Futures Rise On Easing Trump-Musk Spat As Payrolls Loom

S&P 500 futures rose 0.4% as Tesla shares rebounded 4% in premarket on signs that the spat between President Donald Trump and Elon Musk is cooling. Market gains had little conviction as traders brace for Friday’s main event: a pivotal payrolls report (full preview here) that’s likely to set the direction of travel for markets. Nasdaq futures also add 0.5% even as Broadcom shares fall 3% in premarket after giving a a lackluster revenue forecast for the current quarter. European stocks are little changed. Bond yields are 1-2bp lower; the USD is higher; the yen dropped after BBG reported that Bank of Japan officials are likely to discuss slowing their pullback from buying government bonds at a policy meeting later this month. Commodities are mostly higher: Gold climbs $6 to around $3,358/oz while silver tops $36/oz. WTI falls 0.6% to $63 a barrel. Bitcoin rises 3%. Macro headlines were largely muted overnight; All eyes on NFP today.

In premarket trading, Mag7 stocks are higher, led by Tesla, whose shares are set to rebound, rising 4.9% premarket, after plunging on Thursday as the feud between Elon Musk and President Donald Trump showed signs of de-escalation (Amazon +1%, Meta +0.8%, Apple +0.6%, Alphabet +0.6%, Nvidia +0.5%, Microsoft +0.4%).

- Broadcom (AVGO) dropped 3% after the company gave a lackluster revenue forecast for the current quarter, suggesting that the AI spending frenzy isn’t as strong as some investors anticipated. Lululemon added to the gloom after its latest earnings report highlighted the risk posed by new tariffs and exacerbated concerns about slowing growth.

- Docusign (DOCU) shares are down 18% after the e-signature software company gave a second-quarter billings outlook that is weaker than expected.

- Lululemon (LULU) shares plunge 21% after the upscale athletic clothing company cut its earnings per share forecast for the full year.

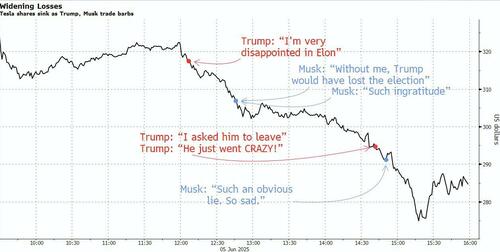

Markets are still reveberating from the spat between Trump and Musk in which Trump proposed cutting off the billionaire’s government contracts. Musk, who sparked the public feud by criticizing Trump’s signature tax bill, later signaled that he’s keen to dial down the hostility. White House aides have reportedly scheduled a call with the world’s richest person for Friday in an effort to cool things down. Their public back-and-forth triggered the most spectacular real-time destruction of wealth ever, with $34 billion erased from Musk’s net worth. Tesla shares are rebounding in premarket, after tanking 14% Thursday.

“Futures are edging higher, perhaps as Musk has started to suggest on X that he would be open to a cooling-off period in his war of words with the President,” said Jim Reid, global head of macro research and thematic strategy at Deutsche Bank AG.

Moves in other asset clases were more muted as traders awaited Friday’s nonfarm payrolls report for fresh insight on how the Trump administration’s trade war is affecting the economy. Turning to today’s main event, economists see payrolls rising by 125,000 after job growth in March and April exceeded projections. The unemployment rate is seen holding at 4.2%. Weak payrolls data would be bad news for markets, with a big miss potentially sending stocks down 1.5%, according to Goldman Sachs traders (full preview here). A softening labor market would support expectations that the Federal Reserve will cut interest rates at least twice this year.

“Investors are getting used to all the noise and are looking at concrete matters like the jobs report or budget,” said Mabrouk Chetouane, head of global market strategy at Natixis Investment Managers. “There is a cooling trend in the labor market, which I expect will show this afternoon. That should further reinforce our call for two or three cuts from the Fed this year.”

