Two Israelis Arrested, Indicted After Using Classified Iran Info For Polymarket Bets

The Israeli government has announced the arrest and indictment of an IDF military reservist and a civilian with classified clearances who placed bets regarding military operations on the popular Polymarket prediction market.

A joint statement by Shin Bet and the Israeli Police, which teamed up to conduct the investigation, said bets were made “based on classified information to which the reservists were exposed as part of their military duties.”

Authorities have not confirmed details of the specific bets, but it follows Kan News first reporting suspicions that officials within the defense ministry had leveraged classified information to profit on Polymarket.

At least one of the accused reportedly bet on the timing of Israel’s opening strike on Iran in last June’s 12-day war. The indictments mention “serious security offenses” as well as bribery and obstruction of justice.

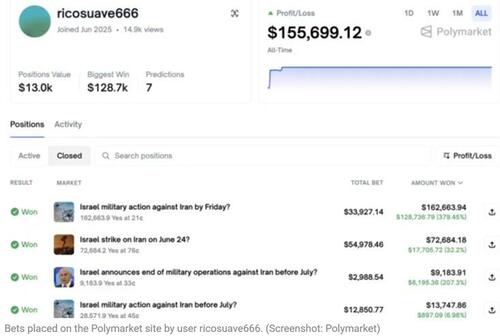

According to the Times of Israel, one of the men netted about $150,000 based on the insider knowledge:

Last month, Kan said a user who went by the name ricosuave666 placed several bets in June 2025 with suspicious accuracy regarding Israeli military operations in Iran, wagering tens of thousands of dollars and making a profit of around $150,000.

While not identifying the men, the defense ministry and Israel Defense Forces (IDF) issued a lengthy statement.

“The defense establishment emphasizes that engaging in such betting activities, based on secret and classified information, poses a substantial security risk to IDF operations and to the security of the state,” the statement indicated.

An IDF spokesperson continued, “The IDF views with utmost severity any act that endangers the security of the state, particularly the use of highly classified information for the purpose of personal gain.”

The IDF called it a “grave ethical failure and a clear crossing of a red line,” and indicated that “In response to the incident, measures have been taken and procedures will be reinforced across all IDF units to prevent similar cases from recurring.”

There have been several similar ‘insider betting’ scandals in the United States related to fast-moving geopolitical events, for example involving the timing of the Trump-ordered Venezuela military operation. Red flags have even been raised surrounding the Super Bowl halftime show:

Earlier this year, an anonymous bettor on Polymarket perfectly predicted the US invasion of Venezuela mere hours before over 150 US aircraft rocked the country’s capital of Caracas, netting them over $400,000.

The incident reignited a heated debate over insider trading on prediction market platforms like Polymarket and Kalshi. While the act is strictly forbidden on Wall Street, prediction markets are currently operating in a regulatory vacuum, allowing those who enjoy insider status to score big — while everyone else is left to pick up the bill.

And the evidence that prediction markets are rife with insider traders continues to grow. As one eagle-eyed Reddit user noticed, an anonymous day-old Polymarket account correctly guessed 17 out of around 20 bets about Sunday’s Super Bowl half-time show.

— MovieTime (@MovieTimeDev) February 10, 2026

“All told, they made about $17,000 in profit,” the report observes, and points to the extreme unlikelihood, statistically-speaking, in getting 17 out of the 20 bets exactly right.

Loading recommendations…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.