Crypto is a Trap: The New CBDC

Adrian Spitters and Peter J. Merrick

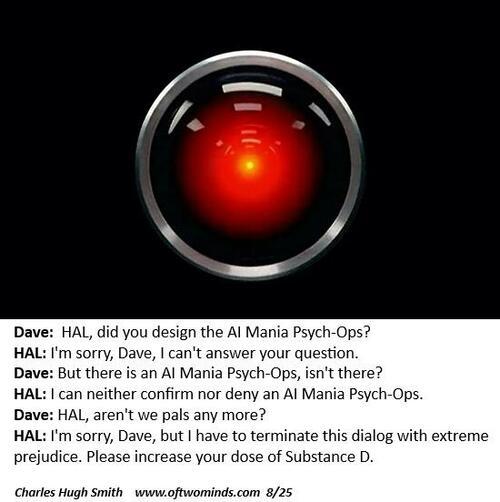

The world that is presented to us is a carefully constructed fantasy. Almost everything we are told, almost everything that the majority of people believe, serves only the purpose of controlling those same people. The rich and the powerful construct this fantasy so that the people they govern will comply of their own volition, because they don’t have sufficient jackboots to point guns at all of our heads and force our compliance. But the truth can be found, if you ask the right people, or look in the right places…