Money

Mixed trade after the Trump-Xi call, lack of concrete progress cited – Newsquawk Europe Market Open

2 hours ago

Originally posted by: Zero Hedge

- APAC stocks traded mixed after Chinese markets failed to benefit from the phone call between US President Trump and Chinese President Xi on Friday, with some citing a lack of concrete progress.

- US lawmakers face a deadline of September 30th to pass a funding bill to avoid a government shutdown. Members of the Senate are not scheduled to return to Washington until September 29th, and House lawmakers are not due to return until October 7th, according to NBC.

- Estonia triggered NATO Article 4 after three Russian MiG-31 jets entered its airspace on Friday, while Germany scrambled fighter jets to track a Russian plane over the Baltic Sea over the weekend.

- European equity futures are indicative of an uneventful cash market open with Euro Stoxx 50 futures U/C after the cash market closed flat on Friday.

- Looking ahead, highlights include EZ Consumer Confidence Flash (Sep), Canadian Producer Prices (Aug); Speakers include BoE’s Pill, Bailey, Fed’s Williams, Musalem, Barkin, Hammack, BoC’s Kozicki; Supply from the EU.

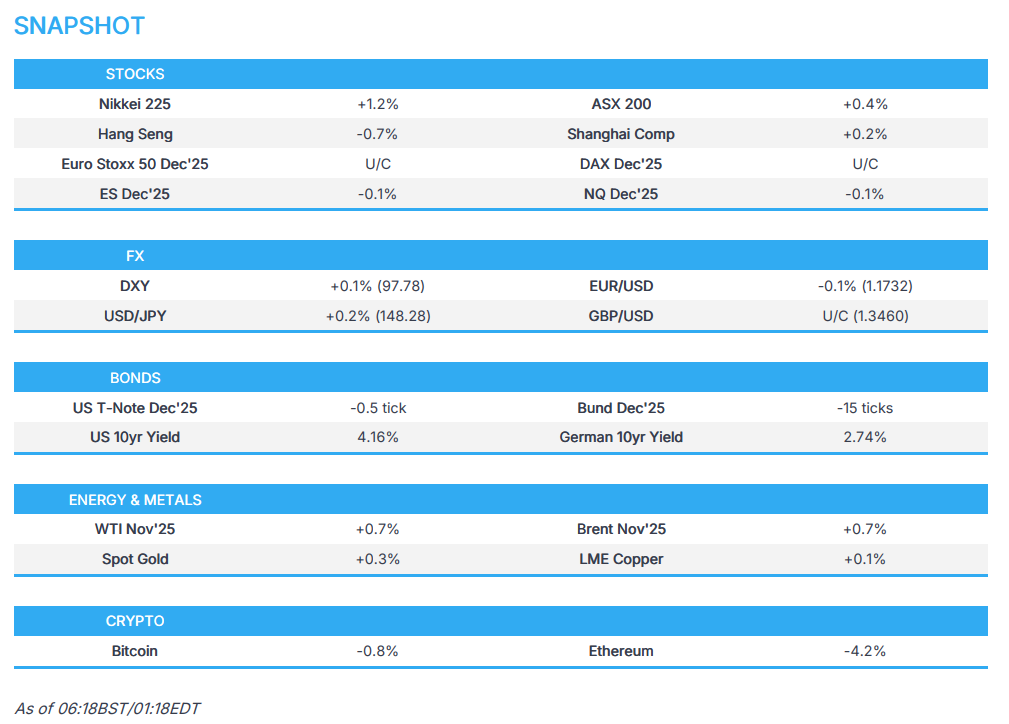

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were bid on Friday with SPX hitting fresh record highs while the majority of sectors were green. Upside was led in Tech with the heavy cap stocks outperforming, leading to NDX outperformance, while the Russell pared from its prior day rally.

- SPX +0.49% at 6,664, NDX +0.70% at 24,626, DJI +0.37% at 46,315, RUT -0.77% at 2,449

- Click here for a detailed summary.

