U.S. | Money

Risk appetite gains after Trump softens stance on Powell & among a number of trade updates – Newsquawk Europe Market Open

4 hours ago

Originally posted by: Zero Hedge

- US Treasury Secretary Bessent told a closed-door investor summit that the tariff standoff with China is unsustainable and expects the situation to de-escalate.

- US President Trump said the Fed should lower interest rates; has no intention of firing the Fed chair and wants Powell to be more active on rates.

- APAC stocks rallied amid tailwinds from the US owing to trade deal hopes and after US President Trump softened his rhetoric on Fed Chair Powell.

- European equity futures indicate a higher cash market open with EuroStoxx 50 futures up 1.7% after the cash market finished with gains of 0.5% on Tuesday.

- USD has pulled back a touch from yesterday’s advances, EUR/USD is back below 1.14, USD/JPY has pulled back from 143+ levels.

- US President Trump’s “final offer” for peace requires Ukraine to accept Russian occupation, according to Axios.

- Looking ahead, highlights include EZ, UK & US PMIs, BoE’s Bailey & Breeden, ECB’s Lane & Cipollone, Fed’s Goolsbee, Musalem & Hammack, RBA’s Bullock, Supply from Germany & US.

- Earnings from Akzo Nobel, BE Semiconductor, Volvo AB, Boliden, Danone, Kering, EssilorLuxottica, Reckitt, NatWest, Saipem, Boeing, AT&T, Vertiv, Phillip Morris, GE Vernova, IBM, Chipotle, Texas Instruments.

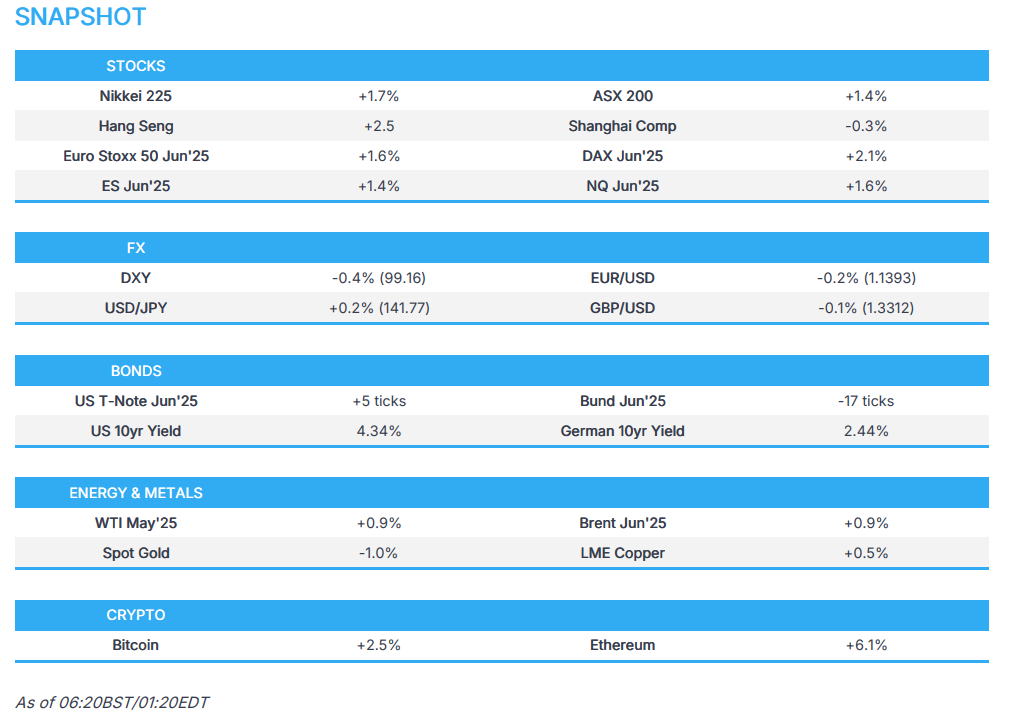

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks rallied and clawed back Monday’s heavy losses with sentiment buoyed by trade-related optimism after Bloomberg reported that US Treasury Secretary Bessent told a closed-door investor summit that the tariff standoff with China is unsustainable and he expects the situation to de-escalate although FBN’s Gasparino later posted on X that he’s been told by a person close to Bessent that the reports on his remarks about a trade deal with China being imminent overstate what he said, while Politico reported that the White House is ‘close’ on Japan and India trade agreements but are likely to leave many of the details to be hashed out at a later date.

- SPX +2.51% at 5,288, NDX +2.63% at 18,276, DJI +2.66% at 39,187, RUT +2.71% at 1,890.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said they are doing fine with China and are going to be very nice with China, while he added that they have to make a deal and if they don’t, the US will set a deal. Trump also stated the tariff on China will not be as high as 145% and will not be anywhere near that level but it won’t be zero.

