Global Stock Rally Pauses As Gold, Silver Slide From Record High

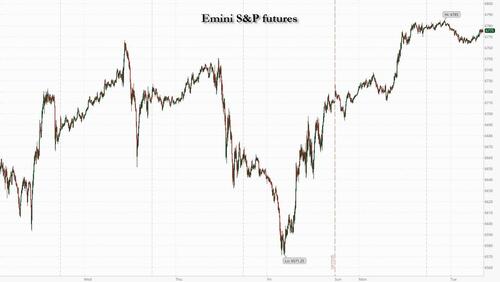

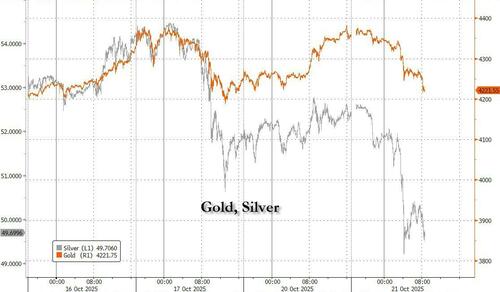

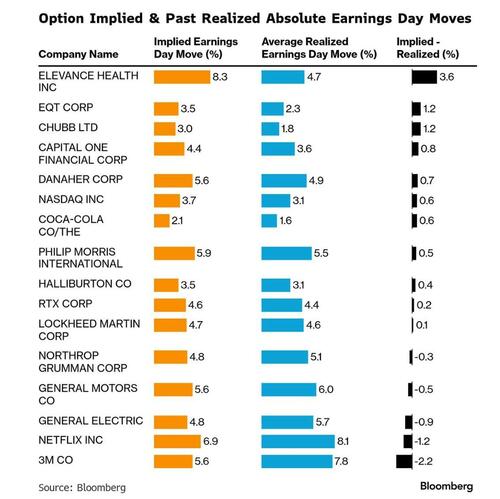

US equity futures are flat, reversing a small overnight loss, with small caps seeing some underperformance in what looks more like profit-taking than material de-risking. As of 8:00am ET, S&P and Nasdaq futures are unchanged after the S&P 500 notched its best two-day gain since June and the Nasdaq closed at a record high; premarket Mag7 / Semis are mixed but are net weaker with cyclicals underperforming as commodity names are underperforming due to a sharp overnight sell-off in precious metals, among the most notable moves today. Gold -2% and Silver -5% which appears to be de-risking in a low liquidity environment with both metals among the top YTD performing asset classes; gold set a new ATH yesterday. The rest of the commodity complex is seeing muted moves. Bond yields are flat to lower by 1bp as the USD sees a bid. The macro data focus is on Philly Fed. Coca-Cola, General Electric, Halliburton, Lockheed Martin, Northrop Grumman, RTX and 3M are expected to report results before the market open. Steady subscriber gains and rising average revenue per member should keep Netflix which reports after the close, on track for 17.3% sales growth in 3Q.

In premarket trading, Mag 7 stocks are mixed (Meta +0.5%, Amazon +0.3%, Microsoft 0.1%, Apple -0.2%, Nvidia little changed, Alphabet -0.1%, Tesla -0.3%)

- Gold and silver companies are tumbling as the precious metals slipped from their latest records as global trade tensions ease.

- Coca-Cola Co. (KO) climbs 2% after posting third-quarter sales growth that beat Wall Street expectations — a sign that consumers are snapping up the company’s beverages despite higher prices.

- Core Scientific Inc. (CORZ) is up 2% after a key proxy adviser said a takeover bid by CoreWeave Inc. undervalues the data center company.

- Crown Holdings (CCK) gains 8% after the packaging products company boosted its adjusted earnings per share guidance for the full year, beating the average analyst estimate.

- Elevance (ELV) gains 4% after the health insurer posted third-quarter profit that was ahead of expectations. The company also reaffirmed its adjusted earnings-per-share forecast for the full year, slightly above the average analyst estimate.

