Tesla Drops After Q3 Profit Slides, Earnings Miss

First a preview (for those who just want the results, skip this section):

As previewed earlier, today’s Tesla earnings report will be closely watched by most – not just because it is the first Mag7 company to report, but because the stocks has soared in recent months, and everyone will be wondering if Elon will substantiate the move with cold, hard data.

The Q3 earnings will be boosted by record third-quarter sales earlier this month, driven by US consumers making purchases before EV tax credits went away at the of September. The deliveries give Tesla respite from an extended rough patch, but the EV maker still remains on track for a second straight year of declining sales. Tesla’s aging vehicle lineup has faced increased competition. There’s also been a backlash against the brand after CEO Elon Musk’s partisan politics and role in the Trump Administration.

The Q3 earnings call will be a precursor to the Nov. 6 vote on Musk’s unprecedented $1 trillion pay package. In some sense, it presents a late opportunity to influence voting. The retail investors who get to submit and vote on questions for the call certainly believe so. Beyond proximity to the annual shareholder meeting, there’s also some math to be done from the quarter Tesla’s reporting, and the company’s plan for the next decade.

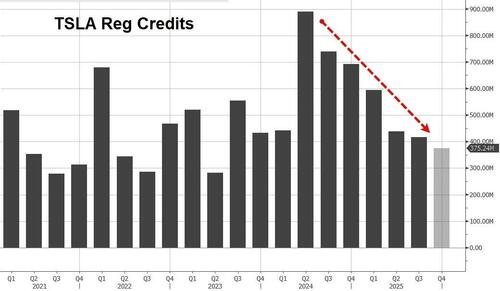

The sale of regulatory credits to other automakers has long been a cash cow for Tesla, including $439 million in the second quarter. But now the market for these credits has largely evaporated, because the Trump administration has eliminated penalties for automakers who don’t comply with CAFE, or corporate average fuel economy, standards. This is a much bigger hit to Tesla’s bottom line than the $7,500 tax credit for consumers that has long helped electric vehicles compete with the internal combustion engine.

Separately, the nearly 500,000 vehicles Tesla delivered last quarter coincided with US consumers rushing to beat federal tax credits expiring. Musk’s proposed pay package mandates that the company delivers 20 million EVs to consumers over the 10 years of the agreement. To do that, Tesla will have to average 500,000 units a quarter. So if last quarter was a one-off boosted by policy, how are Tesla and Musk going to keep hitting that target? Capacity? Better products?

Investors will also vote on a non-binding shareholder proposal for Tesla to take a stake in Musk’s xAI startup, an idea Musk floated last year. The two companies already work together. Some Tesla vehicles integrate xAI’s Grok, and the companies have agreements for xAI to purchase Tesla’s Megapack battery storage systems.

Investors and analysts will also be closely listening for any updates on autonomy efforts, including robotaxi and FSD (Full Self Driving) software. Tesla and Musk have increasingly bet the company on these areas, but the CEO is also known for his overly ambitious timelines. In June, Tesla launched its long-awaited robotaxi, using existing Model Y SUVs with safety drivers in the passenger seat. But there have been few updates. So far Tesla is operating in Austin, and has permits to test autonomous vehicles in Nevada and Arizona.

Earnings aside, BBG’s Ed Ludlow notes that one of Elon Musk’s greatest skills is keeping investors looking to the horizon. In that respect, there will be some repetition on the vision for a robotaxi service, with a fleet split between consumer-owned Tesla submitted to it, Tesla’s Cybercab and off-lease cars. Then there’s the economy-changing Optimus Humanoid robot. Indeed, at Tesla’s engineering HQ, Optimus is already in and amongst the workforce, prowling the rows of desks, and a great source of pride to the company.

Also top of mind for some this earnings call: will any analysts ask Elon Musk about Tesla’s plans to redesign its doors? When Tesla vehicles lose power, crashes can turn into deadly races against time. In September, Bloomberg published an investigation into this issue that focused, in part, on the fatal Cybertruck crash in Piedmont, California, from last year where three of four occupants — all college students — died. Then, on Sept. 16, the US National Highway Traffic Safety Administration said it opened a defect investigation into certain Tesla Model Y door handles. And on Sept. 17, Tesla’s chief designer said the company is working on a redesign of its door handles. What is the timeline for a redesign? And will it be available on all models going forward? Are there any plans to retrofit existing models? Or is the thinking that Tesla is in compliance with existing federal motor vehicle safety standards, so there is no need?

