US stocks plunge AGAIN as hedge fund managers turn on Donald Trump and call for a ‘suspension’

President Donald Trump has threatened even higher tariffs on China as tensions rise between Washington and Beijing.

It comes as US markets opened low for a third trading day in a row, reflecting massive instability in the markets as the White House’s “baseline” 10 per cent tariffs came into force.

Taking to his Truth Social page, Trump wrote: “Yesterday, China issued Retaliatory Tariffs of 34 per cent, on top of their already record setting Tariffs, Non-Monetary Tariffs, Illegal Subsidization of companies, and massive long term Currency Manipulation, despite my warning.

“Therefore, if China does not withdraw its 34 per cent increase above their already long term trading abuses by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs on China of 50 per cent, effective April 9th.

“Additionally, all talks with China concerning their requested meetings with us will be terminated! Negotiations with other countries, which have also requested meetings, will begin taking place immediately.”

Trump added that he has spoken to the Japanese Prime Minister Shigeru Ishiba this morning, and says that the country has treated the US “very poorly on trade.”

FOLLOW BELOW FOR LIVE UPDATES THROUGHOUT THE DAY…

Mexico wants to avoid tariff retaliation as President Sheinbaum confirms negotiations with Washington

Mexico’s President Claudia Sheinbaum said on Monday that her government would like to avoid imposing reciprocal tariffs on the US after President Donald Trump‘s sweeping tariff plans, though she said it could not be ruled out.

Trump has said that foreign governments would have to pay “a lot of money” to get the levies removed.

Sheinbaum said at her regular morning press conference that Economy Minister Marcelo Ebrard would continue negotiations with US officials in Washington.

She said: “As much as possible we would like to avoid imposing reciprocal tariffs…We won’t rule it out, but we prefer continuing with talks.”

Trump’s Truth Social post confirming the new tariffs

President Trump’s latest social media post

Truth Social

Nasdaq and Dow swing wildly amid ‘fake news’ reports suggesting 90-day pause on Trump’s tariffs

Stock markets LIVE: Nasdaq and Dow swing wildly amid ‘fake news’ reports suggesting 90-day pause on Trump’s tariffs

An inaccurate news report about President Donald Trump’s tariff plans caused Wall Street stocks to swing wildly.

The major markets across the US went from major losses to major wins back to losses again in a matter of mere minutes after a false report about a pause on President Trump’s global tariffs.

It follows the publication of a report that economic council director Kevin Hassett said Trump is considering a 90-day pause on tariffs for all countries with the exception of China, which was picked up by CNBC and social media users.

However, White House Press Secretary Karoline Leavitt called the reports of the proposal, which was made by by billionaire Bill Ackman, “fake news.”

Hassett said: “I think that the president is going to decide what the president is going to decide…I would urge everyone, especially Bill, to ease off the rhetoric a little bit.”

He separately that Trump had talked to world leaders all weekend and would listen to proposals for great deals, adding: “He’s doubling down on something that he knows works, and he’s going to continue to do that.

“But he is also going to listen to our trading partners, and if they come to us with really great deals that advantage American manufacturing and American farmers, I’m sure he’ll listen.”

White House trade adviser Peter Navarro said talk of a recession was “silly”.

Wall Street indexes u-turn following Hassett comments

Wall Street’s main indexes reversed course and moved sharply higher after White House economic adviser Kevin Hassett said in an interview that President Donald Trump was considering a 90-day tariff pause on all countries expect China, something the White House denied as “fake news.”

At 10.20am the Dow Jones Industrial Average rose 333.50 points, or 0.87 per cent , to 38,614.49, the S&P 500 gained 79.99 points, or 1.69 per cent, to 5,154.07 and the Nasdaq Composite gained 362.69 points, or 2.33 per cent, to 15,950.47.

Farage says Trump’s tariffs are ‘excessive’ as he admits he speaks to the US President ‘less’

President Donald Trump listens as Nigel Farage speaks in 2020

Getty

Nigel Farage has said Donald Trump’s tariffs are a “bit excessive.”

