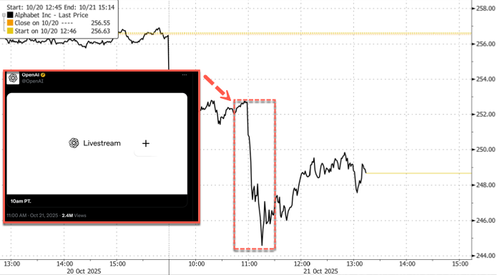

GM Spikes 11% After Raising Outlook On Trump Tariff Relief, Strong Truck Demand

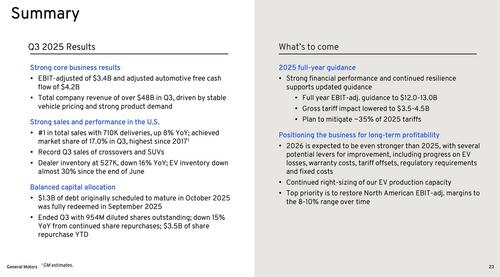

GM shares are trading up about 11% this morning after the automaker delivered stronger-than-expected third-quarter results and raised its 2025 outlook. The company reported adjusted EPS of $2.80 versus $2.31 expected and revenue of $48.59 billion versus $45.27 billion.

CEO Mary Barra said: “Thanks to the collective efforts of our team, and our compelling vehicle portfolio, GM delivered another very good quarter of earnings and free cash flow… we are raising our full-year guidance, underscoring our confidence in the company’s trajectory.”

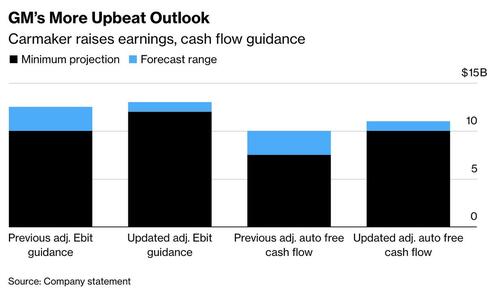

GM now expects $12–$13 billion in adjusted EBIT and $9.75–$10.50 in adjusted EPS for the year, both above prior forecasts. The company also lowered its expected tariff impact to between $3.5 billion and $4.5 billion, down from $4–$5 billion previously.

Barra thanked President Trump for “the important tariff updates” announced last week, which included new levies on imported trucks and parts as well as an offset for U.S.-made vehicles.

Despite EV-related headwinds—only about 40% of GM’s electric models are profitable on a production basis—CFO Paul Jacobson reaffirmed the company’s long-term commitment to electrification, saying, “We continue to believe there is a strong future for electric vehicles.” Gains in China, international markets, and GM Financial helped offset weaker North American margins, as GM focuses on restoring its regional profitability to the 8–10% range.

GM’s stronger outlook also reflects booming demand for its high-margin pickups and SUVs, which delivered the company’s best year-to-date truck and Escalade sales since 2018 and 2007, respectively, and record results for the GMC brand, according to Bloomberg. CEO Mary Barra highlighted that GM is “very well positioned as we invest to increase our already significant domestic sourcing and manufacturing footprint,” thanking President Trump for extending tariff discounts through 2030.

Despite near-term EV challenges, GM’s traditional lineup continues to drive profits, aided by modest price increases in North America and improved performance abroad. The company’s China operations returned to profitability, earning $80 million in the quarter after losses last year. CFO Paul Jacobson said GM’s long-term focus remains on cost reduction and efficiency in its EV business while acknowledging that U.S. demand may soften as federal tax credits expire.

“As we have demonstrated, GM’s commitment to building great vehicles, delivering exceptional customer experiences, and creating lasting value is unchanged. Looking forward, we believe our investments in advanced technologies, manufacturing, and talent will build on our solid foundation, and make GM even more innovative, resilient and capable of leading through change,” Mary Barra said in her shareholder letter.

Loading recommendations…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.