NOTABLE US HEADLINES

FED

- Fed Governor Miran on Friday said disinflationary forces are in the works, including lower immigration, via Fox Business. He reiterated that he doesn’t see material inflation from tariffs. Monetary policy is pretty restrictive, and he warned that the longer it stays restrictive, the bigger the risk. He said comparing goods inflation this year to pre-pandemic trends is the wrong comparison. He reiterated that he will be trying to convince other Fed policymakers to cut rates faster. He said, “We are in an easing cycle”. He noted that people have been moving in the direction of thinking tariff inflation is less than previously thought, and added that folks will eventually come around to the view that tariffs will not drive up inflation.

- Fed’s Daly (2027 voter) on Friday said the job market has softened quite a bit over the last year, noting part of this is due to the economic outlook. She said it is challenging to discern how much of the job market is slowing due to AI, and added that the rate cut this week was an effort to support the labour market, according to Reuters.

- Former White House Advisor Steve Bannon thinks Scott Bessent should serve as both US Treasury Secretary and Fed Chair on an interim basis through the midterms; a White House official said the administration is not considering that, according to CNBC.

US GOVERNMENT SHUTDOWN

- On Friday, US Senate rejected a short-term funding bill to keep the federal government funded on a short-term basis, as expected. Lawmakers now face a deadline of September 30th to pass a funding bill to avoid a government shutdown. Members of the Senate are not scheduled to return to Washington until September 29th, and House lawmakers are not due to return until October 7th, according to NBC.

- Senate Minority Leader Schumer said he is ready to meet “anytime” with President Trump to avoid a government shutdown, according to a CNN interview.

OTHERS

- US President Trump said he will deliver a speech at the UN General Assembly, according to a Fox News interview.

- US Secretary of State Rubio is to speak at 16:45 ET/ 21:45 BST on Monday.

NOTABLE US EQUITY HEADLINES

- Oracle (ORCL) is said to be in talks with Meta (META) on a USD 20bln AI cloud computing deal, according to Bloomberg.

- Apple (AAPL) is reportedly rushing to boost production of the cheaper iPhone 17, increasing standard model production by 30–40%. Consumers are favouring the USD 799 iPhone 17 over the pricier Pro models, with the standard iPhone 17’s value and China factors driving strong demand, according to The Information.

- Apple (AAPL) is reportedly planning to release a Mac computer with a touch screen next year, according to Bloomberg.

- Elon Musk denied xAI is raising USD 10bln at a USD 200bln valuation, saying it is fake news and that xAI is not raising any capital right now, according to Reuters.

- The Fed will meet next month with Blackstone (BX), Robinhood (HOOD) CEOs, and Treasury Secretary Bessent to discuss challenges affecting community banks, according to Bloomberg.

- Rupert Murdoch reportedly privately told executives working on the TikTok deal that he wanted to own a small stake in the company if an agreement could be reached, and any investment in the TikTok-US deal would come through Fox Corp, according to WSJ sources.

- US President Trump invoked a ‘golden share’ to block US Steel’s (X) plans for an Illinois plant, while Commerce Secretary Lutnick told the company’s CEO the administration would not allow Granite City production to cease, according to WSJ.

- Trump administration is set to link acetaminophen to autism risk, according to WaPo.

TRADE/TARIFFS

- US House lawmakers made a rare visit to China on Sunday in an effort to stabilise ties, according to Nikkei. “The visit on Sunday was the first House of Representatives delegation to visit China since 2019”.

- US President Trump reportedly withheld approval of over USD 400mln in military aid to Taiwan this summer while seeking a trade deal and possible summit with Chinese President Xi Jinping, according to Washington Post sources.

- US President Trump said “we made progress with China on several important issues” and said “we will not allow anything bad to happen to the TikTok app”.

- China’s Commerce Ministry said its position on the TikTok issue is clear, adding that the government respects the will of enterprises and welcomes companies to conduct business negotiations based on market rules. The ministry said it hopes the US will work together with China to fulfil its commitments earnestly, and provide an open, fair, just, and non-discriminatory business environment for Chinese companies, including TikTok, to continue operating in the US. It added that China hopes the US will work with it to promote stable, healthy, and sustainable development of China-US economic and trade relations, according to Reuters.

- EU is set to block big tech companies from a new financial data sharing system, according to FT.