With all that in mind…

Here is what Tesla – the first Mag 7 to report – just revealed for the just concluded 3rd quarter:

- Revenue $28.10 billion, +12% y/y, beating estimates of $26.36 billion

- Adjusted EPS 50c, down vs 72c y/y, and missing the estimate if 54c

- GAAP EPS 39c, down vs 62c y/y

- Gross margin 18% vs. 19.8% y/y, beating estimate 17.2%, but…

- Tesla 3Q Auto Gross Margin Ex-Reg Credit 15.4%, missing estimate of 16.3%, and down vs 17.1% Y/Y

- Operating income $1.62 billion, -40% y/y, missing estimate $1.65 billion

- Free cash flow $3.99 billion, +46% y/y, beating estimates $1.25 billion

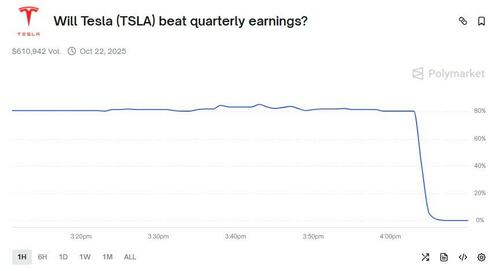

While revenue and margins beat, the Adj EPS miss was a big surprise judging by the violent repricing on Polymarket which had a “beat” at 80% moments before the release:

While the numbers were mixed, perhaps the most important one – the company’s regulator credits are discussed above – slumped to just $417MM, the lowest in two years, and will continue to decline for the duration of Trump’s admin (at least).

A quick snapshot of the company’s discussions of its revenue, which increased 12% YoY to $28.1B, and beat estimates:

- + increase in vehicle deliveries (driven by expiration of tax credit)

- + growth in Energy Generation and Storage

- + growth in Services and Other

- – lower regulatory credit revenue

- – lower one-time FSD revenue recognition YoY due to Q3’24 releases related to Cybertruck and certain features such as Actually Smart Summon

… but while revenue was good, profitability was not: operating income decreased 40% YoY to $1.6B despite a 7% jump in deliveries and the highest auto revenue in nearly two years – resulting in only 5.8% operating margin. Tesla took a notable hit here to the bottom line, and talked about a laundry list including tariffs, new models, lower regulatory credits and increased R&D costs:

- + growth in Energy Generation and Storage gross profit

- + increase in vehicle deliveries

- + growth in Services and Other gross profit

- – lower regulatory credit revenue

- – increase in operating expenses (excl. SBC and Restructuring and Other) driven by SG&A, AI and other R&D projects

- – increase in SBC and Restructuring and Other charges

- – lower one-time FSD revenue recognition YoY as described above

- – higher average cost per vehicle due to lower fixed cost absorption for certain models, an increase in tariffs, and sales mix, partially offset by lower raw material costs

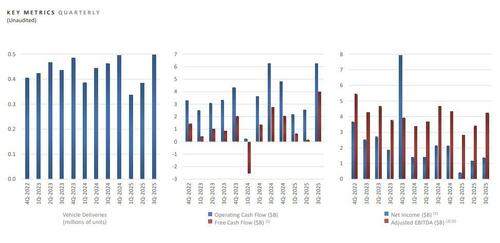

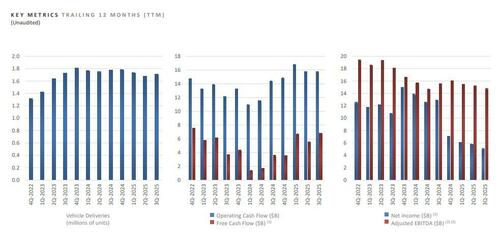

Here are the charts recapping Q3:

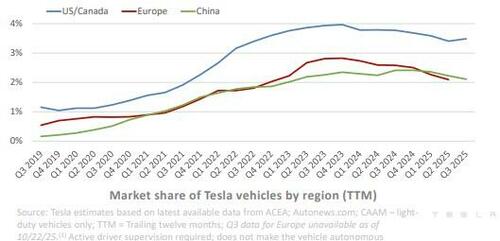

Tesla’s own market share chart in its earnings release shows the slowdown that’s beset the EV maker around the world, particularly in Europe and in China.

