NY Fed Inflation Expectations Tumble To Pre-Tariff Levels, As Consumer Sentiment Blossoms

So much for the Democrats’ panic that the US is about to be hit with hyperinflation (because Toyota is footing US tariff costs).

Moments ago, the NY Fed reported that consumer expectations for future inflation have return to levels last seen at the beginning of the year, before the announcement of aggressive new tariffs, as the fake panic that Trump is about to spark the same runaway inflation that his predecessor unleashed, fade away.

The June survey showed median expectations for consumer price increases one year ahead decreased for the second straight month in June, falling back to 3%, back to where they were at the end of 2024 and before Trump had launched his tariff strategy. Estimates for annualized inflation three and five years ahead remained unchanged at 3% and 2.6%. Inflation uncertainty, or the uncertainty expressed regarding future inflation outcomes, decreased at the one- and three-year-ahead horizons and was unchanged at the five-year-ahead horizon

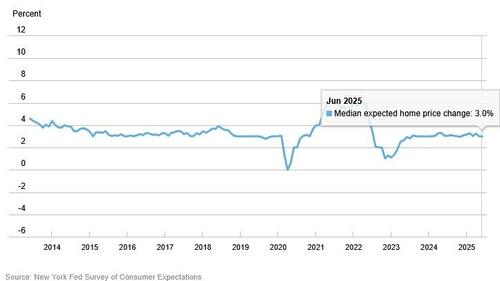

Median home price growth expectations remained unchanged at 3.0%. This series has been moving in a narrow range between 3.0% and 3.3% since August 2023.

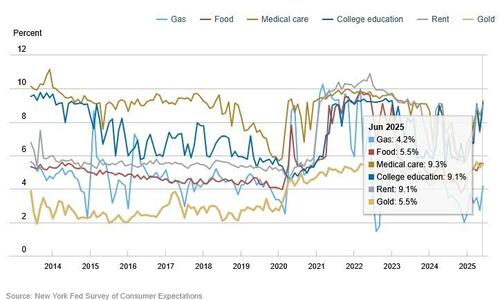

Median year-ahead commodity price change expectations increased by 1.5 percentage points for gas to 4.2%, by 1.9 percentage points for the cost of medical care to 9.3% (the highest level since June 2023), by 1.6 percentage points for the cost of college education to 9.1%, and by 0.7 percentage point for rent to 9.1%. Median year-ahead expected change in food prices remained unchanged at 5.5%.

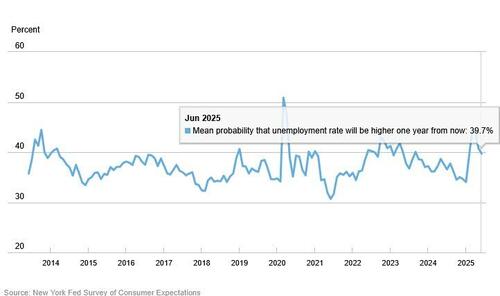

Overall household sentiment also benefited, as unemployment and job loss expectations improved. To wit, mean unemployment expectation, or the mean probability that the U.S. unemployment rate will be higher one year from no, decreased by 1.1 percentage point to 39.7%…

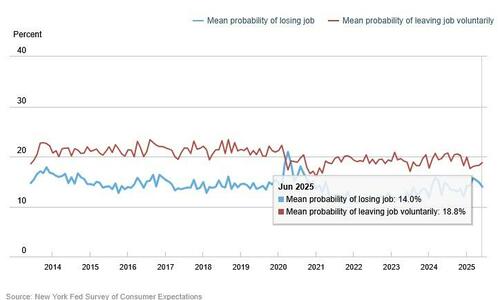

… while the mean perceived probability of losing one’s job in the next 12 months decreased by 0.8% to 14.0%, the lowest level since December 2024. The decrease was broad-based across age and education groups

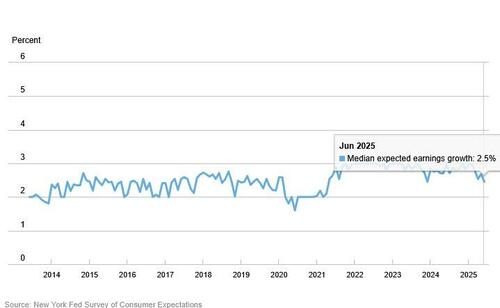

Median one-year-ahead earnings growth expectations fell by 0.2 percentage point to 2.5% in June, remaining below its 12-month trailing average of 2.8%. The series has been moving within the range between 2.5% and 3.0% since May 2021

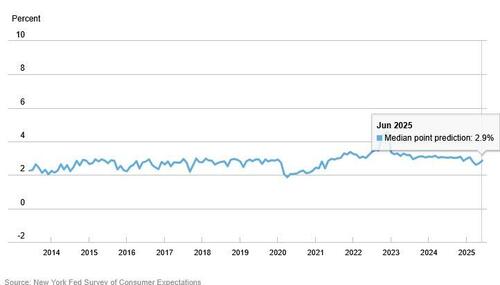

While spending growth expectations slightly declined, household income growth expectations increased: the median expected growth in household income increased by 0.2 percentage point to 2.9% in June, equaling its 12-month trailing average.

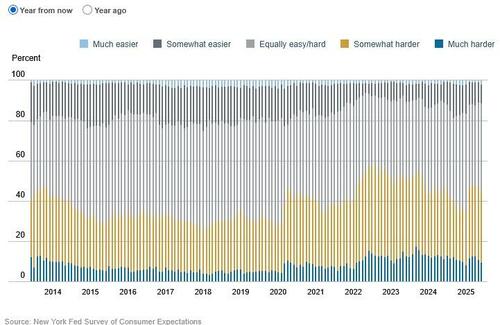

Households were also more optimistic about their year-ahead financial situations and credit access

Finally, after sliding to a record low 33.8% in March, household expectations for higher stock prices one year from now rose to 36.0%…

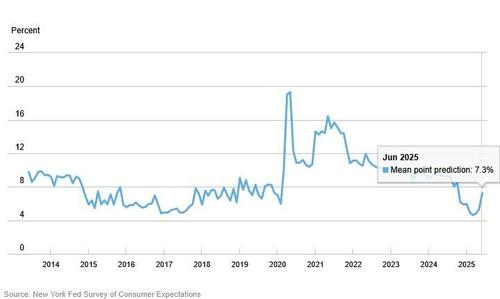

… and while expectations for growth in government debt also rose to a 7.3% annual increase, the highest since October, the real number will be much, much higher now that Trump’s BBB (and future US credit rating) has passed.

Loading…