U.S. | Money

Europe primed for a lower open with earnings and Fed speak ahead – Newsquawk Europe Market Open

8 hours ago

Originally posted by: Zero Hedge

- APAC stocks were mostly subdued following the lacklustre handover from Wall St.

- US President Trump says he is working on five to six trade deals and there will probably be two to three deals by August 1st.

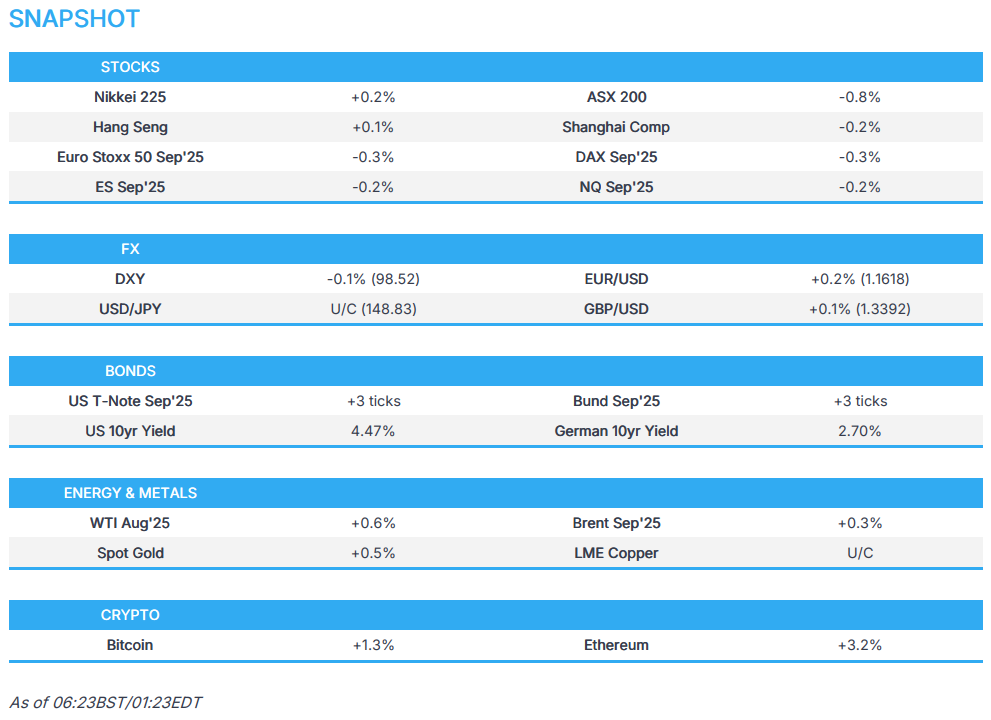

- European equity futures indicate a marginally softer cash market open with Euro Stoxx 50 futures down 0.2% after the cash market closed with losses of 0.3% on Tuesday.

- DXY is fractionally softer after gaining again yesterday, EUR/USD has returned to a 1.16 handle, Cable sits sub-1.34 pre-CPI.

- France’s Marine Le Pen warned that if French PM Bayrou does not revise his public spending plan they “will seek to topple him”.

- Looking ahead, highlights include UK CPI, US PPI, Industrial Production & Capacity Utilisation, Fed’s Barkin, Barr, Cook, Hammack, Logan, Kugler & Williams, Supply from Germany, Earnings from J&J, PNC, BAC, Goldman Sachs, Morgan Stanley, ASML & Sandvik.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks finished mixed albeit with the major indices mostly in the red in the aftermath of the June CPI report which was varied and initially sparked a dovish reaction, although once the internals of the report were digested, like the 0.7% rise in core goods, it showed the start of the pricing impact from tariffs and ultimately pressured stocks and T-notes. As such, there was notable underperformance in the small-cap Russell 2000 (-1.9%) although chip names kept the Nasdaq afloat after reports related to export licences for NVIDIA (NVDA) and AMD (AMD) to sell H20 and MI308 chips to China, while attention was also on the start of earnings season and big banks largely finished the session lower despite profit beats, as some NII and expense metrics disappointed.

- SPX -0.41% at 6,243, NDX +0.13% at 22,885, DJI -0.98% at 44,023, RUT -1.92% at 2,206.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump they are working on five to six trade deals and there will probably be two to three deals by August 1st.

