U.S. | Money

US appeals court deem Trump tariffs as illegal, European bourses look to open higher – Newsquawk Europe Market Open

7 hours ago

Originally posted by: Zero Hedge

- US Appeals Court upheld a ruling that most Trump tariffs were illegal but kept them in place as the case proceeds.

- US was reported on Friday to revoke authorisations for Intel (INTC), SK Hynix (000660 KS) and Samsung (005930 KS) to receive American chipmaking equipment in China unless they obtain licenses, according to the Federal Register.

- US judge did not rule on the dismissal of Fed Governor Cook on Friday and asked both parties to submit subsequent court documents on Tuesday.

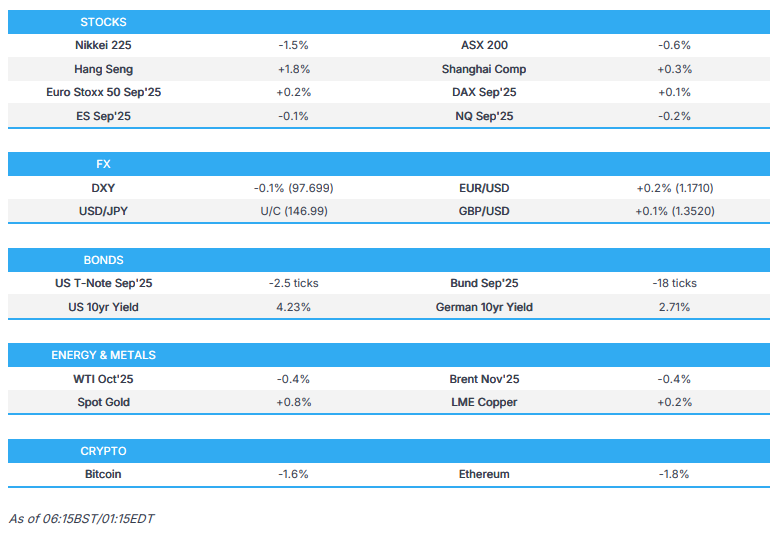

- APAC stocks traded mixed with sentiment mostly subdued; European equity futures indicate a mildly positive open with Euro Stoxx 50 futures up 0.2% after the cash market closed with losses of 0.8% on Friday.

- Looking ahead, highlights include EZ & UK Manufacturing PMI (Final), EU Unemployment Rate (Jul), New Zealand Terms of Trade (Q2), and Speakers include ECB’s Schnabel, Cipollone & Lagarde.

- Holiday: US Labour Day, Canadian Labour Day: The desk will run until 18:00BST/13:00EDT on Monday 1st September, upon which the desk will close and then re-open at 22:00BST/17:00EDT the same day due to US market closures.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed lower on Friday with underperformance in the Nasdaq, although sectors were mixed, with Tech and Consumer Discretionary posting the largest losses, while Consumer Staples and Health Care outperformed. The focus on Friday was US data, which saw in-line PCE, albeit the supercore print saw three months of consecutive gains, raising concerns about sticky inflation in the face of tariffs. However, it had little influence on Fed expectations with participants eyeing the August jobs report next Friday.

- Furthermore, Chicago PMI data was softer than all analyst expectations and the trade deficit widened due to a jump in imports, while the Final UoM consumer sentiment report for August was revised down due to a drop in expectations, and inflation expectations were also revised lower.

- SPX -0.64% at 6,460, NDX -1.22% at 23,415, DJI -0.20% at 45,545, RUT -0.50% at 2,366.

- Click here for a detailed summary.

TARIFFS/TRADE

- US Appeals Court voted 7-4 on ruling that President Trump exceeded authority by imposing global tariffs using IEEPA emergency law, although the court let tariffs stay in place while the case proceeds, while the ruling applies to ‘Liberation Day’ tariffs, reciprocal tariffs and the extra India tariff but not to the de minimis exemption cancellation.

- US President Trump commented that all tariffs are still in effect and that if these tariffs ever went away, it would be a total disaster for the country and would make the US financially weak.

- US Attorney General Bondi said they will appeal the tariff ruling, while it was separately reported that USTR Greer said they will continue to work on trade negotiations following the tariff ruling.

- US was reported on Friday to revoke authorisations for Intel (INTC), SK Hynix (000660 KS) and Samsung (005930 KS) to receive American chipmaking equipment in China unless they obtain licenses, according to the Federal Register.

- China’s Commerce Ministry said senior Chinese trade negotiator Li Chenggang visited the US and held meetings with US officials from August 27th to 29th, while Li stated that China and the US should manage differences and expand cooperation through equal dialogue and consultation. Furthermore, Li and US officials exchanged views on China-US economic and trade relations, as well as the implementation of the prior consensus.

