These Countries Used The Most Cash In 2025

Did you know that entire economies still run on cash, pretty much day to day?

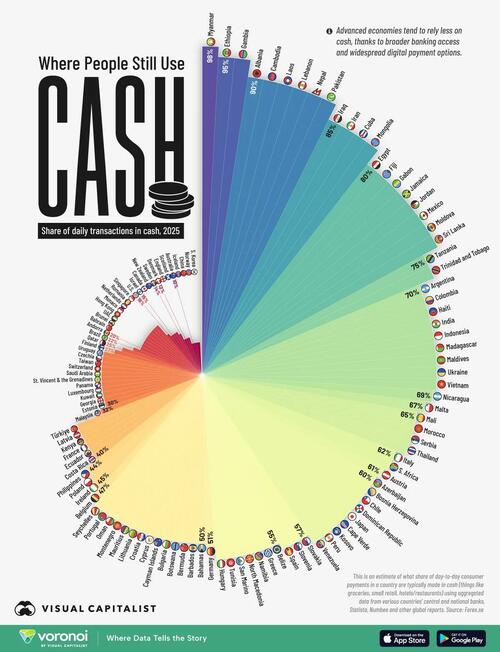

This infographic, via Visual Capitalist’s Pallavi Rao, ranks 123 countries by the share of daily transactions completed with physical banknotes and coins, spotlighting where cash is still king, and where it’s becoming a relic.

The data for this visualization comes from Forex.se.

Poverty and Limited Banking Fuel Cash Dependence

Myanmar tops the ranking at 98% cash usage, followed closely by Ethiopia and Gambia at 95% each.