- US President Trump said pharma tariffs will probably begin at month-end and initial tariffs on pharmaceuticals will be low, while Trump also said they will release tariff letters for smaller countries soon and will probably set one tariff for all of them over 10%.

- US President Trump said a great deal for everybody was just made with Indonesia with Indonesia to pay 19%, while the US will pay nothing and similar deals are in the works. Trump later posted that “Indonesia has committed to purchasing $15 Billion Dollars in U.S. Energy, $4.5 Billion Dollars in American Agricultural Products, and 50 Boeing Jets, many of them 777’s.”

- US President Trump said they are making progress with the EU but already have the letter.

- US President Trump expects to meet UK PM Starmer in Scotland and refine the trade deal.

- US Commerce Secretary Lutnick said China chip sales were part of the rare earth magnets agreements and that they’re selling China their fourth-best chips, while he said they’re not charging tariffs on raw steel, just the finished item, according to CNBC. Lutnick separately commented that they have lots of deals on the table and that AI is going to help create manufacturing.

- US Trade Representative announced the initiation of a Section 301 investigation of Brazil’s unfair trading practices.

- China’s Commerce Ministry said China and Australia signed a memorandum of understanding on the implementation and review of the China-Australia Free Trade Agreement.

NOTABLE HEADLINES

- Fed’s Collins (2025 voter) said a solid economy gives the Fed time to decide its next interest rate move and it is challenging to set monetary policy amid uncertainty, while she said it is time for the Fed to be ‘actively patient’ with monetary policy.

- Fed’s Logan (2026 voter) said the base case is that monetary policy needs to hold tight for a while longer to bring inflation down and she wants to see low inflation continue longer to be convinced, while she added that June CPI data suggests PCE inflation, which the Fed targets at 2%, will rise. Logan also commented that softer inflation and a weakening labour market could call for lower rates fairly soon and under the base case, the Fed can sustain maximum employment even with modestly restrictive policy. Furthermore, she said if the Fed misjudges and doesn’t cut soon enough, it could cut rates further to get employment back on track but also warned that cutting rates too soon risks deeper economic scars and a longer road to price stability.

- Fed’s Barkin (2027 voter) said more price pressures are coming from tariffs.

- US President Trump is expected to sign an executive order in the coming days designed to help open up 401(k)s to private-market investments, according to WSJ.

- US Senator Cassidy said President Trump is to sign Fentanyl Act into law on Wednesday.

- US Defense Secretary Hegseth ordered the release of 2000 National Guard troops from the federal protection mission in LA.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued following the lacklustre handover from Wall St owing to an acceleration in US CPI data, while trade uncertainty lingered after President Trump suggested pharma tariffs could begin at month-end and tariff letters for smaller countries could be sent out soon.

- ASX 200 retreated with nearly all sectors in the red aside from tech and with miners not helped by the indecisive performance in Rio Tinto following its quarterly operations update in which it registered higher iron ore production but a decline in shipments Y/Y.

- Nikkei 225 traded indecisively in which the index swung between gains and losses amid the lack of pertinent drivers for Japan and some political concerns ahead of Sunday’s upper house election as a recent poll showed the ruling bloc was at risk of losing its majority.

- Hang Seng and Shanghai Comp were mixed in the absence of any major fresh pertinent macro drivers and despite comments from China’s Vice Premier He Lifeng who stated that China is accelerating the construction of a modern industrial system and is stepping up efforts to boost consumption.

- US equity futures (ES -0.2%, NQ -0.2%) remained lacklustre after retreating on the inflation data and with large banks failing to take full advantage of the earnings beats.

- European equity futures indicate a marginally softer cash market open with Euro Stoxx 50 futures down 0.2% after the cash market closed with losses of 0.3% on Tuesday.

FX

- DXY took a breather and held on to the prior day’s spoils after ultimately gaining as the dust settled following the US CPI data which printed mixed but showed an acceleration in prices, while recent Fed commentary had little impact including from Fed’s Logan who stated the base case is that monetary policy needs to hold tight for a while longer to bring inflation down and wants to see low inflation continue longer to be convinced. Nonetheless, participants await more price metrics and central bank rhetoric with PPI data and more than half a dozen Fed speakers scheduled today.

