield little changed at 4.09%

- VIX +0.5 points at 19.54

- Bloomberg Dollar Index little changed at 1226.45

- euro little changed at $1.148

- WTI crude +0.7% at $61/barrel

Top overnight News

- The government shutdown dragged into its 36th day becoming the longest in history. Every week that passes with Congress deadlocked costs the US economy between $10 billion to $30 billion, according to analysts’ estimates, with several landing in the $15 billion range. BBG

- A “handful” of moderate Senate Democrats are considering voting to end the government shutdown. The deal would pass three full-year appropriations bills to fund some agencies, along with a short-term bill that would reopen the rest of the government: WaPo

- Democrat Mikie Sherrill won the New Jersey Governor election and Democrat Abigail Spanberger won the Virginia Governor election, while Democrat Zohran Mamdani won the New York mayoral election.

- In addition to Mamdani’s victor in New York, Democrats also scored other victories throughout the country. The party won gubernatorial races in New Jersey and Virginia around a message of economic affordability. California voters approved a new congressional map intended to create five new Democratic-leaning districts. BBG

- New Yorkers squeezed by the city’s housing crunch also voted in favor of proposals to fast-track affordable housing projects, expedite modest developments and create an appeals board, vote tallies recorded by the AP and the NYT showed. BBG

- The Chinese government has issued guidance requiring new data center projects that have received any state funds to only use domestically-made artificial intelligence chips. Order likely to affect U.S. chipmakers Nvidia, AMD, Intel as Beijing tries to cultivate domestic AI chipmakers like Huawei. RTRS

- Japan’s top currency official, Atsushi Mimura, said recent moves by the yen are deviating from what might be expected given interest rate differentials. The yen touched an eight-month low against the dollar after the BOJ left rates unchanged, despite subtle hints of a potential hike from Governor Kazuo Ueda. BBG

- A growing number of policymakers at the Bank of Japan believed that conditions were falling into place for interest rates to rise, with two members advocating an immediate increase, minutes of the central bank’s September meeting showed on Wednesday. RTRS

- The Bank of England is exploring ways of encouraging lenders to use more of their regulatory capital buffers in a bid to boost economic growth. BBG

- German factory orders rose for the first time in five months. Demand increased 1.1% in September, led by automotive and electrical equipment manufacturers and beating estimates. BBG

Trade/Tariffs

- US President Trump posted the “United States Supreme Court case is, literally, LIFE OR DEATH for our Country. With a Victory, we have tremendous, but fair, Financial and National Security. Without it, we are virtually defenceless against other Countries who have, for years, taken advantage of us. Our Stock Market is consistently hitting Record Highs, and our Country has never been more respected than it is right now. A big part of this is the Economic Security created by Tariffs, and the Deals that we have negotiated because of them.”

- US President Trump posts it was his “Great Honor to just meet with high level Representatives of Switzerland. We discussed many subjects including, and most importantly, Trade and Trade Imbalance. The meeting was adjourned with the understanding that our Trade Representative, Jamieson Greer, will discuss the subjects further with Switzerland’s Leaders.”

- White House posted the Executive Order modifying duties addressing the synthetic opioid supply chain in China.

- White House said it is not interested in selling to China at this time regarding NVIDIA (NVDA) Blackwell chips.

- China announced it will suspend 24% US tariffs for a year but will maintain 10% US tariffs, while it will lift some tariffs on US agriculture goods from November 10th.

- Chinese Premier Li said some unilateral and protectionist measures have had severe impacts on the economic world order, while he said they should uphold equality and mutual benefit and consolidate the foundation of legitimate common interest. Li stated that it is all the more important for them to stay committed to mutual cooperation and pursue free trade when economic growth is slowing. Furthermore, he said China is willing to stand with all parties to foster an open and inclusive environment, as well as commented that countries should not seek unilateral wins at the expense of others, and need to balance their interests against the greater good.

- White House said US President Trump feels positively about the relationship with India and trade teams continue to be in serious discussions, while it added that President Trump and Indian PM Modi speak frequently.

