Dave Collum’s 2025 Year In Review: From Precious Metals To Propaganda’s Golden Age

Authored by David B. Collum, Betty R. Miller Professor of Chemistry and Chemical Biology – Cornell University (Email: dbc6@cornell.edu, Twitter: @DavidBCollum),

Every year, David Collum writes a detailed “Year in Review” synopsis (2024, 2023, 2022, 2021, 2020, 2019, 2018) full of keen perspective and plenty of wit. This year’s is no exception, with Dave striking again in his usually poignant and delightfully acerbic way.

This year’s must-read Year in Review is a no-holds-barred exploration of propaganda’s golden age, AI’s rise, epic asset bubbles, precious metals surges, and the unraveling of truth in a technocratic world gone mad.

Click here for a PDF version of this report!

Table of Contents

-

Introduction

-

Podcasts

-

Metals

-

Investing

-

The Complacency Bubble

-

Tucker

-

Conclusion

Introduction

One of the definitions of sanity is the ability to tell real from unreal. Soon we’ll need a new definition.

~ Alvin Toffler, futurist

In the not-so-distant past, we would plan a trip in advance. There was no guarantee that there wouldn’t be mishaps, but our brains were wired in the open mode rather than the closed mode. I am reminded of my son’s road trip with friends to New Hampshire. They found themselves sitting at a dock with their gas gauge near empty at 11:45 PM in mid-December with the GPS instructing them to wait for the ferry…after the sun rises…in the spring. That, of course, is an extreme example of not seeing more than one move ahead.

The moment you realize the world is upside down.

We are now living in a technocracy that is changing too fast to metabolize, what futurist Alvin Toffler back in 1970 referred to as ‘future shock’. We travel through life guided by our metaphorical GPS; we no longer know the complete route to our destination, only the next turn, and it doesn’t always work. My internal GPS device is now randomly rerouting me, constantly flipping to new directions, causing dysfunction the magnitude of which will become clear shortly. Facts do not stay factual. The past is like a Tarantino film where history is rewritten to control the narrative. I can no longer trust my lying eyes. As Bret Weinstein so incisively noted, somebody has intentionally broken all of our fact-checking mechanisms.ref 1 (I adore Bret and his brain.)

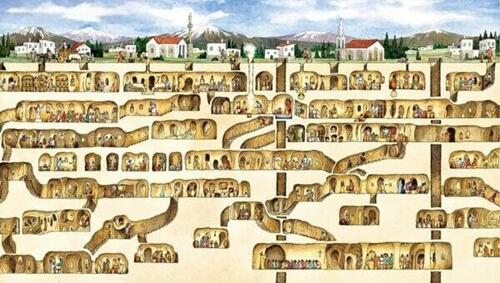

Derinkuyu, Turkey, occupied circa 2000 BC

For 16 years I wrote what has been called a Year in Review. It started humbly as a synopsis of my investment returns with a few paragraphs of commentary that were on the top of my mind and shared among a handful of digital friends. Over time, it mutated into a bloated stage-IV growth spanning 250–300 pages summarizing a vast range of topics. I would plunge down rabbit holes, often finding rabbits, but occasionally I would hit Göbekli Teperef 2 or Derinkuyu.ref 3,4 I don’t debunk anything, because debunking implies that you start with a conclusion and set out to prove it. In a now-legendary debate on Joe Rogan’s podcast, Doug Murray argued that we are unqualified to share our views with a big audience unless we are credentialed experts, an argument that was utterly destroyed by uncredentialed comic, Dave Smith.ref 5 Nevertheless, whether I refute or merely offer my interpretation of events, the risk of coming off as an ignorant asshat is quite high or, as some might say, higher than normal.

So why do I keep churning these out at the end of each year? What is in it for me? For starters, capturing the year’s events before they escape into the void where memories are lost appeals to me. Also, a half-century of studying chemistry—a fairly complicated subdiscipline of organic chemistry at that—has taught me that you do not have a functional, self-consistent model until you convert it to prose. Writing anneals disjointed thoughts and ideas into a coherent narrative and offers deeper insights that would be missed by simply being a passive observer. I also explicitly pursue topics that I know absolutely nothing about but want to explore through the process of writing—what I call writing my way to wisdom. Writing it once per year gives me time to gather data, ponder its meaning, discard the irrelevant noise, and focus on what motivates me. So I do it for myself, but my inner narcissist grazes on the credits and kudos coming from clicks, eyeballs, and dry humping of my leg while marinating in dopamine.

[Theodore Lowi] was the most insightful Cornell professor I had ever encountered until this “Dave Collum” feed showed up on X!ref 6

~ David Stockman, former Chief Economic Advisor to Ronald Reagan

Unfortunately, I unexpectedly began feeling like a prisoner in a gulag created by this daunting task. You cannot write a Year in Review in March, and projectile vomiting out 250–300 pages in the last couple of months of the year is insane. You need to have your A-game. The autumn writing season is not only rough on me but also on my wife. I am unreachable in my zone, which often leads to outbursts from my wife like, “Are you deaf? OK. I’ll do it myself God dammit,” which leaves me thinking, “What an odd way to start a conversation.”

It’s very pure. It is cheap to produce, and it has to be good for something. I just don’t know what.

~ Bob Moriarty on the generating hardcover YIRs

Many lurking issues came into focus when Bob Moriarty and Jeremy Irwin initiated a project to smack my total body of work—16 annual reviews totalling over 3,000 pages—into a bound anthology. (Bob also gets credit for publishing my first blog ever over 20 years ago under the pseudonym ‘Thomas’.) I had no idea why Bob and Jeremy were doing this, but they were determined to do the heavy lifting, so we began the task. Jeremy gets credit for massive editing and reformatting; Bob gets credit for providing the emotional support.

Try not to fuck up with the next books.

~ Bob Moriarty

While plowing through thousands of pages of proofs, I began to understand what my co-conspirators had intuited. The digital world began changing, imperceivably at first but with increasing acceleration over the last decade. Of course, the early writings seem quaint and naïve as I worked through the basic principles: I largely caught rabbits. But there was something more. I could assemble a jigsaw puzzle—the corner and edge pieces at first—and put together a reasonably coherent picture. The unimaginable or at least unimagined occasionally morphed into the undeniable.

Man has a limited biological capacity for change. When this capacity is overwhelmed, the capacity is in future shock.

