The Government’s Dangerously Empty Response to Trump – The Daily Sceptic

Amid a global storm of events and flux, debate rages about Donald Trump’s Great Reset of the world order with his tariffs. Britain has got off somewhat lightly but may not be immune from the further consequences of the President’s attempt to repatriate industries, wealth and power. Here on this island, however, there is no sign that the Government is capable of responding to this new reality besides Keir Starmer’s larping as a world leader.

It is Ed Miliband that we must turn to first to glimpse this Government of fantasists at work. On Friday, the Secretary of State for Energy Security and Net Zero wrote in the Independent an article with the title, ‘Why I promise green wind will save Britain’s economy‘. “Families and businesses have seen their energy bills rocket in the years since Russia’s invasion of Ukraine,” he explained, “and this week, energy bills have risen once again as a direct consequence of the latest spike in global gas prices.”

Miliband was talking about the UK’s energy price cap, which, as reported here was indeed increased in February. On February 25th, Ofgem announced it was increasing the amount households will pay for their energy from April through to the end of June. Ofgem’s CEO Jonathan Brearly said, “Our reliance on international gas markets leads to volatile wholesale prices, and continues to drive up bills, which is why it’s more important than ever that we’re driving forward investment in a cleaner, homegrown system.” In the Independent, Miliband echoed the claim: “The only way to protect families and businesses in the long term is to sprint to clean homegrown power that we control – so we can increase our energy independence and bring down bills for good.”

But there is a problem for both Miliband and Brearly. And it is a problem for those customers who, on the news of the price rises, rushed to lock the prices they pay to energy retailers with fixed price contracts. The price of gas soon fell.

When Ed Miliband claimed on X that Ofgem’s looming price rise was “due to a spike in global markets” (18th February), gas prices on the UK market had already peaked (on the 15th) at £1.42 per therm, and had fallen to £1.15. On the 25th, as Ofgem announced the price rise, the price had dropped further to £1.06. By the time the quarterly price cap came into effect (April 1st) the price had dropped again to £1.02. And when Miliband published his article (April 4th), the price was £0.89. On the day I am writing this article, the market opened at £0.85, and went as low as £0.82. This later price is a whopping 42% less than the peak of “spike in global markets” that Miliband blamed rising prices on back in February, and again last week.

Markets go up. Markets go down. Surely everybody knows this? Not Ed Miliband. He doesn’t even know that there’s no such thing as a ‘global market’ for natural gas. As I explained back in February, natural gas prices in the UK were four times higher than in the USA. But this notion of ‘global’ rather than regional markets helps Miliband’s mythology of things being beyond the control of the Secretary of State with the brief to manage those things. And central to Miliband’s narrative, of course, is the spectre of Putin, pulling the strings. Because he does have control over ‘global markets’, according to Miliband’s story.

Let’s choose a different commodity, then, to make the point more neutrally: houses. Since Labour Chancellor of the Exchequer Gordon Brown promised “no return to boom and bust”, and that he would “not allow house prices to get out of control”, we have of course had all three. House price rises were of great delight to those who saw their paper wealth multiply many times over throughout the early part of the century, offsetting the deep pain that this caused to those who were not well served by low interest rates and asset inflation – i.e., renters, who spent more and more of their income on less and less.

The government and the Bank of England, to which the responsibility for setting interest rates Brown had passed, between them had a number of levers they could have used to control the housing market. First, immigration could have been controlled. Second, with or without immigration control, governments (of all legacy parties) could have been more forceful in allowing greater scale of housing development – planning law restricted supply. (We need not be detained by the rights and wrongs here – the point is about the possibility of policies, not a preference for this or that policy.) Interest rates could have been used to stop the rush towards buy-to-let extracting wealth from young people who could otherwise have been buying their own home and starting families. And so on. In summary, the state of the housing market was completely and totally caused by policies.

The same is true of energy. Scarcity has been sought by UK and EU-member state governments’ policies as well as that of Brussels. Continuing in that hostility to abundant and affordable energy, at the COP29 climate meeting in Baku, Azerbaijan, Keir Starmer boasted that “we committed to no new North Sea oil and gas licences”. That is functionally equivalent to not allowing new houses to be built in order to meet growing housing demand. Had Europe’s politics not been held to ransom by green scaremongering for decades, the continent’s oil, gas and coal would have flowed as freely as it does in China, with comparable prices to show for it.