- China Commerce Ministry suspends unreliable entity list announced in April; removes entity list announced in March and will adjust the list.

A more detailed look at global markets courtesy of newsquawk

APAC stocks were mixed after an early sell-off following the losses stateside, where tech underperformed amid valuation concerns. ASX 200 was rangebound as resilience in defensives and the top-weighted financial sector provided a cushion. Nikkei 225 suffered heavy losses and briefly fell beneath the 50,000 level with the downturn led by tech-related stocks. KOSPI collapsed alongside the tech bloodbath, which prompted the Korea Exchange to briefly trigger sidecars on the KOSPI and KOSDAQ. Hang Seng and Shanghai Comp are mixed after paring most of their earlier losses following somewhat mixed Chinese RatingDog Services and Composite PMI data in which the former marginally topped estimates, but the composite figure slowed, while both the US and China made adjustments to their tariffs following last week’s Trump-Xi talks.

Top Asian News

- BoJ Minutes from the September 18th-19th Meeting stated that members agreed current real interest rates are very low, and the BoJ is likely to continue raising interest rates if its economic and price projections materialise. Furthermore, members agreed there is high uncertainty on trade policy developments and their impact on the economy, while a few members said it is appropriate to maintain current monetary policy to scrutinise trade policy impact on the domestic and overseas economy, as well as prices.

- Japan’s Top Currency Diplomat Mimura says recent JPY moves deviate from fundamentals, JPY long positions have been shrinking after summer. FX excessive volatility, not levels, is the main concern. There is some speculation in the market about Japan’s macroeconomic policies, especially fiscal policy. A bit worried whether or not the current situation in the stock market might be a little too rapid.

European bourses (STOXX 600 -0.2%) opened entirely in the red, as the downbeat risk tone continues to follow through into today’s session. Lack of pertinent newsflow and a slew of EZ PMIs have had little impact to change price action, which has been fairly rangebound throughout the day. European sectors hold a negative bias. Autos takes the top spot, buoyed by post-earning strength in BMW (+1.5%) after reporting decent Q3 metrics, and reiterating its FY outlook. Tech is found towards the foot of the pile, as AI-bubble fears continue to grow; ASML (-2%). Elsewhere, Novo Nordisk (+1%) has pared initial losses, despite poor headline metrics and trimming FY guidance.

Top European News

- UK Chancellor Reeves is to urge insurance bosses to increase investment in London, according to FT.

- The Times’ Shadow MPC says that BoE should wait to cut rates again until after the November 26th budget. The decision was via a narrow 5-4 vote.

- Politico writes that the mood around French Socialist Party Leader Faure concerning the budget bills was rather optimistic. An associate cited said “What would be the point of a governing party doing all this work if they’re not going to vote in the end?”.

- Riksbank maintains its rate at 1.75% as expected; reiterates that policy rate is expected to remain at this level for some time to come. The labour market is still showing weak development, although there are now some signs that a turnaround is on its way.

- ECB’s Nagel says the ECB should be vigilant but not complacent on inflation.

FX

- The recent rally in the USD that has been driven by improving US-China relations, the hawkish FOMC announcement and yesterday’s global equity selling has paused for breath. As the US shutdown enters its 35th day, matching its prior record, official US data releases remain suspended. However, today we will be presented by the latest ADP employment report and ISM services print. The former is expected to see employment in October rise to 28k from the -32k print in September. For the ISM print, consensus looks for the headline metric to pick-up to 50.8 from the neutral 50 mark. Elsewhere, today will see the commencement of the hearing on the legality of US President Trump’s Reciprocal Tariff Policy. DXY remains below Tuesday’s best at 100.25.

- EUR is attempting to stop the rot vs. the USD following a recent run of losses, which dragged EUR/USD down from a 1.1668 peak last week to a 1.1473 trough yesterday. Incremental macro drivers remain on the light side for the Eurozone with final services & composite PMIs and an unrevised ECB annual wage tracker failing to move the dial for the EUR.

