Open Letter to Governor Tiff Macklem of the Bank of Canada on his Speech in Saskatchewan | Friends of Science

September 30, 2025

Dear Governor Macklem,

RE: Comments on Your Speech to the Saskatchewan Trade and Export Partnership and the Greater Saskatoon Chamber of Commerce

In your September 23, 2025, speech in Saskatoon, you said,

“Canadians have embraced the power of economic patriotism—elbows up. But now we need to roll up our sleeves and do the hard work to be more competitive.”

At the same time, you also said,

“The United States will always be a crucial trade partner. But we need to find new markets for our products and new products for our markets. We need to improve our productivity to compete globally. And we need to attract foreign capital. Around the world, countries and corporations are looking for new partners. Canada should be top of the list.”

Are you not aware of US Ambassador Pete Hoekstra’s recent comments about the anti-American “elbows up” campaign reported on September 18, 2025? He is both disappointed by the anti-American attitudes of many Canadians, and surprised that Canada’s Finance Minister François-Phillipe Champagne, characterized the US-Canada trade situation as a trade “war,” saying that if the Americans were waging a trade war against Canada, we’d all know it. In your address, you also called the US tariffs a “trade war.”

In your speech you suggest that something should have been done to diversify trade decades ago.

This has been done. Example: Saskatchewan and other prairie provinces have actively developed special crops, like lentils, fava beans (of diverse types), and chickpeas for export to markets where these are popular for food, or in the case of some faba bean types, for livestock feed. From the early 1970’s, crop research and seed development programs showed how the prairie ag industry “rolled up their sleeves” to breed and define the most suitable faba bean varieties for optimal crop yield and best suited to meet international market demand.[1]

And as for international trade, both Saskatchewan[2] and Alberta[3] have a number of international trade offices. It seems unusual that you did not mention Canada’s existing trade agreement with the EU. Canada began trying to diversify trade decades ago, developing what has now become the Canada-European Union Comprehensive Economic and Trade Agreement (CETA) which was signed in 2016.[4]

- June 2007 – At the 2007 European Union (EU)-Canada Summit in Berlin, Germany, Canadian and EU leaders agree to conduct joint study to examine costs and benefits of pursuing a closer economic partnership

Due to the lumbering nature of the ever-more bureaucratic European Union, CETA has not yet been ratified by all member states, but there are trade doors that have been opened for Canadian products. Some of these will be closed or burdened by regulation when the EU imposes its Carbon Border Adjustment Mechanism (CBAM) in 2026.[5] To participate in trade with the EU under CBAM, products or material goods will be required to do extraordinary carbon emissions reporting (Scope 1, 2, and ultimately Scope 3) with complex and expensive double verification by an accredited body. This will impose inordinate costs, especially on agricultural products, as discussed in our critique of Catherine McKenna’s “Integrity Matters” report, wherein we point out that mandatory climate reporting is a risk to society.[6] To facilitate an easier trade relationship under CBAM, a carbon tax (aka price on carbon) will be a necessity. As the Financial Times has reported, a global price on carbon has been proposed for the upcoming COP30 conference in Belem, Brazil.[7]

Thus, it is unusual, in our opinion, and note-worthy, that in your presentation you did not refer once to climate change or the carbon tax.

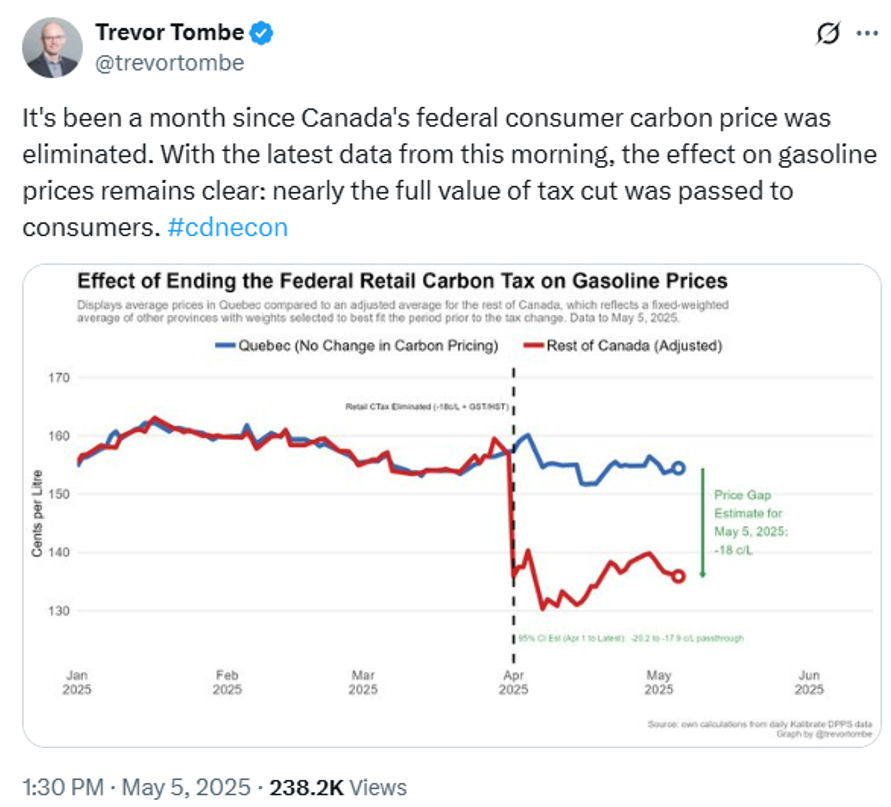

As reported by the Financial Post on May 02, 2024, you told the House of Commons Standing Committee on Finance that the carbon tax did not drive inflation and that dropping it would only offer one-time temporary relief.[8]