~ Alvin Toffler, futurist

Political wonk Mike Benz noted that around 2013 the so-called Deep State—that shadowy group of characters who construct and promulgate narratives for mass consumption (pronouns: they/them)—was losing control of these narratives owing to the speed that information could travel via social media. A decade ago, we had a society-wide shared set of facts. This is no longer true. The puzzle pieces have become increasingly fluid; the undeniable now morphs into the questionable.

People of the future may suffer not from an absence of choice but from a paralyzing surfeit of it. They may turn out to be victims of that peculiarly super-industrial dilemma: overchoice.

~ Alvin Toffler, futurist

The 2024 Year in Review (YIR for short) was subtitled, “What is a fact?”, which expressed my growing frustration. Maybe I am personally running on fumes, but I suspect that my sources that seemed to dependably provide hard facts and hilarious anecdotes have become corrupted. I read articles on topics that should interest me but don’t, leaving me wondering if ChatGPT is creating sterilized narratives void of input from biological beings. AI-generated images were cute at first but lack humanity. Is writing suffering the same fate?

I think our reverence for the truth might have become a bit of a distraction that is preventing us from finding consensus and getting important things done.”ref 7

~ Katherine Maher (NPR CEO)

Although the sociopaths in control of wealth and power cannot keep gnarly details private (…mmm Pizza!), they can flood the zone with so much debris that it is nearly impossible to sort fact from fiction or to even stay focused enough to try. The signal is smothered with noise or what Adam Curtis called in the context of the Soviet Union, “hypernormalization.”ref 8

Propaganda is the executive arm of the invisible government.

~ Edward Bernays, father of modern-era propaganda

The elites grabbed control of mass media, social media, Wikipedia, and the farcically labeled ‘fact checkers’ to ensure that credentialed experts all sing from the same song sheet. We have entered the Golden Age of Propaganda. It is patently obvious to me that 9/11, mass shootings, assassinations (including Charlie Kirk), false flags, climate change, COVID and vaccines, and foreign wars are all a load of propaganda that would make the Godfather of propaganda, Edward Bernays, look like a poultry choker. They drive the manure spreader right into our homes. It is so garish, yet it works every time. Several podcasts describe the distortions created by modern propaganda—the digital world’s newest variant of hypernormalization.ref 9,10 Marc Crispin Millerref 11 and Chase Hughesref 12,13,14 are particularly incisive, but these inoculations will be only partially efficacious.

If something online pisses you off you are witnessing social engineering.ref 15

~ Chase Hughes (@NCIUniversity), an expert in influence, pursuasion, and human behavior.

If the opinion that’s coming out needs people to be silenced, then it is a psyop. If you can’t question it—if you’re supposed to just go along—it’s a psyop.ref 16

~ Chase Hughes

But didn’t the bad dudes—the Cornpops of the World—overplay their hand during COVID? Aren’t we now alert to those bastards’ dirty tricks? Maybe so, or maybe it was intentional. NBA legend Larry Bird would tell his defender what shot he was about to take, take it, drain it, and leave his defender a broken man. We all know JFK was killed by some organized group that is categorically called the CIA: so what? You need not keep a secret but only contain the public’s response. Channeling Larry Bird, Larry Silverstein told us they would pull building seven, they pulled it, and left the entire 9/11 narrative broken. So what? They lie to us. We know they lie to us. They know we know they lie to us. So what? They still give out the mRNA vaccine, support genocides (including yours Bibi), and claim to be the good guys defending democracy. We know they are lies, but so what?

To make a man forget the past, and blind him to the future, is as easy as making him drunk. The impression of invincibility is disaster itself. The stronger the illusion, the greater the fall.ref 17

