Temu Ends China Shipments To US After Trump Closes “De Minimis” Loophole

Container volumes at one of America’s busiest ports are falling fast. President Trump’s 145% tariffs on Chinese goods entering the U.S. are wreaking havoc on trans-Pacific containerized trade, triggering a sharp decline in shipments from Chinese ports.

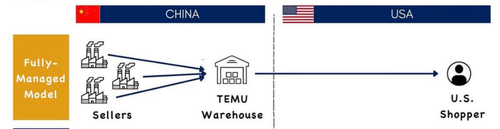

On Friday, Chinese e-commerce giant Temu halted U.S. deliveries after the Trump administration closed the “de minimis” loophole, which had previously allowed a flood of Chinese junk under $800 to enter tariff-free.

The move signals a further decline in Chinese imports to the U.S.

Ahead of Friday’s end of the de minimis exemption for China-made goods, Temu hiked prices and rolled out a complete breakdown of customer import charges. Singapore-based e-commerce website Shein Group also hiked prices.

Temu confirmed late Friday to the New York Times: “This shift is part of Temu’s ongoing adjustments to improve service levels.”

The use of de minimis by Chinese e-commerce has surged in recent years, with Temu and Shein connecting U.S. consumers with cheap Chinese goods priced 20% to 30% less than U.S. competitors like Amazon.

According to the U.S. Customs and Border Protection, nearly 1.4 billion shipments entered the U.S. in 2024 through the de minimis loophole, up from 637 million four years earlier.

The nuking of the de minimis loophole comes from President Trump, who has previously called the exemption “a big scam” that hurts small American businesses.

Kim Glas, the president of the National Council of Textile Organizations, said the exemption allowed “unsafe and illegal Chinese goods” to flood the U.S. duty-free for years.

“Today’s action by the administration is an important step forward to help rebalance the playing field for American manufacturers,” Glas told the NY Times.

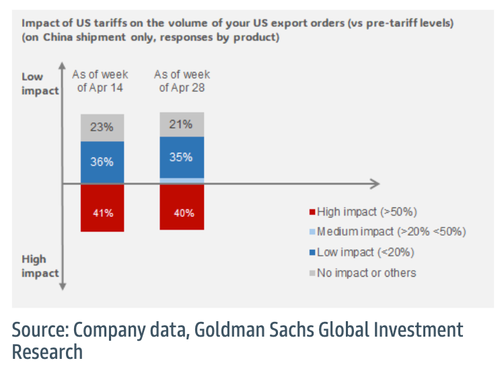

Separately, the second edition of Goldman analyst Trina Chen’s China Export Tracker—covering 48 companies representing 70% of China’s export value to the U.S. by product group—offers new insight into trade flows and growing uncertainty across key trans-Pacific shipping lanes linking Chinese ports to the U.S. West Coast.

Here are some of Chen’s findings:

Nearly 40% of products are seeing substantial impact on their China shipments for U.S. orders, as of week of April 28

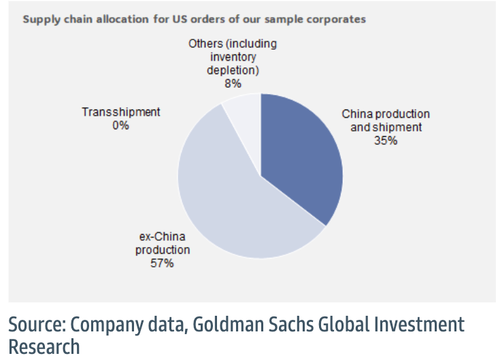

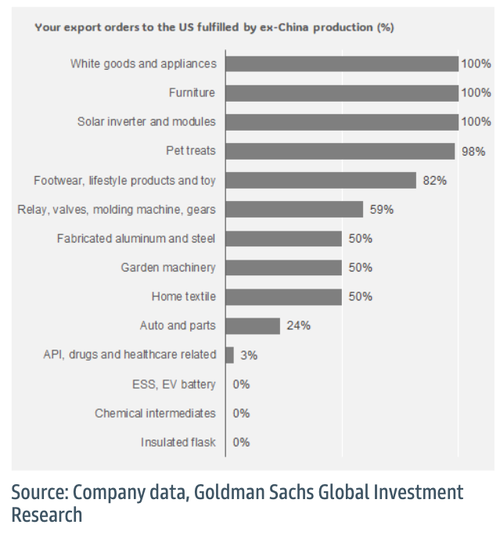

U.S. orders were fulfilled- 35% from China shipments, and 57% from ex-China production, as of week of April 28

Impact of U.S. tariffs on the volume of U.S. export orders by product (for China shipment) – as of week of April 28

Ex-China production provides significant supply chain flexibility for many consumer related products

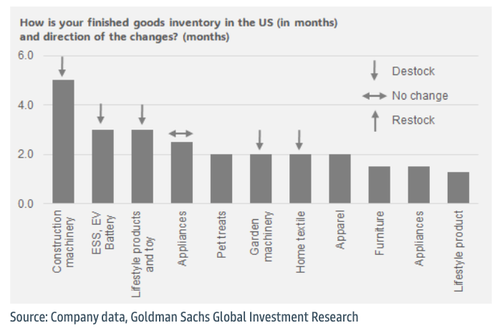

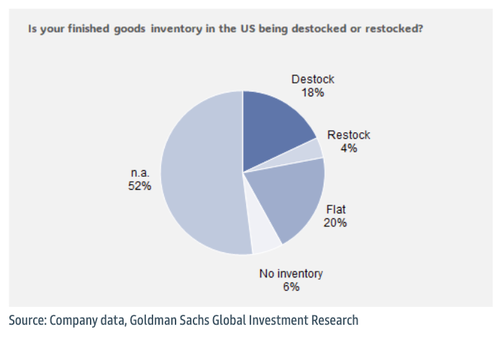

Finished goods inventory in the U.S. quoted by producers and shippers ranged from 1.5 months to 5 months

U.S. monthly container imports are still in positive growth as of March-25, but total imports are projected to fall by nearly 30% in the coming months

Comments from exporters:

-

Orderbook has been received to 3Q25, but uncertainty remains for 4Q25 orders.