- Fluor (FLR) rises 5% after the Wall Street Journal reported that activist investor Starboard Value has amassed a nearly 5% stake in the engineering and construction company, citing people familiar with the matter.

- General Electric Co. (GE) inches 1% higher after the company raised its full-year outlook for a second consecutive quarter as the jet-engine manufacturer cashes in on strong air-travel demand.

- General Motors Co. (GM) climbs 8% after raising its full-year outlook and posting third-quarter results that topped Wall Street estimates on better—than-expected pickup truck sales and fresh relief from the Trump administration’s tariffs on auto parts.

- Halliburton (HAL) rises 3% after the energy service company reported third-quarter revenue that beat the average analyst estimate.

- NuScale Power Corp. (SMR) falls 4% after two analysts downgraded the nuclear small modular reactor company over concerns about its ENTRA1 deal.

- Philip Morris (PM), maker of oral pouch product Zyn, rises 3% after narrowing its adjusted earnings per share forecast for the full year.

- RTX Corp. (RTX) rises 5% after the company boosted its full-year profit outlook and reported third-quarter earnings that topped Wall Street expectations as sales and profit rose across its commercial aerospace and military hardware businesses.

- Zions (ZION) gains 1% after saying its profit topped estimates despite a $50 million loss from an alleged fraud, helping reassure investors who’d feared the credit markets might be harboring some deeper pain.

In corporate news, Amazon Web Services resolved the issues that plagued its services for about 15 hours on Monday, an episode that highlighted how much of the internet is dependent on a single company. Goldman is building out its wealth-management division in Saudi Arabia, while PayPal is said to be taking over a stake in German digital commerce company Shopware from a Carlyle fund.

The S&P 500 logged its biggest two-day gain since June as the third-quarter earnings season gets into full swing, with about 85% of US firms beating profit estimates so far. While the US government shutdown has caused an economic data vacuum, creating uncertainty about the Federal Reserve’s policy path, drawdowns have been short-lived, as investors see them as opportunities to add risk to their portfolios.

“Another day, another dearth of US data, as the government shutdown continues, with no end in sight,” said Michael Brown, a senior research strategist at Pepperstone Group Ltd. “To my mind, the path of least resistance continues to lead to the upside, and dips remain buying opportunities.”

The US Bureau of Labor Statistics is set to release September’s consumer price index on Friday, after a delay due to the government shutdown. The data, originally slated for Oct. 15, will give Fed officials a key reading on inflation ahead of their Oct. 30 policy meeting. The data may take on greater importance due to the government shutdown-driven data drought, said Rick Gardner at RGA Investments. He still sees a Fed cut in October and noted that a key test will be Big Tech earnings, with investors looking for clarity on how spending on artificial intelligence is leading to profitability.

“While earnings will remain in focus, particularly any updates on demand trends, international exposure post-tariffs, and their impact on profitability and capex, I think this week’s key events will be the inflation releases in the UK and US,” said Susana Cruz, a strategist at Panmure Liberum, “Both are still running hot and expected to rise further. Any upside surprises there could easily derail the rally.”

“Everything is weird,” said Bobby Molavi, head of EMEA execution services at Goldman. All-time highs are everywhere and classic asset class correlations are breaking down as stocks continue to climb every “wall of worry,” he wrote. It’s ‘the rally no one trusts,’ according to Bloomberg’s Markets Live blog.

As we have explained time and time again, buy-the-dip behavior from retail traders and faith in the AI narrative are a key reason why this market just keeps grinding higher; throw in a constant relentless short squeeze and you get daily record highs.

The next big test for the tech-fueled rally comes as a deluge of companies – accounting for almost 15% of the S&P 500’s total market value – report this week. Netflix, General Motors, Coca-Cola and Texas Instruments are among today’s highlights. Of the 60 S&P 500 companies that have reported so far, nearly 85% have beaten estimates.

