Inflation The Real Story | Armstrong Economics

QUESTION: Mr. Armstrong, a friend of mine attends your conferences and said you’re the only person who understands the economy because you have international experience and have met with many central banks around the world. He said inflation is no longer the simplistic expansion of the money supply, and anyone who said that is still trapped by Keynesian economics. If inflation is not the quantity of money anymore, then can you explain what inflation is all about? Why have you not appeared on Tucker Carlson to explain your theory?

I appreciate your patience.

Rob

ANSWER: The people who put out this theory have ZERO international experience.

CURRENCY INFLATION:

Currency inflation can take place in primarily two ways. First, the currency declines in value, and this attracts foreign capital to rush in for bargains. I did that myself when the British pound fell to $1.03 in 1985. It was like the country on sale at Harrods.

Secondly, let’s say you have a building in it, and I buy it for $10 million. The money supply is not altered. However, let’s say I’m British and I buy your building in the United States. I have to bring British pounds, convert them into dollars, and then pay you your $10 million. I have just increased the domestic money supply and assets, and the central bank had no impact.

Here are the capital flows during the Great Depression. You see a massive exit of capital in 1931, which was caused by the Sovereign Debt Defaults of 1931, as all of Europe, including Britain and the British Commonwealth, such as Canada, suspended their debt payments. That is what took down 9,000 banks, not tariffs.

Here are the capital flows for the 1987 Crash, which was also caused by capital outflows. Even looking at the 1989 Japanese Bubble, what made it similar to the 1929 bubble in the USA? Capital inflows and concentration from around the world cause the assets to rise, and money pours into the economy. Currently, Canada has seen a 300% rise in real estate, largely due to foreign capital flowing into the country.

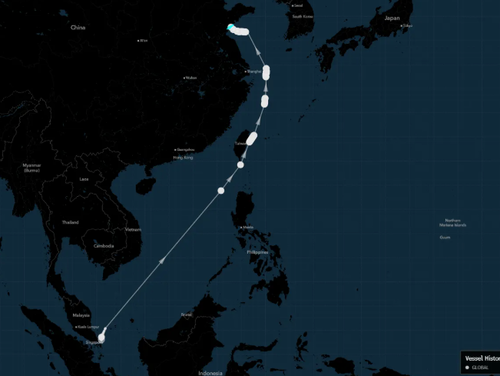

After the 1989 Bubble in Japan, capital then shifted to Southeast Asia. Thailand’s assets soared, both in real estate and stocks. Then it crashed in 1997, as capital was then expected to be the next hot market in 1999. Here you see Thailand’s peak and the US market rose into July 1998. Thailand then passed real estate legislation, which prohibited foreigners from owning land. Foreigners generally cannot own land outright in Thailand, even since the 1997 Asian Currency Crisis. However, exceptions exist for significant investments (e.g., a 2022 cabinet-approved proposal allowing land purchase with a 40 million baht investment in specified sectors, subject to parliamentary processes). This aims to stimulate the economy rather than restrict access.

Foreigners may own up to 49% of the total unit area in a condominium project, provided the funds are imported from abroad, which increases the money supply. Foreigners can lease property for up to 30 years in the classic British system, with potential renewals, although this does not confer ownership – only the right to use. While setting up a Thai company (majority Thai-owned) to hold land is a common workaround, authorities actively scrutinize such arrangements to prevent misuse.

Recent discussions (2022–2023) focused on easing restrictions for high-value investors rather than imposing bans. Thus, Thailand maintains its historical framework: it restricts land ownership but permits certain property investments under regulated conditions. Always consult legal experts for current, case-specific advice. All of this was a response to the 1997 Asian Crisis caused by capital concentration, and then it moved on to the next hot topic.

Here, you can see that the price of gold varies by currency, all based on its value. Are you genuinely looking at a chart of gold, or are you only looking at it in relation to the local currency?