The Reform UK leader added: “Although he promised he’d do it in the run-up to the American election.

“So you can’t say he’s breaking his promises, but I think the impact of it – my own view, is the impact of it has been bigger than he could have predicted.”

He said he speaks to Trump “far less” now than he did during his first term as US president.

Crypto stocks plunge as bitcoin his year-low

Shares of cryptocurrency companies have tumbled as the US market opened on Monday.

Bitcoin fell as much as 5.5 per cent to hit its lowest in 2025, and was last trading 2.1 per cent lower.

Corporate bitcoin holder Strategy MSTR.O fell more than 10 per cent, while crypto exchange Coinbase COIN.O dropped seven per cent.

Online brokerage Robinhood HOOD.O slid 10.5 per cent after Barclays slashed its price target, citing concerns the crypto market turmoil could drag down the company’s transaction revenue this quarter.

Donald Trump urges Americans not to be ‘weak and stupid’

Donald Trump has urged Americans not to “weak” and “stupid”.

The US President took to Truth Social to urge people not to panic, despite the stock market collapse which has seen global turmoil.

He wrote: “The United States has a chance to do something that should have been done DECADES AGO.

“Don’t be Weak! Don’t be Stupid! Don’t be a PANICAN (A new party based on Weak and Stupid people!). Be Strong, Courageous, and Patient, and GREATNESS will be the result!”

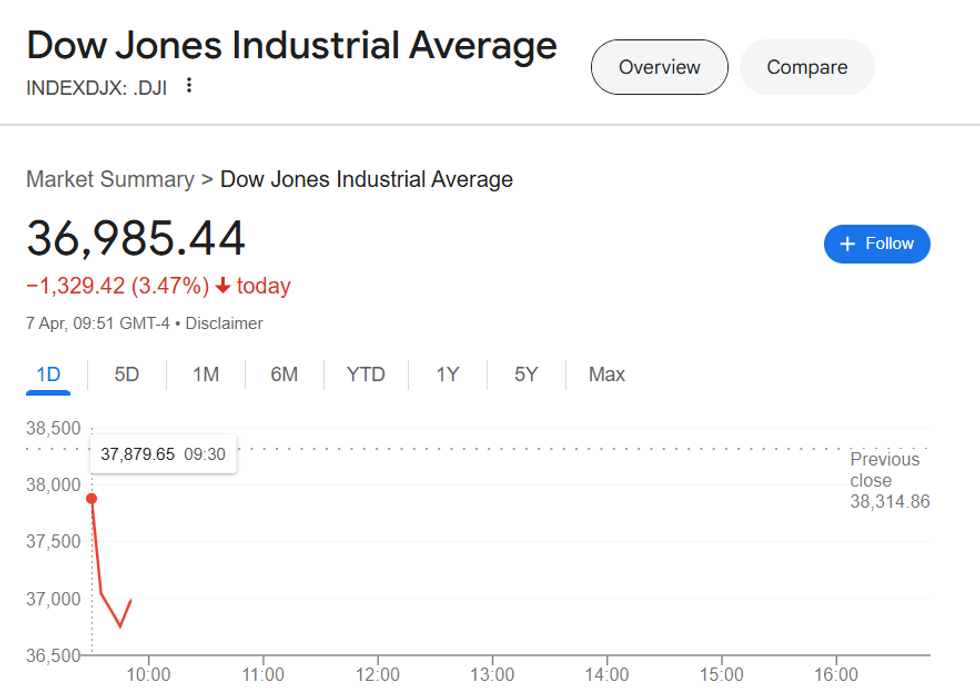

Dow Jones falls and rebounds quickly

Dow Jones fell upon opening but bounced back

Dow Jones has fallen by over three per cent upon opening on Monday morning, before bouncing back slightly.

The Dow posted back-to-back losses of more than 1,500 points for the first time ever.

