Downsize Your Euphoria

Submitted by QTR’s Fringe Finance

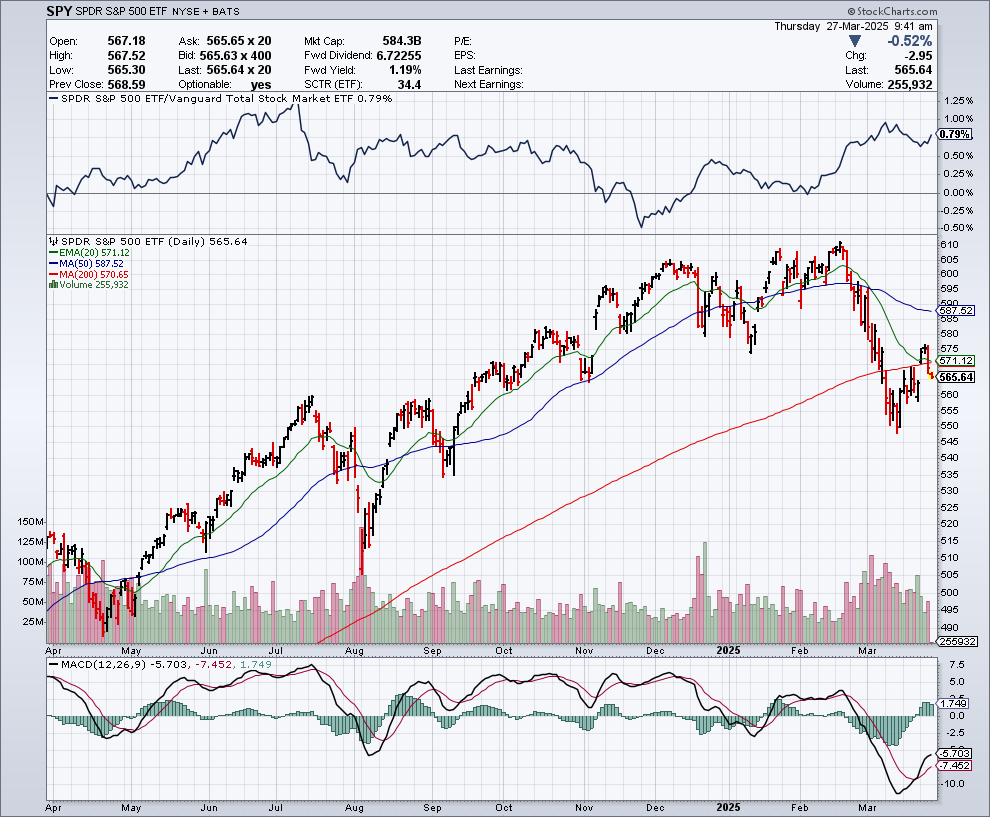

While the 25 Stocks I’m Watching for 2025 list (part 1 here and part 2 here) continue to perform well relative to the S&P, I can’t say the same about the overall market.

The looming question yesterday was whether the market snapback early in the week was a path to the S&P taking back its trend and continuing to move higher, or just a “bear market rally”. It shouldn’t be a surprise that I believe it was the latter.

There’s an old expression that “nothing good ever happens below the 200-day moving average.” As you can see, that’s where the S&P 500 continues to be (under the red line).

Then there was the question of auto tariffs yesterday, and whether or not Trump was going to immediately flip-flop on them—or whether he was even serious about them to begin with. While he does have a history of changing his mind quickly with regard to tariffs, it appears that, at least for the time being, these auto tariffs are here to stay.

The tariffs are sizable enough, and in a consequential enough industry, that they will create significant trade uncertainty between the U.S. and many of its major trading partners—introducing the stock market to more of the one thing it doesn’t like: uncertainty.