Meanwhile, BofA’s Michael Hartnett is warning that global stocks are close to triggering sell signals as both fund inflows and market breadth are running too hot. The strategist said inflows to stocks and high-yield bonds have totaled 0.9% of AUM in the past four weeks. The sell signal will be set off if that exceeds 1%.

European equities are little changed as investors search for fresh catalysts on trade negotiations between the US and China and look ahead to a key US jobs report. The real estate and health care sectors outperform, while consumer shares are among the biggest laggards. Among individual movers, Adidas and Puma fall after Lululemon’s disappointing quarter fueled concerns over rising competition and tariffs. Here are the biggest European movers:

- Chemring gains for an 18th straight day, rising as much as 5.1% following an upgrade to buy at Berenberg which gives the UK defense firm a clean sweep of positive analyst ratings

- Galderma shares gain as much as 3.3%, to the highest level since February after Kepler Cheuvreux initiated coverage of the Swiss pure play dermatology group with a recommendation of buy and a new street high price target.

- Demant shares jump as much as 6.7% as the stock trades for the first time since being upgraded to buy at Citi.

- Huber + Suhner shares rise as much as 4.6% after Berenberg said the Swiss electrical products manufacturer is especially well-positioned for growth as it started coverage with a buy rating.

- Canal+ rises as much as 8.1%, reaching highest since mid December, after the media and entertainment company confirmed its full-year expectations and said it has reached an agreement with France’s cinema agency to settle a tax dispute.

- Recordati shares gain as much as 3.4% to a three-month high after JPMorgan lifted its price target on the stock, saying the Italian pharmaceutical company’s growth outlook is “strong and sustainable,” even before more M&A activity.

- Norwegian salmon stocks gaining after a broad cross-party agreement to delay any sweeping changes to the licensing system for several years, according to a statement from the parties after markets closed on Thursday.

- European athleisure stocks fall as US-listed Lululemon posted a second straight disappointing quarter, fueling concerns around the impact of rising competition and new tariffs.

- Allegro shares drop after two of its major holders — investment vehicles of Cinven and Permira Holdings, sold a 5.2% stake in the company.

- PostNL falls as much as 12.5% as Kepler Cheuvreux analyst Marc Zeck downgraded his recommendation from hold to reduce.

- Dassault Systemes shares decline as much as 2.5% after the company said it aims to double its non-IFRS diluted EPS by 2029, pushing out a more ambitious 2028 goal.

- Polish banking stocks fall after Szymon Holownia, the leader of junior coalition party Polska 2050, told Polsat News that he wants to include a windfall tax on lenders into a renegotiated coalition agreement.

Earlier in the session, Asian stocks traded in a tight range as a much-anticipated call between Donald Trump and China’s Xi Jinping offered little details on how trade negotiations would progress. The MSCI Asia Pacific Index was little changed. Indian stocks rose after the central bank cut interest rates more than projected and unexpectedly reduced the cash reserve ratio for banks. Gauges in Hong Kong fell, while those in Japan rebounded. Markets in Indonesia, Philippines and South Korea were closed for holidays.

In rates, treasuries edge higher ahead of the jobs report, with US 10-year yields falling nearly 2 bps to 3.37%. Bunds outperform their US peers, pushing German 10-year borrowing costs down 5 bps to 2.54%.

In FX, the Bloomberg Dollar Spot Index rises 0.2%. The Japanese yen and Swedish krona are the weakest G-10 currencies, falling 0.4% each. The euro dips 0.3% with little reaction seen after euro-area GDP was revised up for the first quarter. ECB policymakers largely stuck to Thursday’s messaging after they cut rates by a quarter point. USDJPY rose 0.4% to 144.08 after BBG reported that Bank of Japan officials are likely to discuss slowing their pullback from buying government bonds at a policy meeting later this month.

In commodities, gold climbs $6 to around $3,360/oz while silver tops $36/oz. WTI falls 0.6% to $63 a barrel. Bitcoin rises 3%.

