Budget 2025 live: Ordinary people will pay ‘a little bit more’, says Reeves

Huge chunk of tax rises will be spent on rising welfare billpublished at 20:29 GMT

Dharshini David

Dharshini David

Deputy economics editor

More than half of the tax rises will go towards paying the welfare bill, which is forecast to be £16bn higher in 2030 than previously expected.

More than half of that £16bn will be spent on U-turns such as winter fuel payments and the removal of the two-child cap on benefits.

Over £3bn is due to a greater-than-expected increase in annual benefit rates for pensioners and those of working age.

The rest includes increased disability caseloads and an increase in unemployment (which economists say last year’s tax rises contributed to).

That increasing welfare bill underscores the ticking time-bomb that many western nations face as populations get sicker and older, as well as pressure on the chancellor to reform welfare, and the challenges she will face if she takes it on.

Government planning to replace Lifetime Isaspublished at 20:25 GMT

Image source, Getty Images

Image source, Getty Images

Among the measures announced today are some changes to Individual Savings Accounts (Isas).

As part of these changes, the government is starting a consultation into scrapping the Lifetime Isa.

This is a government-supported savings account for people in the UK aged between 18-39 who are saving for a home, or for retirement. For every £4 put in, the government contributes £1.

In the Budget, the government says it will publish a consultation in early 2026 “on the implementation of a new, simpler ISA product to support first time buyers to buy a home”.

“Once available, this new product will be offered in place of the Lifetime ISA,” it says.

Councils welcome reform to SENDpublished at 20:22 GMT

Kate McGough

Education reporter

The Office for Budget Responsibility has pointed out that the government is due to take over responsibility for all spending to meet the needs of children with Special Educational Needs and Disabilities (SEND) from 2028-29.

Rising SEND needs have meant local councils are spending billions more on SEND than they’re getting from central government, with debts currently estimated to reach £4.9bn by 2027/28, and continue rising up to £14bn, the OBR warns.

Since 2020, those debts have been kept off local authority books by something called a “statutory override” – which had been extended to 2027-28.

Teaching unions have warned against cutting school funding when taking this SEND debt into the wider education budget.

The County Councils Network has welcomed the decision, saying it’s a “positive step” in limiting councils’ exposure to “unsustainable” spending.

But they want “decisive action to wipe out historic deficits”.

Ministers have said they will set out plans for reform of the overall SEND system early next year.

Increasing international student costs comes with riskpublished at 20:15 GMT

Hazel Shearing

Hazel Shearing

Education correspondent

The government is consulting, external on plans to charge universities in England £925 per year for every international student they enrol – starting in August 2028 and increasing in line with inflation after that.

It estimates it will raise £445m in the first year – about 4.5% of universities’ international fee income in 2023/24. That’s lower than the 6% it originally suggested., external

International students are a major source of income for universities and there’s a lot up in the air when it comes to weighing up the impact on their finances.

It’s not clear how much of the cost they will absorb and how much they will pass on to international students in the form of higher fees.

If they pass the cost on to international students, there’s a risk that enrolments will drop.

The government estimates the net income loss to the sector in 2028/29 would be about £270m.

It says it will let universities off paying the charge for the first 220 international students “in recognition of the administrative burden” and the potentially “disproportionate impact” on smaller universities.

This Budget is better news for farmers than the lastpublished at 20:10 GMT

Oscar Bentley

BBC News

The budget looks like its slightly better news for farmers on inheritance tax.

The government is allowing spouses to transfer any of their £1m allowance before inheritance tax kicks in between partners.

So if one partner dies and only uses part of their allowance, the surviving partner could have an allowance of MORE than a million pounds.

This has been welcomed by the NFU, although they say more needs to be done to reduce the impact on farmers.

The charge kicks in for the first time in April 2026.

But the government has frozen the £1m allowance for a further year – along with other inheritance tax thresholds – until April 2031.

That could drag more farms into paying the tax.

Image source, Getty Images

Image source, Getty Images

Farmers have today been protesting in London to demand fair reforms in agricultural policies and the reversal of recent inheritance tax changes

Household energy bills could be cut by £150, but government still has some way to gopublished at 20:05 GMT

Mark Poynting

Mark Poynting

Climate reporter

The government had hoped to meet its pledge to cut energy bills by £300 by 2030 by ramping up clean power.

But bills have risen since Labour came to office.

A significant reason for continued high energy costs is the price of gas, which remains relatively high by historical standards.But the costs of switching to a cleaner power system – such as investment to build extra pylons and cables – are also becoming apparent.

So the chancellor has stepped in by removing some costs from bills.