-

Orderbooks from the U.S. have not changed, nor have there been rush orders. Visibility of 2025 annual orderbook can be seen to extend to July-August. But later Beyond that, much will depend on tariffs on Vietnam – an escalated level will affect consumer spending and impact 4Q25, thus flexibility of producers should be kept.

-

Shipments from SEA recovered on the back of the 90-day suspension of the reciprocal tariff. Communication with customers was only viable after stabilization. In early April, the shipment of orders to the U.S. mostly stopped, and now new orders have gradually come in. But shipment remains short of full year expectations.

-

Orderbooks for the factories in North America are strong, extending the typical forward visibility from 2-3 months, to 3-4 months. There are still some uncertainties in the export from Cambodia to the U.S., but production and shipment remains normal.

-

There have been no significant changes in orders and demand, and shipments are still being made continuously, all according to customer requirements for timely delivery.

-

There have been no changes observed in orders.

-

The company has not seen advanced or accelerated purchases by U.S. consumers in anticipation of tariff induced price hikes.

-

Considering the uncertainty of tariffs, U.S. customers slightly increased their orders during the 90-day exemption period.

-

U.S. orders are suspended. Other regions have broken large-sized orders into small and higher-frequency orders.

-

Export to Europe might be higher this year. Export to Southeast Asia and South America is on track and there are no major changes.

-

There are no order cuts, although some customers asked to delay or advance in shipment. Production remained at a normal in pace, given that they are all standard products and we can always find buyers can readily be found even if another someone cancels.

-

Normal production and shipment. The customer did not adjust the purchase plan.

-

The current orders from the U.S. have increased by 10% on average, compared to before the reciprocal tariff was announced. The shipments of lawn mowers and clothing can be sent domestically and overseas.

-

Shipments from China to the U.S. have stopped, versus a 30% drop in mid-April.

-

Shipments from China to the U.S. have been are cut off, and have was mostly stopped ~(20%) as of mid of April.

-

Softening demand induced by IRA uncertainty is the key challenge in the U.S. U.S. orders further slowed down in the past two weeks, especially in utility scale projects. Moreover, given final anti-dumping (AD)/countervailing duty (CVD) determination for the four ASEAN countries came in higher than the preliminary version, potentially higher product price in the U.S. could further dampen downstream demand.

-

Solid demand in the U.S. market, with new orders in thousands of units seen from customers. However, Chinese production for the U.S. orders has stopped, and has been fully replaced by products from other regions, with high utilization rate. Orderbook is solid into July, and 2Q shipment to Korea, UK, Australia, India, Brazil and Middle East was solid.

-

Tariffs have had limited impact on the company YTD. Exports to North America have declined slightly, but more driven by the nature of the demand rather than tariffs. And most of the U.S. orders were produced in facilities in Mexico. Alternate supplies are challenging to procure, most of these products are difficult to replace in the short term, and if any, it will still be among Chinese producers.

-

The direct orders for commercial HVAC components from China to the U.S. have been completely suspended, as customers are considering supply chain changes. Production of commercial HVAC in China has not been suspended — although there are no new orders from the U.S., the production can still supply other regions. Residential HVAC components are currently supplied to the U.S. from Vietnam, and there has been no change so far, as per our onshore tariff impact report.

-

Orders for machinery had delays in the first week of April, given the uncertainty. But recovery from the emerging markets started in the second week and continued in the 3rd week.

-

There has been no change in U.S. orders; the currently imposed tariff is not 145%, but lower, because the reciprocal tariffs only apply to a specific list of goods.

-

For the U.S. market, the company is basically either the sole supplier or a critical supplier, making short-term replacement difficult.

-

Producers mainly cooperate with small brands, which can export and change a label and then re-export to the U.S.

-

Producers now take orders from the U.S. as normal, versus suspending the order two weeks ago. The impact on shipments was about 20-50% but gradually recovering. Currently in normal production.

-

Transpacific routes: In mid-April, a sequential decline of 12-13% in container volumes on Transpacific routes (vs. Mar-2025) was observed, and it deepened to 20% in late week of April 21, and may further deepen to 25-30% in May. The container volume from SEA to U.S. is stable. Company believes the decline in transpacific routes is mainly due to the sharp drop in cargo volume departing from China, while cargo volume departing from Southeast Asia is relatively stable. There is some speculation that there is re-export trade involved but it cannot be separated.

-

The company observed container volume increased on China-to-Southeast Asia routes in April vs. March and sees further upside to cargo volumes within the 90-day window of reciprocal tariff delay. Among Southeast Asia routes, Thailand and Vietnam have seen more significant volume growth. Solar-related products have seen larger volume declines, while household goods remain stable.

-

It is expected that De minimis (accounts for 30-40% of U.S. routes cargo) could decline by 45-50% in May after the removal of De minimis on Chinese products takes effect from May 2nd.

. . .

Loading…