NOTABLE HEADLINES

- Fed’s Daly (2027 voter) said on Friday that policy will be recalibrated soon to better match the economy and noted that both goals are in tension at the moment, with tariffs pushing inflation higher and the labour market showing signs of slowing. Furthermore, she reiterated that she thinks the tariff-related price increases will be a one-off and it will take time before they know that for certain, but added they can’t wait for perfect certainty without risking harm to the labour market, via LinkedIn.

- US judge did not rule on the dismissal of Fed Governor Cook on Friday and asked both parties to submit subsequent court documents on Tuesday.

- US President Trump posted on Truth that “Prices are “WAY DOWN” in the USA, with virtually no inflation. With the exception of ridiculous, corrupt politician approved “Windmills,” which are killing every State and Country that uses them, Energy prices are falling,“big time.” Gasoline is at many year lows. All of this despite magnificent Tariffs, which are bringing in Trillions of Dollars from Countries that took total advantage of us, for decades, and are making America STRONG and RESPECTED AGAIN!!!”

- US bipartisan proposal would ban stock trading by lawmakers with a bipartisan bill set to be unveiled in the upcoming week, which would give lawmakers and their family members a period of 180 days to sell off individual stocks, while lawmakers that don’t comply would face fines equal to 10% of the value of the investment, according to WSJ.

APAC TRADE

EQUITIES

- APAC stocks traded mixed with sentiment mostly subdued amid tariff and trade-related uncertainty after a US Appeals Court upheld a ruling that most Trump tariffs were illegal but kept them in place as the case proceeds. Participants also digested a slew of data, including mixed Chinese PMIs, while tech was pressured following underperformance in the sector on Wall St last Friday and with the US revoking waivers for Intel, Samsung and SK Hynix to use US tech in their Chinese operations.

- ASX 200 declined with underperformance in tech and consumer discretionary offset the strength in gold miners and resilience in defensives.

- Nikkei 225 underperformed and briefly slipped back below the 42,000 level, with the declines led by notable losses in tech.

- Hang Seng and Shanghai Comp bucked the trend as the Hong Kong benchmark surged on the back of a double-digit rally in Alibaba shares post-earnings, while the upside in the mainland was capped as participants digested mixed PMI data from China in which the headline official Manufacturing PMI missed forecasts and remained in contraction territory, but Non-Manufacturing PMI accelerated as expected and the RatingDog (formerly Caixin) Manufacturing PMI topped forecast with a surprise expansion.

- US equity futures were rangebound with a holiday-quietened start to the US trading week and ahead of approaching key events, including Friday’s NFP report.

- European equity futures indicate a mildly positive open with Euro Stoxx 50 futures up 0.2% after the cash market closed with losses of 0.8% on Friday.

FX

- DXY marginally softened with US participants away on Monday due to the Labor Day holiday and with the overall mood cautious amid trade uncertainty after a US Appeals Court ruled late on Friday that most Trump tariffs are illegal but kept them in place as the ruling paves the way for a further battle in the Supreme Court. Fed-related uncertainty also lingered after a US judge did not rule on the dismissal of Fed Governor Cook on Friday and asked both parties to submit subsequent court documents on Tuesday, while there were recent comments from Fed’s Daly that policy will be recalibrated soon to better match the economy and that they can’t wait for perfect certainty without risking harm to the labour market.

- EUR/USD edged higher and reclaimed the 1.1700 handle following last Friday’s upward momentum and despite comments from ECB’s Rehn, who sees the risk of inflation cooling and noted there’s great uncertainty over inflation, which calls for flexibility in reacting to shifts in the economy.

- GBP/USD eked mild gains and remained afloat after recently reclaiming the 1.3500 status, but with the upside capped in the absence of any UK-specific drivers.

- USD/JPY traded indecisively amid the lack of tier-1 releases from Japan and despite the underperformance in Japanese stocks alongside the backdrop of trade uncertainty, as it was recently revealed that Japan’s top trade negotiator had postponed his trip to the US last week due to issues regarding rice purchases, with Tokyo said to protest against the US President telling Japanese government agencies what to do.

- Antipodeans remained afloat although price action is contained amid the predominantly cautious risk appetite and mixed Chinese PMI data.

- PBoC set USD/CNY mid-point at 7.1072 vs exp. 7.1281 (Prev. 7.1030).

FIXED INCOME

- 10yr UST futures traded uneventfully with US cash markets shut today owing to the Labor Day holiday.

- Bund futures remained lacklustre following last Friday’s firmer-than-expected German inflation data and with light EU-specific catalysts to start the week.

- 10yr JGB futures were pressured with a lack of tier-1 data releases from Japan and ahead of tomorrow’s 10yr JGB auction.

COMMODITIES

- Crude futures were marginally lower amid the mixed risk appetite in Asia and with very little energy-specific news flow.