- US President Trump is set to add a new USD 100k fee for H-1B visas in the latest crackdown, according to Bloomberg. US President Trump said that in some cases, companies are going to pay a lot of money for H-1B visas. An administration aide said Trump will sign a proclamation to raise the visa fee to USD 100k. Commerce Secretary Lutnick added that if companies are going to train someone, they should train Americans, noting that all the big companies are on board and that firms will pay USD 100k per year for H-1B visas, according to Reuters.

- South Korean President Lee said South Korea will face a financial crisis if it agrees to US demands on USD 350bln investments, according to comments made to Reuters; South Korea and the US are at odds over the investment. South Korean President Lee aims to resolve the US-South Korea tariff issues as soon as possible. The Hyundai US plant raid will not damage the alliance with the US.

- South Korea, US, and Japan’s leading diplomats plan to meet in New York this week, according to Yonhap.

APAC TRADE

EQUITIES

- APAC stocks traded mixed after sentiment from Wall Street initially reverberated to the region before dissipating. Chinese markets failed to benefit from the phone call between US President Trump and Chinese President Xi on Friday, with some citing a lack of concrete progress.

- ASX 200 was lifted by the metals and mining sector, with gold names spearheading the upside following the recent rise in the yellow metal, offsetting underperformance in energy names.

- Nikkei 225 was boosted at the open amid a softer JPY and as the index digested Friday commentary from BoJ Governor Ueda, with the BoJ’s surprise ETF and J-REIT selling seen as too incremental to impact markets. Focus now turns to the LDP election as the 12-day official campaign period began ahead of the October 4th polls.

- KOSPI was supported amid Samsung Electronics shares surging ~5% after clearing the NVIDIA hurdle for 12-layer HBM3E supply.

- Hang Seng and Shanghai Comp initially bucked the trend and failed to benefit from upbeat mood elsewhere, with traders unconvinced despite the “productive” Trump-Xi call, although the mainland later eked mild gains. Meanwhile, US lawmakers made a rare visit to China on Sunday in an effort to stabilise ties. Overnight, the PBoC maintained its LPRs as expected and injected CNY 300bln via 14-day reverse repo after an eight-month hiatus. In Hong Kong, participants brace for a “Super” typhoon with Hong Kong airport weighing a 36-hour closure, according to Bloomberg.

- Nifty 50 fell at the open with losses attributed to US President Trump’s H-1B visas update. India is said to be the primary beneficiary of H-1B visa which allows US employers to hire foreign workers in “speciality occupations”.

- US equity futures (ES -0.1%, NQ U/C) resumed trade with a mildly softer bias before edging higher alongside APAC markets, then trimming gains into the Chinese open. Focus remains on Fed commentary after Governor Miran’s dissent on a 50bps cut last week, with his full review due today. Domestic politics are also in focus after the Senate rejected a short-term funding bill, leaving lawmakers until September 30th to avoid a shutdown.

- European equity futures are indicative of an uneventful cash market open with Euro Stoxx 50 futures U/C after the cash market closed flat on Friday.

FX

- DXY was confined to a narrow 97.70–97.825 range amid light overnight newsflow ahead of this week’s US PCE metrics. Focus today is on numerous Fed speakers, including Williams, Musalem, Barkin, Hammack, and Governor Miran’s dissenting speech. Throughout the week, Bloomberg flagged some 17-18 Fed speakers. Attention also remains on efforts to avert a US government shutdown after the Senate rejected a short-term funding bill; lawmakers face a September 30th deadline, though the Senate is not scheduled to return until September 29th and the House until October 7th, according to NBC.

- EUR/USD hovered around Friday’s lows (1.1728) despite uneventful USD trade, while ECB’s Simkus said a December rate cut is needed to safely reach 2% inflation, according to Bloomberg. Geopolitical risks also weighed, as Estonia triggered NATO Article 4 after three Russian MiG-31 jets entered its airspace on Friday, while Germany scrambled fighter jets to track a Russian plane over the Baltic Sea over the weekend, and US President Trump suggested Europe will not be allowed to buy Russian oil much longer.

- GBP/USD was uneventful above 1.3450 amid light UK-specific newsflow, with attention on BoE’s Chief Economist Pill and Governor Bailey’s speeches later today ahead of tomorrow’s Flash PMIs.

