When +35% Feels Weak: Froth Rises and the Market’s Begging for a Breather

When up 35% looks “poor”

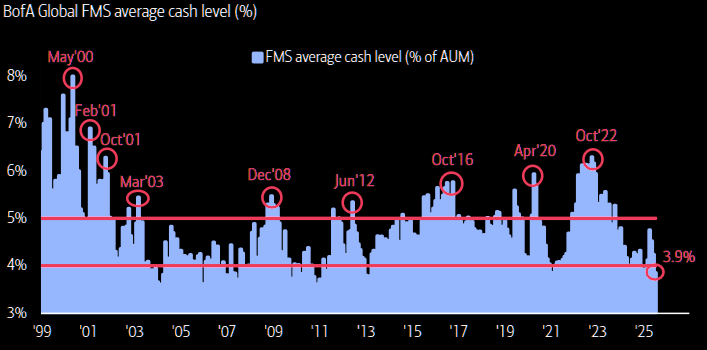

Timing reversals in panic upside moves is impossible, but we have seen some impressive moves since April lows. You know things are starting to feel a bit frothy when QQQ’s 35% rise since April lows looks tiny compared to the huge squeeze in the most shorted basket, up 83% from April lows. The market is ripe for a pause.

Source: LSEG Workspace

Time to chill?

NDX seasonality suggests less bullish times for a few weeks at least. Time to chill at the beach, before the autumn bull starts?