- US Treasury Secretary Bessent told a closed-door investor summit Tuesday that the tariff standoff with China is unsustainable and that he expects the situation to de-escalate, while Bessent added that negotiations haven’t started but a deal is possible, according to people who attended his session at an event hosted by JPMorgan in Washington cited by Bloomberg. Furthermore, Bessent said China negotiations will be a ‘slog’ and he described the current bilateral trade situation as an embargo, according to Reuters citing a person at the JPMorgan session.

- FBN’s Gasparino posted on X that “he’s been told by a person close to US Treasury Secretary Bessent that the reports on his remarks about a trade deal with China being imminent overstate what he said, while he meant there is room for talks and de-escalation but much also depends on China’s willingness to compromise on trade as well.

- White House is reportedly ‘close’ on Japan and India trade agreements to stave off massive US tariffs, although they are likely to leave many of the details to be hashed out at a later date and it may take months to hammer out the final deals as these things are complicated, according to Politico citing sources. It was also reported that the White House Press Secretary said they now have 18 proposals from countries on trade and the trade team is meeting with 34 countries this week.

- US is preparing negotiating terms for UK trade talks and will aim for the UK to reduce its automotive tariff from 10% to 2.5%, while the US will also push the UK to relax rules on agricultural imports from the US, including beef and revise rules of origin for goods from each nation, according to Wall Street Journal citing sources.

NOTABLE HEADLINES

- US President Trump said the Fed should lower interest rates and would like the Fed chair to be early or on time, while he has no intention of firing the Fed chair and wants Powell to be more active on rates.

- Fed’s Kugler (voter) said tariff increases are significantly larger than previously expected and economic effects of tariffs and uncertainty will likely be larger than anticipated. Kugler added that Fed policy is well-positioned for macroeconomic changes and she supports holding the policy rate steady as long as upside risks to inflation continue, whilst economic activity and employment remain stable.

- Fed’s Kashkari (2026 voter) said independent monetary policy leads to better economic outcomes and is foundational, while he added that Fed policymakers are making the best call they can, based on data and it is too soon to judge the path of interest rates.

- Fed’s Barkin (2027 voter) said inflation expectations may have loosened and that firms are defensive, delaying and deferring investments, while he added there are a lot of reasons to be worried about consumer spending.

APAC TRADE

EQUITIES

- APAC stocks rallied amid tailwinds from the US owing to trade deal hopes and after US President Trump softened his rhetoric on Fed Chair Powell in which he stated he has no intention of firing the Fed chair.

- ASX 200 was led higher by outperformance in energy and tech with the former supported by a rebound in oil prices and after a quarterly production update from Woodside Energy, while gold miners suffered after the precious metal dropped as the risk-on mood sapped haven demand.

- Nikkei 225 benefitted from initial currency weakness and briefly surged to above the 35,000 level shortly after the open before fading some of its advances.

- Hang Seng and Shanghai Comp were varied as the Hong Kong benchmark joined in on the broad rally and the mainland was contained despite the encouraging comments from Treasury Secretary Bessent who noted the tariff standoff with China is unsustainable and expects the situation to de-escalate, while President Trump said they are going to be very nice with China and that the tariff on China will not be anywhere near the 145% level.

- US equity futures (ES +1.5%, NQ +1.8%) surged at the reopening of futures trading in reaction to President Trump’s softer tone on Fed Chair Powell, while the key earnings report after-hours was from Tesla which disappointed although its shares were boosted (+5.4%) after Elon Musk said he expects time allocation to DOGE to drop significantly in May and he will be devoting more time to Tesla.

- European equity futures indicate a higher cash market open with EuroStoxx 50 futures up 1.7% after the cash market finished with gains of 0.5% on Tuesday.

FX

- DXY pulled back from yesterday’s peak after steadily advancing amid the trade-related hopes following remarks from Treasury Secretary Bessent who said the tariff standoff with China is unsustainable and expects the situation to de-escalate. However, a person close to Bessent said the reports on his remarks about a trade deal with China being imminent, overstated what he said and he meant there is room for talks and de-escalation but much also depends on China’s willingness to compromise on trade as well. Furthermore, President Trump said the tariff on China will not be as high as 145% and will not be anywhere near that level but it won’t be zero, while the White House said they have 18 proposals from countries on trade, although it was separately reported that despite the US being “close” on agreements with Japan and India, it may take months to reach final deals.

- EUR/USD slipped to below the 1.1400 handle amid the prior day’s resurgence of the greenback and with the moves exacerbated after President Trump said he had no intention of firing Fed Chair Powell. Nonetheless, the pair has since recovered from lows despite the lack of drivers and with participants awaiting PMI data.

- GBP/USD rebounded from the prior day’s trough and briefly returned to the 1.3300 territory but with further upside capped ahead of UK PMI data and incoming comments from BoE’s Bailey and Breeden.

- USD/JPY retreated from a weekly peak after briefly surging to above 143.00 in the aftermath of comments from President Trump who softened his tone on Fed Chair Powell and provided some optimism on US-China trade.

- Antipodeans nursed some of the prior day’s losses with the recovery facilitated by the improvement in risk sentiment and encouraging rhetoric from President Trump regarding China.