Looking at today’s calendar, the payrolls numbers are due at 8:30 a.m., while consumer credit data is due later in the day. The Fed’s Bowman is scheduled to give a speech on supervision and regulation.

Market Snapshot

- S&P 500 mini +0.5%

- Nasdaq 100 mini +0.5%

- Russell 2000 mini +0.6%

- Stoxx Europe 600 little changed

- DAX -0.2%, CAC 40 little changed

- 10-year Treasury yield -1 basis point at 4.38%

- VIX -0.3 points at 18.18

- Bloomberg Dollar Index +0.2% at 1210.26

- euro -0.3% at $1.1413

- WTI crude -0.5% at $63.03/barrel

Top Overnight News

- Elon Musk signaled he would move to cool tensions with US President Donald Trump, after differences between the two exploded Thursday into an all-out public feud.

- White House aides scheduled a call with Elon Musk today to take down the temperature after a public feud erupted with Donald Trump. Musk signaled he’s open to cooling tensions. Premarket, Tesla shares (+4.3%) pared some of yesterday’s plunge. Musk also backed off on a threat to decommission SpaceX’s Dragon spacecraft. BBG

- In the midst of the trade war and administration efforts to disentangle the U.S. and Chinese economies, US pharma companies have simultaneously supercharged their interest in China-based biotechs, announcing what are likely to be the biggest deals ever for the rights to experimental medicines invented by Chinese companies. Barron’s

- The US Treasury called on the BOJ to raise rates to strengthen the yen, making a remarkable policy recommendation in its semiannual currency report. Japan’s finance ministry said it doesn’t comment on the views of a foreign government. BBG

- Expectations in the market are intensifying that the Japanese government may adjust debt issuance as soon as next month by increasing sales of shorter maturity securities and trimming offerings of longer-dated ones to prevent a further rise in yields. BBG

- The European Central Bank is approaching the end of its interest-rate cuts, according to two Governing Council members, as others declared inflation has been vanquished.

- The Reserve Bank of India cut its key policy rate on Friday by an unexpectedly sharp 50 bps to 5.5%, its lowest level in nearly three years, as tepid inflation allowed the bank to focus on spurring economic growth. Nikkei

- Iran orders thousands of tons of ballistic missile material from China as Tehran looks to rebuild its arsenal and provide more weapons to proxies in the Middle East. WSJ

- We estimate nonfarm payrolls rose by 110k in May, below consensus of 125k and the three-month average of +155k. On the positive side, big data indicators suggested a healthy pace of job creation. On the negative side, trade policy uncertainty was very high across the survey period and we expect another 10k decline in federal government payrolls from workforce reductions. GIR

- The ECB is approaching the end of its interest-rate cycle, Madis Muller said. Fellow Governing Council member Yannis Stournaras told BTV that the bank should take a break to give officials a chance to assess recent shocks. BBG

- Trump told Senate Republicans he’s open to a SALT cap below the $40,000 in the House-passed tax bill. BBG

Tariffs/Trade

- German Chancellor Merz said Europe is looking for more independence from China and tariffs are having a “terrible” impact on German automakers, while the Chancellery and White House agreed to even closer cooperation on trade talks, according to CNN. Merz also commented that US tariffs are threatening our economy and we are looking for ways to bring them down, according to a Fox News interview. German Chancellor Merz said this US admin is open for discussions, and hearing other opinions; no doubts US will stick with NATO

- Canadian PM Carney spoke with Chinese Premier Li Qiang and exchanged views on bilateral relations, while they emphasised the importance of engagement and both leaders agreed to regularise communication channels between Canada and China. Furthermore, they also discussed trade between the two nations and Carney’s office stated that both governments committed to collaborating on addressing the fentanyl crisis.