Earnings aside, signs of easing trade tensions between the US and China continue to offer equities further support. Gold, a classic haven, dipped from its latest record ahead of the two sides returning to the negotiating table. Before those talks resume, Trump signed a landmark pact with Australian PM Anthony Albanese to boost America’s access to rare earths and other critical minerals, an effort to counter China’s tight grip on the sector. In other tariff news, small businesses challenging many of Trump’s global levies urged the Supreme Court to affirm lower court rulings that the import levies amount to a massive illegal tax.

Gold slumps, with spot prices falling by $94 to $4,262/oz, though recent precious metals volatility means it’s only hit the lowest since Monday. Silver prices are also slumping and on track for their biggest drop since April.

The selloff reversed in Europe too, with the Stoxx 600 erasing an earlier loss as real estate and utilities shares outperformed, while chemicals and mining shares lagged after prices of gold and silver slumped due to the stronger dollar. Among individual movers in Europe, Eurofins Scientific SE dropped 9% after third-quarter results. Edenred SE jumped as much as 15%, the most on record, after the digital platform for services and payments reported better revenue growth for the third quarter. Assa Abloy AB gained as much as 3.4% after the Swedish lock and entrance systems group reported reassuring results. Here are the biggest movers Tuesday:

- Edenred shares rise as much as 15%, the biggest intraday spike on record, after the digital platform for services and payments reported better 3Q revenue growth than anticipated

- Bper Banca jumped as much as 8% to the highest in 18 years after the Italian lender signed derivative contracts for a synthetic exposure to its own shares equal to 9.99% of its share capital, according to a statement

- Getinge shares rise as much as 6.8%, to the highest in more than a year, after the Swedish health-care equipment firm reported better-than-expected earnings and sales for the third quarter

- Assa Abloy gains as much as 3.6% to a fresh high, after the Swedish lock and entrance systems group reported solid and reassuring results

- Segro shares rise as much as 3.9%, after the property investment and development company said occupier sentiment has improved, leading to the strongest quarter of pre-letting activity since early 202

- Var Energi shares jump as much as 4.6% after the oil and gas company delivered cashflow and adjusted earnings ahead of expectations, tempered by a miss at the bottom-line

- Eurofins Scientific shares fall as much as 10%, the most in a year, on continued softness of the French firm’s biopharma division

- Nordnet falls as much as 8.9%, the most since June 2023 after the Swedish retail trading platform and bank’s third-quarter report missed expectations and revealed a SEK18 million one-time cost related to an administrative error

- Tele2 shares fall as much as 6.7% after the Swedish telecom operator reported 3Q Ebitda that missed estimates, causing traders to take profits following a strong rally this year

- OVH Groupe shares slide as much as 19%, the biggest drop in 18 months, after the IT services firm issued growth guidance for fiscal year 2026 that analysts found underwhelming

Earlier in the session, Asian stocks hovered near record-high levels, led by an extended rally in Chinese equities on optimism over a trade deal with the US. The MSCI Asia Pacific Index was little changed after rising about 1% earlier. Alibaba and BHP Group were among the biggest boosts. The CSI 300 Index for mainland shares gained more than 1%. Japanese stocks were volatile and the yen dropped 0.5% after Sanae Takaichi won a parliamentary vote to become prime minister, opening the way for more fiscal spending. The benchmark Nikkei 225 had nearly hit 50,000 earlier Tuesday, Pictet Asset Management Japan Ltd. head of investment strategy Jumpei Tanaka said, adding that “some profit-taking likely emerged as a reaction to that earlier rally.” Chinese stocks extended their recent rally as anticipation grew over a potential deal ahead of President Donald Trump’s meeting with his counterpart Xi Jinping next week. Trump said said he expects the US to have a “really fair and really great trade deal” with China. Meanwhile, the Fourth Plenum underway in Beijing is being monitored for potential policy boosts. “I think investors feel good about the upcoming US-China trade resolution, against a backdrop of falling rates and structural AI demand growth,” said Vey-Sern Ling, senior equity adviser for Asia technology at Union Bancaire Privee. “There’s a lot to feel comfortable about and not many visible dark clouds on the horizon.”

