Five Things To Know As BYD’s 5-Minute EV Chargers Juice Up Next Week

Less than two weeks after China’s BYD unveiled game-changing EV charging technology capable of delivering 1,000 kW fast charges and adding 250 miles of range in just five minutes, BloombergNEF analysts published a note Wednesday titled “Five Things to Know About BYD’s Five-Minute Charging.”

BloombergNEF EV analyst Ash Wang told clients that BYD’s 1,000 kW chargers are “as fast as filling a tank with gasoline at the pump, and could be a game changer for electric vehicle adoption.”

Wang outlined five of the most critical things to know about the fast-charging advancement:

1. BYD blew competition out of the water with 1,000 kilowatts charging

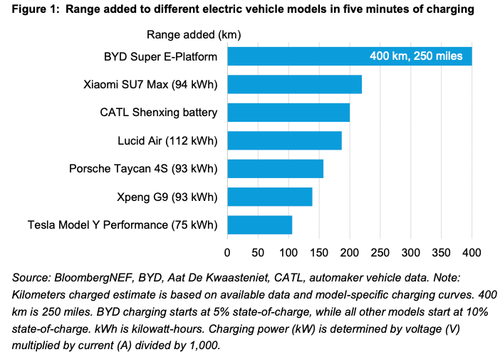

BYD’s newest Han L and Tang L electric vehicles will be capable of adding 250 miles of range in just five minutes. That’s twice as fast as the best fast-charging vehicles in the market today, such as the Xiaomi SU7 Max, which can do 220 km in five minutes, and the Lucid Air which can do 187 km in the same time (Figure 1).

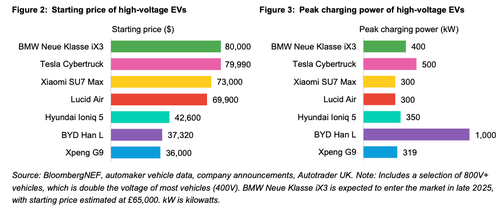

The vehicles will be available from Spring 2025, starting at around 270,000 yuan ($37,320) and will have peak charging power of 1,000 kilowatts. This is four times more than that of Tesla’s Model Y and even twice that of the Tesla Cybertruck that announced peak charger power of 500 kW.

Charging power (kilowatts or kW) is determined by voltage and current. Having high voltage architecture — BYD has a 1,000-volt platform — enables faster charging.

At this price, these vehicles pose a big threat to other automakers. It may take some time for the vehicles to arrive in Europe and North America, though, giving those regions some breathing space.

The advancement could undermine the case for next generation solid-state batteries. Toyota’s plans to bring that technology in mass production by 2025 now look slightly irrelevant. Honda and Nissan have also been working on solid-state batteries. The case for battery swapping may also stand diluted. While NIO’s latest system changes a battery slightly faster — in three minutes — it requires extra capital for the spare batteries in the swapping systems.

2. How does it work and is it real?

BYD’s new vehicles will be built on its new Super e-Platform 3.0, which has a 1,000-volt architecture. The high voltage, BYD’s proprietary “Flash Charging Battery” are key enablers of five-minute charging.

For context, most EVs use a 400-volt architecture. At higher voltages the required current for fast- charging is reduced. This is advantageous as the current is a driver of heat. There are a spate of models that have high voltages though, and BloombergNEF expects it will become popular across price points.

For example, Hyundai’s Ioniq 5 came to market with an 800-volt architecture in 2021, Xpeng’s 800-volt G6 came to market in 2023, and the new BMW Neue Klasse vehicles due in late 2025 will also have voltages of 800V. BYD’s ability to deliver faster charging than the competition and price below $40,000 could be pivotal (Figure 2, Figure 3).

BYD’s 1,000V architecture still manages currents of 1,000 amps, which is enabled through a mix of innovations in the battery pack, electrical system, and thermal management. All are aided by the company’s vertical integration strategy.

The battery technology is interesting because it is an evolution of the currently used lithium-iron- phosphate (LFP) chemistry. It is one of the cheapest cathode chemistries on the market, and it is the same chemistry CATL’s fastest charging Shenxing battery uses. It can charge 400km in 10 minutes rather than 5 minutes. The exact upgrades that will be made to BYD’s battery and its anode are currently unclear.

BYD has also upgraded the thermal management system around the battery cells and motors. In- house developed silicon carbide (SiC) chips, with ratings of up to 1,500 volts, supersede the performance of traditional silicon chips.

Will the vehicle actually charge at 1,000kW?

The video released on launch suggests it is possible. It would be a risk for BYD to announce they were going to be able to do it on vehicles coming out in two months, only for it not to materialize. Secondly, it’s important to understand that this performance is only under specific conditions.

The vehicle is only likely to achieve 1,000kW charging for a short period of time at low states of battery charge, so when drivers turn up with 40% charge they may not achieve these rates. Further, to achieve 1,000kW charging, it seems the vehicles need to use “dual-gun” charging, which is two 500 kW connectors used simultaneously. BYD has previously demonstrated the dual-gun charging on a Denza model (Figure 4).

3. Risks

Managing the heat and stress generated at such high currents is complex and could increase the risk of failure and warranty costs.

This has already been an issue in the EV industry. In February 2025, Samsung SDI recalled up to 180,196 high voltage battery packs, and in 2021, LG and GM agreed on a $1.9 billion deal to recoup recall costs due to battery issues on the Bolt.

Additionally, delivering 1,000 kW could decrease efficiency and therefore make charging more expensive.

4. BYD to expand charging infrastructure

BYD plans to install 4,000 “megawatt flash charging” stations in China. The company already operates 11,000 charge points in a joint venture with Shell, so BYD has some experience in the market. Tesla, by comparison, had over 12,000 Supercharger stalls across 2,000 stations in China by January 2025.

The impact of BYD’s rollout in a country the size of China may be limited, as there are already 3.6 million public chargers in the country, of which BloombergNEF estimates about 1.2 million are between 100kW and 400kW. I

t remains unclear who will own and operate BYD’s charging network, and whether it will open access to other brands. BYD will need other operators in the market, such as TGood and Starcharge, to take up the technology for it to be widely available.

BYD stations will also incorporate a battery pack of 250kWh to alleviate pressure on local grids. Incorporation of storage has long been touted with chargers but has so far been limited. This could be the catalyst for wider adoption. The rollout of megawatt-class chargers could face limitations outside China due to grid constraints.

5. Charging speed isn’t the only battle

Automakers are competing on other technologies like advanced driver-assistance systems (ADAS). Brands are attempting to stand out with more sophisticated products than their rivals.

The rollout of BYD’s 1,000 kW ultra-fast chargers could begin as soon as April—less than one week away—according to a report by CNEVPost. BYD’s general brand and public relations manager confirmed that 4,000 of these chargers would be installed in the coming months.