- Chinese Premier Li held talks with Canadian PM Carney, according to Xinhua; China willing to safeguard multilaterals and free trade with Canada. There is ‘great potential’ for cooperation between China & Canada. Both should strengthen cooperation in clean energy, climate change, and innovation.

- Japan’s government said trade negotiator Akazawa met with US Commerce Secretary Lutnick and Akazawa strongly sought a review of US tariffs, while they discussed non-tariff barriers and trade expansion.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the subdued handover from the US where a stunning online bust-up between US President Trump and Elon Musk overshadowed the recent call between President Trump and Chinese President Xi in which the leaders agreed to start a new round of talks ASAP. ASX 200 saw two-way, rangebound trade as outperformance in the energy and utilities sectors was counterbalanced by losses in gold miners and the top-weighted financial industry, while a lack of pertinent data releases also contributed to the uneventful picture. Nikkei 225 gained with the index supported by recent currency weakness although further upside was capped following disappointing Household Spending data which showed a steeper-than-feared M/M decline and a surprise Y/Y contraction. Hang Seng and Shanghai Comp were indecisive despite the recent phone call between US President Trump and Chinese President Xi which the White House had been touting throughout the week, while Xi reiterated calls for the US to handle the Taiwan issue with caution.

Top Asian News

- RBI cut the Repurchase Rate by 50bps to 5.50% (exp. 25bps cut) and changed its stance to neutral from accommodative, while it cut the Standing Deposit Facility Rate and Marginal Standing Facility Rate by 50bps each to 5.25% and 5.75%, respectively. RBI Governor Malhotra said growth remains lower than aspirations and it is important to stimulate growth, as well as noted that front-loading rate cuts to support growth was felt necessary. Malhotra also stated that inflation has softened significantly over the last six months and inflation is likely to undershoot the full-year target at the margin, while he noted that monetary policy has limited space left to support growth and they retained the FY26 Real GDP growth forecast at 6.5%. Furthermore, the RBI Governor announced to cut the Cash Reserve Ratio by 100bps in four equal tranches, which will release INR 2.5tln, as well as noted that they will continue to monitor and take measures as necessary and that the CRR cut is to reduce the cost of funding of banks and help accelerate policy transmission.

- PBoC set USD/CNY mid-point at 7.1845 vs exp. 7.1935 (Prev. 7.1865).

- Japan’s former top FX diplomat says narrowing US-Japan rate gap will likely support the yen at around 135-140 against USD by year-end.

European bourses – Flat/lower trade across Europe following the fallout of the dramatic Trump-Musk spat, but with traders setting their sights on the US jobs report due 13:30 BST/08:30 EDT. On the week, futures of the broad Stoxx 600 and Euro Stoxx 50 indices are currently poised for a second week of gains, though not by much at this stage, and will depend on how the aforementioned data comes in. European sectors – Sectors display a mixed picture with the breadth of the market also narrow, with no real bias. Top gainers at the time of writing include Health Care (+0.6%), Energy (+0.5%), and Retail (+0.3%); losers include Basic Resources (-0.9%), Industrial Goods and Services (-0.4%), and Media (-0.3%). European movers – HSBC (+0.3%) chairman Mark Tucker will step down on September 30th. Adidas (-1.3%), JD Sports (-0.5%), and Puma (-1.6%) are all slipping after US apparel maker Lululemon (LULU) saw its shares tumble by over 20% in extended trading. Airbus (-0.9%) confirmed that it delivered 51 jets in May (-4% Y/Y),

Top European News

- UK government unveiled new concessions to private equity firms regarding its tax break crackdown in which it proposed changes to tax treatment of carried interest that will make the regime less onerous, according to FT.

- ECB’s Holzmann says “I dissented” at the rate decision on Thursday (as expected)Lowering rates at a time of high savings and low investments ha no effect except a monetary effectCurrently expansive in monetary policyLagarde said we are at the end of the cycle, wanted to discuss whether that is the caseCurrent nominal neutral rate is around 3%

- ECB’s Muller said ECB can be happy with inflation where it is; and he agrees with ECB President Lagarde that cycle almost finished. Hard to say what’s coming next on rates.

