Goldman: Tesla’s China FSD Push Is Mission-Critical

At the start of the week, Goldman analysts Mark Delaney, Dan Duggan, and others told clients that Tesla’s market share in China has remained stable, and the world’s second-largest economy has recently overtaken the U.S. as Tesla’s largest market. The analysts also reviewed Tesla’s rollout of Full Self-Driving (FSD) software in China, noting that the autopilot market is in an “increasingly competitive landscape.”

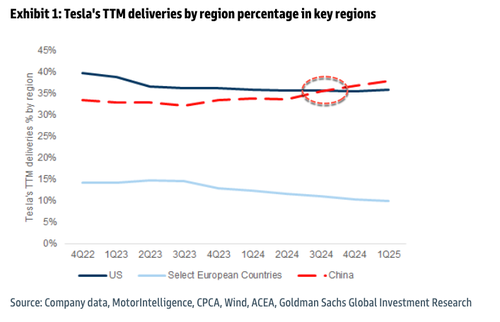

Delaney highlighted that China has become Tesla’s largest auto market in recent quarters, overtaking the U.S. auto market in late 2024.

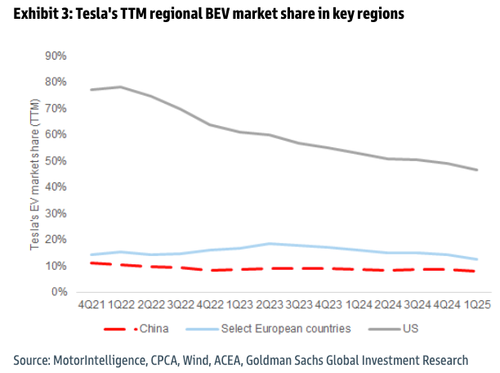

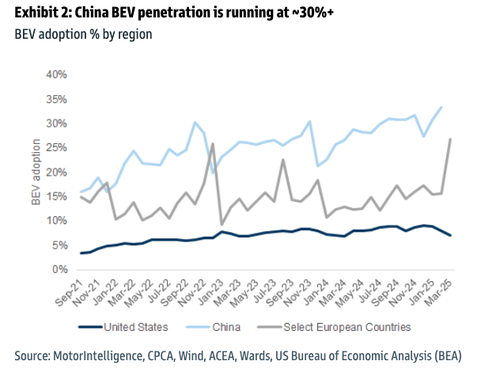

The analysts said Tesla’s appeal in China is primarily driven by the country’s higher battery electric vehicle (BEV) penetration rates compared to other markets.

In Western markets, Tesla’s dominance has eroded from the U.S. to Europe. In the U.S., its market share plunged from 80% in 2021 to around 45% in Q1 2025. In Europe, the story is very similar, with share slipping to low double digits. However, Tesla’s market share in China has remained relatively stable, holding around the high single-digit range (even despite a trade war).

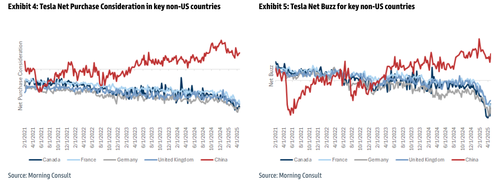

High-frequency data from Morning Consult shows that consumer sentiment around Tesla has shifted lower in recent months, yet it has held steadily in positive territory in China. The dismal sentiment in the West has mainly been caused by unhinged liberals, their rogue NGOs, and far-left corporate media outlets waging war against Tesla CEO Elon Musk for his involvement with DOGE. In return, Musk’s involvement with DOGE has hit the brand.

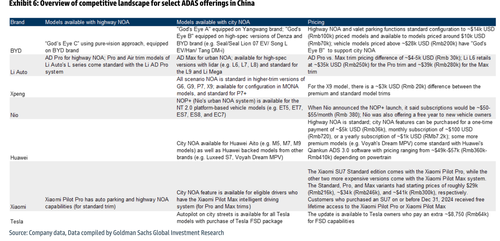

Given China’s growing importance to Tesla, the analysts emphasized that the world’s largest auto market remains a highly competitive environment for FSD, with several domestic EV makers offering comparable driver-assistance features.

Here’s more color from the analysts about FSD in China:

On 2/25/25, media outlets reported that Tesla had pushed an update to some users who had previously purchased Tesla’s FSD software (which costs ¥64,000 or ~$8,750 USD) with several FSD-like features including automatic lane change, traffic light detection, and turning capabilities. Tesla commented on its 1Q25 earnings call that it was able to launch supervised FSD in China with minimal local specific data for the China market, as the company was able to leverage the more generalized software it had already developed. That said, Tesla’s FSD software has historically worked better in the U.S. per media reports, as Tesla has had more data and time to refine the product domestically. Tesla also spoke to the benefits of local training and parameters on its 1Q25 call. Per reviews (link & link), FSD in China has performed relatively well, especially given limits to Tesla’s data collection in China. However, some reviews cite a lack of understanding of local traffic rules (e.g. Tesla vehicles going into shoulder/bike lanes on turns) and the sporadic use of wrong lanes, which we believe could be due to the more limited data for the China market.

Tesla’s FSD offering is one of several ADAS options for consumers in China, with many local competitors offering this as a standard feature even on mainstream vehicles (Exhibit 6). The level of technology and cost improvement that Tesla can achieve with FSD, both absolute and relative to competitors, will be key for its longer-term economics related to autonomy in our opinion (both globally and in China).

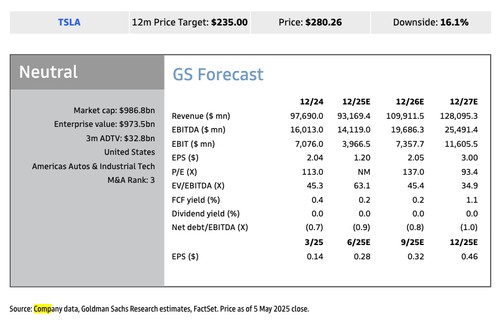

The analysts remain “Neutral” rated on Tesla shares with a 12-month price target of $235.

Shares are down 40% from the $479 peak established in Decemeber 2024.

An emerging theme this year for Tesla is that China has become its largest market in terms of deliveries. However, key questions remain about whether Tesla’s FSD offering is competitive enough to outperform driver-assistance systems from local brands. Musk’s anticipated pivot away from DOGE may also help repair Tesla’s negative brand sentiment in Western markets in the second half.

Loading…