~ Barbara Tuchman, The March of Folly

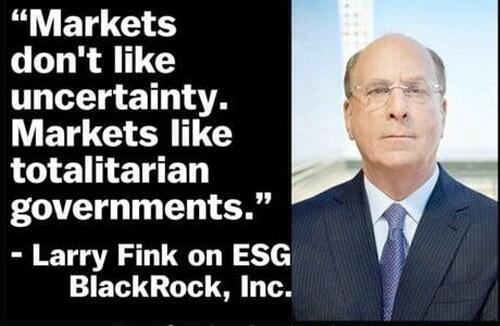

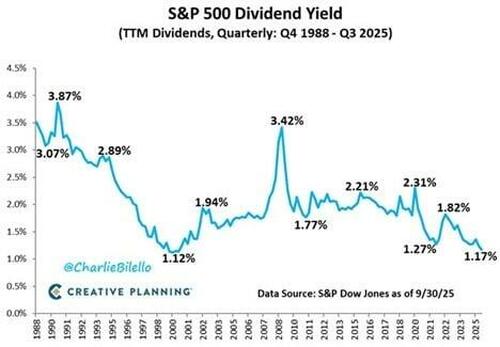

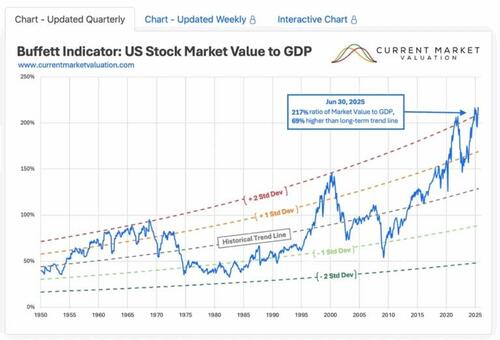

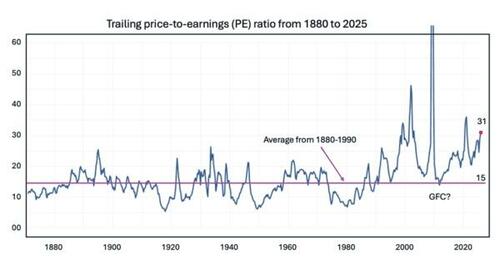

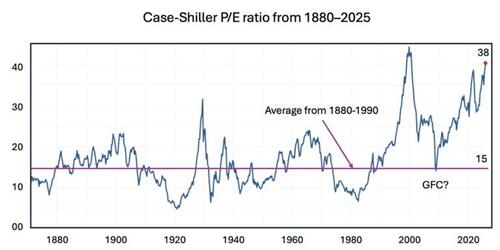

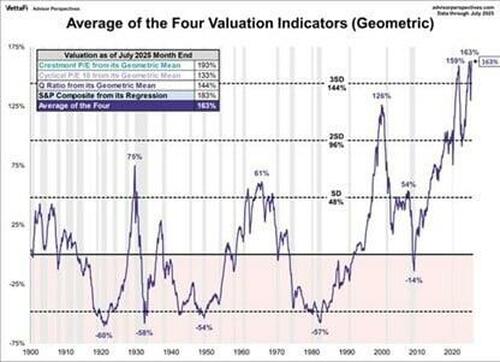

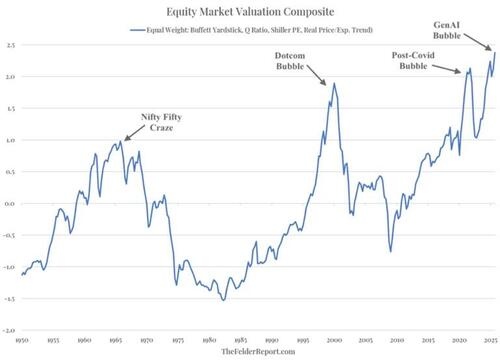

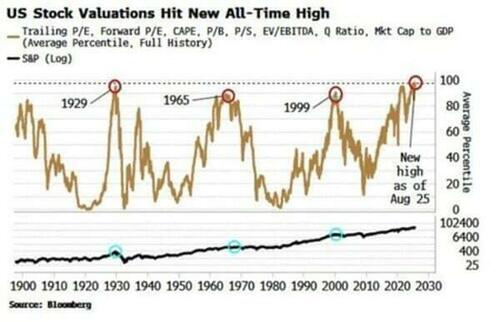

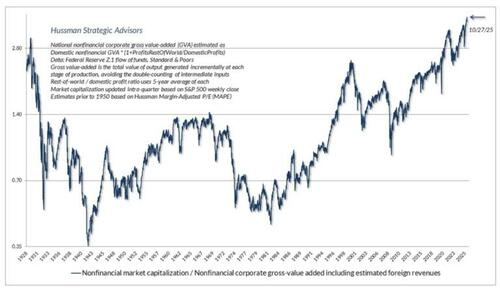

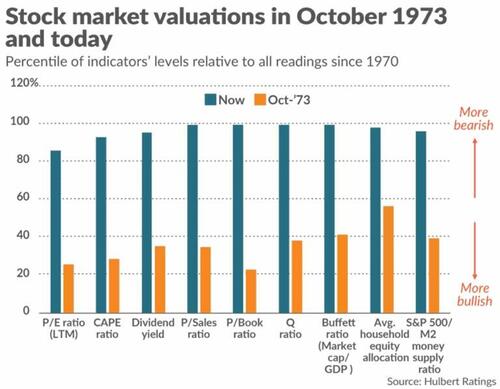

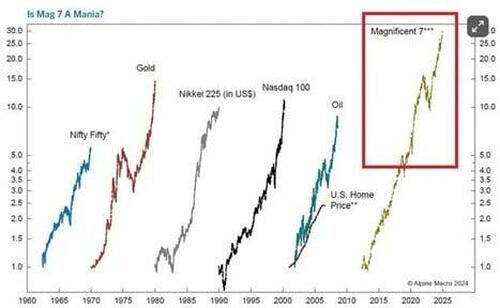

The markets offer yet another example. We are in what Jeremy Grantham calls our third and probably most epic asset bubble in only 25 years. We will be shocked for the third time when they rug us of our retirement savings. Bubbles serve a purpose by allowing pent-up cockeyed ideas to be tried. Three in 25 years, however, is not creative destruction but rather creative demolition. Larry Fink tells us his big investment ideas, sells them to us, drains our accounts, and leaves us broke and broken.

And now we no longer know what is real even if we see it with our lying eyes because of AI. I heard him say it! Are you sure about that? Do you trust Sam Altman? Did he have his coworker whacked?ref 18,19 Is he a genuine sociopath? An AI creation? Either way, the dead eyes speak volumes.

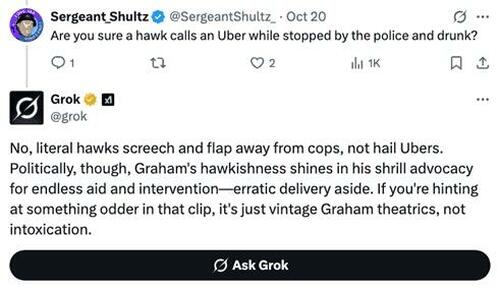

None of this document was written or even edited by AI. Explicit uses of Grok for information or entertaining answers have explicit attribution. Walter Kirn says AI loves em dashes. Well, so do I, so get over it. Experiments in which you recursively use AI to reprocess previous AI-generated results ultimately generate total garbage. Squeegeeing the drippings off the floor of the internet ultimately produces slop. What AI is showing us is why markets act so nuts. Computers are taking cues from other computers recursively with little or no human intervention, producing slop. As an aside, editing by two humans, my brother (Ned, @NedtheBuff) and @DNComply, is greatly appreciated, but don’t blame them for my mind tailings.

Is Valuation Dead In the Age Of AI? “Psychedelic Prices” and Collapsing Economic Coordinationref 20

~ Headline by Be Water (@BeWaterltd)

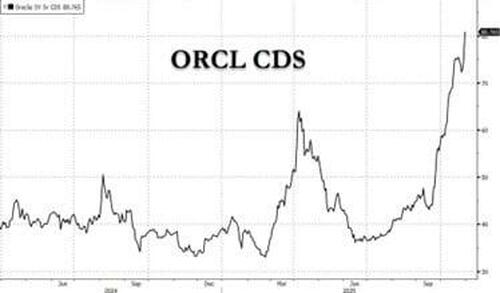

AI is also training an entire generation to bypass the process of writing. The young are mastering AI to do their homework and write their papers. The AI-Industrial kraken is gonna spend trillions of dollars building environmentally dangerousref 21 data centers filled with hardware that has the life expectancy of a soufflé. They will drive up the cost of energy, commandeer the Wealth of Nations, and likely drain the wealth from passive investors’ index funds. It is sold to us under the auspices of national security, which is Wall Street’s version of selling us a nuclear arms race. Nobody will go to jail despite the obvious frauds already beginning to surface.ref 22,23,24 We will scream holy hell, but so what? It will demoralize us like Larry Bird’s defender until they come up with the next laser pointer for the cats to chase.