- ECB’s Villeroy said the ECB has won the battle against inflation in Europe, and we will not again see the low rates we saw a few years ago, and added that French inflation is now under control but debt remains a serious issue, “France cannot continue like this”, according to Bloomberg.

- ECB’s Simkus said interest rates are now at neutral; its important to keep full flexibility, according to Reuters. Stournaras said the best thing for the ECB is to wait and see, ECB rate cutting is nearly done, ECB has achieved a soft landing, and ECB may cut if the economy weakens and inflation falls. Stournaras noted of downside risks to growth, and the bank is “quite” confident in its forecasts, and said he’s afraid the Dollar may lose some of its status.

- Bundesbank semi-annual report: German recovery delayed further; economy to tread water in 2025; German GDP to stagnate in 2025, grow by 0.7% in 2026. Increased defence, infrastructure spending to significantly increase growth by the end of 2027. German exports will decline significantly in 2025, increase only slightly next year.

- Italian Stats Bureau ISTAT cut Italy’s 2025 GDP growth to 0.6% from 0.8% forecast in December.

- SNB noted that it does not engage in any manipulation of the CHF; does not seek to prevent adjustments in the balance of trade or to gain unfair competitive advantages for the Swiss economy. In addition, the use of FX market interventions may be necessary under certain circumstances to ensure appropriate monetary conditions. SNB monetary policy is geared towards the needs of Switzerland.

FX

- USD – USD is slightly firmer in what has ultimately been a week of losses for DXY. Attention now is firmly fixated on today’s NFP report which is set to see payroll growth slow to 130k from 177k and unemployment rate hold steady @ 4.2%. As it stands, the next 25bps cut is not fully priced until September with 54bps of loosening seen by year-end. DXY is towards the top end of yesterday’s 98.35-98.94 range.

- EUR – EUR is trivially softer vs. the USD after gaining yesterday on account of the ECB rate decision which saw policymakers pull the trigger on a 25bps rate cut, whilst noting that policy is “well-positioned”; suggesting that the ECB could be nearing or at the end of its cutting cycle. ECB speak this morning hasn’t shifted the dial with policymakers signalling flexibility going forward, whilst acknowledging progress on inflation. EUR/USD is contained within yesterday’s 1.1404-1.1495 range.

- JPY – JPY is the laggard across the majors following disappointing Household Spending data. Subsequently, USD/JPY briefly made its way back onto a 144 handle with a current session peak @ 144.13, stopping shy of the WTD high @ 144.39. On the trade front, Japan’s government said trade negotiator Akazawa met with US Commerce Secretary Lutnick and Akazawa strongly sought a review of US tariffs. Elsewhere, Japan’s former top FX diplomat says narrowing US-Japan rate gap will likely support the yen at around 135-140 against USD by year-end.

- GBP – GBP is softer vs. the broadly firmer USD with UK-specific newsflow on the light side ahead of next week’s UK spending review. On which, UK Chancellor Reeves reaffirmed she will not have a UK budget like October’s again, but can’t rule out any tax changes over the next four years. For today’s agenda, BoE Chief Economist Pill is due to speak @ 13:00BST, but given the subject matter of “AI and Households”, it is unclear how much he will touch on monetary policy. After printing a multi-year high yesterday @ 1.3616, Cable has since retreated and moved back below the 1.3550 mark.

- Antipodeans – Antipodeans are steady vs. the USD following a light data docket and relevant newsflow overnight. Both continue to keep an eye on US-Sino relations following the Xi-Trump call yesterday given their trade exposure. However, the readout had little follow-through into either currency. AUD/USD has moved back onto a 0.64 handle and pulled back from yesterday’s YTD peak @ 0.6538. NZD/USD has also retreated from yesterday’s YTD high @ 0.6080 but is still holding above the 0.60 mark.

