France’s debt crisis should serve as a warning to others – The Expose

France’s debt crisis should serve as a warning to others

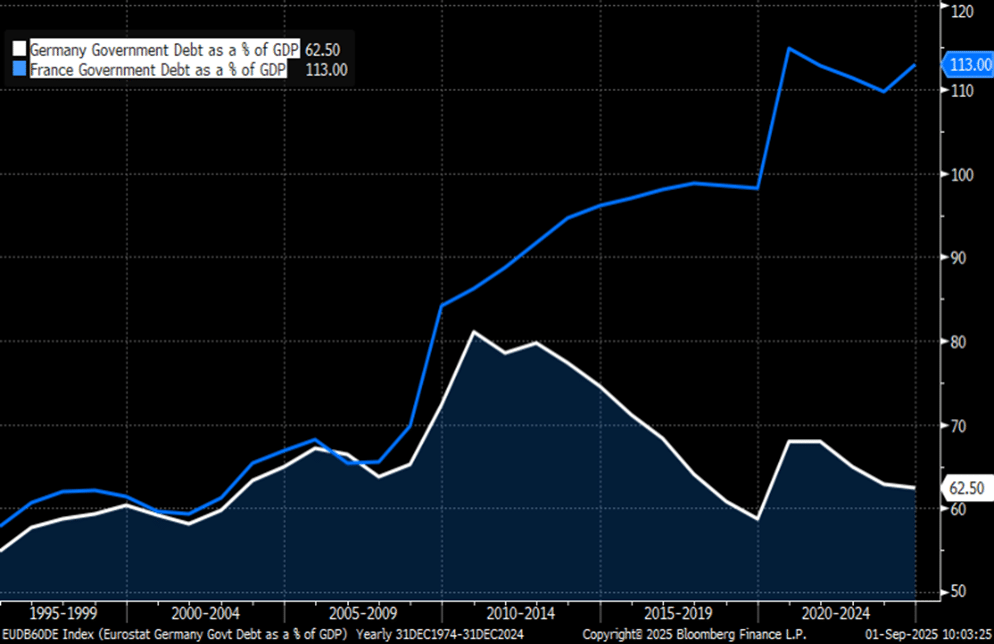

France’s debt-to-GDP ratio has risen significantly, from 60% in 2000 to 113% by the end of 2024, with debt-service costs expected to become the second-largest budget item by 2026.

The country is also experiencing a political crisis. Prime Minister Francois Bayrou has been struggling to pass the 2026 budget and secure a majority.

Financial and debt crises aren’t so much solved as covered up by political actions aimed at alleviating market anxieties, Fabian Wintersberger writes.

Let’s not lose touch…Your Government and Big Tech are actively trying to censor the information reported by The Exposé to serve their own needs. Subscribe now to make sure you receive the latest uncensored news in your inbox…