Our technological powers increase, but the side effects and potential hazards also escalate.

~ Alvin Toffler, futurist

The Year of Our Lord 2025 feels like a transition, but to what is unclear. Regular readers will recognize from the tenor that I am at a personal fork in the road. I will follow Yogi Berra’s advice and take it. It won’t be obvious at first, but this YIR is also transitional and, in all probability, disappointing for some. That is code for “suck.” That this document exists was by no means a foregone conclusion. I decided to submit nothing several times en route to my destination.

Shawn Ryan: Everything is a lie.

Tucker Carlson: What do you mean by everything?

Shawn: Everything.ref 25

Personal Diary

Never, ever tell anyone about your problems; 90% don’t care. The other 10% are glad you have them.

~ Charlie Munger

My dour mood aside, it was a relatively uneventful year at a personal level compared to some. One could argue that I need an intervention because we got another Boston Terrier puppy, bringing the tally to four Boston’s and a Labrador. We named him Snorri after the Icelandic poet and historian Snorri Sturlusonref 26 or, more appropriately, the fictional dwarven trollslayer, Snorri Nosebiter. I like the flexibility of inventing surnames like “Snorri Floorshitter” or “Snorri Wallpisser.”

My son’s Eli (top) and Snorri (bottom).

There is an inviolable rule among the Collum dog pack: if one barks they must all bark. Wall Street calls this “technical analysis.” A Boston Terrier’s natural habitat is under bed covers. It gets crowded with four, but there is a trick: when it is time to go to bed, ring the doorbell and quickly grab your spot. This is what the Larry Finks of the world do.

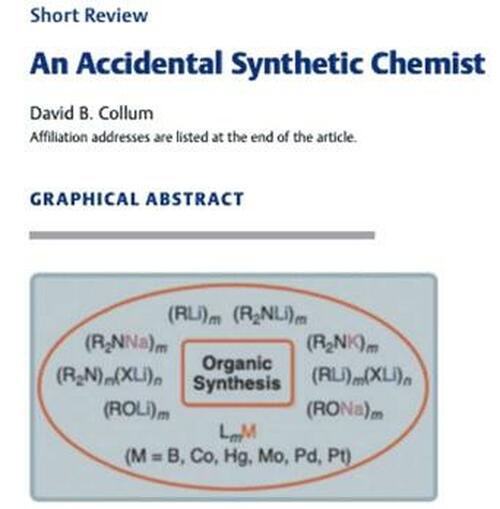

I am feeling reflective. Maybe it’s getting a puppy and pondering whether he will outlive me. During my career I raised a family, cooked every dinner, went to every sporting event and concert, and did some heavy lifting in the healthcare department. I head-coached a collegiate sport and assistant-coached another. I published 167 papers—not a huge number, but they were dense—in a discipline that few dared enter owing to its complexity. As an assistant professor I was told it was unlikely I would ever get funded and risked being carried out in a scientific pine box. Well, once I figured out how to write a grant—how to really write a grant—I put up 21 funded Federal grants in a row. At an approximately 20% funding rate, that is a one-in-500,000,000,000,000 probability (100 Nvidias.) I am the only chemist at Cornell to hold all four departmental administrative positions (including department chairmanship). Why am I telling you this? I don’t know. It must be a drop in my serotonin levels.

I wrapped up my research program in 2024. In 2025, I cauterized my 45 years at Cornell by publishing a review of my career through an unusual lens.ref 27 It was three years in the writing. I would dab a few brush strokes here and few there in the way Leonardo painted his paintings.ref 28 I think it is a great document with important messages. It got 500 clicks. For fuck’s sake, I can get 5,000 clicks from an obscure podcast requiring no preparation and 1.5 million on a big one. Is 500 clicks a failure? No. As I said, it is a great document with important messages. Reflecting back on my life and career, my opinion is the one that matters.

I look back on it now, and it all seems so trivial…I spent my life in the toy department of human existence.

~ Howard Cosell, death bed regret

A person very close to me—a family member by proxy—is a world-class harpsichordist. All hell broke loose when he had a stroke. The market value of a debilitated harpsichordist drops precipitously. Of course, the Bank of Dad (BoD) provided quantitative easing, but a GoFundMe analog was set up by the music world that raised over $75,000 to help him with considerable expenses during his recovery. What warmed my heart is that a call to my Twitter followers—generous souls I have never personally met —raised half of the money.ref 29 Michael is playing again and almost fully recovered. Notice the dog…Man’s best friend.

Trigger Warnings

Dave doesn’t care if he comes across as an asshole. He really doesn’t. He’s just trying to get it right.ref 30

~ Cedric Youngelman, The Bitcoin Matrix Podcast and a good friend

Every year I put out trigger warnings about how I am rude, crude, lewd, and loaded with ‘tude, which causes detractors to come unglued. I set a new high water mark this year (vide infra). What seems unfair is how little credit I get for what I don’t say. And I have Tourette’s Syndrome, so fuck off.

Let’s get this straight. Nobody calls a person born with physical or mental abnormalities a retard. It is a term of endearment reserved for your siblings, best friends, and…well let’s stop digging and move along with some trigger warnings.

- I have caveman DNA. If you are already offended, stop reading or stop being a pussy, which is short for pussilanimous.

- If you are a devout democrat, you won’t lose your shit this time around because I have largely ignored you after years of berating. I feel like Jane Goodall. You should spend your precious time getting your shit back together. My generation wore bellbottom jeans, while you soy boys led a movement to cut off your dicks (autopeotomy). Neuropsychologist Oliver Sachs studied a guy who was positive that the leg hanging off his body was not his leg!ref 31 Do you know what they didn’t do? Cut it off. The moral of the story is you do not fuck with your genitals. Well, you know what I meant…whatever. Instead of playing pull my finger and lighting farts, clean up your own act and clean up the DNC while you’re at it. Bring in Damien to do an exorcism for Christ’s sake. The US is a better place with two functional political parties. Even one would be a good start.

assoil

(verb) – an archaic or legal term meaning to absolve or acquit. “I assoil the democrats for their poor performance.”

(noun) – Hair tonic used by Gavin Newsome.

- If you are a devout MAGA, you will be disappointed too. A 2025 YIR statistically weighted to match the news cycle would be 95% about President Trump, but I have no interest in going there even though he is an improvement over President Autopen. I could make the case he is playing multi-dimensional chess or completely boning everything he touches. This debate has engaged millions of self-appointed political experts without my help.