Source: Equity Clock

Get ready for the fade

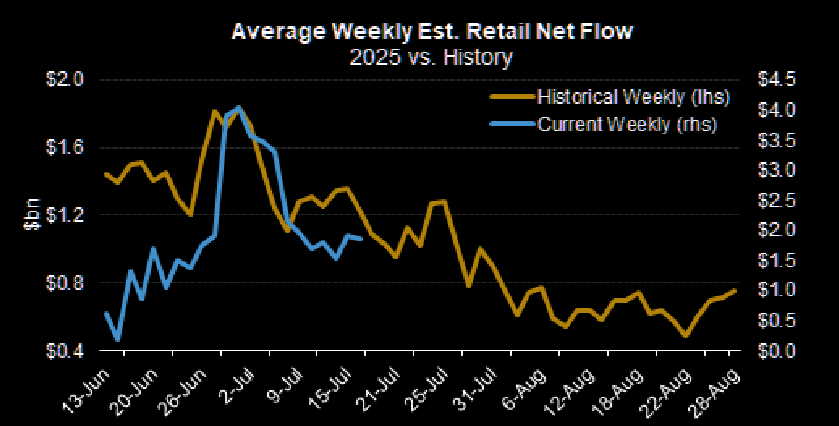

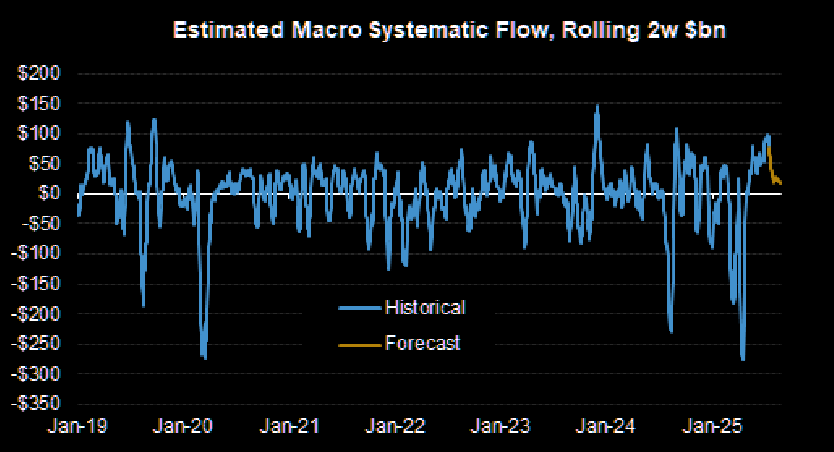

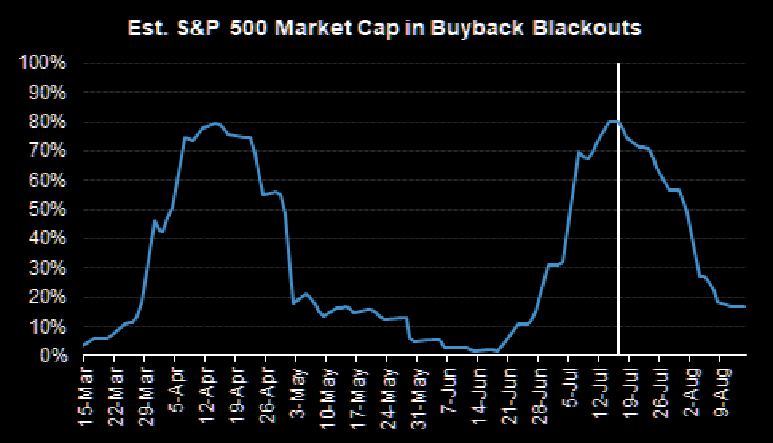

Morgan Stanley’s great QDS team points out that the rally may need to go higher before pulling back, as hedge funds still haven’t fully chased. But with passive inflows (retail, systematic, buybacks) set to slow in late July, the market could become more fragile—leaving room for a ~5% correction if earnings, macro, or tariffs disappoint.

Source: MS

What to do

MS QDS likes:

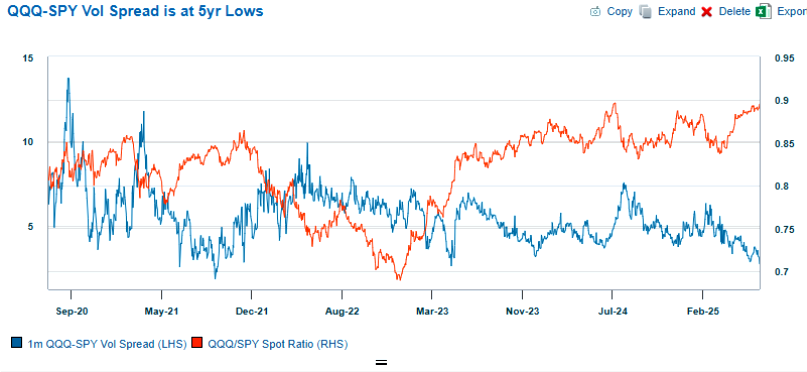

1. NDX Stock Replacement: QQQ Aug 575 calls (3% OTM) cost ~0.75%, cheap as NDX/SPX vol spread is at 5-year lows (see chart).

2. NDX Lookbacks: 3m 95% lookbacks cost ~2.85%, attractive for hedging without timing risk; especially compelling vs. vanilla (26th %ile pricing). Consider ex-AI baskets to stay long AI.

3. VIX Hedge: Oct 25/35 KO call with 10-vol rebate costs ~2.10—pays out if touched, a smarter hedge vs. failed past call spreads.

Source: MS QDS

Always watch the “delta”

MS QDS expects the systematic bid to halve going forward, from over $5bn to $2.5bn per day.

Source: MS

Sleeping giant

Do not underestimate the fact a high share of companies are in buyback blackouts at the moment.