These include a large chunk of the subsidies for older renewable projects and funding for energy efficiency schemes.

The government says those changes could cut the average annual household energy bill by roughly £150 from April.

The announcement has been broadly welcomed by energy analysts, many of whom had been calling for this for some time.

But some of the costs of these changes will be met from general taxation – and the government still has some way to go to meet its £300 pledge.

Budget falls short for oil industrypublished at 20:00 GMT

Kevin Keane

Kevin Keane

Scotland environment, energy and rural affairs correspondent

It was being viewed as a make-or-break moment for Europe’senergy capital – as Aberdeen waited to see whether the chancellor would scrapthe windfall tax.

As it turned out, workers and businesses in Scotland’s thirdlargest city were left bitterly disappointed.

The industry says the tax, which was introduced whenRussia’s invasion of Ukraine caused oil prices to spike sharply, is cripplingthe sector.

The oil price has since halved, to about $60 a barrel, andcompanies say there are no profits to be made under such a high tax regime soare taking their cash to other parts of the world.

Investment in the North Sea is at a record low and a studyfrom Robert Gordon University says jobs are being “quietly” lost at arate of 1,000 a month.

But there was no mention of the windfall tax in thechancellor’s Budget speech and the Office for Budget Responsibility assessmentprojects receipts from it for the rest of the decade.

That has left an entire city utterly flabbergasted.

Motability scheme hit with biggest change since it beganpublished at 19:55 GMT

Nikki Fox

Nikki Fox

BBC News Disability Correspondent

This is the biggest change to the Motability scheme since itsinception in the 1970s. Around 25% of the population is disabled and nearly a million people have a car through Motability.

Today’s announcement on the way the scheme is taxed will inevitably mean higher costs for manypeople who use the scheme.

The intense focus on the Motability scheme in recent months has been asource of frustration for many disabled people – with widespread criticismsof misinformation around so-called “free” expensivecars.

But the reality is the scheme has grown in line with the numbersof people who are eligible for the underlying benefit you need to lease a carthrough Motability – the non-means tested benefit designed to help coverthe extra costs disabled people face.

Today’s changes will not reduce the disability benefit bill. Thesame, increasing numbers of people will still receive the higher rate PersonalIndependence Payment (PIP) and have the choice to then use that forMotability.

Earlier in the year the government tried to tackle the disabilitybenefits bill by proposing a change to the eligibility criteria of one part ofPIP.

It didn’t work and they were forced to U-turn.

Many disabled people see today’s announcement as the Treasurytrying to “tackle welfare,” without actually reducing the number ofPIP claimants.

Motability have told us today’s announcement means the scheme willneed to change, but they will test out what impact any changes might havebefore they carry anything out.

Postpublished at 19:49 GMT

Matt Spivey

Matt Spivey

Live editor

We’ve been combing through the Budget in the hours since it was announced by Rachel Reeves – and indeed before, considering much of the detail was mistakenly released by the OBR ahead of time.

There’s a lot to digest and our BBC correspondents and reporters have been unpicking the finer details and, crucially, what the changes mean for you.

In our next few posts, we’ll be bringing you some more of the details within the Budget you may have missed.

Unions deliver mixed reactionspublished at 19:37 GMT

Image source, PA Media

Image source, PA Media

Public service union Unison says scrapping the two-child benefit cap is a “victory for thousands of working families” but “should’ve happened sooner”.

“It shows Labour is at last heading in the right direction and helping those who most need support, but the government must go further and faster if it wants to fix Britain,” the union’s general secretary Christina McAnea says.

But Unite general secretary Sharon Graham says: “The chancellor has picked a side. Health workers, engineers, and tanker drivers will pay by stealth taxes, while City bankers and billionaires are unscathed.”

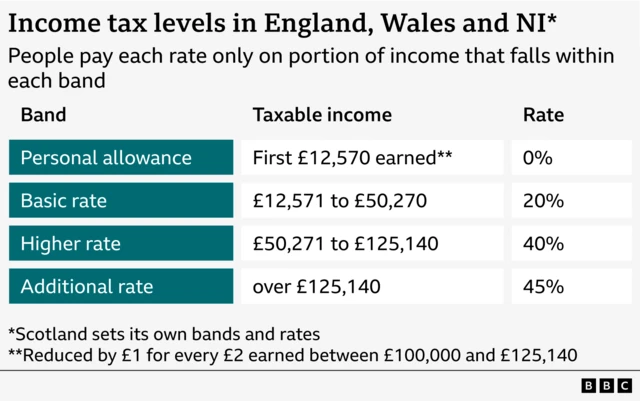

The union says its analysis shows Reeves’s decision to freeze income tax thresholds will result in an additional 10 million workers paying the higher rate of income tax.