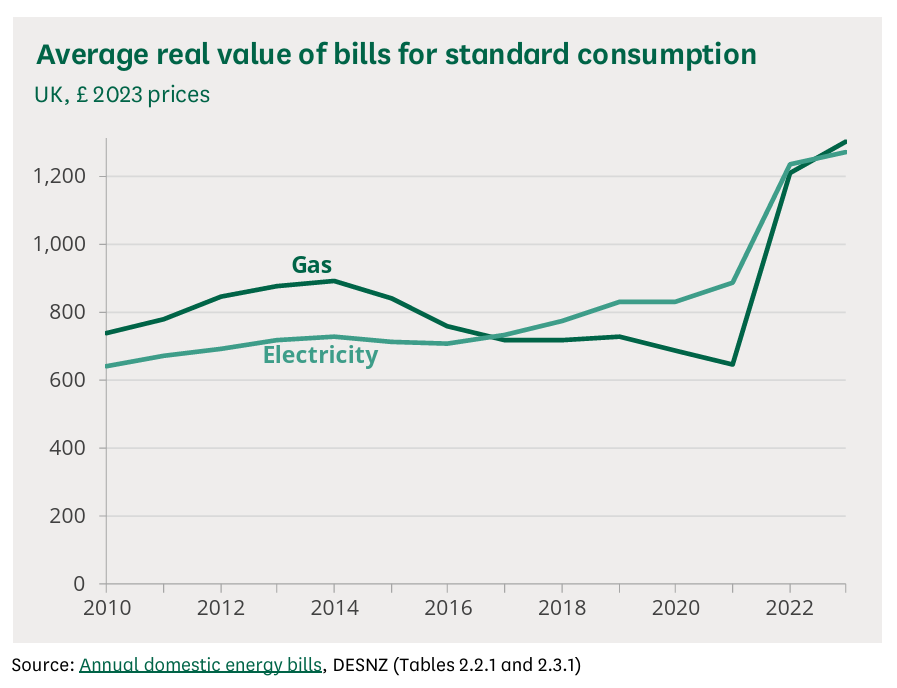

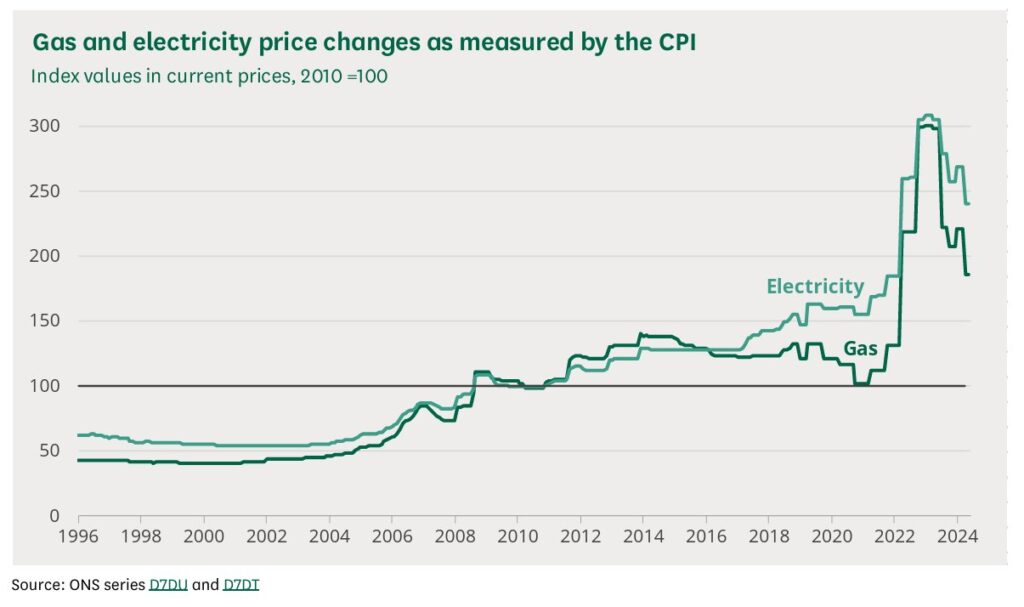

If anything, ‘global markets’ have come to the rescue of people under the boot of green idiots. In the 2010s, despite the EU and UK’s best efforts, the world faced an energy glut, which really upset green economics. As data from Ed Miliband’s own department show, his and others’ claims that dependence on gas is responsible for rising prices is simply false. Between 2014 and into the pandemic, gas prices fell, whereas electricity prices increased.