- JPY is now only incrementally firmer vs. the USD following a bout of strength overnight as global equities continued to slip. USD/JPY delved as low as 152.97 before returning to levels above 153.50. Recent strength in JPY has been stemming more from the risk-aversion price action in the market as opposed to anything Japan-specific. Fleeting modest JPY appreciation was seen in early European trade after Japanese Top Currency Diplomat Mimura noted that recent JPY moves are deviating from fundamentals and that excessive FX volatility, not levels, is the main concern.

- GBP is attempting to atone for its recent run of losses, which have largely been driven by increasing odds of a December BoE cut and ongoing angst ahead of the November 26th budget. This angst was brought to the forefront yesterday following Chancellor Reeve’s pre-budget speech in which she stopped shy of naming any specific policies but helped reaffirm the markets view that it will be a growth-negative event. Cable is holding above Tuesday’s 1.3010 trough but some way off the 1.3139 peak.

- Antipodeans are mixed, with the Kiwi marginally outmuscling the Aussie on the cross. Overnight markets had Chinese Services/Composite PMI data, in which the former marginally topped estimates, but the composite figure slowed. Overall, quiet trade for the pair this morning, as the FX space awaits key US data.

- As was widely-expected, the Riksbank opted to keep rates unchanged and reiterated guidance that the “policy rate is expected to remain at this level for some time to come”. Within its economic assessment, it was judged that the outlook for inflation and economic activity remains largely unchanged. SEK was little moved.

Fixed Income

- A firmer start to the day for USTs but only modestly so. Action for USTs overnight occurred in tandem with the broader risk tone, as a move lower in equity futures was seen around the beginning of the APAC session, the fixed benchmark picked up, taking USTs to an overnight 113-02 high. Thereafter, the benchmark drifted as the risk tone picked up off lows and stabilised. Nonetheless, USTs hold onto modest gains but are at the lower-end of a narrow 112-26 to 113-02 band. The docket ahead is packed from a US perspective. On the data front, the monthly ADP (reminder, they also do a weekly update now on non-NFP weeks) series is due and expected to come in at 28k (prev. -32k); ISM Services also due. The Quarterly Refunding Announcement is also due and is expected to maintain the nominal coupon auction sizes for the November-January period. Finally, the Supreme Court tariff hearing begins today with oral arguments to be presented for the first time.

- Bunds are echoing USTs in terms of overnight direction, though the magnitude of action has been slightly more pronounced, Bunds are in a 129.26-47 band but ultimately remain in the green by a tick or two, as is the case with USTs. No move to the morning’s final PMIs, posting upward revisions to the services and composite measures. The latest ECB wage tracker maintained the annual rate and did not spark any price action.

- Gilts are underperforming peers. Opened unchanged 93.66 before lifting a few ticks higher to 93.69, acknowledging the overnight move, and then slipping into the red and currently to a 93.50 trough, posting downside of 16 ticks at most. Pressure that sends Gilts back to the 93.49 low from Tuesday, but still above Monday’s 93.37 close and thus retaining some of the support derived from the late-Monday/early-Tuesday press briefings around potential UK tax moves. Overnight updates include The Times reporting that Reeves is considering removing the 5p cut to fuel duty (introduced in 2022, after Russia invaded Ukraine), as it is not being passed onto individual customers. That cut, alongside the duty freeze that has been in place since 2011, costs c. GBP 3bln/yr.

Commodities

- Crude benchmarks dipped at the start of the APAC session as Asian equities followed the sell-off seen stateside but gradually reversed as the European session got underway as risk sentiment improved a little. WTI and Brent dipped to a trough of USD 60.02/bbl and 63.92/bbl respectively before reversing to a peak of USD 60.90/bbl and 64.78/bbl as European players entered the market. Currently, crude benchmarks remain near session highs as markets wait for a new catalyst to drive the oil market. In the meantime, US ADP/ISM Services will keep markets busy.

- Spot XAU has rebounded from Tuesday’s selloff, which moved counter to the wider risk theme running through markets. XAU fell just shy of Tuesday’s low of USD 3928/oz at the start of the APAC session before trading higher to a peak of USD 3979/oz as the European session got underway. The yellow metal briefly extended higher to USD 3987/oz but has since fallen back into prior ranges. After falling over 12% from ATHs, there is a wider consensus that the pullback is mostly over as underlying drivers remain strong.