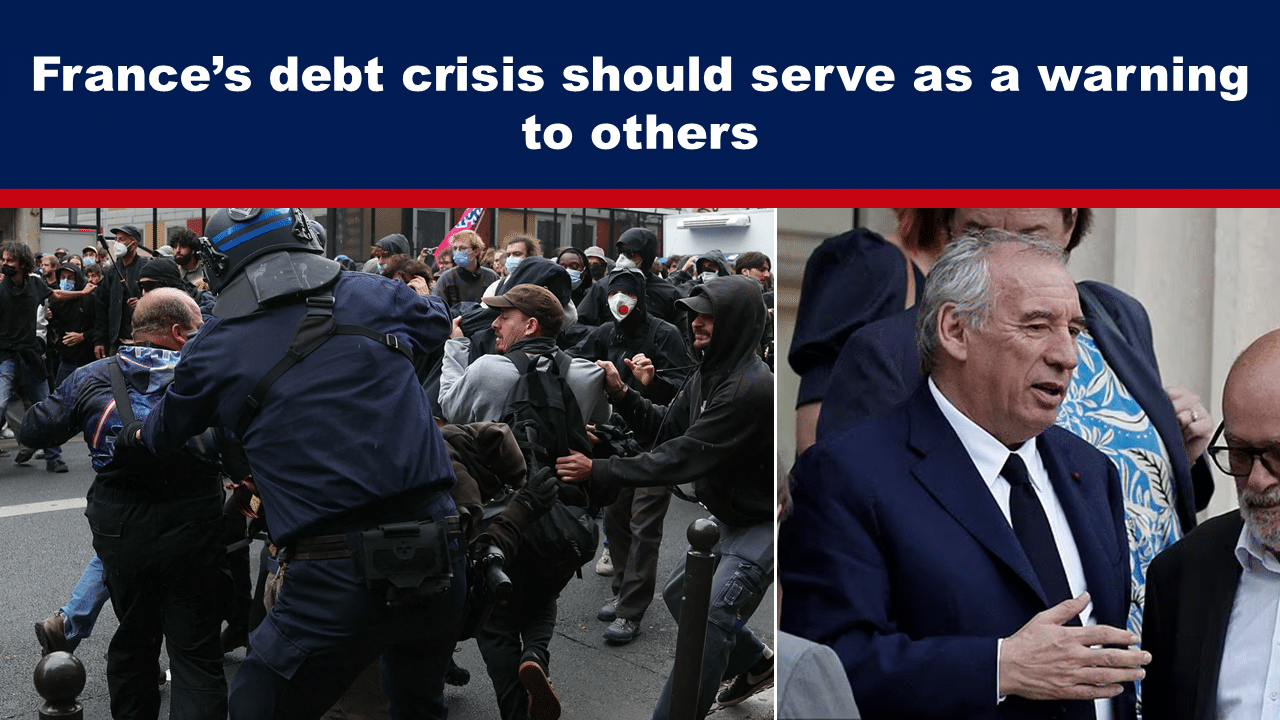

Note: Since Wintersberger’s article was published earlier today, Sébastien Lecornu has taken office as the new Prime Minister, France’s fifth Prime Minister in two years, as ‘Block Everything’ protests rock the country. The nationwide “Block Everything” movement is aimed at opposing President Emmanuel Macron’s government, the political establishment and planned austerity budget cuts.

France’s Financial Misery Is a Bad Omen for Other Countries

By Fabian Wintersberger, as published by The Daily Economy

History doesn’t repeat, but it often rhymes,” is a famous saying attributed to American author Mark Twain. When you read today’s news about the French government and its debt situation, it’s not unlikely that the saying comes to mind.

The European Debt Crisis Revisited

It has been about 15 years since the European Union (“EU”) faced its first severe crisis. As a result of the aftermath of the Great Financial Crisis in 2008, the continent stumbled into a multi-year debt crisis that brought enormous economic hardship to many members of the Eurozone.

Back then, it was the so-called PIIGS states (Portugal, Ireland, Italy, Greece and Spain) that got into the spotlight of financial markets. After the euro was implemented in 2002, these countries were able to issue government debt at rates they had never seen before. Unsurprisingly, politicians couldn’t withstand the pressure and issued more and more debt in an attempt to bring their countries into prosperity.

As always, things that sound too good to be true turn out not to be true. And when the appetite for new debt and risky credit abated after the US housing bubble started to burst, it was only a matter of time before the crisis would spread and affect European countries that piled up debt under the low-interest-rate regime.