- Germany’s gas storage sites reached the key 70% threshold as of Friday, while the government had aimed to reach the aforementioned level by November 1st, which eases fears about winter heating shortages, according to Bloomberg.

- Spot gold was initially traded rangebound with US and Canadian markets on an extended weekend, but then found inspiration alongside a rally in silver, which breached above the USD 40/oz level to print its highest since 2011.

- Copper futures lacked firm direction amid global trade uncertainty and following mixed Chinese PMI data.

CRYPTO

- Bitcoin retreated overnight in choppy trade with prices back beneath the USD 108k level.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi said at the Shanghai Cooperation Organisation Summit that the SCO made important contributions to upholding regional security and has set a model for a new type of international relations, while China will work with all parties to take the SCO to a new stage and to draw a blueprint for high-quality development, as well as build a closer SCO community. Xi also said the SCO will promote true multilateralism and will constructively participate in international affairs.

- Chinese President Xi met with Indian PM Modi and stated that they must strengthen strategic communication and deepen mutual trust, while he noted that China and India are at a critical stage of development and revitalisation, and should focus on development. Furthermore, he said they should expand exchanges and cooperation to achieve mutual benefit and win-win results, as well as noted that joint efforts should be made to maintain peace and tranquillity in border areas, according to Chinese state media.

- Chinese President Xi and Indian PM Modi underlined in their meeting the need to proceed from a political and strategic direction to expand the bilateral trade and investment ties and reduce the trade deficit, while PM Modi noted that their countries should both pursue strategic autonomy and their relations should not be seen through a third country’s lens. Furthermore, they deemed it necessary to expand common ground on bilateral, regional, and global issues and challenges, according to a statement from India.

- Chinese President Xi said in a meeting with Turkish President Erdogan that they should counter-terrorism security cooperation, while he added that both sides should create new cooperation highlights like new energy, 5G, and biomedicine, according to Chinese state media.

- Chinese President Xi told UN Secretary General Guterres that China upholds multilateralism and supports the UN playing a central role in international affairs, according to CCTV.

- China and Armenia established a strategic partnership and China supports Armenia joining the SCO, while it was stated that China and Armenia should firmly support each other and deepen cooperation in various fields, according to CCTV.

- China’s home sales continued to slump in August despite declining prices and the nation’s two largest cities rolling out additional stimulus measures, according to Bloomberg citing preliminary data from China Real Estate Information Corp.

- Indonesian President Prabowo said parliament agreed to revoke some allowances for parliamentarians, while he added that the state must protect the people in the face of the destruction of private property. Furthermore, he ordered the police and military to take the strongest actions against public facility destruction and looting amid unrest.

- New Zealand PM Luxon said on a radio interview that they are weeks away from appointing a new RBNZ Governor and have got a couple of candidates, according to The New Zealand Herald

DATA RECAP

- Chinese NBS Manufacturing PMI (Aug) 49.4 vs. Exp. 49.5 (Prev. 49.3)

- Chinese NBS Non-Manufacturing PMI (Aug) 50.3 vs Exp. 50.3 (Prev. 50.1)

- Chinese Composite PMI (Aug) 50.5 (Prev. 50.2)

- Chinese RatingDog (formerly Caixin) Manufacturing PMI Final (Aug) 50.5 vs. Exp. 49.7 (Prev. 49.5)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said they targeted Hamas spokesman Abu Obaida, while Israel’s Defence Minister separately commented that the Hamas armed wing spokesperson was killed in Gaza.

- Palestinian media reported Israeli planes launched intensive raids in the centre of the Gaza Strip.

- Yemeni Houthi-run news agency said the Houthi PM and a number of ministers were killed in an Israeli strike on Thursday, while the Defence Minister said the group is ready to confront Israel following the Israeli strike that targeted senior officials.

- Yemeni Houthi rebels raided UN offices in the capital of Sanaa and detained at least 11 personnel, according to AFP.

- UKMTO received a report of an incident 40NM southwest of Yanbu, Saudi Arabia, in which a vessel reported a splash in close proximity to an unknown projectile and heard a loud bang. Furthermore, British security firm Ambrey suggested the vessel in the incident is aligned with the Houthis’ target profile, with the vessel Liberia-flagged and ‘publicly Israeli-owned.

- US State Department official said Palestinian Authority President Abbas and 80 other officials had their visas revoked, which means they will not be able to participate in the UN General Assembly discussions in New York.

- Iranian President Pezeshkian said on Friday that they do not seek war, but Israel and the US seek to cut up and destroy Iran, which is unacceptable to Iranians and they will not allow it, according to state TV.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said Ukraine plans new strikes deep into Russia.

- Ukraine’s General Staff said that despite Russian claims of a successful summer offensive, Russian forces have not gained full control of any major Ukrainian city.