- NBP’s Litwiniuk said they need to be cautious regarding the disinflation path; MPC can return to the subject of cuts in July or September; rates can still be cut by 100-125bps this year.

Treasuries

- USTs – USTs are a touch higher ahead of the US jobs report and following yesterday’s ECB-led losses which outmuscled a spike higher in weekly claims metrics. As it stands, the next 25bps cut is not fully priced until September with 54bps of loosening seen by year-end. Sep’25 USTs are currently within yesterday’s 110.23+ to 111.14+ range. From a yield perspective, the US curve is fractionally in bull flattening mode, whilst the 10yr yield has moved back to the 4.37% after venturing as low as 4.318% yesterday.

- Bunds – Bunds are attempting to atone for yesterday’s losses which were seen in the wake of the ECB rate decision. Sep’25 Bunds have been as high as 130.72 but are still some way away from yesterday’s peak @ 131.47. The 10yr yield is back below the 2.55% mark after climbing as high as 2.581% yesterday.

- Gilts – Gilts are currently being led by the upside in German paper as UK-specific newsflow remains light ahead of next week’s UK spending review. Sep’25 Gilts have been as high as 92.31 but still have some ground to cover before approaching yesterday’s best @ 92.63. The 10yr yield currently sits just above the 4.6% mark and within yesterday’s 4.557-4.648% range.

Commodities

- Crude Futures – Subdued trade amid a firmer Dollar and overall cautious risk tone heading into the US jobs report before the weekend. Contracts saw a leg lower likely on technicals as WTI dipped under USD 63.00/bbl at the same time as Brent fell under USD 65.00/bbl, although prices thereafter stabilised. News flow has been light for the complex, with nothing major to report in geopolitics either.

- Precious Metals – Spot gold and silver are largely treading water amid a lack of catalysts during the European morning in the run-up to the US jobs report. Spot gold currently resides in a current USD 3,351.49-3,375.29/oz range, well within yesterday’s USD 3,338.29-3,403.15/oz parameter.

- Base Metals – Mixed trade across base metals, in fitting with the cautious risk tone ahead of the US jobs report, with the Trump-Xi phone call doing little to keep broader prices underpinned during this session. 3M LME copper dipped back under USD 9,700/t to trade in a USD 9,659.00-9,768.00/t range at the time of writing. Dalian iron ore futures rose to a one-week peak overnight with traders citing strong Chinese demand coupled with some optimism following the Trump-Xi call, with the front-month contract ending daytime trade +0.9%.

- HSBC expects OPEC+ to accelerate supply hikes in August and September; weaker fundamentals after the summer, raise downside risks to the Bank’s USD 65/bbl brent forecast from Q425.

- LME has intervened to make Mercuria roll its “huge” position in aluminium, according to Bloomberg.

- India’s Mines Minister said exploring critical mineral assets in Australia, Argentina and Chile.

- EU Ags Commissioner said EU-Ukraine trade has reverted to conditions of pre-war trade deal, after the expiry of wartime exemptions; could conclude a longer-term trade arrangement by summer. New EU-Ukraine trade arrangement will be in between the quotas under pre-war trade deal and war-time exemptions

Geopolitics: Middle East

- Israel assured the US it won’t strike Iran unless talks fail, according to Axios.

- Iran is said to have ordered material from China that could make hundreds of ballistic missiles, according to Wall Street Journal.

- “Lebanese Army: Israel’s continued violation of the agreement may push us to freeze cooperation with the monitoring committee regarding site inspection”, via Al Hadath.

Geopolitics: Ukraine

- Ukraine said Russia launched a drone and missile attack with explosions and air defence activity heard over Kyiv.

- Russian Deputy Minister of Foreign Affairs Ryabkov said returning to the arms control agreement with the US is becoming less and less realistic amid the US’ Golden Dome project.