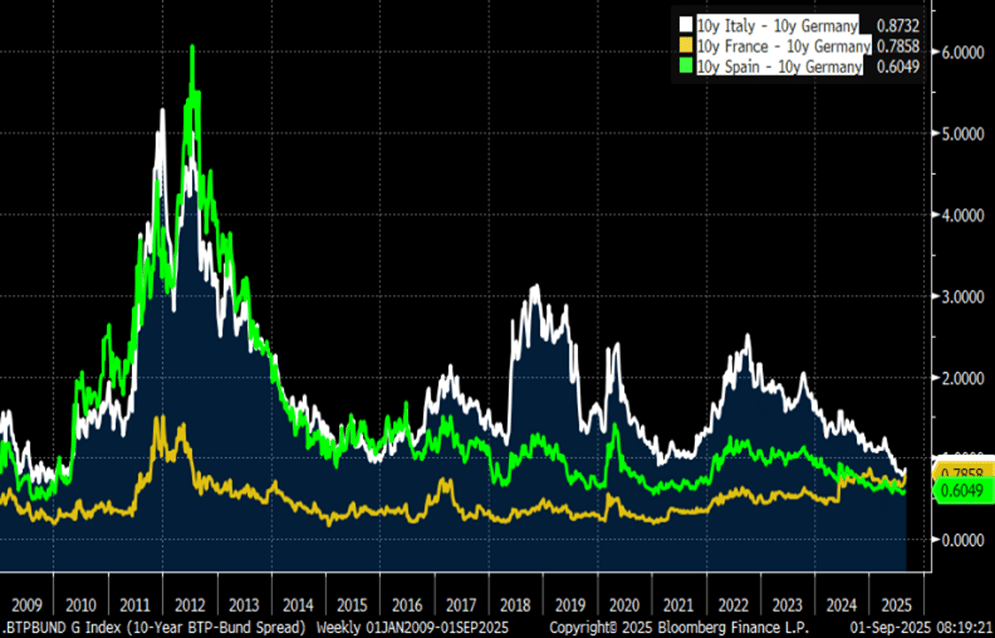

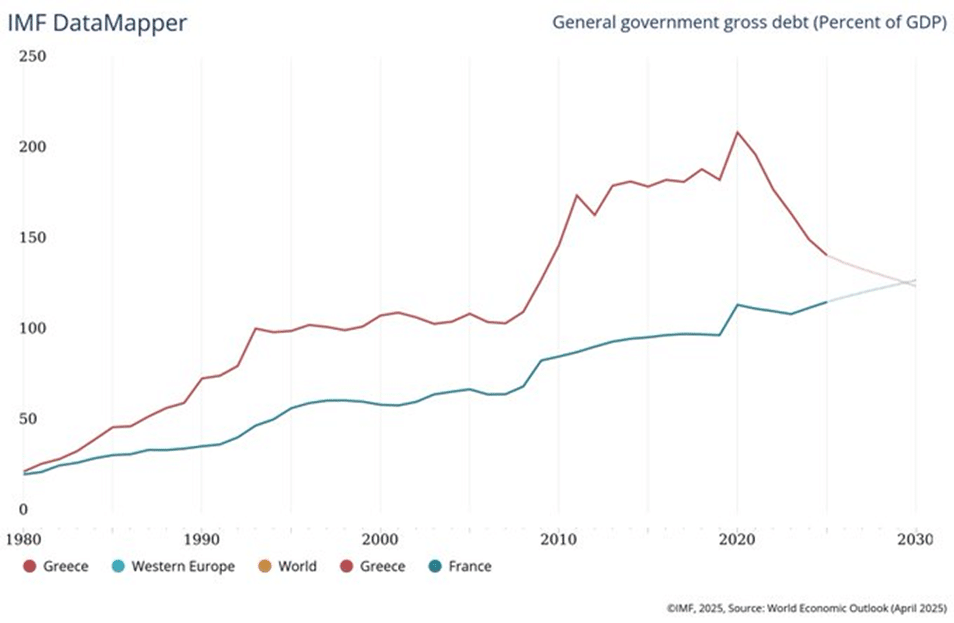

Interest rate spreads of government bonds compared to German Bunds (figuratively the “US treasury bond” of the Eurozone) widened significantly. Mario Draghi, then the head of the European Central Bank (“ECB”), intervened verbally with his famous “Whatever It Takes” speech and interest rate spreads began to narrow again. Greece suffered extraordinarily under the crisis. Things deteriorated to the point of requiring financial support from the EU and the International Monetary Fund (“IMF”).

The EU also put political instruments in place, which somehow wiggled around the “no-bailout” clause from the Maastricht Treaty. In the end, one could say that the crisis wasn’t solved, but instead covered up by political actions aimed at alleviating the nervousness of financial markets.

Debt Accumulation of the French Government

Although France was not necessarily a fiscally frugal country at the time, it did not come into the spotlight. Notably, France’s interest rate risk spread over German Bunds was substantially higher during the height of the sovereign debt crisis in the 2010s compared to its current level.