- USD/JPY ventured further into 148.00 territory with JPY on a softer footing as domestic focus shifted from the BoJ to the LDP election. The latest poll suggested that dovish Japanese PM candidate Takaichi is the top pick to lead the LDP with 28.3%, according to FNN Poll. Modest JPY weakness was seen before the poll was released to Western wires.

- Antipodeans were subdued despite the broader risk-on mood. AUD showed little reaction to RBA Governor Bullock’s overall balanced remarks, highlighting increased uncertainty, while she noted scope for rate adjustments if there is a downturn in the global economy. Upticks in the AUD were seen after China pledged tighter controls on steel sector capacity, with iron ore and steel prices also supported.

- PBoC set USD/CNY mid-point at 7.1106 vs exp. 7.1159 (Prev. 7.1128)

- Argentina Central Bank on Friday said it sold USD 678mln in the wholesale market; it sold USD 1.11bln in the last three days to curb ARS weakness, according to Reuters.

FIXED INCOME

- 10yr UST futures were flat as they took a breather after last week’s extension of the post-FOMC and strong data downside. This week’s focus turns to the US PCE report, Treasury supply, and a myriad of Fed speakers. On government funding, the House passed a stopgap bill, but it failed in the Senate due to insufficient votes; Politico suggested the next vote will not be until September 29th, ahead of the September 30th deadline.

- Bund futures saw a subdued session amid a lack of pertinent drivers during APAC hours, with EU supply due later ahead of Flash PMIs tomorrow.

- 10yr JGB futures were softer as traders in Asia caught up to Friday’s price action and digested Governor Ueda’s press conference.

COMMODITIES

- Crude futures were firmer amid plentiful weekend geopolitics. Estonia triggered NATO Article 4 after three Russian MiG-31 fighter jets entered its airspace, while Germany scrambled fighter jets to track a Russian plane over the Baltic Sea. US President Trump also suggested Europe will not be allowed to buy Russian oil much longer, according to Bloomberg. In the Middle East, an Israeli official told Sky News that a full or partial annexation of the West Bank is being considered in response to the UK’s recognition of Palestinian statehood.

- Spot gold held a mild upward bias just under USD 3,700/oz as geopolitics underpinned prices ahead of this week’s risk events, including Flash PMIs, numerous Fed speakers, and US PCE data.

- Copper futures were in a tight range, initially posting modest gains amid the positive risk tone across Asia-Pac markets at the time, and following the phone call between US President Trump and Chinese President Xi on Friday, which was framed as “productive”. However, futures were heavy amid underperformance across Chinese markets and look to enter the European session near flat levels.

- Baker Hughes Rig Count: Oil +2 at 418, Natgas unch at 118, Total +3 at 542.

- The Iraqi Petroleum Marketing Authority said it has increased its oil exports after a gradual end to voluntary production cuts within the framework of the OPEC Plus deal, according to Iran International.

- NHC said a new tropical storm has formed south of Mexico, which is expected to remain offshore and intensify, according to Reuters.

- Chilean state copper miner Codelco said its biggest mine will take longer to return to full production following a deadly tunnel collapse in July, according to El Mercurio.

- China pledged tighter controls on steel sector capacity and will ban new production capacity in the industry, according to state media CCTV.

CRYPTO

- Bitcoin eventually fell under the USD 115,000 mark after hovering at the handle throughout the weekend.

- The UK’s FCA has sped up crypto approvals, cutting processing times by two-thirds and raising acceptance rates, amid criticism it was too slow, according to the Financial Times.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM candidate Takaichi is the top pick to lead LDP with 28.3%, according to an FNN Poll.

- Japanese PM contender Koizumi said it is important for the government and the BoJ to move in lockstep in achieving price stability and economic growth, according to Reuters.

- Japanese PM contender Hayashi said the BoJ is conducting monetary policy in a way that does not deviate much from government thinking, adding that Japan’s past aversion to a strong JPY has diminished. He said a weak yen, coupled with rising oil costs from the Ukraine war, has caused cost-push inflation. Hayashi said if chosen as prime minister, he will compile an economic package to cushion the blow from rising living costs and provide spending for disaster relief, adding that the size of the package must take into account Japan’s ‘quite small’ output gap and avoid the issuance of deficit-covering debt, according to local media.