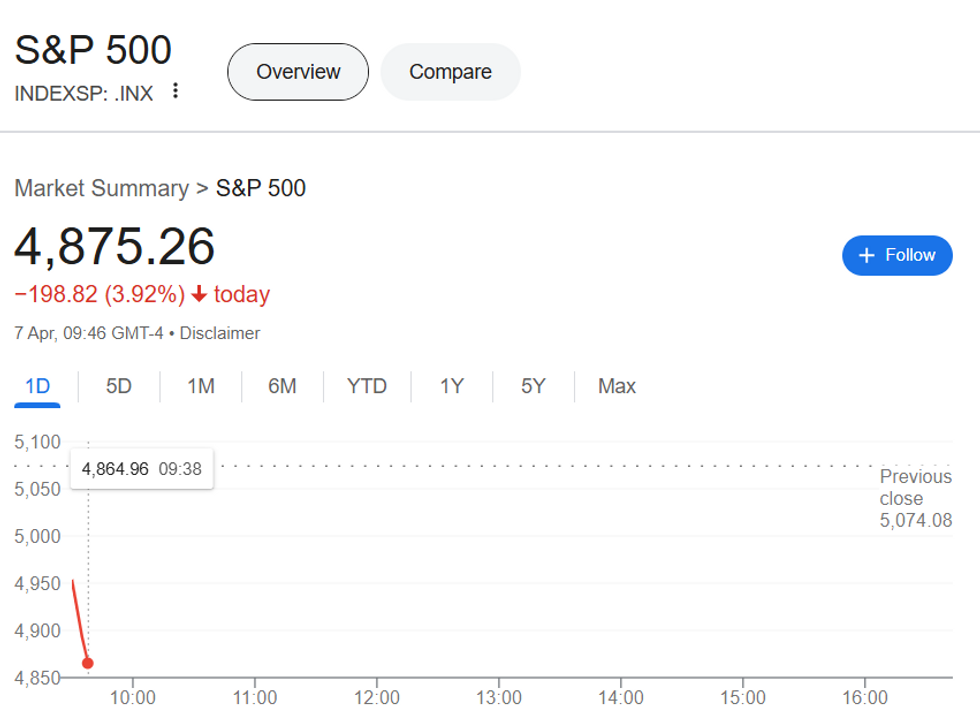

S&P 500 plunges on opening

The S&P 500 plunges on Monday morning

The S&P 500 has plunged upon opening on Monday morning, falling by over three per cent.

The S&P 500 was at one point set to open in bear-market territory — a drop of 20 per cent from a recent peak — after hitting a record high less than seven weeks ago, on February 19.

New York stock exchange opens

New York stock exchange opens

GB NEWS

The New York stock exchange has opened. Stay up to date with the markets on our live blog here.

Donald Trump blames ‘biggest abuser of them all’ China for stock market crash

Donald Trump has blamed China for the stock market crash, slamming Beijing for retaliating to his tariffs.

The US President took to Truth Social to blast Beijing’s role in the markets plunging, referring to the Asian country as the “biggest abuser of them all”.

He wrote: “Oil prices are down, interest rates are down (the slow moving Fed should cut rates!), food prices are down, there is NO INFLATION, and the long time abused USA is bringing in Billions of Dollars a week from the abusing countries on Tariffs that are already in place.

“This is despite the fact that the biggest abuser of them all, China, whose markets are crashing, just raised its Tariffs by 34%, on top of its long term ridiculously high Tariffs (Plus!), not acknowledging my warning for abusing countries not to retaliate.

“They’ve made enough, for decades, taking advantage of the Good OL’ USA! Our past “leaders” are to blame for allowing this, and so much else, to happen to our Country. MAKE AMERICA GREAT AGAIN!”

Audi holding its cars in US ports due to tariffs

Audi is holding its cars in US ports

REUTERS

Audi is holding its cars which arrived in US ports after April 2, as a result of Donald Trump’s 25 per cent tariffs on automobile imports.

The Volkswagen owned brand has around 37,000 vehicles, sufficient for approximately two months of sales, in its US inventory, a spokesperson said.

Carmakers on average have just under three months’ worth of inventory on hand in the United States, according to data from automotive services provider Cox Automotive, giving them some breathing room to keep supply intact until they establish a longer-term strategy for dealing with the tariffs.