It seems disingenuous of you, Governor Macklem, to not mention this looming problem of CBAM when blithely advising Saskatchewan businesses and industry to “roll up your sleeves.” CBAM was part of the Fall Economic Statement, which Robert Lyman, retired energy economist, former public servant and diplomat said would effectively be a tariff against the USA and would be like “waving a red flag to the Trump administration bull.”[9]

- Inflation dropped 1.7% and, “As the divisive carbon tax ended, gasoline prices took a nosedive, dropping 18.1 per cent in April compared to a year earlier. Natural gas prices fell 14.1 per cent during the same period, StatsCan noted.”

From our Jan. 30, 2025, press release:[10]

While Trump threatens tariffs on Canada, few people are aware of the European Carbon Border Adjustment Mechanism (CBAM) which becomes fully operational in 2026; basically a climate policy tariff. In Canada’s Fall Economic Statement, reference is made to Canada using climate policy such as CBAM to restrict trade.

In his May 08, 2024, testimony to the Canadian Senate on climate-aligned finance, Mark Carney foresaw Canada as a future ‘hub’ for Europe’s Carbon Border Adjustment Mechanism (CBAM). The National Post of Jan. 29, 2025, reports that Canadians hope that Carney, if elected, would cancel Canada’s very unpopular carbon tax. This seems unlikely, as a carbon tax paid in a foreign country becomes deductible from the CBAM rate of the imported good or service.

…Analysis of Canada’s Net Zero targets and pathways by Friends of Science Society director Ian Cameron, P. Eng., shows that “Getting to Net Zero” means drastic degrowth and deindustrialization. Video explainer here.

As noted in the foregoing, it seemed unlikely that incoming Prime Minister Carney would cancel the carbon tax, and he did not; he only zero-ed the consumer carbon tax. Likewise, the industrial carbon tax remains. Prof. Sylvain Charlebois (@FoodProfessor) has pointed out that the industrial carbon tax drives higher food prices, despite the relief from the consumer carbon tax.

In your talk, you said,

“Central banks also have a role to play, but it is limited. Monetary policy cannot undo the damage caused by tariffs.”

In fact, Bank of Canada has a substantial role to play, and you, in particular, Governor, based on your biography,[11] could constructively affect the future of Canada and global trade relations.

Banks have been trying to ascertain climate risks, ever since Mark Carney, then governor of the Bank of England, gave his famous “Breaking the Tragedy of the Horizon” speech to Lloyd’s of London, 10 years ago on Sept. 29, 2015. At that time, Governor Carney’s speech was fact-checked by analyst Steve Kopits and found to be wanting: “As an analyst, I find Mr. Carney’s speech is truly dismaying. For the Governor of the Bank to claim that climate change is leading to rapidly rising insurance claims is, at best, a critical failure of analysis.”[12]

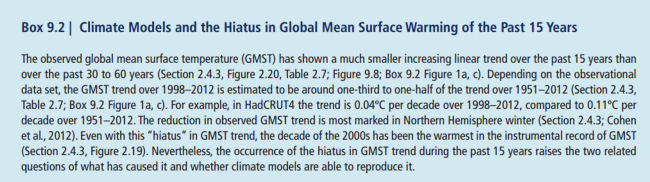

Unfortunately, Governor Carney’s speech to Lloyd’s of London marked the day that climate science and climate finance took separate paths. In the fall of 2013, the Intergovernmental Panel on Climate Change (IPCC) had published its AR5 report, noting that there had been no statistically significant warming for the prior 15 years.

In January of 2014, Dr. Judith Curry testified to the US Senate Committee on Environment And Public Works that: Evidence reported by the IPCC AR5 weakens the case for human factors dominating climate change in the 20th and early 21st centuries, and that carbon dioxide (CO2) is not the ‘control knob’ on climate.[13]

In the spring of 2014, the report “Risky Business” was compiled by several ‘green’ billionaires and a group of climate activists.[14] This report proliferated through the finance community, and its alarming projections were based on a research model known as Representative Concentration Pathway 8.5 (RCP 8.5). This is an improbable scenario, only meant for research purposes, but central banks adopted it as a climate risk ‘business-as-usual.’ RCP 8.5 does not represent business-as-usual.

In your various roles related to international banking, you must tell these banks that RCP 8.5 is an improbable scenario that misrepresents the future. Climate policy must not be based on this scenario.

Likewise, more recently, the Network for Greening the Financial System (NGFS) adopted a climate damage function which comes from a flawed and conflicted research paper by Kotz et al (2024). We have written to the Office of the Superintendent of Financial Institutions and copied Bank of Canada and BIS.[15] However, in your role with the Bank of Canada and the various boards that you sit on in the banking sector, you can help remove this climate damage function.

This is crucial to the economic success of Canada, Governor Macklem. As you know, the NGFS has established a Shadow Carbon Price of $800/t for Net Zero 2050. Canadian industry and especially the farm industry, was staggering under the burden of an $80/t carbon tax. Imagine a price ten times that.

Continue reading the Open Letter in the following PDF document.

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.