Miliband’s claims are dependent on the extreme situations caused by lockdowns (supressing economic activity and printing vast amounts of money), and by the sanctions imposed by the West against Russia, which restricted (but did not eliminate) energy supplies to the West. These conditions did indeed make, for a very brief time, green energy ‘cheaper than gas’. But those conditions were thankfully not sustained. “Today,” said Miliband last Friday, “we have taken another step forward by granting consent for the Rampion Offshore Wind Farm.” And this, the Minister believes, is progress: “This secures 1.2GW of clean electricity – which is enough to power one million homes, whilst supporting an estimated 4,000 jobs in construction.”

But if Rampion II goes ahead and produces power at the same rate as the offshore wind farms commissioned at the sixth Contracts for Difference auction round finalised in September last year, then its owners will receive 7.6p for every kilowatt-hour it produces. At today’s prices, the wholesale price of power from gas would be 5.7 pence per kilowatt-hour. And two more facts need to be kept in mind when understanding that 33% increase in price. First, the given price of wind power does not include the cost of backup and balancing the grid – i.e., when the wind isn’t blowing, or the power it is making is not required, and so on. Second, the current price of gas is still high, in historical terms. In April 2016, gas prices were as low as a third of today’s price. Taking inflation into account, that amounts to a bit less than half of what they are today. The new wind farm therefore offers the hard-pressed British consumer nothing at all except greater expense. The Minister should be seeking to halve the costs of gas. Instead, he is seeking to lock-in higher energy prices. Ed Miliband simple has not run the arithmetic on his promise that “green wind will save Britain’s economy”.

Or is he simply a liar? A perhaps even more bizarre missive was penned at the weekend by Miliband’s boss. In response to Trump, Keir Starmer promises in the Telegraph that, “My Government will champion the voice of British industry on the international stage.”

What British industry?

“From the car manufacturers of the West Midlands to the whisky producers of the Western Isles, free trade is a galvanising force for British export businesses,” claims the Prime Minister.

Free trade?!!

Who does he think is he kidding?

On Monday, Under-Secretary of State for Future of Roads, Lilian Greenwood MP appeared on GB News to discuss Labour’s continuation of the Boris Johnson government’s policies. “What we’re setting out today is our plans to give the British car industry certainty, stability and confidence,” said Greenwood. “We are formally confirming our manifesto commitment which is to reinstate the 2030 date for the phase-out of the sale of new petrol and diesel cars.”

That’s not “free trade”. That’s exactly a prohibition of trade.

Moreover, it’s a prohibition of a trade in an attempt to ‘transition’ to a technology that, as has been explained here recently, the UK and Europe have simply no capacity to sustain a position in. Despite extremely generous UK and EU-member Government support for solar PV and wind energy, Chinese manufacturers, with substantially less support, very quickly dominated the global market. And they are doing the same with EVs, while British and European Governments destroy the advantages and the markets that domestic producers enjoy.

Amid turmoil on actual – rather than imagined – global markets, two missives from senior politicians show that the Government has no connection to reality whatsoever, and thus no plan. They show that it believes that it can sustain its position by fobbing the public off with very obvious lies and hollow waffle.

Some say that Trump’s radical interventions have signalled, if not yet caused, the end of the era of globalisation – the integration of markets and cooperation between governments on policy agendas that the publics of those governments have no say in, mostly in the interests of Big Money. If that is true, then the UK Government, which has long established itself precisely on the mores and ambitions of globalism and attempted to situate itself at the centre of global agendas, needs very urgently to escape the fantasy.

As welcome as the fall in the price of gas might be, it does not reflect good news. Stock markets are tumbling and commodity prices are collapsing. The gas price is down because demand is down. And that’s a bad thing.

Starmer and others will no doubt blame Trump’s intervention for our gloomy future. But that would also be a lie. It was not Trump who destroyed Britain’s coal-fired power stations, nor signed the death warrant for North Sea oil and gas exploration, nor banned fracking. It was not Trump who decided that UK manufacturers may no longer produce and sell petrol and diesel cars. It was not Trump that bought and closed down British steelworks. Those were the result of agreements between all three legacy parties, to align with and push the global agenda, no matter that it undermined our interests, destroyed our industries and transferred the initiative to China. It is those parties, not Trump, nor even China, nor even Vladimir Putin, who have acted against our interests and need to take the blame. The longer the dawning of this reality, the more traumatic it will be.