Trade Union Congress general secretary Paul Nowak says Reeves has “delivered urgent relief to millions of hard-pressed households up and down the country and helped to rebuild our public services”.

“The policy decisions announced today will disproportionately benefit those low and middle-income households at the sharp end – and tax increases will fall on the wealthiest,” he says.

Performing arts and entertainment trade union Equity labels today’s announcement a “damp squib”.

Political parties pile on Reeves’s Budget – what have they said?published at 19:33 GMT

Image source, EPA

Image source, EPA

Conservative leader Kemi Badenoch called the Budget a “smorgasbord of misery” and accused Reeves of breaking Labour’s manifesto by extending the income tax band freeze.

Liberal Democrat leader Ed Davey warned “you can’t tax your way to growth” and accused the chancellor of having “diagnosed the disease but not administered the cure”.

Green Party leader Zack Polanski said Labour was “once again protecting power and wealth”, and the party said it would “squeeze households already struggling”.

Leader of Reform UK Nigel Farage said that “working people are going to be subsidising a welfare bill that shows no sign of going down” and called it an “assault on aspiration”.

Scottish National Party’s Shona Robison – Scotland’s finance secretary – said the Budget “fails to deliver” for Scotland and has been “absolute chaos from start to finish”.

Northern Ireland’s Finance Minister John O’Dowd, of Sinn Féin, said the Budget “doesn’t go far enough” in boosting growth or investing in public services.

Plaid Cymru leader Rhun ap Iorwerth criticised a lack of devolution or tax on “extreme wealth”. He said that “Wales is losing to Westminster (again)”.

You can read a recap of what Reeves said about the measures she is taking here.

Why does freezing tax thresholds cost me money?published at 19:02 GMT

One of Rachel Reeves’s main announcements was that income tax thresholds will be frozen until April 2031.

That means more workers will pay more tax. But why?

Take someone on a £50,000 salary. At the moment, their first £12,570 has income tax of 0% (the personal allowance). The rest of their salary has income tax of 20%.

If their pay keeps pace with the current rate of inflation, their salary will be almost £60,000 in five years’ time.

So – in real terms – their pay won’t have risen, because it has only matched inflation.

But their tax bill will have increased in real terms. The 40% tax rate begins at £50,270, so in five years’ time they will pay that higher rate on almost £10,000 of their income.

At the moment, they don’t pay the 40% rate at all.

It’s not just people whose wages are near a threshold who will be affected. Anyone who pays income tax, who then gets a pay rise, will lose more of their pay, compared to if thresholds rose with inflation.

And about a million people who don’t earn enough to pay income tax now will start paying income tax when their earnings inch above the £12,570 threshold, according to the IFS. Read our full explainer here.

Scotland sets its own income tax bands and rates, but the personal allowance is set in Westminster. You can read more about the impact in Scotland here.

Green Party: ‘Struggling households squeezed while super-rich off the hook’published at 18:33 GMT

Image source, Getty Images

Image source, Getty Images

The Green Party says Rachel Reeves’s Budget chose to “paper over the cracks” instead of taxing “extreme wealth fairly”.

Green Party Treasury spokesman Adrian Ramsay says Labour’s “half-measures” won’t fix deep-rooted issues in the economy that “are keeping ordinary people in poverty while the super-rich get richer”.

“The chancellor spoke about asking everyone to make a contribution, but it is frankly inexcusable that she has made the political choice to squeeze households already struggling with the cost of essentials, whilst letting multimillionaires and billionaires off the hook,” he says.

Ramsay says the decision to scrap the two-child benefit cap is a “huge relief”, but says it is “unforgivable that it has taken 18 months”.

Why increase minimum wage if people will pay it back in tax?published at 18:18 GMT

The next question, from Cathy, asks what is the point of increasing the minimum wage if the government is then going to take that back in tax?

“There is definitely a case of giving with one hand and taking away with the other here,” Laura Suter, head of personal finance at AJ Bell, says.

She says the extension to the tax threshold freeze means that as wages rise, more of their income is being taxed than it otherwise would if the income tax bands rose with inflation.

“It’s good news for those on minimum wage because their wages are going up, but they are going to be facing higher tax bills than they otherwise would have been,” she says.

Will ‘mansion tax’ impact council tax bands?published at 18:09 GMT

Laura Suter, head of personal finance at AJ Bell

David in Brighton and Brian in Warrington have both asked for clarity on the new so-called mansions tax, and how it will impact current council tax bands.

“We don’t have lots of clarity on this,” says Laura Suter, head of personal finance at AJ Bell.