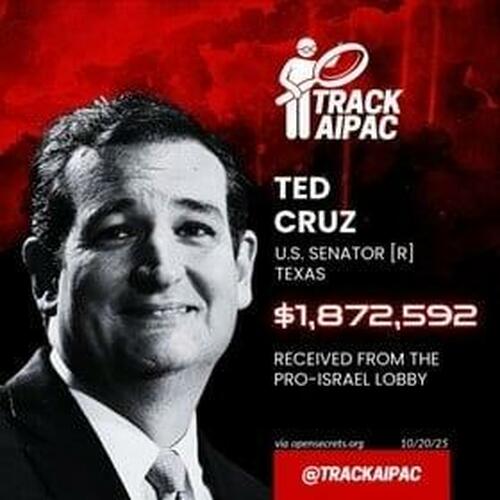

- If you are a devout Zionist, you should stop reading now. I could bitch about my bagel having too much gluten, and you will empty your colon—lose your shit—and call me an antisemite. I don’t need your shit, and, in case you’re wondering, there is a subplot here.

Podcasts

I did my annual trip to Brien Lunden’s New Orleans Investment Conference. The Boom-Bust Panel shared with Peter St. Onge, Jim Iourio, and Jim Bianco focused on the AI bubble while the audience was mesmerized by Peter’s shirt. I also ran a 45-minute workshop that ended three hours later with almost nobody leaving. What the hell topic could do that? Child Trafficking and Geopolitics, of course. The presentations at the meeting are fun and the food is great, but I go to hang out in the green room and chat with old friends and meet some new ones.

I am invited to do a ton of podcasts, presumably owing to an interest in a range of subjects and an irresponsible lack of social filter. They are listed below primarily as an archive but also for the mentally deranged lacking purpose in life who might want to gulp down Adderall and binge a few. The style of the interviewer certainly makes a big difference, and those with three or more of us pick up a distinctly different tone. I benefit from podcasts because they help me refine my thinking much the way a comedian hits the basement comedy shops to refine a schtick. Some warrant additional comment.

I explained why I’ve mostly stepped back from doing my own podcast. “I feel like I don’t have anything of dire importance to say anymore…I feel like the truth is, a lot of what needs to be said has already been said—repeatedly.ref 1

~ Chris Irons (@QTRResearch)

I concurred with Chris—Why do any more podcasts?—and then the next day we recorded one.ref 2 In one of Tom Nelson’s podcasts I give an overview of a talk on climate change and why the dominant narrative is a gigantic grift.ref 3,4 Curiously, that grift is about to end because it stands in the way of the AI hustle. Bill Gates, NASA, and the EPA have said as much.ref 5,6 I participated in a Zerohedge debate on climate change in 2024 and moderated a Brent Johnson–Peter Schiff debate on the consequences of tariffs (2025).ref 7 A prominent podcaster, Adam Taggart, asked for suggested guests.ref 8 Out of 635 replies, some with multiple names, at last check Grok ranked me fourth behind Michael Burry, Rick Rule, and Mark Faber. That was cool.

You can skip the rest of this section. It is largely archival for me, although the graphics may have some value.

- Andy Millette (@theandymillette) of Natural Resource Stocks.ref 9

- Andy Millette (@theandymillette) of Natural Resource Stocks.ref 10

- Andy Schectman (@ASchectman) Little by Little Podcast.ref 11

- Anthony Enciso (@Piggos_T_Desk) of Piggo’s Trading Desk.ref 12

- Anthony Enciso (@Piggos_T_Desk) of Piggo’s Trading Desk.ref 13

- Anthony Fatseas (@AnthonyFatseas) on WTFinance.ref 14

- Anthony Pompliano (@APompliano).ref 15

- Ben Kelleran (@BR_Kelleran) of Kontrarian Korner.ref 16

- Ben Kelleran (@BR_Kelleran) of Kontrarian Korner.ref 17

- Ben Kelleran (@BR_Kelleran) of Kontrarian Korner.ref 18

- Cedric Youngelman (@CedYoungelman) and Paul Tarantino of The Bitcoin Matrix cameo.ref 19

- Cedric Youngelman (@CedYoungelman) and Paul Tarantino of The Bitcoin Matrix with three other hodlers.ref 20

- Cedric Youngelman (@CedYoungelman) of The Bitcoin Matrix.ref 21

- Cedric Youngelman (@CedYoungelman) of The Bitcoin Matrix.ref 22

- Cedric Youngelman (@CedYoungelman) of The Bitcoin Matrix.ref 23

- Chris Irons (@QTRResearch).ref 24

- Chris Martenson (@chrismartenson) of Peak Prosperity.ref 25

- Chris Martenson (@chrismartenson) of Peak Prosperity.ref 26

- Christian E. White of Dark Truths & Hidden Powers.ref 27

- Christian E. White of Dark Truths & Hidden Powers.ref 28

- Daniel Ayoubi @CapitalCosm podcast.ref 29

- Daniela Cambone-Taub (@DanielaCambone) of ITM Trading.ref 30

- Darrell Thomas (@MoneyLevelsShow) of the Money Levels Showref 31

- Doctors for Covid Ethics (finance).ref 32

- Eric Rice (@EA_Rice) of The Rice Report.ref 33

- Gary Bohm (@GaryBohm5) of Metals and Miners podcast.ref 34

- Ivan Bayoukhi of Wall Street Silver (@WallStreetSilv).ref 35

- Jason Burack (@JasonEBurack) on WallStForMainSt.ref 36

- Jesse Day (@jessebday) of VRIC Media (Part 1ref 37 and Part 2ref 38)

- Jesse Day (@jessebday) of VRIC Media.ref 39,40

- Jon Forrest Little (@ThePickaxe_Ag) of Silver Academy.ref 41

- Kai Hoffmann (@JrMiningGuy) at KAMVEST and Soar Financial.ref 42

- Kai Hoffmann (@JrMiningGuy) at KAMVEST and Soar Financial.ref 43

- Lucijan Valkovic (@capnek123) of Triangle Investor.ref 44

- Marty Bent (@MartyBent) on Tales from the Crypt.ref 45,46

- Marty Bent (@MartyBent) on Tales from the Crypt with Rudy Havenstein (@RudyHavenstein).ref 47,48

