WTI Holds Losses After Surprise Crude Draw As Rig Count Decline Rejects ‘Drill, Baby, Drill’

Crude futures are lower for a third session in a row with the market refocusing on supply and demand balances after putting concerns about U.S. tariffs and Russia sanctions on hold, and API reporting another build in crude (and gasoline) stocks – the third straight weekly rise in inventories.

While global crude inventories have been swelling in recent months, the bulk of the accumulation has come in markets that have relatively little impact on futures prices, according to Morgan Stanley.

The premiums traders are paying for more immediate supplies, a pattern known as backwardation, signal strong short-term demand.

API

-

Crude +800k

-

Cushing +100k

-

Gasoline +1.9mm

-

Distillates +800k

DOE

-

Crude -3.86mm

-

Cushing +213k

-

Gasoline +3.39mm

-

Distillates +4.17mm

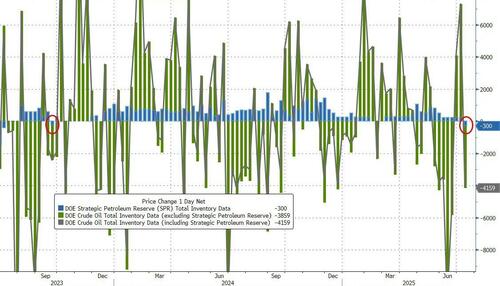

The official data reversed API’s guess with a sizable Crude inventory draw (ending the short streak of builds), but products stocks soared…

Source: Bloomberg

For the first time since Sept 2023, the SPR saw a drawdown as DoE Authorizes Exxon To Tap SPR To Avert Refinery Disruptions…

Source: Bloomberg

US Crude production remains at or near record highs as rig counts continue to tumble despite Trump’s ‘drill baby drill’ mantra…

Source: Bloomberg

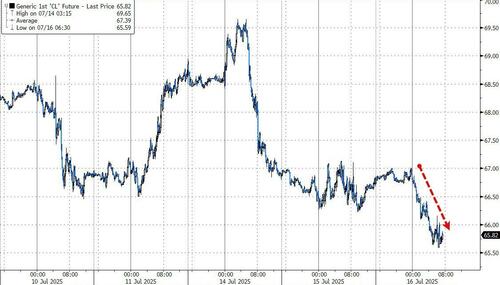

WTI was trading lower ahead of the official data and shows no signs of life post…

Source: Bloomberg

Price gauges indicate that availability is tight for the time being, with a premium of 81 cents on the international benchmark’s prompt spread, and US distillate inventories, which include diesel, touching the lowest level since 2005.

“The Brent futures curve remains firmly in backwardation across the first four-to-six months — a structure that usually points to market tightness,” Morgan Stanley analysts including Martijn Rats said in a note, which highlighted what they described as an uneven distribution of inventory increases.

“The builds have been in the Pacific, but Brent is priced in the Atlantic,” they said.

Oil has traded in a tight range over the past three weeks as strong summer demand is being matched with rising supply. OPEC+ has been adding 411,000 barrels per day to the market in monthly tranches that began in May and will boost that by 548,000 bpd in August.

The additional supply is boosting inventories.

Loading…