Audi is directly in the firing line of Trump’s tariffs, with its best-selling US model, the Q5, produced in Mexico, and its remaining models all coming from Europe or elsewhere.

EU finance ministers hold meeting to discuss how to tackle Europe’s growth following Trump’s tarrifs

European Union finance ministers are due to hold talks over how to tackle Europe’s economic growth following Donald Trump’s tariffs.

Andrzej Domanski, the finance minister of Poland which holds the rotating presidency of the EU until June, said the ministers should consider tighter integration of the EU’s own internal market as a response.

The European Central Bank forecast last month – before the US announcements on tariffs – that euro zone economic growth would be around 0.9 per cent this year and inflation at 2.3 per cent.

Since then, Washington has imposed 25 per cent tariffs on European steel, aluminium and cars and 20 per cent of almost all other goods.

Domanski said that removing EU regulatory barriers hampering trade between the EU’s 27 countries should be the natural response to the US move.

The International Monetary Fund has said such regulations were equivalent to an over-40% tariff on goods and 110% on services.

Tariff retaliation would lead to ‘recessionary’ race to the bottom, economists warn

Retaliating to Donald Trump’s tariffs would lead to a “recessionary” race to the bottom, economists have warned.

Emmanuel Cau of Barclays said: “The Trump 2.0 global order reset has brought chaos to global economies and markets.

“Reciprocal tariffs and retaliation are recessionary, protracted policy uncertainty will likely keep downward pressure on equities until Trump backs off.”

Vanguard investment platform in the UK suffers outage

The Vanguard investment platform is down in the UK this morning, as stock markets continue to tumble.

The Down Detector website has recorded a spike in Vanguard users reporting problems since around 8am this morning when European markets opened.

Although the Vanguard website is accessible, attempts to log in to the investment platform are met with error messages, such as “Your request for this web page has been blocked” and “Sorry, we can’t find the page you’re looking for or something went wrong”.

Ftse 100 bounces back after initial early morning plunge

The Ftse 100 has bounced back following this morning’s plunge

The Ftse 100 has bounced back in the last few hours, following its plunge this morning.

The London stock market saw a drop of over six per cent shortly after opening, but has now bounced back by 2.5 per cent to 3.57 per cent down.

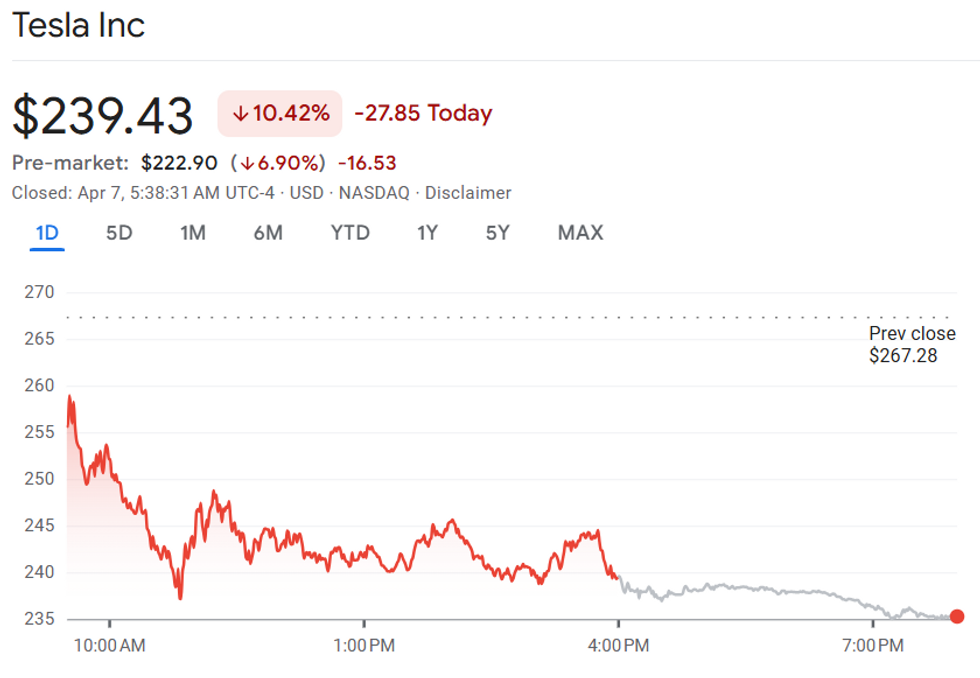

Tesla stock plummets by more than 10 per cent

Tesla stock price dropped

Tesla stock prices have plummeted by more than 10 per cent in early trading today.

