US economy shrinks 0.3%, companies race to get ahead of Trump tariffs – live updates

Economists divided over latest GDP datapublished at 15:45 British Summer Time

Natalie Sherman

Natalie Sherman

New York business reporter

Economists on Wall Street are parsing through the GDP data – and their reactions are showing just how hard it is to get a grip on what’s happening.

On the one hand, the US economy was already slowing – and the report suggested a further, significant loss of momentum.

But the data was distorted by a surge in trade, as firms pulled forward purchases.

Solid consumer spending data might be coloured by a similar phenomenon.

Business investment grew unexpectedly, while final sales to private domestic purchases – a closely watched indicator of demand – grew 3%, little changed from the previous quarter.

Conclusions are divided.

“At this point, it’s difficult to imagine how a recession could be prevented, aside from substantial further backpedalling on tariff policy,” says Richard Flynn, managing director at Charles Schwab UK.

But Wells Fargo economists say the data is too noisy to indicate a downturn is here.

“The US economy is at a greater risk of recession today than it was even a month ago, but this contraction in GDP is not the start of one,” they said.

No sign of mineral deal so far at the White Housepublished at 15:41 British Summer Time

Bernd Debusmann Jr

Bernd Debusmann Jr

Reporting from the White House

Good morning from the White House, where there is so far no sign of any impending mineral deal between the US and Ukraine – although that could change quickly.

So far, US officials from both the White House and Treasury have not answered my repeated inquiries about the deal.

And just moments ago, one of President Trump’s chief trade advisors, Peter Navarro, gave no indication that the deal would be signed soon.

His focus, and that of the media, was largely on GDP figures which show that the US economy shrank in the first quarter of the year.

Trump’s cabinet meeting will take place soon, and the press “pool” – the small number of reporters who will be in the room – are likely to ask about that.

Any announcement of the deal would be seen as a considerable victory for the administration, which just this week celebrated its 100th day in office.

Ukraine and US close to signing minerals deal, source tells BBCpublished at 15:36 British Summer Time

Image source, Getty Images

Image source, Getty Images

As economists grapple with the latest GDP figures, a senior Ukrainian official has told the BBC that Ukraine is “ready to sign” a minerals agreement with the US “today” – a significant development that could impact the US economy.

The US and Ukraine have been negotiating for several months over the deal which would involve an economic partnership between the two countries to develop Ukraine’s natural resources.

Kyiv estimates that about 5% of the world’s “critical raw materials” are in Ukraine.

Ukraine’s deputy prime minister, Yulia Svyrydenko, is on the way to Washington to sign the deal.

You can read the latest developments on this story in our separate live page.

Pete Navarro says GDP figures should be ‘positive news’published at 15:24 British Summer Time

Bernd Debusmann Jr

Bernd Debusmann Jr

Reporting from the White House

Image source, Bernd Debusmann Jr/BBC News

Image source, Bernd Debusmann Jr/BBC News

Just a few moments ago, we heard from Donald Trump’s trade advisor Pete Navarro – who walked up to a group of journalists with the words “what’s up, team?” after doing a live TV hit.

In brief remarks before he entered the West Wing, Navarro said that, in the administration’s views, data showing that the US economy shrank in the first quarter “should be positive news” that has been skewed by an uptick in imports.

“What happened with the numbers today is that we had a fairly extraordinary surge of imports, driven by the rest of the world trying to get their products in here before the tariffs,” he says.

“Next time, that won’t be the case at all, and it will reverse,” he says.

Additionally, Navarro pointed to a 22% increase in domestic investment – which he described as “literally off the charts” as a positive sign.

Asked about Trump’s earlier Truth Social post asking people to patient, Navarro says that Trump “inherited a tremendously bad set of economic policies” from the Biden administration.

“The fruit of the that poison by the tree is a series of spending bills that had drawn debt over a fiscal cliff.”

Navarro was also asked about potential trade deals with China and India, but declined to give specifics.

“Deals are coming,” he said as he walked away. “Just be patient.”

Inflationary shock will weaken growth for remainder of this year, says KPMG economistpublished at 15:14 British Summer Time

Ken Kim, a senior economist at accounting firm KPMG, says today’s GDP report indicates “pre-emptive behaviour by both consumers and businesses, acting before the tariffs were announced in early April”.

Speaking to the the BBC’s Business Today programme, Kim says that with the exception of the Covid-19 pandemic, the surge in US imports was “the highest since the early 1970s”.

“The reason for that was businesses wanted to bring the goods in ahead of time before the tariffs hit prices,” he says.

