Trump To Buy Tiny 1 Million Barrels For SPR As China Unleashes Record Oil Stockpiling Spree

Badly beating down oil jumped, if only briefly, on a Bloomberg report that the Trump administration plans to buy 1 million barrels for the US Strategic Petroleum Reserve, taking advantage of low oil prices to begin filing the depleted stockpile.

The Energy Department intends to announce Tuesday that it’s seeking oil for delivery in December and January, using a portion of the $171 million from President Donald Trump’s signature tax and spending law that provided for crude purchases, according to an agency official.

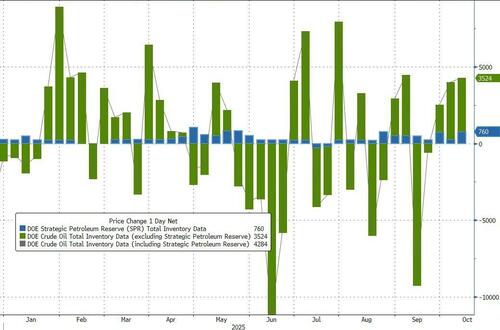

West Texas Intermediate, which is down about 30% since its peak in mid-January and traded at about $58 a barrel on Tuesday, near the lowest since 2021, staged a modest bounce, only to sink after the kneejerk reaction was processed.

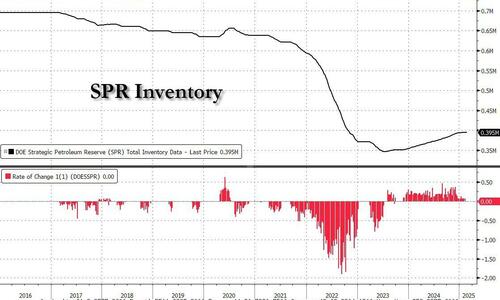

Trump has vowed to refill the oil reserve, which has a maximum capacity of about 700 million barrels. It currently has about 408 million barrels, but the administration has limited funds to buy more. Unfortunately just 1 million here and there won’t do anything in the grand scheme of things; meanwhile China has been aggressively adding millions of barrels every month to its SPR, and according to many analysts has been the main reason preventing far lower oil prices. Here is Reuters on the topic:

China is building oil reserve sites at a rapid clip as part of a campaign to boost crude stockpiles that increased in urgency after Russia’s Ukraine invasion upended global energy flows and has accelerated this year, according to public data, traders and industry experts.

State oil companies including Sinopec and CNOOC will add at least 169 million barrels of storage across 11 sites during 2025 and 2026, according to public sources including domestic news reports, government reports and company websites.

Of that, 37 million barrels of capacity has been built, the sources show. Once completed, the new sites will be able to store two weeks of China’s net crude imports, according to Reuters calculations based on Chinese trade data, a significant volume as China is by far the world’s biggest oil importer.

Beijing’s reserve-building – S&P Global Commodity Insight last month estimated China had stockpiled an average of 530,000 barrels per day thus far in 2025 – is soaking up surplus global supply and supporting prices under pressure as the OPEC+ producers group winds down production cuts. Traders and consultancies say they expect the stockpiling, fuelled by prices recently below $70 per barrel, to continue at least through the first quarter of 2026.

The reserve’s levels were sharply reduced under President Autopen, when gasoline prices spiked following Russia’s invasion of Ukraine. The drawdown of some 180 million barrels in 2022 cost about $280 million and delayed maintenance, according to the Energy Department.

Bids for the Energy Department’s 1 million barrel solicitation for delivery to the Bayou Choctaw site are due no later than 11:00 a.m. CT on Oct. 28, the official said. The purchases will be through a spot-price-indexed contract.

Loading recommendations…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.