- Ukraine’s military said it struck Russia’s Krasnodar and Syzran oil refineries, while Ukraine’s air force said on Saturday morning that Russia launched 537 drones and 45 missiles in an overnight attack.

- US State Department approved the potential sale of Starlink satellite communication services and approved a possible foreign military sale to Ukraine of Patriot air defence system sustainment and related equipment, while it approved the sale of an integrated battle command system enabled Patriot to Denmark.

- Russian President Putin said UN principles, including respect for the sovereignty of states, are still valid and unshakable today, while he appreciates China and India’s efforts to resolve the crisis in Ukraine and discussed with China and other leaders the outcome of the summit with US President Trump in Alaska. Putin said the root causes of the crisis in Ukraine must be addressed and a security balance established, while he reiterated Moscow’s positions that the crisis in Ukraine did not arise as a result of an invasion but as a result of a coup d’état in Kyiv, supported by Ukraine’s Western allies, and that attempts by the West to drag Ukraine into NATO are one of the causes of the crisis in Ukraine. However, he also commented that understandings reached at the Alaska summit with Trump opening a way to peace in Ukraine.

- Russian military chief Gerasimov said Russian troops are conducting non-stop offensive along the entire front line and the task of creating a buffer zone along the border of Ukraine’s Sumy and Kharkiv regions is being successfully completed. Furthermore, he said Russia controls 99.7% of Ukraine’s Luhansk region and 76% of the Kherson region, according to IFAX.

- Russia targeted four power facilities in the Odesa region, while Russian forces hit Ukrainian port infrastructure used for military purposes, and it was reported on Sunday morning to have downed 112 Ukrainian drones over the past 24 hours. It was separately reported that the capacity of Russia’s Kursk nuclear power plant’s third reactor was completely restored after disruption by a drone attack.

- Russian forces reportedly captured Komyshuvakha in eastern Ukraine and struck Ukrainian enterprises, a rocket and aviation facility, as well as military airfields, according to RIA.

- Russia’s Kremlin said Europeans are hindering US President Trump’s efforts on Ukraine.

- European Commission President Von der Leyen said Europe has a ‘pretty precise’ plan to send troops to Ukraine and stated that security guarantees are paramount and absolutely crucial, according to an FT interview. Von der Leyen said they have a clear roadmap and had an agreement in the White House regarding security guarantees for Ukraine, and that this work is going very well, while she stated that US President Trump reassured them there will be an American presence as part of the backstop for Ukraine, which was repeatedly affirmed. Furthermore, she said the European Commission would explore new funding streams to provide sustainable financing of the Ukrainian armed forces, while it was also reported that Von der Leyen, German Chancellor Merz, UK PM Starmer and NATO Secretary-General Rutte are expected to gather in Paris on Thursday.

- German Chancellor Merz said he hasn’t given up hope that a ceasefire can be secured in Ukraine, but he’s “not under any illusions either” and is preparing himself for the possibility that the war may drag on for a long time, according to an interview with ZDF.

- EU’s Kallas said she asked EU countries to submit proposals for new sanctions on Russia in the upcoming week, while she stated the EU urges the US to reconsider the decision not to allow Palestinian officials to take part in the UN General Assembly.

OTHER

- US Senate Armed Services Committee Chairman Roger Wicker said the US and Taiwan could feasibly manufacture weapons jointly.

EU/UK

NOTABLE HEADLINES

- UK secured a GBP 10bln deal to supply the Norwegian navy with at least five new warships.

- ECB’s Rehn sees risk of inflation cooling and noted “There are more downside risks to inflation stemming from a stronger euro, cheaper energy and easing of core inflation, together with the damage trade-policy has caused to the global economy”, while he added that “Economic shocks in the euro area are now more complicated than before and there’s great uncertainty over inflation, which calls for flexibility in reacting to shifts in the economy”.

- Austrian Central Bank chief-designate Kocher said on ORF Radio that he thinks the age of hawks vs doves is over and what matters is making the right move at the right time, while he sees himself as neither a hawk nor a dove and said the classification will come over time. Kocher said that monetary policy is much more data-driven now, and it is important to be constant and reliable, as well as noted that Austria will continue to take a cautious role and ensure price stability is the central objective in all ECB decisions. Furthermore, he commented regarding the September ECB rate decision that unless data gives a strong signal in one way or another, there are strong arguments to keep room for manoeuvre and noted it is important to avoid see-sawing on rate decisions.

- France issued warnings for thunderstorms and floods in the south.

- S&P upgraded Portugal on Friday from A to A+; Outlook Stable.

- Goldman Sachs raises Stoxx 600 index target for the next 12 months to 580 from 570 (vs 550.14 close on Friday); GS raises its FTSE 100 index target for the next 12 months to 9,600 from 8,800 (vs 9,187.34 close on Friday)

Loading…