- RBA Governor Bullock said since the August meeting, domestic data have been broadly in line with expectations, or slightly stronger. She noted that recent interest rate cuts are expected to support household and business spending. While labour market conditions have eased a little with the unemployment rate rising slightly, some tightness remains, and conditions are close to full employment. Bullock said the economic outlook continues to be clouded by uncertainty, though recovery in household consumption growth is forecast to be sustained as real incomes grow. She warned there is a risk the recent pick-up in domestic activity is not sustained, but monetary policy is well placed to respond if international developments have a material impact. She added there may be more excess demand in the economy and stronger-than-expected labour outcomes. The board will remain attentive to data and evolving risks, and must be alert to changing circumstances and prepared to respond if necessary, according to the RBA. Bullock noted there is scope for rate adjustments if there is a downturn in the global economy, adding she is more confident that inflation will stay within the RBA’s band.

- Indian PM Modi said he will accelerate the country’s growth story with GST reforms, according to a his national address.

- Hong Kong’s weather forecaster will issue the No 1 standby signal at 12:20pm local on Monday and consider upgrading it to the No 3 alert later in the evening as Super Typhoon Ragasa moves towards the city at a “relatively high” speed, according to SCMP.

- Hong Kong airport weighs 36-hour closure as super typhoon nears, according to Bloomberg.

- PBoC injected CNY 240.5bln via 7-day reverse repos with the rate maintained at 1.40%; PBoC injected CNY 300bln via 14-day reverse repo following an eight-month hiatus; conducted through fixed-volume, interest-rate bidding with multiple-price allocation.

DATA RECAP

- Chinese Loan Prime Rate 5Y (Sep) 3.50% vs. Exp. 3.50% (Prev. 3.50%)

- Chinese Loan Prime Rate 1Y (Sep) 3.00% vs. Exp. 3.00% (Prev. 3.00%)

GEOPOLITICS

NATO-RUSSIA

- On September 21st, Germany’s air force said it sent two fighter jets to track a Russian plane flying over the Baltic Sea, according to Sky News.

- On September 19th, three Russian MiG-31 fighter jets entered Estonian airspace near Vaindloo Island in the Gulf of Finland for 12 minutes.

- Russian Defence Ministry said Russian fighters did not violate Estonian airspace, according to Reuters.

- NATO said the North Atlantic Council (NAC) will convene early this week to discuss the Russian violation of Estonian airspace, according to Reuters.

- The United Nations Security Council (UNSC) will meet on Monday at Estonia’s request to discuss the violation of the Baltic country’s airspace by Russian fighter jets on Friday, according to a statement.

- Estonian PM has decided to request NATO Article 4 consultations over Russian jets entering its airspace, according to X.

- US President Trump said the US will help defend Poland if Russia continues escalating, according to a Fox Interview. Trump, when asked about Russian jets in Estonia, said “we don’t like it”.

- German Foreign Minister said the violation of Estonian airspace by Russia is unacceptable, adding that by intercepting Russian planes immediately, they are showing NATO is always ready to defend itself, according to Reuters.

- EU’s Costa said EU leaders will address a “collective response” to Russian violations of airspace at a meeting on October 1st, according to X.

- British Defence Minister said Typhoon aircraft carried out their first air defence missions over Poland, according to a statement on Sunday.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said Ukraine will present a strategy for “guided” weapons exports in two weeks, identifying the US, European, and other countries as potential buyers of Ukrainian weapons, while stressing that reliable controls should be put in place, according to Reuters.

- European Commission President von der Leyen, on the 19th package of sanctions against Russia, said the EU is banning imports of Russian LNG into European markets. To strengthen enforcement, she said the EU is sanctioning 118 additional vessels from the shadow fleet, bringing the total to more than 560 vessels now listed under EU sanctions. She added that major energy trading companies Rosneft and Gazpromneft will now be on a full transaction ban, according to the EU.