- Base metals have traded rangebound as the European session gets underway after 3M LME Copper fell for 4 straight days, its longest losing streak since late July. 3M LME Copper oscillates in a USD 10.58k-10.71k/t band as markets wait for a catalyst.

- US Private Energy Inventory Data (bbls): Crude +6.5mln (exp. +0.6mln), Distillate -2.5mln (exp. -2mln), Gasoline -5.7mln (exp. -1.1mln), Cushing +0.4mln.

Geopolitics

- IAEA’s Grossi said Iran must seriously improve cooperation with UN inspectors to avoid heightening tensions with the West, according to FT.

- North Korea shows signs of preparing to launch additional spy satellites aided by Russia, while it was also reported that North Korean leader Kim could conduct a nuclear test in the near future if he wants, according to South Korea’s spy agency.

- US Secretary of Defense Hegseth said the US military carried out a lethal kinetic strike on a vessel in international waters in the Eastern Pacific.

US Event Calendar

- 7:00 am: Oct 31 MBA Mortgage Applications -1.9%, prior 7.1%

- 8:15 am: Oct ADP Employment Change, est. 30k, prior -32k

- 9:45 am: Oct F S&P Global U.S. Services PMI, est. 55.2, prior 55.2

- 9:45 am: Oct F S&P Global U.S. Composite PMI, est. 54.85, prior 54.8

- 10:00 am: Oct ISM Services Index, est. 50.8, prior 50

DB’s Jim Reid concludes the overnight wrap

The last 24 hours have brought a clear risk-off move, as concerns over lofty tech valuations have hit investor sentiment. Markets compounded these losses in the early hours of Asian trading but have been rallying back in the couple of hours prior to going to print with US futures clawing back towards flat with the KOSPI rallying back a couple of percentage points from early -5% plus losses. In the main session yesterday, the S&P 500 (-1.17%) lost ground thanks to sharp losses among tech stocks, and there was a big slump for Palantir (-7.94%) after its earnings the previous day. Moreover, this pattern was clear across multiple asset classes, as US HY spreads (+10bps) ticked up for a 4th consecutive day, Brent crude oil (-0.69%) fell back again, whilst Bitcoin (-6.18%) fell below $100k for the first time since June, some -20% off its recent all-time highs.

In terms of overnight news, it was a big election day across many states in the US yesterday including NYC mayor and gubernatorial races in New Jersey and Virginia. While the Democrat victories that we’ve seen were expected in these high profile races, the party appears to have mostly outperformed opinion polls. So an early sign of an anti-incumbent party swing ahead of the mid-terms in a year’s time, even if one has to be cautious in the read across from state to federal elections. In NYC, the Democrats’ candidate and self-described democratic socialist Zohran Mamdani won the three-way mayoral race ahead of former Governor Andrew Cuomo. The vote was in part seen as a test of Mamdani’s leftist economic proposals which include higher local corporate and top-end income tax rates, though it is far from clear if these would get the necessary backing of the New York state legislature and Governor.

US political news will remain in the spotlight today as the Supreme Court is due to hear oral arguments in the case against Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose broad tariffs. Lower courts invalidated the IEEPEA tariffs back in the summer but left them in place pending appeal. While a ruling by the Supreme Court may take some time, today’s hearing could well provide hints of how the justices view the arguments. If the Supreme Court upholds the earlier decisions, it would impact many of the tariffs imposed this year, with implications for government revenue, though the administration may look to replace these using other statutes.

Back to yesterday and whilst the moves were only one day’s selloff, the market narrative saw a discernible shift, with a growing chorus discussing whether we might be on the verge of an equity correction. That speculation has gathered pace over the last month in particular, mainly because the Magnificent 7 has diverged from the rest of the S&P 500, which has revived questions about how concentrated this equity market now is. Indeed, whilst the Mag 7 have been advancing in recent weeks, the equal-weighted S&P 500 actually fell in October for the first time in 6 months.

