Trump’s banning of CBDCs is a moot point; Americans already live under a CBDC system – The Expose

Trump’s banning of CBDCs is a moot point; Americans already live under a CBDC system

President Donald Trump’s Executive Order 14178 ostensibly “bans” CBDCs. However, his administration is quietly advancing stablecoin legislation that would hand digital currency control to the same banking cartel that owns the Federal Reserve.

Aaron Day says that the STABLE Act and GENIUS Act don’t protect financial privacy – they enshrine financial surveillance into law, requiring strict Know Your Customer tracking on every transaction.

“This isn’t defeating digital tyranny – it’s rebranding it,” he said.

Let’s not lose touch…Your Government and Big Tech are actively trying to censor the information reported by The Exposé to serve their own needs. Subscribe now to make sure you receive the latest uncensored news in your inbox…

Last week, Brownstone Institute published an article written by American entrepreneur Aaron Day about stablecoins being the backdoor to total financial control. The following is an overview of Day’s article.

“This article cuts through the distractions to expose a sobering truth: the battle isn’t about stopping a future CBDC – it’s about recognising the financial surveillance system that already exists. Your financial sovereignty is already under attack, and the last off-ramps are disappearing,” he wrote.

Adding, “The greatest sleight of hand in modern finance isn’t cryptocurrency or complex derivatives – it’s convincing Americans they don’t already live under a central bank digital currency system. Let’s dismantle this illusion by examining how our current dollar already functions as a fully operational CBDC.”

Central Bank Digital Currencies

A central bank digital currency (“CBDC”) is issued and controlled by a nation’s monetary authority. As Day argues in his book ‘Fifty Shades of Central Bank Tyranny’, the US financial system already functions as a digital control grid, with 92% of all US dollars existing only as digital entries in databases allowing for monitoring and restriction of transactions.

“The Fed’s digital infrastructure processes over $4 trillion in transactions daily, all without a single physical dollar changing hands. This isn’t some small experimental system – it’s the backbone of our entire economy,” Day wrote. “The Federal Reserve, our central bank, doesn’t create most new money by printing bills [physical bank notes]; it generates it by adding numbers to an Oracle database.”

“Commercial banks extend this digital system,” Day explained. “When you deposit money, the bank records it in their Microsoft or Oracle database … The key point remains: the dollar predominantly exists as entries in a network of databases controlled by the Fed and commercial banks … Our current digital dollars already have [programmable and trackable] capabilities built in.”

In other words, the US government’s financial surveillance system is already in place. Day explained that, facilitated by laws such as the Bank Secrecy Act and Patriot Act, the existing financial surveillance system enables government agencies like the Internal Revenue Service (“IRS”) and National Security Agency (“NSA”) to collect and analyse financial data without meaningful oversight, effectively creating a system of digital control.

This surveillance enables active censorship, for example, as demonstrated during Canada’s trucker protests in 2022 and targeting people in the USA, such as Kanye West and Dr. Joseph Mercola.

The government’s true intention is not to stop financial crime but to control people, as evidenced by the accumulation of trillions of financial records on ordinary Americans and the failure to curb financial crime.

And the ultimate goal, rooted in the technocracy movement since the 1930s, is to digitise all assets, including money, stocks and real estate, under a global ledger, enabling central banks and governments to monitor and program every asset and tying wealth to resource consumption and a social credit system.

Multiple countries, including the Bahamas, Jamaica and Nigeria, have launched retail CBDCs, with 44 pilots ongoing worldwide, driven by goals of modernising payments and enhancing financial inclusion.

The US is taking a different approach, with legislation like the STABLE Act and GENIUS Act aiming to create a framework for privately issued digital dollars, effectively achieving the same surveillance and control objectives as CBDCs through stablecoins.

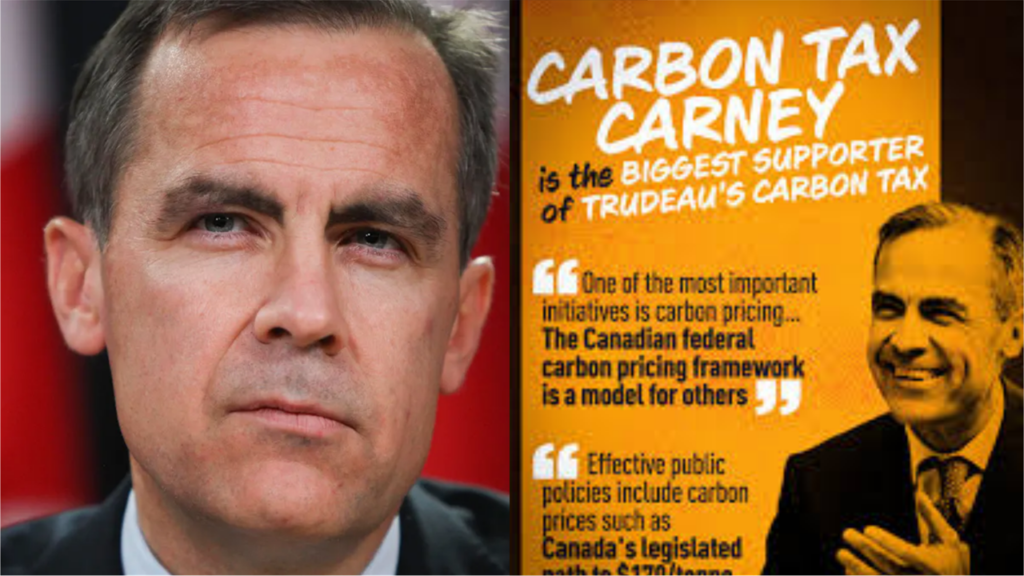

These legislative efforts, supported by figures like President Trump and Mark Carney, the new Prime Minister of Canada, are designed to implement a system of financial control where every transaction is monitored and assets are tokenised* and regulated, ultimately leading to a loss of financial autonomy and privacy.