- EUR/USD attempted to nurse losses after briefly slipping beneath the 1.1600 level owing to dollar strength and with the single currency not helped by political headwinds in France where the ‘far right’ and ‘hard left’ have both threatened to topple the government over the French PM’s budget squeeze.

- GBP/USD remained beneath the 1.3400 level after recent pressure in cyclicals and as UK inflation data looms.

- USD/JPY revisited the 149.00 level to the upside after advancing alongside the firmer buck in the aftermath of US CPI data.

- Antipodeans received slight reprieve after the prior day’s selling but with a recovery restricted by the mixed sentiment.

- PBoC set USD/CNY mid-point at 7.1526 vs exp. 7.1914 (Prev. 7.1498)

FIXED INCOME

- 10yr UST futures languished near the prior day’s lows after ultimately slumping in the aftermath of the US CPI data which printed mixed but showed an acceleration from the previous, while participants now await more data due later including PPI and Industrial Production.

- Bund futures struggled for direction after recent fluctuations and as Bund issuances loomed.

- 10yr JGB futures continued on the recent downtrend amid a quiet data calendar and absence of fresh catalysts for Japan.

COMMODITIES

- Crude futures mildly rebounded off the prior day’s trough after prices were constrained by recent geopolitical updates and a firmer dollar, while private sector inventory data provided some confusion with some sources reporting different figures.

- US Private Sector Inventory data showed (bbls) crude +0.8mln (exp. -0.6mln), gasoline +1.9mln (-1.0mln), distillate +0.8mln (+0.2mln), according to Reuters citing sources.

- Spot gold regained composure after yesterday’s declines which were exacerbated after US CPI showed a tariff impact.

- Copper futures were subdued following recent whipsawing and amid the overall mixed risk sentiment in the Asia-Pac region.

CRYPTO

- Bitcoin traded indecisively and gradually pulled back after briefly reclaiming the USD 118k level.

- US House Republicans failed to clear a procedural motion that would allow consideration of a pair of crypto bills and the defence spending bill, although President Trump later posted that he was in the Oval Office with 11 of the 12 Congressmen/women necessary to pass the GENIUS Act and after a short discussion, they have all agreed to vote on Wednesday morning in favour of the rule.

NOTABLE ASIA-PAC HEADLINES

- China’s Vice Premier He Lifeng said China is accelerating the construction of a modern industrial system and its industrial upgrading providing support to global industrial and supply chain operations, while He added China is stepping up efforts to boost consumption.

- Japan’s ruling coalition risks losing a majority at the upper house election, according to Nikkei.

GEOPOLITICS

MIDDLE EAST

- US President Trump’s administration asked Israel to stop its strikes on Syrian military forces in the south of the country, while Israel promised that it would cease the attacks on Tuesday evening, according to a US official cited by Axios.

- US President Trump is to meet with the Qatari PM today to discuss negotiations over Gaza’s ceasefire deal and are expected to discuss efforts to resume negotiations between the US and Iran to reach a new nuclear agreement, according to Axios.

- US, France and Germany agreed that Iran faces stiff sanctions if there is no deal by the end of August, according to Axios.

- Foreign tanker reportedly seized by Iran for ‘smuggling’ 2mln litres of fuel, according to SNN.

RUSSIA-UKRAINE

- US President Trump said weapons are already being shipped to Ukraine and NATO will pay them back for everything and won’t have boots on the ground, while he added that Iran wants to talk but he is in no rush to talk with Iran.

- US President Trump said it is “too bad” if there is no deal with Russia in 50 days and that Ukrainian President Zelensky should not target Moscow. Trump also said he is on nobody’s side and wants to stop the killing, while he added they are going to see what happens with Russian President Putin.

EU/UK

NOTABLE HEADLINES

- BoE Governor Bailey said multilateral institutions are essential for good policymaking and they are following financial stability risks closely, while he noted countries with big deficits typically come under most financial market pressure and he is yet to be convinced about the need for a retail CBDC.

- ECB’s Nagel said a steady hand is needed on ECB rates, according to Handelsblatt.

- EU approves Germany’s multi-year fiscal plan, according to Politico.

- France’s Marine Le Pen warned that if French PM Bayrou does not revise his public spending plan they “will seek to topple him”. It was also reported that French hard-left lawmaker Coquerel said lawmakers will not vote for PM’s public finance plan and will act to oust the government if it seeks to ram it through parliament without a vote.

Loading…