- EU is weighing adding Russia to its money laundering ‘grey list’, according to FT.

- French Minister for Europe and Foreign Affairs hopes the European Commission will put new Russian sanctions package before the end of June, according to Reuters.

US Event Calendar

- 8:30 am: May Change in Nonfarm Payrolls, est. 126k, prior 177k

- 8:30 am: May Change in Private Payrolls, est. 120k, prior 167k

- 8:30 am: May Change in Manufact. Payrolls, est. -4.5k, prior -1k

- 8:30 am: May Unemployment Rate, est. 4.2%, prior 4.2%

- 8:30 am: May Average Hourly Earnings MoM, est. 0.3%, prior 0.2%

- 8:30 am: May Average Hourly Earnings YoY, est. 3.7%, prior 3.8%

- 3:00 pm: Apr Consumer Credit, est. 10b, prior 10.17b

Central Banks

- 10:00 am: Fed’s Bowman Gives Speech on Supervision, Regulation

DB’s Jim Reid concludes the overnight wrap

Markets had a volatile session yesterday, as they grappled with a barrage of news that each pushed in different directions. Those included positive US-China headlines amid a call between Trump and Xi, a hawkish ECB decision and more weak data from the US. But the most remarkable was an extraordinary war of words between Trump and Elon Musk that ultimately left risks assets losing ground. Tesla’s shares plunged by -14.26%, while the S&P 500 fell -0.53% despite earlier briefly moving into technical bull market territory as it climbed just over +20% since its recent low on April 8.

The dramatic feud between the US President and the world’s richest man emerged after Trump said during a meeting with Germany’s chancellor Merz that he was “disappointed” and “surprised” in Musk’s recent criticism of the Republicans’ budget bill, with Musk responding on X by suggesting that Trump would have lost the election without his support. The war of words then escalated on social media, with Trump posting that “The easiest way to save money in our Budget, Billions and Billions of Dollars, is to terminate Elon’s Governmental Subsidies and Contracts”, while Musk posted that Trump’s tariffs “will cause a recession in the second half of this year” and responded “yes” to a suggestion that Trump should be impeached.

Following the Trump-Musk spat, Tesla’s shares slumped -14.26%, which together with a -3.55% decline on Wednesday marked its worst two-day decline (-17.30%) since 2020. The feud also weighed on US risk assets more broadly, with the S&P 500 (-0.53%) seeing ten of its eleven sector groups move lower on the day. Meanwhile, the VIX volatility index rose +0.87pts to 18.48, having been earlier on course to fall to its lowest level since late March. The tech mood has stayed subdued overnight as Broadcom’s results delivered a lackluster revenue forecast. The chipmaker, which is now the 7th largest company in the S&P 500 and around $300bn of market cap ahead of Tesla, saw its shares slide by more than -4% after-hours. However S&P 500 (+0.25%) and NASDAQ 100 (+0.14%) futures are edging higher, perhaps as Musk has started to suggest on X that he would be open to a cooling-off period in his war of words with the President.

Earlier on in the session we had seen a clear risk-on move on both sides of the Atlantic as a surprise Trump-Xi call raised the prospect of fresh US-China talks, leading to growing optimism that trade tensions would ease. The news of a call by Chinese state media led to an immediate jump in US equity futures. Shortly after, the rally got a further boost after Trump posted that it was “a very good phone call” which “resulted in a very positive conclusion for both Countries.” In the post, it said that their respective teams would soon meet, and also that “There should no longer be any questions respecting the complexity of Rare Earth products.” So that helped to boost market optimism, particularly after Trump had posted the previous day that Xi was “VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!”.