| Rank | Country | ISO Code | Share of daily transactions in cash |

|---|---|---|---|

| 1 | 🇲🇲 Myanmar | MMR | 98% |

| 2 | 🇪🇹 Ethiopia | ETH | 95% |

| 3 | 🇬🇲 The Gambia | GMB | 95% |

| 4 | 🇦🇱 Albania | ALB | 90% |

| 5 | 🇰🇭 Cambodia | KHM | 90% |

| 6 | 🇱🇦 Laos | LAO | 90% |

| 7 | 🇱🇧 Lebanon | LBN | 90% |

| 8 | 🇳🇵 Nepal | NPL | 90% |

| 9 | 🇵🇰 Pakistan | PAK | 90% |

| 10 | 🇮🇶 Iraq | IRQ | 85% |

| 11 | 🇮🇷 Iran | IRN | 85% |

| 12 | 🇨🇺 Cuba | CUB | 85% |

| 13 | 🇲🇳 Mongolia | MNG | 85% |

| 14 | 🇪🇬 Egypt | EGY | 80% |

| 15 | 🇫🇯 Fiji | FJI | 80% |

| 16 | 🇬🇦 Gabon | GAB | 80% |

| 17 | 🇯🇲 Jamaica | JAM | 80% |

| 18 | 🇯🇴 Jordan | JOR | 80% |

| 19 | 🇲🇽 Mexico | MEX | 80% |

| 20 | 🇲🇩 Moldova | MDA | 80% |

| 21 | 🇱🇰 Sri Lanka | LKA | 80% |

| 22 | 🇹🇿 Tanzania | TZA | 75% |

| 23 | 🇹🇹 Trinidad & Tobago | TTO | 75% |

| 24 | 🇦🇷 Argentina | ARG | 70% |

| 25 | 🇨🇴 Colombia | COL | 70% |

| 26 | 🇭🇹 Haiti | HTI | 70% |

| 27 | 🇮🇳 India | IND | 70% |

| 28 | 🇮🇩 Indonesia | IDN | 70% |

| 29 | 🇲🇬 Madagascar | MDG | 70% |

| 30 | 🇲🇻 The Maldives | MDV | 70% |

| 31 | 🇺🇦 Ukraine | UKR | 70% |

| 32 | 🇻🇳 Vietnam | VNM | 70% |

| 33 | 🇳🇮 Nicaragua | NIC | 69% |

| 34 | 🇲🇹 Malta | MLT | 67% |

| 35 | 🇲🇱 Mali | MLI | 65% |

| 36 | 🇲🇦 Morocco | MAR | 65% |

| 37 | 🇷🇸 Serbia | SRB | 65% |

| 38 | 🇹🇭 Thailand | THA | 65% |

| 39 | 🇮🇹 Italy | ITA | 62% |

| 40 | 🇿🇦 South Africa | ZAF | 62% |

| 41 | 🇦🇹 Austria | AUT | 61% |

| 42 | 🇦🇿 Azerbaijan | AZE | 60% |

| 43 | 🇧🇦 Bosnia & Herzegovina | BIH | 60% |

| 44 | 🇨🇱 Chile | CHL | 60% |

| 45 | 🇩🇴 Dominican Republic | DOM | 60% |

| 46 | 🇯🇵 Japan | JPN | 60% |

| 47 | 🇨🇻 Cape Verde | CPV | 60% |

| 48 | 🇽🇰 Kosovo | XKX | 60% |

| 49 | 🇵🇪 Peru | PER | 60% |

| 50 | 🇻🇪 Venezuela | VEN | 60% |

| 51 | 🇸🇰 Slovakia | SVK | 57% |

| 52 | 🇸🇮 Slovenia | SVN | 57% |

| 53 | 🇪🇸 Spain | ESP | 57% |

| 54 | 🇧🇿 Belize | BLZ | 55% |

| 55 | 🇬🇷 Greece | GRC | 55% |

| 56 | 🇳🇦 Namibia | NAM | 55% |

| 57 | 🇲🇰 North Macedonia | MKD | 55% |

| 58 | 🇸🇲 San Marino | SMR | 55% |

| 59 | 🇹🇳 Tunisia | TUN | 55% |

| 60 | 🇭🇺 Hungary | HUN | 55% |

| 61 | 🇩🇪 Germany | DEU | 51% |

| 62 | 🇧🇸 Bahamas | BHS | 50% |

| 63 | 🇧🇧 Barbados | BRB | 50% |

| 64 | 🇧🇲 Bermuda | BMU | 50% |

| 65 | 🇧🇼 Botswana | BWA | 50% |

| 66 | 🇧🇬 Bulgaria | BGR | 50% |

| 67 | 🇰🇾 Cayman Islands | CYM | 50% |

| 68 | 🇨🇾 Cyprus | CYP | 50% |

| 69 | 🇭🇷 Croatia | HRV | 50% |

| 70 | 🇱🇹 Lithuania | LTU | 50% |

| 71 | 🇲🇺 Mauritius | MUS | 50% |

| 72 | 🇲🇪 Montenegro | MNE | 50% |

| 73 | 🇴🇲 Oman | OMN | 50% |

| 74 | 🇵🇹 Portugal | PRT | 50% |

| 75 | 🇸🇨 Seychelles | SYC | 50% |

| 76 | 🇧🇪 Belgium | BEL | 47% |

| 77 | 🇮🇪 Ireland | IRL | 45% |

| 78 | 🇵🇱 Poland | POL | 45% |

| 79 | 🇵🇭 Philippines | PHL | 44% |

| 80 | 🇨🇷 Costa Rica | CRI | 40% |

| 81 | 🇪🇨 Ecuador | ECU | 40% |

| 82 | 🇫🇷 France | FRA | 40% |

| 83 | 🇰🇪 Kenya | KEN | 40% |

| 84 | 🇱🇻 Latvia | LVA | 40% |

| 85 | 🇹🇷 Turkey | TUR | 40% |

| 86 | 🇲🇾 Malaysia | MYS | 32% |

| 87 | 🇪🇪 Estonia | EST | 30% |

| 88 | 🇬🇪 Georgia | GEO | 30% |

| 89 | 🇰🇼 Kuwait | KWT | 30% |

| 90 | 🇱🇺 Luxembourg | LUX | 30% |

| 91 | 🇵🇦 Panama | PAN | 30% |

| 92 | 🇻🇨 Saint Vincent & the Grenadines | VCT | 30% |

| 93 | 🇸🇦 Saudi Arabia | SAU | 30% |

| 94 | 🇨🇭 Switzerland | CHE | 30% |