In FX, the dollar is stronger and gaining against all G-10 peers. The yen is among the underperformers following the appointment of Japan’s new prime minister. The Swiss franc is not far from a decade-high versus the euro on haven flows.

In rates, treasuries are little changed, keeping yields within 1bp of Monday’s closing levels, amid similar price action in European bonds and recently active French-German spreads. The US curve is slightly flatter on the day. US stock index futures are little changed, holding Monday’s 1% advance following constituents’ quarterly results. US 10-year is near 3.97% after dipping as low as 3.96% overnight, underperforming. There’s small and mixed moves across European bond markets, with bund yields lower at the long-end and little changed at the short. Gilts are rallying at the long-end despite an overshoot on borrowing.

In commodities, oil prices fluctuate, with Brent sitting around $61/barrel. Gold slumps, with spot prices falling by $94 to $4,262/oz, though recent precious metals volatility means it’s only hit the lowest since Monday. Silver prices are also slumping and on track for their biggest drop since April.

The US economic calendar calendar includes October Philadelphia Fed non-manufacturing activity at 8:30am (-22.2, down from -12.3). Fed’s external communications blackout ahead of the Oct. 29 Fed policy decision began Saturday

Market Snapshot

- S&P 500 mini unch

- Nasdaq 100 mini -0.1%

- Russell 2000 mini -0.3%

- Stoxx Europe 600 little changed

- DAX -0.1%

- CAC 40 little changed

- 10-year Treasury yield -1 basis point at 3.97%

- VIX +0.5 points at 18.72

- Bloomberg Dollar Index +0.2% at 1211.97

- euro -0.2% at $1.1622

- WTI crude little changed at $57.57/barrel

Top Overnight News

- USTR Jamieson Greer warned China not to retaliate against foreign companies helping the US to develop critical industries after Beijing sanctioned the American units of South Korea’s Hanwha Ocean. BBG

- BoJ officials see no urgency to hike the benchmark rate next week. The officials believe conditions are coming together for a rate hike as soon as December, but there is no conclusive factor to raise the rate on Oct. 30. BBG

- US Director of Federal Housing Pulte said the Trump administration is opportunistically evaluating an offering for Freddie and Fannie, which could occur as early as the end of 2025.

- US Senate Democrats are launching an effort to repeal a portion of Republicans’ budget law that exempts certain “orphan drugs” from Medicare price negotiations: Axios

- Japan’s benchmark Nikkei Stock Average neared the 50,000 mark on Tuesday, as foreign investors bet on the expansionary policies of Sanae Takaichi, who received parliamentary approval the same day to become the country’s first female PM. Nikkei

- The longest-duration Japanese bonds are attracting relative-value hunters, suggesting there’ll be more flattening of the JGB curve, according to MLIV. BBG

- Small businesses urged the Supreme Court to affirm lower court rulings that Trump’s global tariffs amount to an illegal tax on American companies to the tune of $3 trillion. BBG

- The BOE has begun reaching out to financial institutions about conducting stress tests on the private credit market, people familiar said. BBG

- Republican leaders on Capitol Hill are quietly ramping up talks within their senior ranks and with White House officials over how to structure and advance a potential extension of key Affordable Care Act insurance subsidies before the end of the year. Politico

- The US Army asked Apollo, Carlyle, KKR and other PE firms to pitch financing models to help fund a $150 billion infrastructure overhaul. FT

- ZION Q3 earnings report: Core PPNR beat driven by slightly higher NII, while expenses came in below. Credit performance outside of the two identified credits was solid noting that ex these charge off NCOs would have been 4bps. Despite the elevated credit losses in the quarter, ZION noted it anticipates the credit losses are an isolated incident, with further review of the portfolio not showing any incremental credit issues. (H/T GS Fins Trading)