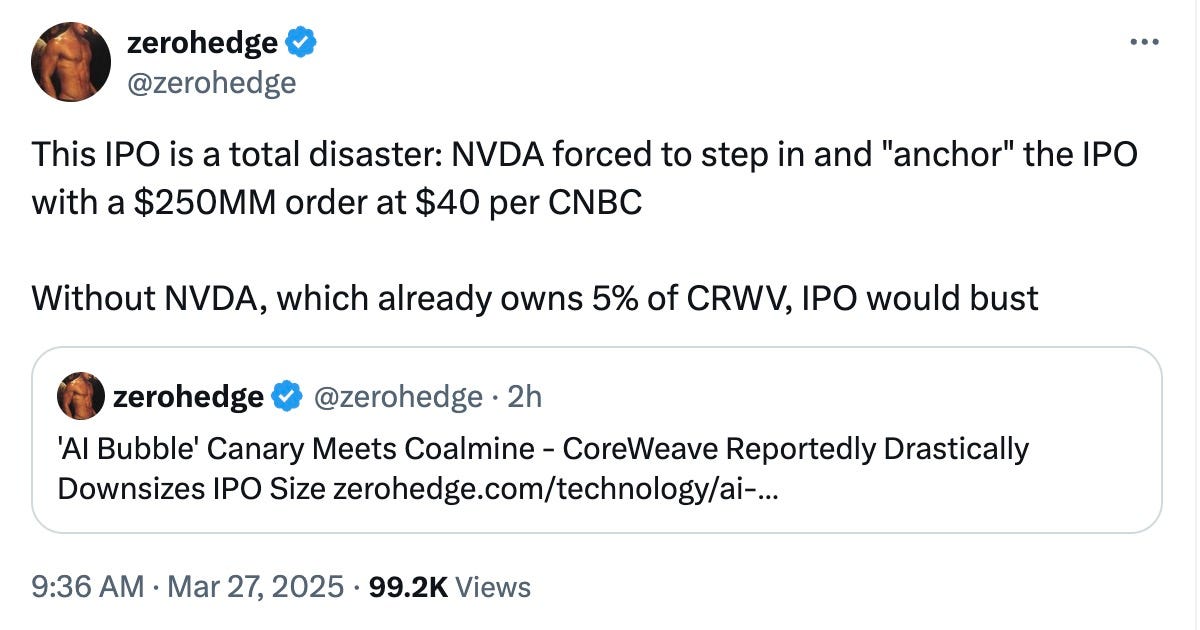

Finally, the big headline this morning is the news that CoreWeave, a purported player in the same atmosphere as Nvidia, was being forced to downsize its plans for an initial public offering.

Semafor reported that CoreWeave is set to scale back its IPO, cutting both the share price and fundraising target. The cloud firm is now aiming for a valuation closer to its $23 billion private-market figure from last year, down from the $30 billion it originally sought. It may also raise less than the $3 billion it had planned.

Shares are expected to price Thursday night and begin trading Friday, though shifting sentiment during today’s session could influence final decisions.

My longer-term readers know that about a year and a half ago, I started asking questions about where the black swans in the market could be. Where are the bodies buried that the rest of the market doesn’t necessarily know about yet? One of the places I ventured a guess was potentially between Nvidia and CoreWeave.

I wrote about the two following critical analysis that began circulating in lesser-trafficked analyst circles about the circuitous relationship between Nvidia and CoreWeave. As a reminder, here’s one video discussing the relationship I linked to with another writeup by The Mad King (paywalled now) — both of which made their rounds in mid-2023.

That circuitous relationship seems to, again, be what’s holding up CoreWeave:

“CoreWeave has been compared to WeWork because its tremendous revenue growth has come at the expense of unsustainable capex and cash burn, which in turn require tremendous constant outside investment (or debt): CoreWeave burned nearly $6 billion of cash in 2024 and $1.1 billion the previous year, because of the massive capex to build out its AI infrastructure,” Zero Hedge wrote Thursday morning, in their must-read analysis of the situation.

“Not surprisingly, CoreWeave – which also counts Microsoft as its largest customer – has been frequently rumored to be a core spoke in revenue roundtripping schemes involving Microsoft, Nvidia and OpenAI,” they continued.

And over the course of time since my 2023 article, other players in the same industry—namely Super Micro—have also had skeptical eyes cast upon them.

And just yesterday, legendary short-seller Jim Chanos raised critical questions about one of Nvidia’s acquisition of Lepton AI.

“Don’t know if this deal happens, and it’s not particularly big, but trying to buyout your resellers is usually a huge red flag. It’s often a way to bury inventory costs and/or avoid receivables provisioning,” Chanos wrote on X.