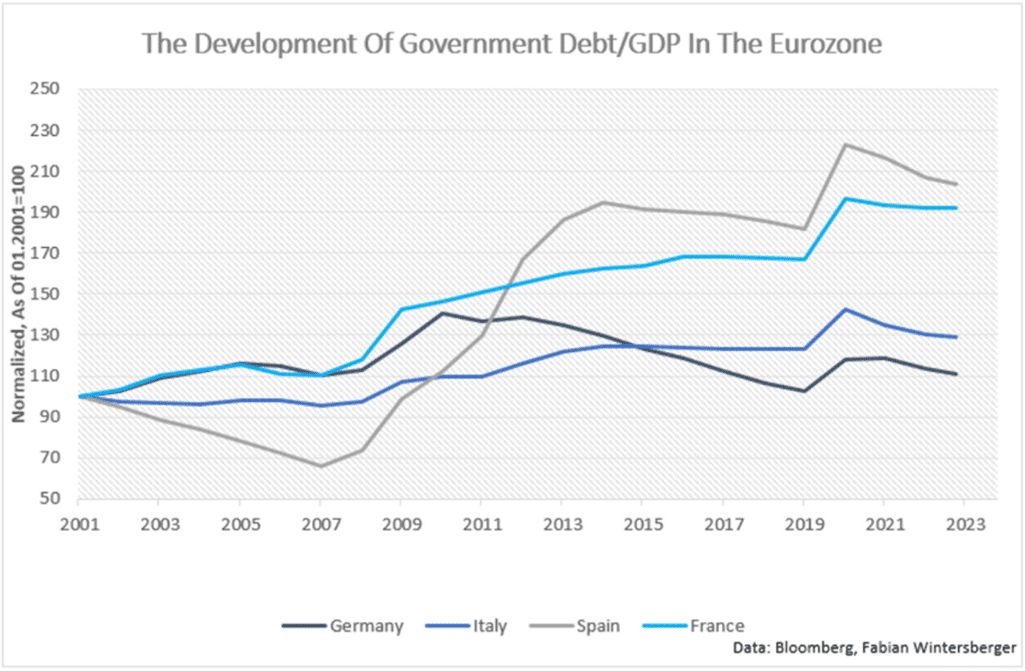

What changed is the debt situation of the French government. In 2000, France’s debt-to-GDP ratio stood at approximately 60 per cent, and it has continued to rise steadily since then. Until 2010, it had climbed to 84 per cent. At the end of 2019, it was close to 100 per cent and had gone up to 113 per cent by the end of 2024. In percentage terms, its debt rose much faster than Italy’s.

What’s also noteworthy is that the ratio was similar to Germany’s until 2008, after which it diverged significantly.

Back in the 2010s, however, when interest rates were falling and near zero, it was much easier to refinance that debt. The expansion of the deficit had limited consequences, as borrowing became cheaper and cheaper.

When interest rates begin to rise, however, one must borrow increasingly more money just to pay the interest on the debt. In France, the portion of debt-service costs is on its way to becoming the second-largest budget item by 2026, Le Monde reported:

According to government forecasts, debt service is expected to be the second-largest item of public spending in 2026, with a projected €75 billion. This would put it well ahead of national education and defence spending, but behind tax reimbursements to businesses and individuals (linked to tax breaks and other incentive schemes).

Although the size of France’s debt is still far lower than in Greece, financial markets are becoming concerned due to the trajectory of the debt. For example, while Greece has implemented fiscal measures and economic reforms to reduce its deficit and has experienced solid economic growth in recent years, France has seen increasing deficits since 2022. Currently, the IMF even anticipates that France will have a higher debt-to-GDP ratio than Greece.

An Ongoing Political Crisis

Beyond the darkening fiscal situation, France is also in a political crisis. During the sovereign debt crisis of the 2010s, France remained a stable political environment. These days are long gone now.

In 2022, Emmanuel Macron secured a victory for the presidency that was closer than anticipated against far-right candidate Marine Le Pen. In the spring of 2024, Macron called for snap elections, which resulted in a significant win for the far-right in the first round. Still, the second round ended with a surprising victory of the leftist New-Popular-Front.