Kim says the expectation is that the US will be hit by price shocks because of the tariffs, and inflation “is likely to go higher over the coming months”.

He adds that the Fed is not expected to cut interest rates until the fourth quarter of this year.

“Going forward, we think the inflationary shock that will hit both consumers and businesses will dampen consumer spending as well as curtail capital spending by businesses,” Kim says, adding that this will “weaken growth for the remainder of this year”.

Analysts say it will take more time to understand impact of tariffspublished at 14:54 British Summer Time

Image source, Getty Images

Image source, Getty Images

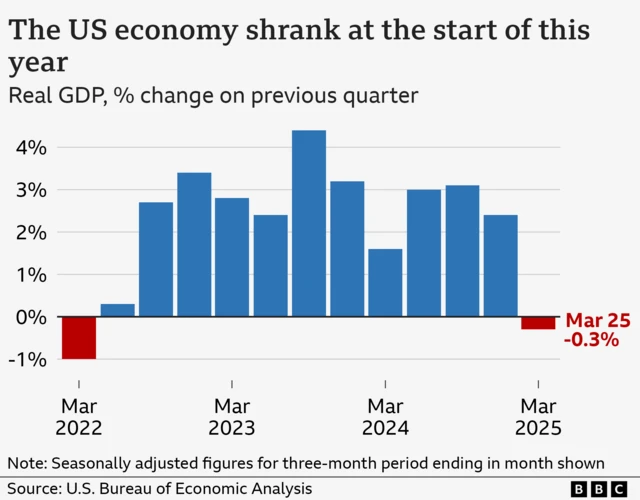

As we’ve been reporting, the US economy shrank in the first three months of 2025, according to the latest figures released by the US Bureau of Economic Analysis.

This was driven by a drop in government spending and a surge in imports – which count against growth – as firms raced to get good into the country ahead of tariffs.

Today’s report is the most comprehensive reading of how the world’s largest economy is holding up following the introduction of import taxes by President Donald Trump, which have scrambled global trade and created major uncertainty.

But analysts say it will take more time to understand the impact of those changes and the surge in imports is expected to be reversed in the months ahead.

The data shows business investment increased unexpectedly, while consumer spending – the primary driver of the US economy – also expanded, though at a slower pace than in 2024.

“Overall, not as bad as feared,” said Paul Ashworth, chief North America economist at Capital Economics.

Trump ‘making recessions great again’, Democratic lawmaker sayspublished at 14:42 British Summer Time

New York congressman Ritchie Torres has taken to social media to criticise the White House over the latest news that America’s gross domestic product (GDP) has dropped this quarter.

“It’s official: Donald Trump has finally liberated the American economy—from growth. GDP shrank by 0.3%,” he said on X.

“Making Recessions Great Again.”

US markets open downpublished at 14:33 British Summer Time

Breaking

Image source, Getty Images

Image source, Getty Images

The bell has sounded and trading on Wall Street has just opened for the day.

All three main indexes have opened down:

- S&P 500 -1.55%

- Dow Jones -1.17%

- Nasdaq -2.15%

Trump says economy figures have ‘nothing to do with tariffs’published at 14:27 British Summer Time

Breaking

US President Donald Trump has shared his thoughts on the economy after GDP figures were announced this morning, which indicates the US economy shrank 0.3% in first three months of this year.

On Truth Social, Trump claims: “this is Biden’s Stock Market, not Trump’s”.

“I didn’t take over until January 20th. Tariffs will soon start kicking in, and companies are starting to move into the USA in record numbers,” he says in a post on his Truth Social account.

“Our Country will boom, but we have to get rid of the Biden “Overhang.” This will take a while, has NOTHING TO DO WITH TARIFFS, only that he left us with bad numbers, but when the boom begins, it will be like no other. BE PATIENT!!!”

Economist suggests downturn could be a one-offpublished at 14:19 British Summer Time

Michael Race

Michael Race

Business reporter

The surge in companies rushing to bring in more goods fromoverseas ahead of import taxes kicking in has been the main driver behind theUS economy contracting.

However, some economists are suggesting the downturn couldprove to be a one-off.

While the first three months of the year saw imports risesome 41.3%, “the surge now appears to be going into reverse,” according to PaulAshworth, chief North America economist at Capital Economics.

That makes sense given a lot of firms shipped in the goods theywanted before the tariffs – and might be now looking for alternative and/orAmerican-based suppliers, which is what Trump wants in order to boost Americanmanufacturing.

Ashworth predicts imports falling going forward willlikely lead to the economy bouncing back in the next few months.