Trade/Tariffs

- US Trade Representative Greer said they will take action over Nicaragua’s labour rights policies and he proposed additional duties of up to 100% on Nicaragua following the conclusion of a Section 301 investigation, while he proposed to suspend all of Nicaragua’s benefits under the Central America-Dominican Republic Free Trade Agreement, either immediately or phased in over 12 months.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks took their cues from the rally on Wall Street as the focus remained on US-China trade with some optimism following US President Trump’s comments in which he stated that China has been respectful of them and although he continued to tout a November 1st deadline for additional tariffs, he also reaffirmed that he will be meeting with Chinese President Xi and thinks they will reach a ‘fantastic deal’. ASX 200 climbed to a fresh record high with the advances led by the mining and resources sectors after Australia and the US signed a critical minerals agreement, and with mining giant BHP gaining following its quarterly production update. Nikkei 225 rallied and briefly approached to near the 50k level before fading some of the gains, while attention was on the PM vote in parliament where Abe-protege Takaichi was elected to become Japan’s first female PM, and which is seen to potentially delay or slow the BoJ hiking rates. Hang Seng and Shanghai Comp were higher amid the hopes for an improvement in US-China trade relations and with the ongoing plenum where China is to map out its next five-year plan.

Top Asian News

- Japanese PM Takaichi to speak at 14:00BST.

- Japanese LDP leader Takaichi won the lower house vote (237 votes out of 465-seats) to become Japan’s first female PM, as expected. It was separately reported that Takaichi is to appoint Satsuki Katayama as Finance Minister and Kimi Onoda as Economic Security Minister, while she will appoint Ryosei Akazawa as Trade Minister and Shinjiro Koizumi as Defence Minister, according to FNN.

- Japan incoming Finance Minister Katayama says it is desirable for FX to move in a stable manner reflecting fundamentals; no comments at this moment when asked about BoJ hikes.

- Japan’s Finance Minister Katayama says he will continue with efforts to pass on prices and was asked to push forward tax credits with handouts.

- BoJ is said to be closer to rate hike, but with little need to rush and is said to see no urgency to hike rates next week, according to Bloomberg

European equities (STOXX 600 +0.2%) are mixed and have traded choppy throughout the European morning. A lack of fresh catalysts and quiet stock-specific newsflow has led to indecisive trade so far. European sectors are split down the middle, with no clear out/underperformer today. Real Estate benefits from the relatively lower yield environment, joined closely by Utilities whilst Chemicals lags a touch.

Top European News

- ECB’s Lane says monetary policy transmission is progressing smoothly; makes sense to maintain a meeting-by-meeting and data-dependent approach to assessing the strength of monetary transmission at any given point in time.

- UK reportedly explores private credit stress tests as risk worries grow, according to Bloomberg.

FX

- A firm day for the broader Dollar and index, with some suggesting the ease of credit market concerns, and reinforcement by solid Zions Bancorp earnings excluding the fraud losses. Newsflow has been relatively quiet today, whilst on the trade front there is little to update on since Monday, although US President Trump kept a conciliatory tone whilst maintaining the November 1st threat of 100% additional tariffs on China. DXY resides in a 98.50-98.89 range with clean air seen until the 99 psychological level.

- Subdued trade for the EUR in quiet newsflow with little action seen from ECB commentary as the clock ticks down to next week’s ECB confab, with pricing firmly at a hold (98.4% chance). That being said, analysts at ING posit “not all the Governing Council may be entirely comfortable with an even stronger euro, even if direct comments on FX have been rather rare of late.” EUR/USD falls further under its 100 DMA (1.1653) and trades in a current 1.1614-1.1655 parameter.

- USD/JPY holds a firmer bias and moved back to the 151.00 territory amid the fresh record highs in Tokyo stocks, with focus on the parliamentary vote in which LDP leader Takaichi won to become Japan’s first female Prime Minister; source reports that the BoJ have no urgency to hike next week will also be weighing on the JPY. Japan’s incoming Finance Minister Katayama echoed the outgoing Finance Minister Kato, and said it is desirable for FX to move in a stable manner reflecting fundamentals; no comments at this moment when asked about BoJ hikes. USD/JPY resides in and at the upper end of a 150.47-151.77 range with the next upside level at the 151.87 mark.

