How Global Carmakers Are Responding To Tariffs: Full Summary

Premium

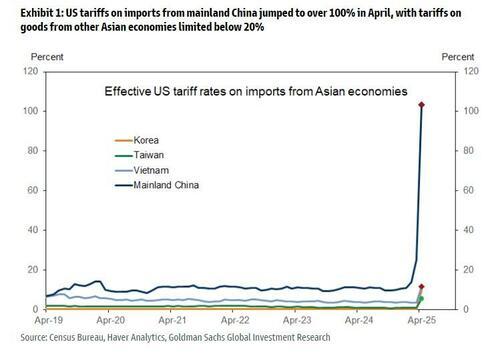

With auto tariffs becoming the new normal in the US, investors have begun to track responses by OEMs every week both in terms of pricing/incentives and production. Needless to say, this is a fluid situation and policy could change quickly.

To be sure, there is the occasional automaker – like Ferrari – which doesn’t even have to worry about the impact of tariffs and can boast of zero cancelations even as the average Ferrari price rises by 25%. After all, its clients are uniformly wealthy and most would be glad to pay even more for a car; after all, it is a status symbol. Other OEMs, however, are less lucky and since the battle for market share and against margin erosion is about to get fierce, here is the latest state of the OEM industry.

As DB’s Edison Yu writes in a note this week, lately the administration appears to be content to extend the USMCA-compliant auto parts exemption and will also grant credits back to OEMs for domestically-made vehicles in the first and second years. Across OEMs, we are monitoring post-tariff reactions, with GM saying that it will not raise prices across the board but continue to see consistent pricing (up 0.5%-1.0% for the year), and Ford holding off on price increases for its May-built vehicles. Others like Hyundai have launched a “Customer Assurance” program to shield buyers from tariff-related price hikes until June.