The trade headlines outweighed an initial negative reaction to the latest weekly US jobless claims, which added to fears that the US labour market was finally deteriorating after Liberation Day. Initial jobless claims (one of the most timely indicators we get) moved up to 247k in the week ending May 31 (vs. 235k expected), reaching their highest level since October. Moreover, that followed the very soft ADP report the previous day, which had private payrolls up by just +37k in May. The one caveat to the claims data is that seasonals tend to boost the number a bit at this time of the year. However it’s not the only evidence of a slightly weakening labour market. So that’s really heightened the focus on today’s jobs report for May, as any softness there would really magnify those fears. In terms of what to expect, our US economists forecast nonfarm payrolls to come in at +125k, dipping down from the +177k in March, with the unemployment rate remaining at 4.2%.

Those competing factors drove a big turnaround for US Treasuries yesterday. They initially fell back, with the 10yr yield hitting an intraday low of 4.31% just after the claims data. But the hawkish ECB decision and the Trump-Xi call led to a significant turnaround, with the 10yr yield ultimately closing up +3.7bps at 4.39%. The moves were even larger at the front-end of the curve, with the 2yr yield up +5.4bps to 3.92% as investors dialled back the likelihood of Fed rate cuts.

Meanwhile in Europe, the ECB was the biggest market driver yesterday. They cut rates by 25bps as expected, taking the deposit rate down to 2%. But significantly, President Lagarde signalled that they had “nearly concluded” the easing cycle, suggesting that policy rates weren’t likely to go much lower from here. She also signalled little urgency to cut rates, saying that the current level left them “in a good position to navigate the uncertain conditions that will be coming up.” As such, the ECB appears to be saying that it may have now reached the appropriate level of rates, a stronger message than a soft signal of a pause our European economists had expected. That said, our economists see expected soft growth in H2 and more significant disinflation than projected by the ECB as still favouring some further easing. See their full reaction here.

Lagarde’s comments immediately drove a clear market reaction, with another 25bp ECB cut now being less than fully priced, the 2yr German yield surging +7.8bps on the day and the euro itself strengthening +0.25%. Several other details also fed into the hawkish narrative, with the policy statement saying that although trade uncertainty would be a short-term drag, “rising government investment in defence and infrastructure will increasingly support growth over the medium term.” Later in the day, Bloomberg also reported that ECB officials thought a pause at the next meeting in July was the most likely scenario, with mixed views on whether another rate cut was likely after that. By the close, yields on 10yr bunds (+5.2bps), OATs (+4.7bps) and BTPs (+3.5bps) had all moved higher. Otherwise, equities ended the day higher with the STOXX 600 up +0.16%, but that was mainly thanks to the Trump-Xi call, as the index had been in negative territory after the hawkish ECB news.

In Asia markets are relatively subdued this morning. The Nikkei (+0.24%) has risen a little on weak Japanese economic data that might delay further rate hikes by the BOJ (more below). Meanwhile, the CSI (-0.12%) and the Shanghai Composite (-0.06%) are struggling to gain traction while the Hang Seng (-0.21%) and the S&P/ASX 200 (-0.19%) are seeing minor losses.

Coming back to Japan household spending (-0.1% y/y) unexpectedly fell in April, attributed to consumers curbing spending due to rising prices. This contrasted sharply with market expectations of a +1.5% gain following the previous month’s +2.1% increase.

Elsewhere yesterday, data showed the US trade deficit narrowed sharply to $61.6bn in April, reflecting the impact of the new tariffs. That was the smallest monthly deficit since September 2023, and a huge decline from the prior month’s $138.3bn trade deficit. Given that lower imports mechanically add to GDP, this is expected to lead to a strong bounceback in GDP for Q2 after the Q1 contraction. Indeed, the Atlanta Fed’s latest GDPNow estimate is pointing to annualised growth of +3.8% in Q2.

To the day ahead now, and the main highlight will be the US jobs report for May. Over in Europe, there’s also Euro Area retail sales for April, and German and French industrial production for April. Otherwise, central bank speakers include ECB President Lagarde, and the ECB’s Holzmann, Simkus and Centeno.

Loading…