- Cable marginally softened and breached the 1.3400 level to the downside in the absence of any UK-specific catalysts. Though, action has seemingly been influenced by broader action in the USD in recent trade. The latest PSNB metrics printed shy of expectations, but above the OBR’s own view from March; While elevated yields continued to push the borrowing figure higher, that narrative has improved from a Treasury perspective since October 10th. GBP/USD resides in a 1.3372-1.3416 range, with clean air seen until the Oct 15th low at 1.3315.

- CAD is softer amid USD strength at the time of writing, although Loonie traders look ahead to CPI from the country. The headline is seen unchanged M/M (prev. -0.1%), while the annual rate is seen rising to 2.3% Y/Y from 1.9%. This is the last inflation report before the October BoC meeting.

- Antipodeans are the G10 laggards amid the cautious risk tone after failing to benefit from the positive risk appetite overnight. NZD/USD is the laggard after slightly softer exports and credit card spending data overnight.

Fixed Income

- USTs are firmer, moving directionally in-fitting with peers as outlined above. Thus far, to a 113-24 peak but with upside of just a handful of ticks at most. Ahead, the US docket is focused on several pertinent earnings releases and comments from Fed’s Waller; however, the blackout period is in force ahead of the October policy decision.

- A contained start to the day, with Bunds initially firmer but only by a handful of ticks in a quiet early morning where newsflow was dominated by stock specifics and events in Japan. Since, benchmarks generally but initially OATs derived a bid from a Bloomberg article that BlackRock (BLK) and State Street (STT) have recently stopped using indexes with AA rating criteria as the benchmark, according to sources. Meaning that the firms will continue to be able to hold French debt even after the downgrade by S&P on Friday. This lifted OATs to a 123.29 peak for the season with gains of 17 ticks at most. No reaction to remarks from ECB’s Lane this morning. A speech/text that had some interesting points, but ultimately stuck to familiar lines on EZ monetary policy. Ahead, Lagarde and Nagel are scheduled with a text expected from the President.

- Gilts are firmer today. The morning’s PSNB data showed a slightly lower borrowing figure than expected, though a touch above the OBR’s view from March, while the prior was subject to a revision lower. For the FY to September 2025, borrowing stood at GBP 99.8bln vs the GBP 92.6bln forecast by the OBR in March. Modest outperformance in Gilts this morning, seemingly a function of the slightly better than expected borrowing view. To a 92.92 peak with gains of 25 ticks at most. If the move continues, resistance from last week factors at 93.02 and 93.17. Ahead, BoE’s Bailey and Breeden appear before the House of Lords; however, as they are discussing reform since 2008, it remains to be seen whether the remarks will factor into the discussion around current policy.

- JGBs are stronger overnight as markets awaited the parliamentary votes on the next Japanese PM and also acknowledged stronger demand at the latest climate-related auction.

- Orders for Italy’s new 7 year BTP Valore bond reach EUR 6bln since the start of the offer.

- BlackRock (BLK) and State Street (STT) have recently stopped using indexes with AA rating criteria as the benchmark, via Bloomberg citing sources; this will allow exposure to French debt to be maintained.

- UK sells GBP 1.5bln 1.5% 2053 Green Gilt: b/c 3.17x (prev. 3.2x), average yield 5.294% (prev. 5.169%), tail 0.8bps (prev. 0.8bps).

- Germany sells EUR 0.733bln vs exp. EUR 0.75bln 1.30% 2027 Green Bobl and EUR 0.718bln vs exp. EUR 0.75bln 2.50% 2035 Green Bund.