- PBoC set USD/CNY mid-point at 7.2116 vs exp. 7.3466 (Prev. 7.1980).

FIXED INCOME

- 10yr UST futures eked marginal gains amid softer long-end yields stateside and as the more amicable tone from President Trump spurred demand for US asset classes.

- Bund futures were contained after slightly pulling back from resistance at the 132.00 level, while participants now await Eurozone PMIs and a EUR 4bln Bund issuance.

- 10yr JGB futures gapped lower as risk assets surged on trade deal hopes and Trump’s softer Powell rhetoric.

COMMODITIES

- Crude futures were underpinned by the mostly constructive risk sentiment and after private sector inventory data showed a larger-than-expected draw in crude stockpiles and drawdowns across other products.

- US Private Energy Inventory Data (bbls): US Crude -4.6mln (exp. -0.8mln), Cushing -0.4mln, Distillate -1.6mln (exp. 0.0mln), Gasoline -2.2mln (exp. -1.4mln).

- Iran set May Iranian light crude price to Asia at Oman/Dubai plus USD 1.65/bbl.

- Senior EU official said the EU Commission is looking at legal options to allow companies to break Russian gas contracts without facing penalties and is looking at legal options that could forbid EU companies from signing new Russian gas and LNG contracts.

- Spot gold slumped at the reopen as risk assets were boosted following US President Trump’s softer tone regarding Fed Chair Powell, while he also provided some optimism regarding a potential trade deal with China.

- Copper futures kept afloat amid the positive risk tone but with gains capped as China lagged.

- Peru’s Antamina copper mine reported the death of an operations manager in an incident at the mining camp, while Antamina launched a total shutdown for security as it investigates the accident.

- Corporation National del Cobre de Chile market intelligence and strategy specialist Eric Medel said the upside potential of copper has been reduced and copper prices are likely to remain bearish in the short term amid trade war risks.

CRYPTO

- Bitcoin took a breather overnight after it recently rallied to back above the USD 93,000 level.

- US President Trump said crypto needs regulatory certainty and newly appointed SEC chair Atkins is perfect for certainty in regulating cryptocurrency. It was also reported that US SEC Chairman Atkins said it is time for SEC to end waywardness and keep politics out of securities laws, while he added there are clear rules of the road and the top priority is to have a firm foundation for digital assets.

NOTABLE ASIA-PAC HEADLINES

- China’s Commerce Ministry said China received the EU side’s appeal request on intellectual property rights case and will handle it in accordance with relevant rules, while China will work with other multi-party interim arbitration arrangement participants to firmly uphold the rules-based multilateral trading system.

DATA RECAP

- Japanese JibunBK Manufacturing PMI Flash SA (Apr) 48.5 (Prev. 48.4)

- Japanese JibunBK Services PMI Flash SA (Apr) 52.2 (Prev. 50)

- Japanese JibunBK Composite Op Flash SA (Apr) 51.1 (Prev. 48.9)

- Australian S&P Global Manufacturing PMI Flash (Apr) 51.7 (Prev. 52.1)

- Australian S&P Global Services PMI Flash (Apr) 51.4 (Prev. 51.6)

- Australian S&P Global Composite PMI Flash (Apr) 51.4 (Prev. 51.6)

GEOPOLITICS

MIDDLE EAST

- Israeli army said it monitored the launch of a missile from Yemen towards Israeli territory and air defence systems were activated, according to Sky News Arabia.

- Iran Foreign Ministry said expert-level Iran-US talks are to be held on Saturday instead of Wednesday.

- Iranian authorities seized two Tanzania-flagged vessels carrying ‘smuggled fuel’ in the Gulf.White House said US President Trump will travel to Saudi, Qatar, and UAE from May 13th-17th.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said the Ukrainian delegation has a mandate to discuss a full or partial ceasefire at talks on Wednesday in London and once a ceasefire is in place, Ukraine is ready for talks with Russia in any format. Zelensky added it is impossible to agree on all terms of a peace deal quickly and that Ukraine will not recognise Russian occupation of Crimea De Jure which would be unconstitutional.

- Ukrainian Foreign Ministry said the Chinese ambassador was summoned and told of ‘serious concern’ over Chinese involvement on Russia’s side in the war.

- US President Trump’s “final offer” for peace requires Ukraine to accept Russian occupation, according to Axios. It was also reported that the US proposed recognising Crimea as Russian as peace talks ramp up and proposals include eventually lifting sanctions against Russia under a future accord, according to WaPo.

- UK Foreign Secretary Lammy said the UK is working with the US, Ukraine and Europe for peace and to put an end to Russian President Putin’s illegal invasion, while he added that talks continue at a pace and officials will meet in London today.

- Russian President Putin reportedly offered to halt the invasion of Ukraine across the current front line as part of efforts to reach a peace deal with US President Trump, according to FT.

- Russia launched a large drone attack on east, south and central Ukraine, which damaged civilian infrastructure, according to regional officials.

Loading…