DEMAND INFLATION:

This was Keynes’ misconception, who assumed the bull market up to 1929 was purely driven by domestic demand. He proposed raising interest rates to make borrowing more costly and lowering interest rates to encourage borrowing. The idea was seriously myopic. He did not understand capital flows, and that higher interest rates sometimes attract capital, as was the case when Volcker raised interest rates to insane levels in 1981, which sent the dollar soaring to a record high in 1985.

Lowering rates in 1927 to try to deflect the capital inflows back to Europe failed. The Fed raised rates from 3.5% to 6%, and it did not stop the rally in the share market. The Fed then lowered rates from 6% to 1,5% in 1931, and it had no impact on supporting the market. So, again, all we have are failed theories, yet people lacking international experience mouth the same old stuff over and over again because everyone else does.

ASSET INFLATION:

Then you have raw shortages or oversupply. The purchasing value of gold dropped significantly thanks to the 1849 California Gold Rush. During inflation, assets rise in value, and money declines. That took place during the 19th century when a gold coin was money. MONEY has NEVER been of a constant value – NEVER! These people yelling fiat simply do not comprehend that for thousands of years, there has always been a business cycle, and that means money rises and falls in purchasing power, REGARDLESS of whatever it has been. The fiscal irresponsibility of governments is well-documented throughout history, long before the introduction of paper money.

Even under a gold standard, there were periods of inflation and deflation. Read the history of the California Gold Rush.  During the 1849 Gold Rush in California, the journalist for the New York Tribune, Bayard Taylor (1825-1878), arrived in San Francisco by ship during the summer of 1849. He was shocked at what he encountered and did not think that anyone would even believe what he was going to write. His dispatches about the gold rush economy in California stunned many and helped to create the 1849 Gold Rush.

During the 1849 Gold Rush in California, the journalist for the New York Tribune, Bayard Taylor (1825-1878), arrived in San Francisco by ship during the summer of 1849. He was shocked at what he encountered and did not think that anyone would even believe what he was going to write. His dispatches about the gold rush economy in California stunned many and helped to create the 1849 Gold Rush.

The average wage for a laborer in New York was about one or two dollars a day. In California, individual hotel rooms were rented to professional gamblers for upwards of $10,000 a month, which is the equivalent of about $300,000 today. The degree of inflation in terms of gold was astounding and lacks comparison in modern times. There was so much gold that the value of goods rose even though they did not in New York. The inflation phenomenon was local – akin to the Tulip Bubble.

There is a lot more to this than simply the quantity of money. In case you haven’t noticed, some Marxist economists who propose MMT (Modern Monetary Theory) claim that since the U.S. borrows in its own currency, it can print dollars to cover its obligations and can’t go broke. The theory has won converts among freshman Democrats, like Alexandria Ocasio-Cortez, as a way to finance social policies like the Green New Deal and Medicare for All. They pointed to the vast Quantitative Easing (QE) in 2008-2009, and inflation was not created. The European Central Bank expanded the money supply and lowered interest rates to negative in 2014, despite no inflation.

Quantitative Easing (QE) does not increase the Supply of Money—it is only a maturity swap. Today’s total money supply includes debt, unlike during the pre-19th century. This has erroneously given rise to Modern Monetary Theory, for they pointed to QE and said there was no inflation, so that we could print without repercussions. It was merely a swap of maturities when you finally realized that debt is now money that earns interest, as paper money was introduced during the Civil War.

When paper money stopped paying interest, the term “Greenback” emerged, meaning there was no interest payment schedule on the reverse, just green ink. Paper money began as essentially debt or bonds that circulated as a form of cash. Today, people blame the central bank, but remain clueless that the money created by the central bank is only a tiny fraction of the money supply. Because debt issued after 1971 is now legal to use as collateral, posting T-Bills to trade futures, the $34 trillion debt is part of the money supply that dwarfs the central bank. Shutting down the Federal Reserve will make things worse. The real source of inflation under this theory of the Quantity Theory of Inflation is the debt itself.

Moreover, we pay interest, and that no longer stimulates the economy because much of it is held offshore. China has 10% of the US debt, which accounts for 10% of the $1 trillion in interest payments that flow to China, not the domestic economy.