Commodities

- Crude is currently trading around the unchanged mark, and very much off worst levels, after a recent (albeit fleeting) pick-up in prices. Nothing really driving things at the moment for the complex, as Middle Eastern geopols take a backseat. More focus on Russia-Ukraine, after it was reported that President Trump’s plans for a quick meeting with Russian President Putin may be stalled. Brent Dec’25 currently trading towards the upper end of a USD 60.58-61.20/bbl range.

- Precious metals have been falling as the European session got underway, with spot XAU easing from USD 4,375/oz to a trough of USD 4,244/oz after the yellow metal formed a new ATH late in Monday’s session. XAG has slipped back below USD 50/oz as the precious metal space comes under pressure, but is currently off worst levels.

- Base metals are slowly falling lower despite a lack of newsflow as markets await the meeting between US Treasury Secretary Bessent and Chinese Vice Premier He Lifeng. 3M LME Copper peaked at USD 10.73k/t before falling through Monday’s range and forming a low at USD 10.63k/t.

- UBS expects oil prices to stabilise around current levels, though prices may come under some pressure should trade tensions escalate further.

- MMG (1208 HK) says Las Bambas is now expected to achieve copper production of 400k tonnes in 2025 (vs prior guidance of 360k-400k tonnes)

Geopolitics

- US President Trump’s hopes for a quick meeting with Russian President Putin may be stalled, while the anticipated meeting between US Secretary of State Rubio and Russian Foreign Minister Lavrov has been put on hold, according to according to CNN citing a White House official.

- Russian Foreign Ministry, on the meeting between Russian Foreign Minister Lavrov and US Secretary of State Rubio being postponed, says you cannot postpone what was never agreed upon, says the meeting requires preparation.

- Russia’s Kremlin says neither US President Trump or Russian President Putin named exact date on the Putin-Trump summit timing. Says they cannot postpone what wasn’t scheduled. Both the USA and Russia said that careful preparation was needed which requires time. Peace with Ukraine is not easy.

- Russia’s Foreign Minister Lavrov has agreed with US Secretary of State Rubio to continue with phone contact, Russia hasn’t change its position since Anchorage, a halt at current frontline means to forget war causes.

US Event Calendar

- 8:30am Philly Fed non-mfg Activity

- Fed’s External Communications Blackout (October 18 – October 30)

DB’s Jim Reid concludes the overnight wrap

Markets got the week off to a strong start yesterday, with the S&P 500 (+1.07%) closing within 0.3% of its all-time high, whilst 30yr Treasury yields (-3.6bps) hit a 6-month low of 4.57%. The main catalyst was positive news on the trade side, coupled with signals that the US government shutdown might come to an end soon. Moreover, Brent crude oil prices (-0.46%) hit a 5-month low of $61.01/bbl, which helped to ease concerns about inflation too. So collectively, all those forces served to boost investor optimism, and managed to outweigh any lingering concerns about the regional banks.

In terms of the trade story, we’re now just over 10 days away from President Trump’s deadline to put additional 100% tariffs on China from November 1. But there were increasingly positive headlines that have led investors to expect that the higher tariffs will be avoided. Indeed, President Trump himself said to reporters in the Oval Office that “I think when we finish our meetings in South Korea, China and I will have a really fair and really great trade deal together.” And earlier in the day, NEC Director Kevin Hasset said on CNBC that “Our expectation is that Secretary Bessent is going to land this plane”, when it comes to the China trade negotiations. So that’s led markets to anticipate that some kind of truce will remain in place, and trade-sensitive stocks have continued to recover. Indeed, the Philadelphia semiconductor index (+1.58%) hit a new record yesterday. And if we look at Polymarket, it currently points to just a 10% likelihood that the 100% China tariffs will come into effect by November 1.