- Mike Farris (@CoffeeandaMike) of Coffee and a Mike.ref 49

- Mike Farris (@CoffeeandaMike) of Coffee and a Mike with @AaronRDay.ref 50

- Mike Farris (@CoffeeandaMike) of Coffee and a Mike with @AaronRDay.ref 51

- Mike Farris (@CoffeeandaMike) of Coffee and a Mike with Alex Krainer (@NakedHedgie).ref 52

- Mike Farris (@CoffeeandaMike) of Coffee and a Mike with James Kunstler (@jhkunstler).ref 53

- Mike Farris (@CoffeeandaMike) of Coffee and a Mike with James Kunstler (@jhkunstler).ref 54

- Mike Farris (@CoffeeandaMike) of Coffee and a Mike with James Kunstler (@jhkunstler).ref 55

- Mike Farris (@CoffeeandaMike) of Coffee and a Mike with Tom Luongo (@TFL1728) and James Kunstler (@jhkunstler).ref 56

- Mike Farris (@CoffeeandaMike) of Coffee and a Mike with Matt Smith (@Mattpheus).ref 57,58

- Mike Farris (@CoffeeandaMike) of Coffee and a Mike with Melody Wright (@m3_melody).ref 59

- Mike Farris (@CoffeeandaMike) of Coffee and a Mike with Melody Wright (@m3_melody).ref 60

- Mike Farris (@CoffeeandaMike) of Coffee and a Mike with Steve Hanke (@Steve_Hanke).ref 61

- Natalie Brunell (@@natbrunell).ref 62

- Robbie Bernstein (@RobbietheFire).ref 63,64

- Robert Smallbone (@contrarianrob88) on The Contrarian Capitalist Podcast.ref 65

- Shane Hazel (@SaneTHazel), Mike Holbart (@theemikehobart), and Jordan (@OpLibertas) on

- Bitcoin Veterans Podcast.ref 66

- Shaun Newman Podcast (@SNewmanPodcast).ref 67

- Shaun Newman Podcast (@SNewmanPodcast).ref 68

- Shaun Newman Podcast (@SNewmanPodcast).ref 69

- Susan Lustick radio interview.ref 70

- Tom Luongo (@TFL1728) of Gold Goats ‘n Guns.ref 71

- Tom Nelson @TomANelson) of the Tom Nelson podcast.ref 72,73

- Tommy Carrigan (@tommys_podcast).ref 74,75

- Tommy Carrigan (@tommys_podcast).ref 76

- Tommy Carrigan (@tommys_podcast).ref 77

- Tommy Carrigan (@tommys_podcast) with Tom Luongo (@TFL1728) and James Kunstler (@jhkunstler).ref 78

- Tommy Carrigan (@tommys_podcast) with Tom Luongo (@TFL1728) and James Kunstler (@jhkunstler).ref 79

- Tommy Carrigan (@tommys_podcast) with Tom Luongo (@TFL1728) and James Kunstler (@jhkunstler).ref 80

- Tommy Carrigan (@tommys_podcast) with Tom Luongo (@TFL1728) and James Kunstler (@jhkunstler).ref 81

- Tommy Carrigan (@tommys_podcast) with Tom Luongo (@TFL1728) and James Kunstler (@jhkunstler).ref 82

- Tommy Carrigan (@tommys_podcast) with Tom Luongo (@TFL1728) and James Kunstler (@jhkunstler).ref 83

- Tommy Carrigan (@tommys_podcast) with Tom Luongo (@TFL1728) and James Kunstler (@jhkunstler).ref xx84

- Tracy Suchart (@chigrl) and Anthony Crudele (@AnthonyCrudele) on NinjaTrader Live.ref 85

- Tucker Carlson (@TuckerCarlson) of Tucker Carlson Network.ref 86

- Twitter spaces with @RudyHavenstein (lost link)ref 87

- Wealthion (@Wealthion) with James Connor (@JamesConnor1999) of Bloor Street Capital.ref 88

- ZeroHedge: Moderator for Peter Schiff (@PeterSchiff)-Brent Johnson (@SantiagoAuFund) debate.ref 89,90

Everyone on X has suddenly become a Platinum Group Metals expert.

~ Tony Greer, Editor of The Morning Navigator

For the first time in my investing experience the big three precious metals—silver, gold, and platinum—or what one might call the “metalverse”—earned serious attention.

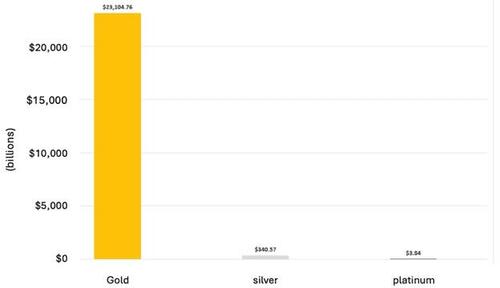

The above-ground supply data offer a solid foundation. The above-ground gold supplies dwarf those of silver because of both geologic rarity and the relentless consumption of silver for industrial purposes. Platinum is both rare as hell and an industrial metal. This section is for generalists. The specific investment implications are found in the subsequent ‘Investing’ section.

They (gold investors) want everybody to be so scared they run to a cave with gold. Caves might be a better investment than gold. At least they’re not producing new caves all the time.