| 95 | 🇹🇼 Taiwan | TWN | 30% |

| 96 | 🇨🇿 Czech Republic | CZE | 30% |

| 97 | 🇺🇾 Uruguay | URY | 30% |

| 98 | 🇫🇮 Finland | FIN | 27% |

| 99 | 🇶🇦 Qatar | QAT | 25% |

| 100 | 🇧🇷 Brazil | BRA | 22% |

| 101 | 🇦🇩 Andorra | AND | 20% |

| 102 | 🇧🇭 Bahrain | BHR | 20% |

| 103 | 🇧🇳 Brunei | BRN | 20% |

| 104 | 🇦🇪 UAE | ARE | 20% |

| 105 | 🇭🇰 Hong Kong | HKG | 20% |

| 106 | 🇲🇨 Monaco | MCO | 20% |

| 107 | 🇳🇱 The Netherlands | NLD | 20% |

| 108 | 🇷🇴 Romania | ROU | 20% |

| 109 | 🇸🇬 Singapore | SGP | 20% |

| 110 | 🇺🇸 U.S. | USA | 16% |

| 111 | 🇮🇱 Israel | ISR | 15% |

| 112 | 🇨🇦 Canada | CAN | 15% |

| 113 | 🇳🇿 New Zealand | NZL | 15% |

| 114 | 🇸🇪 Sweden | SWE | 14% |

| 115 | 🇩🇰 Denmark | DNK | 12% |

| 116 | 🏴 England | N/A | 12% |

| 117 | 🏴 Scotland | N/A | 12% |

| 118 | 🇦🇺 Australia | AUS | 10% |

| 119 | 🇮🇸 Iceland | ISL | 10% |

| 120 | 🇨🇳 China | CHN | 10% |

| 121 | 🇳🇴 Norway | NOR | 10% |

| 122 | 🇰🇷 South Korea | KOR | 10% |

Note: The FOREX Cash Index aggregates data from Statista, Numbeo, and other global reports, along with annual publications from central and national banks. The reported figure is an approximate average derived from sources including Cash Essentials, G4S, Euro Monitor, the World Bank, Statrys, and the Federal Reserve.

In these countries, a large share of the population remains unbanked, internet penetration is low, and merchants cannot afford card terminals.

Consequently, physical currency provides the simplest, cheapest, and most trusted medium of exchange, even if it limits consumers’ ability to save securely or access credit.

Generally speaking, cash remains virtually ubiquitous in lower-income nations and starts to drop as a country’s economy develops.

Even middle-income countries see high usage, Cambodia, Laos, and Nepal all post 90% cash usage, while neighboring India manages to bring it down to 70% thanks to its government-backed Unified Payments Interface (UPI).

ℹ️ Related: See how economic development correlate with cash use by looking at this map categorizing countries by income groups.

Countries That Are Cashless

At the opposite end of the spectrum, advanced economies with mature fintech ecosystems are rapidly phasing out bills and coins.

Norway and South Korea sit at 10%, the lowest amongst the lot, with the the U.S. at 16%.

Universal broadband, high smartphone penetration, and robust consumer protection frameworks give shoppers confidence to go fully digital.

Meanwhile, merchants benefit from faster settlement and reduced security risks.

Countries That Are Outliers in Cash Use

Japan at 60% is remarkably high for such a technologically advanced nation, helped by more use in rural areas.

Similarly, Germany at 51% is an anomaly among wealthy European nations, but this may be more due to privacy reasons and mistrust in big banking institutions.

On the other hand, upper-middle-income China at just 10% reflecting its leapfrog to mobile payments (Alipay/WeChat Pay), bypassing traditional card infrastructure entirely.

If you enjoyed today’s post, check out The 25 Richest Countries in the World in Three Metrics on Voronoi, the new app from Visual Capitalist.

Loading recommendations…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.