As BBG notes, it is a strange chart to include in an earnings release, which shines a light on just how much market share growth has stunted.

Going down the press release we find this good news…

“Cybercab, Tesla Semi and Megapack 3 are on schedule for volume production starting in 2026. First generation production lines for Optimus are being installed in anticipation of volume production.”

… but then again, it may all change: Tesla warned again they are in a time of transition, expanding the portfolio of EV products, bracing for future revenues from AI and robotics. Here’s how they explain their volumes:

“It is difficult to measure the impacts of shifting global trade and fiscal policies on the automotive and energy supply chains, our cost structure and demand for durable goods and related services. While we are making prudent investments that will set up our vehicle, energy and other future businesses for growth, the actual results will depend on a variety of factors, including the broader macroeconomic environment, the rate of acceleration of our autonomy efforts and production ramp at our factories”

As Tesla notes, it launched ride-hailing service in the Bay Area using Robotaxi technology. It’s worth noting that the service isn’t permitted for, or considered fully autonomous. The company also uses the term Robotaxi FSD to refer to the latest version of FSD (Supervised) that has been deployed to some beta testers. Btw, there was no mention of robotaxi in Nevada or Arizona where the company has autonomous test permits.

A quick look at best geographies:

“South Korea is now our third-largest market behind only the U.S. and China, serving as validation of our competitive positioning in a robust EV market.”

And an update on onshoring efforts:

“We expect our lithium refinery in Texas to begin production in Q4 2025 and our LFP lines in Nevada to begin production Q1 2026.”

There is also the question how much of an anomaly the 3Q was, with record deliveries highly impacted by a rush of consumers before federal tax credits expired. Tesla’s acknowledging near the top of the PR that the environment is changing for them and they are beholden to factors outside of their control:

“While we face near-term uncertainty from shifting trade, tariff and fiscal policy, we are focused on long-term growth and value creation. We are prudently making the necessary investments in our business, including future business lines, that we believe will drive incredible value for Tesla and the world across transport, energy and robotics”

Yes, Tesla specifically called out the increase in tariffs leading to a dent in profitability when describing higher average costs per vehicle.

Which leads us to the outlook… which doesn’t say much:

“It is difficult to measure the impacts of shifting global trade and fiscal policies on the automotive and energy supply chains, our cost structure and demand for durable goods and related services. While we are making prudent investments that will set up our vehicle, energy and other future businesses for growth, the actual results will depend on a variety of factors, including the broader macroeconomic environment, the rate of acceleration of our autonomy efforts and production ramp at our factories.”

A quick look at the cash flow and the near record FCF, which was significantly better than expected, at $4 billion far above the consensus print of $1.25 billion, Tesla attributed the performance to record vehicle deliveries in the period, and record energy deployments.

“In Q3, the Tesla team achieved record vehicle deliveries globally, showing strength and growth across all regions, while also achieving record energy storage deployments across the residential, industrial and utility sectors. This strong performance resulted in both record revenue and free cash flow generation in the quarter.”

Not surprisingly, the tax-credit expiration led to an EV buying spree which allowed Tesla to clear virtually all the excess vehicles produced in the first half of the year during the third quarter. The results was a massive, one-off working capital release of $2.1 billion, teeing up the big free cash flow of $3.99 billion.

Turning to energy, Tesla disclosed that revenue from energy and storage revenue jumped 44% from a year ago, far eclipsing the 6% increase from autos. That comes from residential, industrial and utility storage. The company is also leaning back toward solar leasing. The appeal of leases: They still qualify for tax credits after President Donald Trump ended some federal renewable incentives. The company says its new solar-and-Powerwall lease “will help drive incremental demand” for its residential-energy products. Still, Tesla didn’t disclose its 3Q solar deployments. It hasn’t done so in several quarters.

All in all, the stocks kneejerked lower, bounced, and is once again sliding as markets focus on the EPS miss, the drop in profits and the neutered guidance.

Loading recommendations…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.