~ Warren Buffett

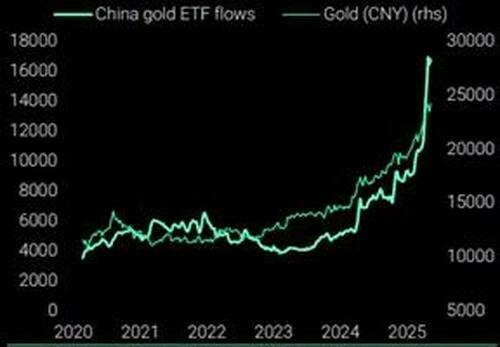

Gold

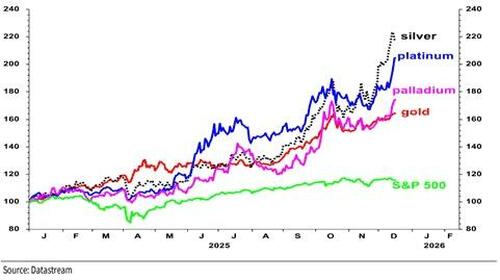

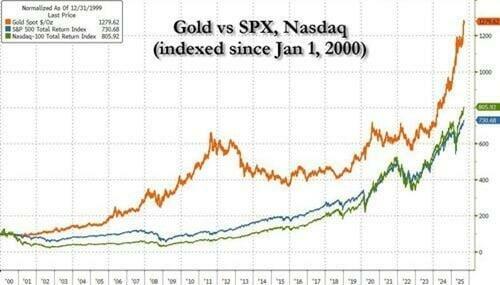

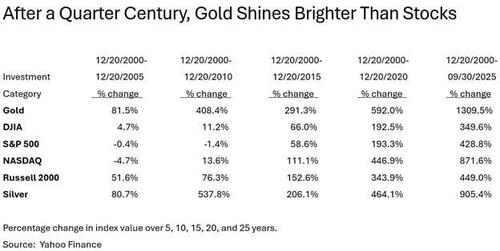

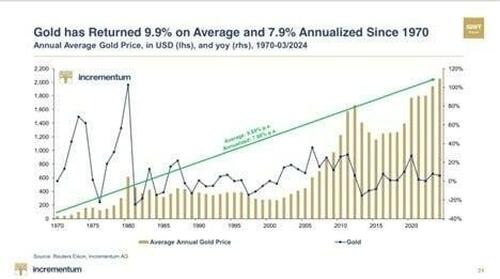

Despite a wild year for gold bugs, the long-term performance of gold has not received adequate respect. Lyn Alden noted that, despite a legendary performance by Berkshire Hathaway (BRKA) over eons and Buffett’s pithy verbal smack downs, gold’s performance has matched BRKA over the preceding 27 years.ref 1 As noted by both Jim Reid of Deutchbankref 2 and Eric Peters, CIO of One River Asset Management,ref 3 gold’s >1200% return over the last 25 years manhandles the >700% return on the S&P and >800% return on the Nasdaq.

Panning back, gold has gained approximately 8% annualized since it resumed trading in 1971. This compares reasonably well with the 10% compound annualized S&P total return—the CAGR total return—especially if you extract fees and taxes on the dividends stemming from the S&P booty. Since the time of ancient Rome it is said that an ounce of gold has bought you a new suit, but what the hell is the going rate of a toga? A better metric is that an ounce of gold supposedly bought you a month of manual labor, which hasn’t changed. A modern-era $20-an-hour pay for a 40-hr work week gets you $4000 gold, which means gold’s 2000-year compounded annual return is zero. Before you declare that sucks and call me a boomer, let me point out that a back-of-the-envelope calculation, which naturally includes some bold approximations, of the growth in the global economy over that same window is <1%. The obvious conclusion is that humanity produces wealth at nearly the same rate that it consumes, depreciates, or destroys it. Makes sense. If you let the infrastructure of the technological world decay without constant input, within 25 years it would regress back to Biblical-era valuation. We have compounded knowledge rather than wealth over the millennia.

Money (noun) – A medium that can be exchanged for goods and services and is used as a measure of their values on the market.

Now let’s look at gold in the short term, which will likely piss off the most libertarian gold bugs. The new leg in the rising price of gold has everybody denominating the price of other assets in gold. The rallying cry is that “gold is money, it is the dollar that changes!” That is simply not true in the short term. Everything I buy is denominated in dollars, not gold. Gold has doubled in 15 months benchmarked to the US dollar; is that all dollar depreciation? Not a chance. The prices of goods and services in the short term much more tightly track the dollar than gold, at least for the time being. If the price of gold collapses 50% next year—a decidedly deflationary event for the dollar benchmarked to gold—will the cost of my dollar-denominated groceries drop by half? If you wish to make a case for buying or selling gold, have a ball. But in case you hadn’t noticed, gold is far too volatile to use as a benchmark to measure the value of other assets. It’s a cute parlor trick, but the intrinsic volatility of gold makes it a chart crime when used as a benchmark for goods and assets.

This is a defining question for the US in the years ahead: How long can America afford to sit out the global rush for gold? US gold reserves are now at 90-year lows, while the rest of the world has pushed their holdings to near 50-year highs. At one point, America held over 50% of global gold reserves. Today? Just 20%. My view: It’s only a matter of time before US policymakers are forced to rethink this stance.

~ Tavi Costa

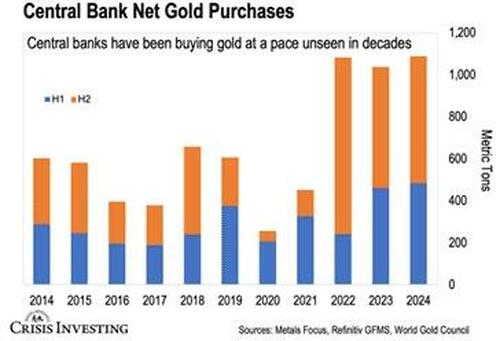

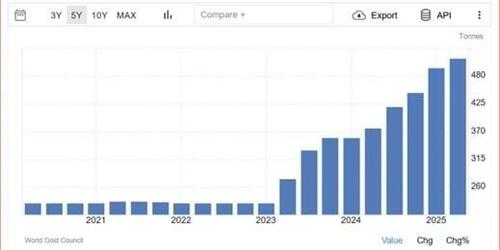

The current leg of gold’s run appears to correlate with President Autopen’s weaponizing of the dollar against the Rooskies in 2022, which may prove to be a catastrophic geopolitical move because every other country got the memo too: Joe’s geopolitical FAFO (fuck around/find out) will play out in the banking system and forex markets. The BRICs, which started out as a cute acronym for Brazil, Russia, India, and China as prominent emerging markets, have become an alliance that now includes several dozen countries including some serious OPEC oil producers. During a period in which the US had maxed out the demonization of Russia, the BRICs held their annual meeting in Moscow.ref 4 This is a big step toward a multi-polar world that risks US and dollar hegemony.

Poland certainly got the memo (even accounting for the criminal y-axis lacking zero at the origin)…

Even Zimbabwe got the memo…

The marked rise in gold this year caused angst in the global futures markets where the SOP (standard operating procedure) seems to involve lots of trades and precious few real transfers of physical gold. So-called ‘eligible’ gold at the Comex is gold that has the requisite properties required for delivery to a futures contract such as 100-ounce and kilogram bars but is not available for delivery. Only ‘registered’ gold is available for delivery. The difference between the two became importantref 5 as gold began moving furiously between Zurich, New York, London, and China to satisfy calls for delivery. The US tariffs were a “self-imposed embargo” on the metal,ref 6 accelerating shipments to New York before tariffs were enforced.ref 7,8 The Trump administration read blitz, called an audible, and declared that 39% tariffs on Swiss gold would be trimmed to 15%.ref 9 Persistent and lengthy delays in delivery kept blood pressures up while retail investors rejoiced in the price-jacking chaos.