Tesla suffered a slump in its prices earlier this year too, on the back of boycotts against owner, Elon Musk.

The company’s shares have fallen 50 per cent from a record high in mid-December.

S&P could fall by another EIGHT per cent, Morgan Stanley says

The S&P 500 could fall by another eight per cent, Morgan Stanley has warned.

That’s according to a Morgan Stanley team of strategists led by Mike Wilson, who told clients in a note early Monday that the next level of support for the index SPX -5.97% — the point at which buyers will step in — now sits at 4,700.

They add that valuations offer better support at that level, which is close to the 200-week moving average, a longer-term indicator of technical trends.

The S&P 500 finished at 5,074.08 last week, falling nine per cent — its biggest weekly percentage drop since March 2020.

German online broker Trade Republic suffers outage

The German online broker Trade Republic suffered an outage on Monday as stocks fell in a global rout, German media reported.

The scale of the outage, reported by Bild and other news organisations, was not immediately clear.

The online broker is among Germany’s most popular, with over 8 million customers in 17 countries with assets of €100billion.

Trade Republic’s trading was disrupted on its platform in 2021 when there was a surge in trading due to dealings in Gamestop, Blackberry and other stocks at the centre of a tussle between retail investors and big hedge funds.

Lord Mandelson to hold White House talks over market plunge

Lord Mandelson is due to hold talks with the White House later this week

PA

Lord Mandelson will hold talks with the White House this week over concerns about Donald Trump’s tariffs.

A Whitehall official told the Telegraph that the British delegation in the US were “watching market movements carefully” and have been in touch with “a lot of very concerned British businesses”.

The source added that “major UK businesses with operations in the US – who would like to invest more – are seeking greater clarity on the administration’s path forward”.

Oil prices and oil company shares plunge amidst recession fears

Oil prices have plunged to their lowest level in four years amidst fears of a recession.

Brent crude, the international benchmark, dropped another 3.5 per cent towards $63 a barrel, dropping nearly 15 per cent over the last five trading days.

West Texas Intermediate has fallen below $60 a barrel for the first time in four years.

This comes as BP shares have also dropped to their lowest level since the Covid-19 pandemic.

The oil giant saw another 7.6 per cent drop in its shares – 20 per cent over the last three trading days.

Indian markets bounce back after significant drop

Indian markets suffered a significant drop upon opening this morning, but have rebounded slightly in the hours since.

Both the Nifty 50 (NSEI) and the BSE Sensex (BSESN) lost around five per cent at the open, with both recovering to a decline of 3.96% and 3.71% respectively.

Labour Minister refuses to rule out rescinding Donald Trump’s state visit on back of tariff war

Heidi Alexander refused to rule out rescinding the offer of Trump’s second state visit

PA

Transport Secretary Heidi Alexander has refused to rule out rescinding the offer of a second state visit to Donald Trump as the fallout over the President’s tariffs grows.

Probed on whether Labour should withdraw the historic offer, Alexander failed to provide a direct answer as she told the BBC: “So, standing up for British industry is about finding solutions, and, as I have said, a constantly escalating trade war is in nobody’s best interest.

“I know that the Prime Minister has been speaking to Mark Carney in Canada, President Macron from France, over the last couple of days to ensure that we have those conversations with our international partners to make sure that we navigate this situation as well as we can.

“And it’s part of the reason why today I am announcing those changes to the zero-emission vehicles mandate, which provides certainty to the car industry and British manufacturers.”