*Note: Tokenisation is the process of converting rights to an asset into a digital token on a blockchain or database. This applies to both currencies and other assets like real estate, stocks, or commodities. Tokenisation enables:

- Digital representation of ownership.

- Programmability (restrictions on how/when/where assets can be used).

- Traceability of all transactions.

“When politicians and central bankers claim we don’t have a CBDC, they’re playing a game of definitions. The substantive elements that define a CBDC – digital creation, central bank issuance, programmability, surveillance and censorship capability – are all present in our current system,” Day said.

Stablecoins

Stablecoin is a type of cryptocurrency designed to maintain a stable value by pegging to an external asset, typically the US dollar. Examples of stablecoin include Tether (“USDT”), USD Coin (“USDC,” issued by Circle Internet Financial with backing from Goldman Sachs and BlackRock) and JPM Coin (issued by JPMorgan Chase).

Stablecoins, such as USDC and USDT, are being used as tools for financial censorship, which demonstrates that they are not censorship-resistant and can be frozen by issuers or regulators.

The US government, including the Trump Administration, is supporting the use of stablecoins but with strict regulations such as Know Your Customer (“KYC”) and Anti-Money Laundering (“AML”) requirements, which will lead to pervasive tracking and control.

The use of stablecoins poses significant risks to privacy and autonomy and could lead to corporate control over digital assets, with companies like Circle and Tether having significant influence over the market and ties to the Trump Administration through figures like David Sacks and Steven Mnuchin.

The STABLE Act and GENIUS Act restrict stablecoin issuance to banks and Fed-aligned entities, further consolidating power and benefiting investors like Goldman Sachs and BlackRock.

Related: Peter Thiel and other technocrats surrounding Donald Trump

Resistance to Centralised Control

Privacy coins are cryptocurrencies specifically designed to preserve transaction privacy and resist surveillance, Day said. Adding that privacy coins like Monero, Zano and Kaurma offer a way to maintain financial privacy and autonomy and resist the growing surveillance state but are under pressure from regulators.

“’Privacy isn’t a luxury – it’s a tool for self-reliance’. Using these [privacy] coins means choosing economic freedom in a world leaning toward centralised control,” he concluded.

You can read Day’s full article HERE.

Day doesn’t believe fiat money is the answer. He explained that fiat currencies are inherently unstable, created from debt and backed by trust rather than tangible assets. Governments exploit them to extend their power, printing endless money for wars and bailouts, which ultimately devalue citizens’ savings, he said.

We don’t agree with Day’s trust in specified cryptocurrencies over physical forms of currency. We believe that the greatest protection of privacy and resistance of them all is cash, i.e., physical bank notes and coins, or some other physical form of currency such as gold, silver or Bradbury Treasury notes, also known as the Bradbury Pound. Because all digital “money” will be as detrimental to privacy and autonomy as CBDCs or stablecoins, even if they did not start that way.

Bitcoin is an example of digital “money” that was reportedly started by a group of libertarians and anarchists as an act of resistance to centralised control. However, the same group that came up with Bitcoin were also transhumanists and were pushing the ideas of artificial intelligence, intelligence augmentation of humans, space colonisation, digital currencies, nanotechnologies and genetic engineering. Transhumanism is also tied up with depopulation; it is the eugenics movement rebranded.

All forms of cryptocurrency, more accurately digital data posing as currency, are setting the stage for technocracy and transhumanism.

Further reading:

- The founders of Bitcoin were transhumanists, The Exposé, 5 March 2025

- Roger Ver faces prison for exposing how US government hijacked Bitcoin, The Exposé, 21 December 2024

- The next bankers’ heist: Swap US government-owned land and minerals for Bitcoin, The Exposé, 29 November 2024

- Jeffrey Epstein’s links to the development of Bitcoin and CBDCs, The Exposé, 23 January 2024

- Eugenics, Transhumanism and Jeffrey Epstein’s Network, The Exposé, 17 February 2023

- An open letter to the UK Prime Minister and Chancellor of the Exchequer, The Exposé, 5 November 2022

- The 1914 Bank Run That Nearly Sparked a Revolution, LinkedIn post by Graham Rowan, 17 September 2024 (archived HERE)

Follow Daily Expose on Telegram

Follow Daily Expose on Telegram

While previously it was a hobby culminating in writing articles for Wikipedia (until things made a drastic and undeniable turn in 2020) and a few books for private consumption, since March 2020 I have become a full-time researcher and writer in reaction to the global takeover that came into full view with the introduction of covid-19. For most of my life, I have tried to raise awareness that a small group of people planned to take over the world for their own benefit. There was no way I was going to sit back quietly and simply let them do it once they made their final move.