Source: MS

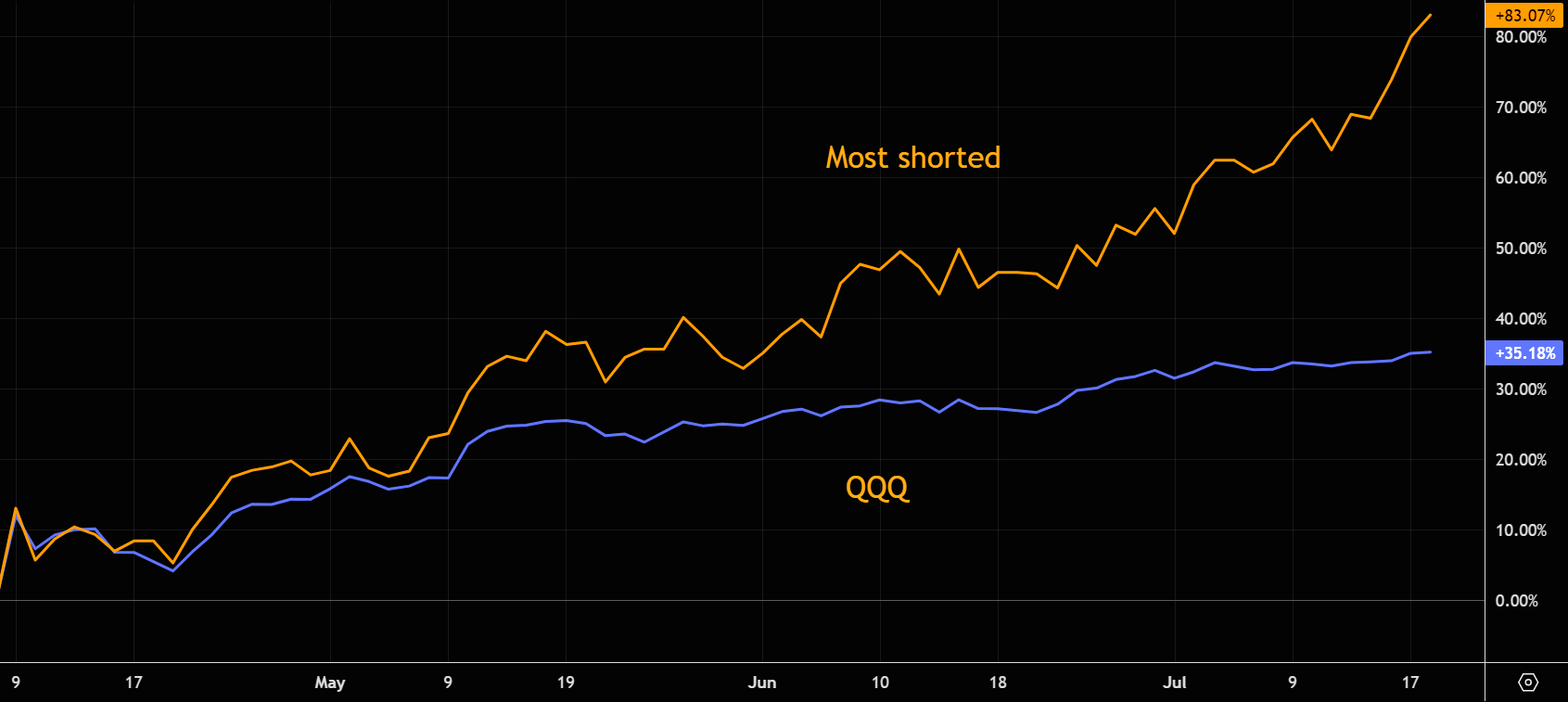

Dare to sell?

BofA’s cash level indicator dropping to 3.9%, triggering the first sell signal in a while. Track record is: “median 4-week S&P 500 loss post 17 “sell” signals since 2011 is -2% (biggest loss recorded post-sell signal = -29%, best gain 3%)”

Source: BofA

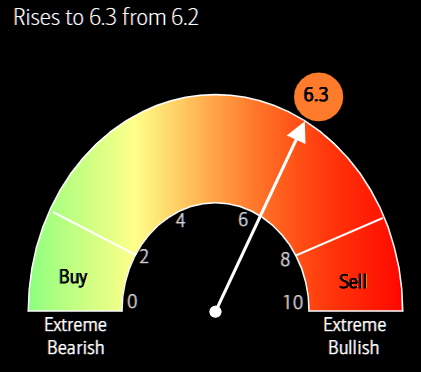

Bull/bear

BofA’s bull/bear indicator edging higher this week again: “…up to 6.3 from 6.2, highest since Oct’24 on strong EM/HY inflows & lower FMS cash levels (offset by hedge fund S&P500 short positioning); what pushes B&B Indicator toward sell signal of 8 in coming weeks…equity inflows >$25bn, HY bond inflow >$3bn, S&P500 >6400, hedge funds covering SPX shorts.“

Source: BofA

Skew rising

Skew has risen over the past sessions. We are in the early stages, but watch this closely, as the crowd has been forced into chasing longs, and are paying up for downside protection.

Source: LSEG Workspace

Loading…