It is likely that councils will use the current council tax bands as a guide to assess the kind of properties that might be over the £2m limit, she adds.

But, she says, the charge is based on the property’s value, not on the council tax band it is in.

“We will get more information in the new year, the government will have a consultation on this and they will lay out their plans on how they actually plan to run this system and do these valuations,” Suter adds.

- As a reminder, owners of homes worth more than £2m in England will pay a £2,500 a year from April 2028, rising to £7,500 per year for properties valued above £5 million.

How will the government fund scrapping the two-child benefit cap?published at 17:56 GMT

Andy Verity

Andy Verity

BBC Economics correspondent

A question from Abi Knowles asks about the two-child benefit cap being removed – how does the government plan to fund this?

Government funds aren’t like ours; they don’t tax people in order to stick it into a savings account and thereby pay doctors and nurses or benefits.

However, if you’re talking about whether they have enough, comfortably, you’ve got £26 billion of tax rises in this Budget.

That’s more than enough to cover the £2.5bn it would cost to lift the two-child limit.

Rachel Reeves has clearly taken the view that the benefit of lifting 450,000 children out of poverty is well worth it.

It’s important to remember that public finances are not like household finances.

The government doesn’t have to first find the money before it spends it. It spends the money into existence in the economy and then taxes it back out.

Can the Chancellor change her fiscal rules?published at 17:50 GMT

Damian Grammaticas

Damian Grammaticas

Political correspondent

Andrew in Goole asks whether the Chancellor can change her fiscal rules.

Rachel Reeves sets the rules and this Budget – so she could change them.

The rules are just two quite simple things, one is that by 2029-30 day-to-day spending must be covered by tax receipts and the second rule is that, by that period, the amount of government debt should be falling compared to the size of the economy.

The thing that the chancellor would say is she thinks it is important to stick to those rules – and she has done today – because that gives the markets credibility – that the government is managing things effectively – and therefore means borrowing costs are kept down.

So, she would say she needs to keep those things in balance.

Reeves says energy bill cut will put ‘money in the pockets of working people’published at 17:44 GMT

Image source, Getty Images

Image source, Getty Images

If you’re just joining us, here’s a quick summary of what Chancellor Rachel Reeves set out today:

- Energy bills: Reeves said she is putting “money in the pockets of working people”, announcing during a post-Budget news conference “there will be a reduction of £150 in your energy bills” from April next year

- Frozen tax thresholds: But, pushed on the decision to freeze income tax thresholds until 2031, the chancellor accepted that she is asking “ordinary people to pay a little bit more”

- Tackling national debt: The chancellor reiterated that she is sticking to her fiscal rules – more on what those are here – as she says they will “get borrowing down while supporting investment”

- Scrapping the two-child benefit cap: Reeves told the Commons this will deliver “the biggest reduction in child poverty” since records began

- New measures: Meanwhile, she said a so-called mansion tax – on properties worth over £2 million – was an example of asking those with the “broadest shoulders” to help out

We’re answering your questions livepublished at 17:33 GMT

The detail has been coming thick and fast today – if you still have lingering questions about what it all means, you can tune into our Q&A starting now – press watch live above to follow along.

And if you’ve got a question, you can get in touch:

- Email: bbcyourvoice@bbc.co.uk, external, external

- WhatsApp: +44 7756 165803, external, external

- Upload your pictures and video

Please do read our terms & conditions and privacy policy.

In some cases a selection of your comments and questions will be published, displaying your name and location as you provide it unless you state otherwise. Don’t worry, your contact details will never be published.

Chancellor gets Labour manifesto tax pledge wording wrongpublished at 17:24 GMT

By Anthony Reuben

Let’s return briefly to Reeves’s post-Budget news conference, where the chancellor was pressed about her decision to extend freezes to income tax andNational Insurance thresholds – which will raise more revenue for thegovernment.

She was asked whether this broke a Labour manifesto pledgenot to increase taxes on working people.

She denied this, saying: “If you read the manifesto, we’revery clear – we say the rates of income tax, National Insurance and VAT.”

But that is not what the manifesto said.

Labour’s 2024 election manifesto pledged that the party”will not increase taxes on working people, which is why we will notincrease National Insurance, the basic, higher, or additional rates of incometax, or VAT”.

So it specified that the rates of income tax would not beraised but on National Insurance it just pledged that there would be noincrease.

Freezing the thresholds on income tax and National Insurancemeans that more money will be raised – an estimated £8bn in 2029-30.

HelenMiller from the Institute for Fiscal Studies, an economic research group, says this would “break theletter of the manifesto which said no increase in National Insurance”.

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.