As GDP shrinks, White House touts economic achievementpublished at 14:12 British Summer Time

Bernd Debusmann Jr

Bernd Debusmann Jr

Reporting from the White House

Image source, Reuters

Image source, Reuters

Last night – to mark Trump’s 100 days in office celebrations – the Trump administration proudly put out a statement touting its economic achievements, including investments from some of the firms whose CEOs are in town for the president’s event later today.

The statement boasted of over $5tn (£3.74tr) in investments, which it claims will create over 450,000 new jobs and usher in an age of “American prosperity”.

Among the current and planned investments listed are $500bn from Japan-based SoftBank and US-based OpenAI and Oracle, another $500bn from Apple in US manufacturing and training, $500m from Nvidia for US-based AI infrastructure.

Additionally, the White House statements pointed to foreign investments pledged by foreign governments, including $1.4tn from the UAE, $1tn from Japan and $600bn from Saudi Arabia.

Trump to meet with Cabinetpublished at 14:05 British Summer Time

Today, US President Donald Trump has a Cabinet meeting at 11:00 EST (16:00 BST), a White House “investing in America” event at 16:00, and will phone-in for a televised town hall at 20:00.

He’s been on a media blitz to mark his first 100 days in office, which was yesterday.

We’ll be following his day closely to see if he addresses today’s GDP figures.

A worse outcome for growth than economists expectedpublished at 13:50 British Summer Time

Dharshini David

Dharshini David

Deputy economics editor

Not 24 hours after the White House Press Secretary claimedthat the American economy was going great guns, there’s dramatic proof that it wasn’t –even ahead of so-called Liberation Day.

This is a worse outcome for growth than economists expected.Some of the first quarter’s weakness was due to a surge in imports, asretailers stockpiled ahead of tariffs coming in – and that counts as depressingGDP growth.

But, with consumer spending weak, there are clear signs thatthe damage to growth may be sustained.

Influential economists hadpreviously warned that the risk of the US economy falling into recession thisyear was close to 50%.

Many will be hastily readjusting those expectations,fearing that the pain for households and businesses has come sooner and will bemore acute.

And don’t forget, Americans account for $1 in $6 of globalconsumer spending – if they’re not buying, it’s harder for other countries tosell. We’re not immune to their pain

Economy shrinks as companies race to get ahead of the tariffspublished at 13:43 British Summer Time

Natalie Sherman

Natalie Sherman

New York business reporter

We just got our first comprehensive read of how the US economy was doing at the start of the year.

The US economy shrunk at an annual rate of 0.3% in the first three months of the year, the Commerce Department says.

That marked a sharp downturn after growth at an annual pace of 2.4% in the previous quarter, though the fall was not as severe as some analysts had predicted.

The decline was driven by drop in government spending and a more than 40% surge in imports – which count against growth – as companies raced to get ahead of the tariffs.

Consumer spending growth also slowed from the end of last year, with growth of 1.8%, down from 4% in the prior quarter.

Treasury Secretary Scott Bessent just yesterday urged people to focus less on sentiment and more on the hard data as they try to evaluate how the economy is doing.

This report, which focuses on a period before US President Donald Trump’s most far-reaching tariffs were announced, is unlikely to settle the debate.

US economy shrinks 0.3%published at 13:41 British Summer Time

Breaking

We have the initial data from the US Bureau of Economic Analysis. It indicates the US gross domestic product (GDP) decreased at an annual rate of0.3 percent in the first quarter of 2025.

CEOs at the White House todaypublished at 13:39 British Summer Time

Image source, Getty Images

Image source, Getty Images

Multiple CEOs will visit the White House on Wednesday for Trump’s “invest in America” event, according to a White House spokesperson.

Some of the notable companies include:

- Nvidia CEO

- GE Aerospace CEO

- Johnson & Johnson CEO

- Eli Lilly CEO

- SoftBank CEO

During a press briefing yesterday, the White House boasted having more than $5tn (£3.7tn) of investments in the US since Trump has entered office.

The Trump administration is looking to boost the president’s economic gains amid polling that suggests a majority of Americans are displeased with some of his aggressive economic policies.

His announcement of a sweeping tariff rollout has sent the stock markets tumbling and impacted the value of the US dollar. It has also impacted some relationships with key trading partners.

Key economic report to set tone of the daypublished at 13:35 British Summer Time

Brandon Livesay

Brandon Livesay

Reporting from New York

Hello and welcome to our live coverage of US politics, where the economy is set to be the major talking point of the day.

We’re about to get data from a key economic report on the US gross domestic product.

Then later today, US President Donald Trump will meet with CEOs from major companies for an investment event.

There’s plenty more happening today in the world of US politics, so stick with us.