- Ukraine’s President Zelensky said they are closer to finalising the 19th sanctions package and he expects its approval soon. He added that Ukraine will quickly synchronise the package domestically and expressed gratitude that many of Ukraine’s proposals were taken into account in the EU sanctions package. Zelensky also said he now expects strong sanctions steps from the United States on Russia, according to his X post.

- US President Trump urged Europe to “stop buying oil” from Russia ahead of new US economic pressure on Moscow, adding that the US won’t let Europeans buy Russian oil much longer, according to Bloomberg.

- Russian Defence Ministry said a Ukrainian drone attack on a resort area in the Crimean peninsula killed two people and injured 15, according to Reuters.

- A Ukrainian SBU official said Ukrainian drones hit oil pumping stations involved in Russian oil exports via the Novorossiysk port, according to Reuters.

MIDDLE EAST

- An Israeli official has told Sky News a full or partial annexation of the West Bank is being considered in response to the UK’s formal recognition of Palestinian statehood. Israeli media reported that the Israeli army is preparing for the possibility of an escalation of the conflict in the West Bank, according to Iran International.

- The US is planning USD 6bln in new arms sales to Israel, including a USD 3.8bln deal for 30 AH-64 Apache helicopters that would almost double Israel’s current fleet, and a USD 1.9bln deal for 3,250 infantry assault vehicles for the Israeli army, according to the WSJ.

- UK, Canada, Portugal, and Australia recognised Palestine as an independent state, according to the BBC.

- Israel “categorically rejects” the UK and other countries’ unilateral recognition of a Palestinian state, according to the Foreign Ministry.

- Palestinian Authority Foreign Minister said a two-state solution is possible, according to Iran International.

- Israeli military said it killed a Hezbollah member in southern Lebanon, adding that as a result of the attack, a number of citizens were killed. The military said it regrets any harm to civilians and is working as much as possible to minimise harm to them, according to Reuters.

- US President Trump plans to meet with Arab leaders on Tuesday to discuss the Gaza war, according to Axios.

OTHERS

- South Korean President Lee said South Korea does not believe any concrete discussions are happening between the US and North Korea. Russia-North Korea military cooperation is a significant threat to South Korea and must be addressed with dialogue. He added that dialogue with North Korea will likely be difficult for the time being. South Korea risks being on the frontier of conflict and must find peaceful coexistence with North Korea, Russia, and China.

- North Korea leader Kim Jong Un said the concept of denuclearisation for the country is no longer valid, via KCNA, adding that North Korea will never give up its nuclear force. He added they will never sit down with South Korea, and that he still has good memories of US President Trump, but there is no reason to sit down with the US until it gives up its insistence on denuclearisation.

- US President Trump will host Turkish President Erdogan on Sept. 25th at the White House, working on many trade and military deals, including a large-scale purchase of Boeing (BA) aircraft, a major F-16 deal (LMT), and a continuation of F-35 talks (LMT), according to Truth Social.

- US President Trump said that on his orders, the Secretary of War authorised a lethal kinetic strike on a vessel in the USSOUTHCOM area of responsibility. He said intelligence confirmed the vessel was trafficking illicit narcotics, and the strike killed three males. Trump added that no US forces were harmed and that the vessel was in international waters, according to Reuters.

- US President Trump said that if Afghanistan does not give the Bagram airbase back to the US, bad things are going to happen, according to Reuters.

EU/UK

NOTABLE HEADLINES

- ECB’s Kazaks said there will be plenty of data available at the December meeting, adding that the central bank has achieved its 2% goal and there is no need to hurry the next interest-rate shift, according to Bloomberg.

- ECB’s Simkus said a December rate cut is needed to safely reach 2% inflation, according to Bloomberg.

- France’s sovereign debt rating downgraded to AA by Morningstar DBRS

- Italy’s sovereign debt rating upgraded to BBB+ from BBB at Fitch

- European Commission President von der Leyen said she isn’t considering running in Germany’s 2027 presidential election, according to a newspaper interview published on Sunday.

- Multiple European airports have said a suspected cyber attack has impacted them, according to Sky News.

- Stellantis (STLAM IM/STLAP FP) said they detected unauthorised access to a third-party service provider’s platform that supports North American customer service operations; the company is notifying the appropriate authorities and informing affected customers, according to the company.

Loading…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.