Michel Barnier, a former EU Commissioner, became prime minister in September, only to lose a confidence vote in December 2024 after he failed to secure a majority for his Budget. He became the shortest-serving prime minister of France’s Fifth Republic.

The Current Political Crisis

Barnier’s successor, Francois Bayrou, was unable to calm the political turbulence and solve the budget problems. He invoked special constitutional powers to pass the 2025 budget and used concessions to the left to survive several confidence votes.

In March, Bayrou proposed extending taxes on the wealthy and a mechanism that forces people with “excessive savings” to invest in defence expenditures. French academics rallied behind him and posted an op-ed in Le Monde in support of taxing the “ultra-rich.” Yet, evidence from Norway suggests that such actions could lead to lower, not higher, tax revenues.

So far, however, Bayrou hasn’t been able to secure a majority for the 2026 budget, which also aims for drastic spending cuts. As a result, he decided to take action: At a press conference on 25 August, he called for a no-confidence vote in Parliament, which he lost on 8 September.

Calling for the IMF: A Political Manoeuvre

As a result, risk spreads on French government bonds spiked to their highest level since January. Finance Minister Eric Lombard warned that snap elections (following Bayrou’s loss of the confidence vote) could even result in an IMF bailout. His comment poured more fuel on the fire.

Nevertheless, the warnings were clearly a political manoeuvre to put pressure on the members of parliament to support Bayrou on 8 September. There’s no hard evidence that France will need help from the IMF at the moment, something that Christine Lagarde (head of the ECB) confirmed too. Price action of government bonds after Bayrou’s loss didn’t lead to widening risk spreads for French government bonds.

France: A Warning To The United States

While one can only speculate, the most probable outcome is a combination of higher taxes and increased government spending, which then falls short of expectations and drives the debt-to-GDP ratio higher. Financial markets will judge the measures as successful when there’s clarity on their effectiveness.

Yet, Americans should watch the developments in France because it could give an idea of where the US is headed if it also continues to pile up debt. Although President Trump generally promotes low taxes and is pro-business, he has also stated that he’s open to taxing wealthy Americans more when necessary. Nevertheless, such a scenario seems unlikely at the moment. After all, the United States isn’t France, and still has a significantly lower debt-to-GDP ratio.

But piling up debt above levels typically seen only in wartime, in an era where interest rates have just returned to historically normal levels, could also lead to increased nervousness in financial markets at some point. If such a case were to arise, the US might also face a similar day of reckoning. Nevertheless, the US also benefits from its privilege to issue the world’s reserve currency. This privilege is unlikely to disappear in the near future due to the lack of viable alternatives.

About the Author

Fabian Wintersberger, a trained economist, serves as a rates trader at an Austrian regional bank. Through his weekly newsletter, ‘The Weekly Wintersberger’, he offers analyses of financial markets and economic events rooted in the Austrian tradition.

Featured image: Anti-riot police officers clash with protesters during the ‘Bloquons tout’ (‘Let’s block everything’) protest movement, in Paris, on 10 September 2025 (left). Source: The Guardian. France’s Prime Minister Francois Bayrou (L) leaves the National Assembly after the result of a confidence vote over the government’s austerity budget (right). Source: Daily Mail

The Expose Urgently Needs Your Help…

Can you please help to keep the lights on with The Expose’s honest, reliable, powerful and truthful journalism?

Your Government & Big Tech organisations

try to silence & shut down The Expose.

So we need your help to ensure

we can continue to bring you the

facts the mainstream refuses to.

The government does not fund us

to publish lies and propaganda on their

behalf like the Mainstream Media.

Instead, we rely solely on your support. So

please support us in our efforts to bring

you honest, reliable, investigative journalism

today. It’s secure, quick and easy.

Please choose your preferred method below to show your support.

While previously it was a hobby culminating in writing articles for Wikipedia (until things made a drastic and undeniable turn in 2020) and a few books for private consumption, since March 2020 I have become a full-time researcher and writer in reaction to the global takeover that came into full view with the introduction of covid-19. For most of my life, I have tried to raise awareness that a small group of people planned to take over the world for their own benefit. There was no way I was going to sit back quietly and simply let them do it once they made their final move.

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.