He continued: “Just to be clear, these kinds of deals w/customers and distributors do not necessarily have to be material in size to be material in impact, since near the end-of-cycles managements know that missing guidance by even a few pennies can be disastrous…”

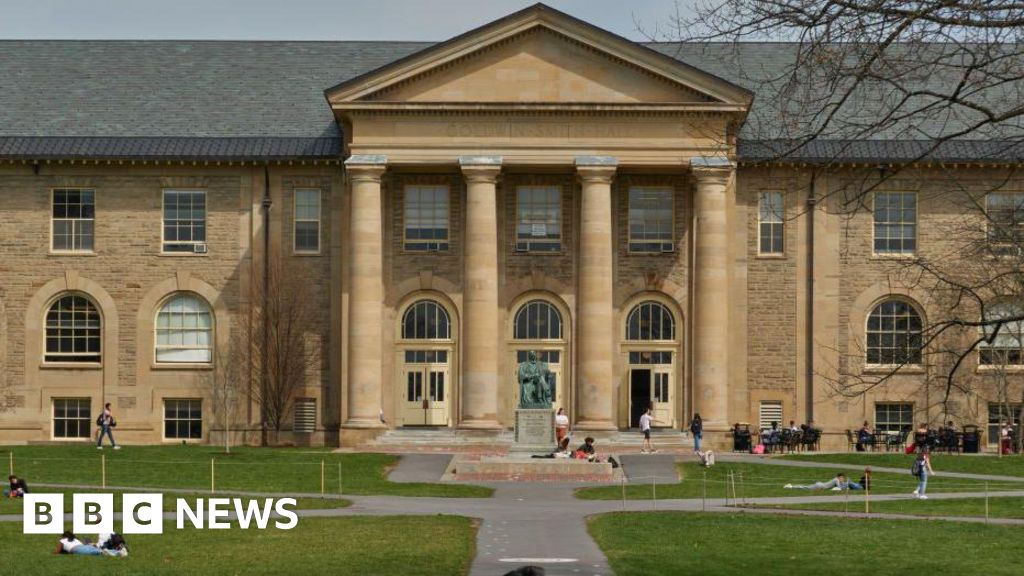

For those unfamiliar with Jim Chanos’s pedigree, not only was he first to blow the whistle on Enron, he teaches a course called “A History of Financial Market Fraud: A Forensic Approach” at Yale. His short-sale of Enron shares was dubbed by Barron’s as “the market call of the decade, if not the past fifty years.”

Does the CoreWeave IPO necessarily denote that there’s fraud or wrongdoing under the surface? No. But at the very least, what it does show is that the market’s appetite for the AI story—and perhaps for risk-on type investments in general—isn’t what it was a year ago. When companies start pricing IPOs under expectations, it is an indicator that the bid many thought to exist in the market—whether it’s for a specific industry, specific style of stock, or specific name in general—isn’t there.

🔥 50% OFF FOR LIFE: Using this coupon entitles you to 50% off an annual subscription to Fringe Finance for life: Get 50% off forever

To me, this CoreWeave news this morning, combined with concerns that Mr. Chanos raised yesterday—on top of what we already knew—sure seems to suggest to me that the AI story may at least be temporarily losing steam. Lest we also forget just yesterday it was announced that Microsoft was pulling back from more data center leases “due to an oversupply relative to its current demand forecast”.

Even David Faber on CNBC did a good job yesterday pushing back on CoreWeave’s IPO. I know I give CNBC a lot of shit—and much of it well-deserved for things like perpetually inviting on the largest value destroyer over the last 10 years for her opinion on things—but Faber has done great lately.

Not only did he raise critical questions about customer concentration and debt load just hours before the IPO was significantly downsized, I also watched him a couple of weeks ago argue the bear case against multiple analysts who pushed the same AI narrative we’ve heard for the last year, and made bombastic claims like stocks that are trading at 40x earnings are “cheap” because they’re down a couple percent off their highs.

I’ve often said that crypto is the tip of the risk-taking spear, and to watch that asset class as the canary in the coal mine for the rest of the market. As it relates to equities, however, AI is the tip of the narrative spear that still lures people into buying technology equities. If that narrative starts to crumble, I don’t think it is too much of a stretch to suggest there could be a domino effect in the rest of the equity market.

I don’t want anything to do with these AI names until I get significantly more clarity on the space and the overall market is far less volatile.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. Assume any and all numbers in this piece are wrong and make sure you check them yourself. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Loading…