Trump-backing hedge fund billionaire calls for 90-day tariff suspension

Bill Ackman called for a 90-day suspension on tariffs

REUTERS

A hedge fund billionaire who backs Donald Trump’s plan to “fix a global system of tariffs that has disadvantaged the US”, has called on the President to impose a 90-day tariff suspension.

Bill Ackman, CEO of Pershing Square Capital, wrote on X: “The country is 100% behind the president on fixing a global system of tariffs that has disadvantaged the country. But, business is a confidence game and confidence depends on trust.

“By placing massive and disproportionate tariffs on our friends and our enemies alike and thereby launching a global economic war against the whole world at once, we are in the process of destroying confidence in our country as a trading partner, as a place to do business, and as a market to invest capital.

“The president has an opportunity to call a 90-day time out, negotiate and resolve unfair asymmetric tariff deals, and induce trillions of dollars of new investment in our country.

“If, on the other hand, on April 9 we launch economic nuclear war on every country in the world, business investment will grind to a halt, consumers will close their wallets and pocket books, and we will severely damage our reputation with the rest of the world that will take years and potentially decades to rehabilitate.”

Donald Trump’s finance chief rejects US recession fears

Donald Trump’s finance chief has rejected fears of a US recession, despite markets tumbling again.

Scott Bessent, the treasury secretary, said there was “no reason” to expect a downturn in America and that the economy will be helped by strong job numbers, low borrowing rates and falling oil prices.

He said: “I see no reason that we have to price in a recession. Markets are organic animals and you never know what the reaction’s going to be. We get these short-term market reactions from time to time.

“There doesn’t have to be a recession. Who knows how the market is going to react in a day, in a week?”

Taiwan stocks plummet in biggest one-day drop on record

Taiwan stocks plummeted almost 10 per cent on Monday, the biggest one-day percentage fall on record.

Taiwan, hit with a 32 per cent duty, was singled out by Donald Trump as among the US trading partners with one of the highest trade surpluses with the country.

After resuming trade on Monday following market holidays on Thursday and Friday, Taiwan’s benchmark stock index (.TWII).

European shares plunge to 16-month low

The pan-European STOXX 600 slumped 5.68 per cent

European shares plunged to a 16-month low on Monday as investors grappled with the possibility of a recession after sweeping tariffs announced by United States last week.

The pan-European STOXX 600 slumped 5.68 per cent, after registering its steepest one-day percentage decline since the Covid-19 pandemic on Friday.

Trade-sensitive Germany’s benchmark index (.GDAXI), dove 6.6 per cent, among the worst hit, with Commerzbank (CBKG.DE), and Deutsche Bank (DBKGn.DE), shedding 10.7 per cent and 10 per cent, respectively.

Goldman Sachs raises US recession risk by 10 per cent

Goldman Sachs economists have raised their estimation of a US recession within a year to 45 per cent – up 10 per cent from a previous estimate of 35 per cent.

The economists said that if most of the tariffs take effect on Wednesday, April 9, then the effective tariff rate will rise by an estimated 20 points.

They said: “If so, we expect to change our forecast to a recession.”

Pound and euro rise as investors lose faith in the dollar

The pound has risen against the dollar by 0.2 per cent as investors are voicing their concerns over the world’s largest economy.

Meanwhile the euro gained 0.4 per cent on the dollar.

£1 now equates to $1.292, while €1 is $1.10.

Britain to suffer £22bn hit from Donald Trump’s tariffs

Trump’s trade war could severely derail Rachel Reeves’s economic plans

PA

Donald Trump’s tariffs are set to deliver a £22billion hit to Britain, economists have warned.

New analysis from KPMG predicts that the US President’s trade war will shave 0.8 per cent off the economy over the next two years.

The ‘Big Four’ firm slashed the UK’s growth forecasts for the current year from 1.7 per cent down to 0.8 per cent as a result.

This will leave the UK £21.6bn worse off by 2027, as Trump’s 10 per cent tariffs threaten to derail Labour’s plans.

Yael Selfin, KPMG’s chief UK economist, said: “There are so many things that could get worse.

“Ultimately, the main worry is confidence. Trade disruption is bad, but uncertainty is the big unknown.”