Yesterday’s decline for Palantir (-7.94%) was seen as emblematic of this shift, particularly given they’d actually raised their revenue outlook the previous day. But given their share price had quadrupled in the last year, that’s set the bar incredibly high for any earnings releases. In fact, the Magnificent 7 (-2.28%) led the declines yesterday, with Nvidia itself down by a larger -3.96% as some of those top-performing stocks came under scrutiny. The S&P 500 ex-Mag-7 was also down a notable -0.75% with the equal-weight index -0.63% and the Russell 2000 -1.78%. For the S&P 500 itself (-1.17%), it was the worst day since October 10, when trade escalation fears between US and China spiked.

Whilst many assets struggled yesterday, US Treasuries benefited from the risk-off tone, with yields falling across the curve. So the 2yr yield (-2.9bps) fell back to 3.58%, whilst the 10yr yield (-2.5bps) fell to 4.09% (4.072% as I type in Asia). That came as investors dialled up the likelihood of a December rate cut again, particularly as fears of a larger equity correction gathered pace. So by the close, a December rate cut was back up to a 74% probability, and that move got further support from the decline in commodity prices, with Brent crude down -0.69% to $64.44/bbl. Despite the fall in yields, the dollar index (+0.35%) gained amid the risk-off mood, while gold (-1.73%) retreated.

Elsewhere, the mood hasn’t been helped by the ongoing US government shutdown, which is now the longest on record at 36 days today, surpassing the most recent 35-day shutdown in 2018-19. Interestingly, we did see mounting speculation yesterday about a potential deal between Republicans and Democrats, with hopes that a compromise will become more likely with yesterday’s elections out of the way. Indeed, the Polymarket odds of the shutdown continuing past November 16 have fallen from around 40% when we went to press yesterday to 27% now. We also heard from President Trump, who said that SNAP benefits (the Supplemental Nutrition Assistance Program) would only be given when the government was open, and he said in another post that the Senate filibuster should be terminated so Republicans could reopen the government themselves.

Overnight in Asia, markets are continuing their decline but are well off their early morning lows. The Nikkei (-2.62%) and Kospi (-2.83%) are leading the way with the latter down over -5% earlier. Elsewhere the sell-off is less severe with the Hang Seng (-0.31%) and ASX (-0.13%) rallying back towards flat and the Shanghai Composite (+0.14%) actually higher. NASDAQ futures are down -0.20% and S&P 500 futures down -0.07%, with the former rallying nearly a percentage point from the lows.

Earlier in Europe, the main news came from the UK, where gilts rallied after Chancellor Reeves delivered a speech that reassured markets about future bond issuance. Notably, she said that the “more we try and sell, the more it will cost us”, and she also affirmed that her “commitment to the fiscal rules is ironclad.” So that helped 10yr gilt yields to fall -1.0bps yesterday, ending the session at 4.42%. The speech comes ahead of the budget on November 26, and another significant feature was that Reeves didn’t rule out the prospect of tax rises either. That’s important, because the governing Labour Party promised at last year’s general election that they wouldn’t raise income tax, VAT or National Insurance (a payroll tax), so a shift in that stance would be a big political moment.

Elsewhere in Europe, the risk-off tone mirrored what we saw in the US, with the STOXX 600 (-0.30%) falling to a two-week low. Several of the major indices lost ground, including the DAX (-0.76%) and the CAC 40 (-0.52%), although the FTSE 100 (+0.14%) posted a modest gain as it was supported by the weakness in the pound sterling (-0.91% vs USD). Meanwhile, sovereign bonds rallied across the continent, with yields on 10yr bunds (-1.3bps), OATs (-0.6bps) and BTPs (-1.0bps) all falling back.

To the day ahead now, and data releases from the US include the ISM services index and the ADP’s report of private payrolls for October. Otherwise, we’ll get the final services and composite PMIs from the US and Europe, German factory orders for September. Otherwise, central bank speakers include the ECB’s Villeroy, Nagel and Kocher, along with the BoE’s Breeden. Earnings releases include McDonald’s and Qualcomm.

Loading recommendations…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.