Meanwhile on the shutdown, there were also growing hopes for an earlier resolution. That was caused by comments from Kevin Hasset that the shutdown was “likely to end sometime this week”, and there was a clear shift in the Polymarket odds after those comments. For example, when we went to press yesterday, it still suggested there was a 45% likelihood that the shutdown would last beyond November 16, but those have since fallen to 29%. And overall, there is a 49% cumulative likelihood priced in that there will be a resolution by November 3rd. So, there’s been a clear shift in that probability distribution towards an earlier end to the shutdown, which has added to hopes that the regular flow of US data might resume soon. Bear in mind that today is day 21 of the shutdown, which now makes this the joint second-longest along with the 1995-96 shutdown, only behind the most recent 35-day shutdown in 2018-19.

Another positive catalyst came from the regional banks, as Zions Bancorp reported its earnings after the US close last night. Remember that its share price had fallen -13.1% last Thursday after it said it was exposed to alleged fraud, so there’d been a lot of jitters. But altogether, the results were largely positive, and its profits beat estimates despite a $56mn write-down of bad loans in Q3, including $50mn in alleged fraud tied to a CRE investor group. Since Thursday, its share price has recovered +10.7% in the last two sessions (+4.65% yesterday), and its share price rose roughly +3% in after-market trading as well following the results. Remember that we’ve got Western Alliance Bancorp reporting earnings after today’s close as well, but its shares also got a boost after-hours thanks to the positive sentiment from the Zion earnings call.

Ahead of that result, equities had already put in a strong performance on both sides of the Atlantic. The S&P 500 (+1.07%) continued its recovery, with the Magnificent 7 (+1.44%) leading the way, including a very strong performance for Apple (+3.94%) as it hit a new record. The S&P finished just off the highs of the day, and just less than -0.3% beneath its all-time high. Bank stocks also continued to pare back their losses from last Thursday, with the KBW Bank Index (+2.19%) and the KBW Regional Banking Index (+2.27%) both advancing. Meanwhile in Europe, the STOXX 600 (+1.03%) closed less than half a percent beneath its own record a couple of weeks ago, with very strong gains for the DAX (+1.80%) and the FTSE MIB (+1.52%). So it was a strong day all round, and futures this morning remain positive, with those on the S&P 500 (+0.05%) and the DAX (+0.19%) both advancing.

Whilst equities saw consistent gains, the picture for sovereign bonds was far more mixed. The US Treasury curve flattened, with a muted move on the front-end. So 2yr yields (-0.2bps) closed very marginally lower at 3.46%, while longer-dated yields fell back further, with the 10yr yield (-2.9bps) falling back beneath 4% to 3.98%, whilst the 30yr yield (-3.6bps) hit a 6-month low of 4.57%. Meanwhile in Europe, French OATs initially underperformed as they reacted to the S&P credit rating downgrade on Friday, with their 10yr yields up +3.5bps in early trading before rallying though the day to ultimately close nearly unchanged (+0.2bps). This was just worse than the -0.3bps drop in German 10yr bund yields. So the Franco-German 10yr spread was ultimately little changed at 78bps as well.

Overnight in Asia, that equity advance has continued, supported by growing investor optimism on US-China trade. Indeed, both Japan’s Nikkei (+0.71%) and South Korea’s KOSPI (+0.19%) are at record highs this morning. And in mainland China, both the CSI 300 (+1.53%) and the Shanghai Comp (+1.20%) have posted even bigger gains this morning.

Lastly, gold prices (+2.46%) closed at another record high yesterday of $4,356/oz, leaving its YTD gains at +66%. So it remains on track for its strongest annual gain since 1979, when it rose +127% as inflation surged after the oil crisis that year. Indeed, the strongest year in the interim was a +31% gain in 2007, and it’s already risen by more than double that this year. Meanwhile, silver prices (+1.02%) closed at $52.45/oz, just shy of last week’s levels, taking its own YTD gains to +81%, the strongest since an +83% annual increase in 2010.

To the day ahead now, and data releases include the UK public finances for September, and Canada’s CPI for September. Central bank speakers include ECB President Lagarde, and the ECB’s Lane, Escriva, Kocher and Nagel. Lastly, today’s earnings releases include Western Alliance Bancorp, Netflix, General Electric, Coca-Cola and General Motors.

Loading recommendations…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.