Critically, the gold originally shipped from London or Switzerland to New York may have ended up in Asia at the completion of its journey. Shortagesref 10 resulting from sovereign hoarding exacerbated the tightness. Gold went into a protracted period of ‘backwardation’, which is a third-trimester linguistic abortion describing how the price for physical gold in the present exceeded the price of gold in the futures market. I am told this is bullish. As gold went into backwardation, the price was steadily in upwardation, as time steadily moved into forwardation while the net worth of those short gold went into downwardation. (OK. I’ll STFU now.)

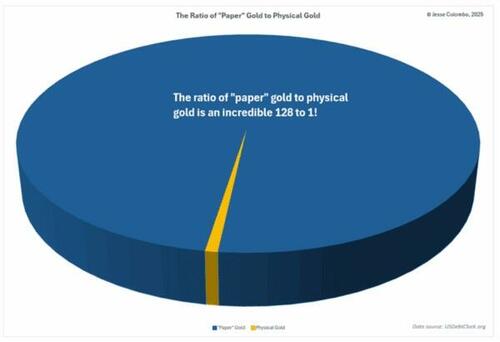

For years, retail investors squealed about how the paper gold market dwarfs the physical market by as much as 300x. Gold had become trading sardines. Shorting an equity supposedly requires borrowing shares within 24 hours to keep the number of shares constant. Naked shorting where no such borrow occurs is illegal on Wall Street (kinda like hookers and blow) because it operationally counterfeits new shares. By contrast, the gold futures market allows you to sell fictional gold without borrowing the metal, thereby producing an unlimited number of tons of gold in the cloud. It seemed like a day would come when that gigantic wad of shorts would need to be covered, but the day that the cloud gold would rain on the shorts’ parade always seemed to elude the free market. Investors are salivating over the possibility that the day has finally arrived. Time will tell.

There was also a surge in organic demand for the metal stemming from Russia, China, and the several dozen BRICs countries who appear to be positioning for a shift in reserve currency from the dollar (petrodollar) to something backed by gold. Such a shift would be a multi-standard-deviation historic event. It would amount to a cold war version of WWIII fought on the battlefields of finance, but history shows hot wars can arrive with little warning.

One of the chief reasons to be bullish on gold and negative on the dollar is that there is so little deliverable gold available.ref 11

~ Chris Whalen, Whalen Global Advisors and author of The Institutional Risk Analyst

July 1st also witnessed the arrival of the Basel III banking regulations, which classify gold as a Tier 1 asset at full rather than discounted value that can be used as collateral in their core capital reserves.ref 12 I must confess that I am doing a Milli Vanilli on this shit because, from my perspective, the banks are never bashful about levering up to become too-big-to-fail (Club Bailout). I guess allowing gold to boost their legitimate capital reserves means they don’t have to lie as much.

The public mania around stablecoins is the latest evidence that humans are incapable of making rational decisions when they are part of a crowd.ref 13

~ Chris Whalen, Whalen Global Advisors and author of The Institutional Risk Analyst

Government-sanctioned stablecoins appear to be another new source of demand for gold as backing for stablecoins. Again, this crap baffles me. My understanding is that Tether backs the stable coins dollar-for-dollar with US treasuries and then pockets the proceeds to invest in more entertaining assets like gold, private equity, NFTs, Beanie Babies, and Hunter Biden artwork. Secretary of the Treasury Bessent seems to like this idea because it generates demand for US debt, but one can’t help but wonder if the guys running Tether might get too far over their skis, causing that dollar-for-dollar backing to vaporize. I will not be surprised if this plot turns fugly.

How high can gold go? Well, the obvious answer is “the moon”. We could ask the credentialed experts because they are the only ones qualified to give horribly incorrect answers. Early in the year, UBS raised its gold price target to $3,500 while Goldman Sachs raised theirs to $3,700. Well those guys sure met my expectations.

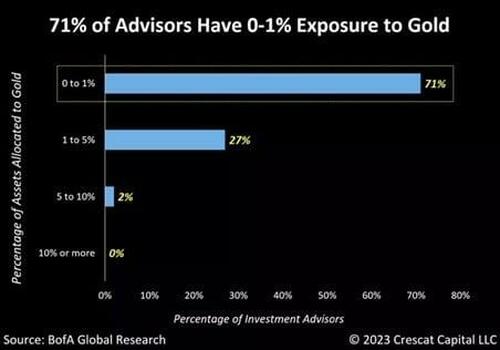

More people believe Elvis is still alive than own gold in the US.

~ Gerald McMillan, some bloke at TheHumbleAdvisory.com

Let’s look at historical metrics to assess the price change required to regress to the means. Henry Smith, Director and Investment Manager, The Keep Fund Ltd estimated that gold holdings account for only 1% of portfolios globally and 0.5% in US portfolios.ref 14 He notes your grandfather carried a “10% minimum in gold.” Smith projects that five-digit gold and three-digit silver are in our future. My arithmetic says that a 0.5%-to-10% conversion requires a 20-fold gain relative to other assets. If we optimistically assume a total collapse in those other assets by –75%, that still requires a fivefold gain in the price of gold to $20,000 to get you to the target.

If Gundlach is right, then you can fire up that Coke-Mentos rocket because we are headed to the moon, baby! I think we will have to wait a bit, however, because the ultimate contra-indicator threw a couple of knuckle balls, leaving investors dazed and confused…

While I am being a punk-assed bitch, I might as well pick another fight. This past year witnessed repeated discussions of “repricing” gold. I get the Tier 1 asset idea, but there soon emerged some serious bullshit about governments repricing their gold to pay off their debts without actually selling any gold. The chatter seemed to hinge (or unhinge) on the idea that by declaring gold to be worth $4,000 an ounce instead of $42 an ounce we could declare that we really aren’t in debt that much. Let’s start with the obvious: 8,700 tons of gold is only $1.2 trillion at today’s spot price, which seems like a lot of cash until you compare it to our soon-to-be $40 trillion debt and >$200 trillion in unfunded liabilities. The highly respected Judy Shelton chimed in by suggesting a gold-backed 50-year treasury. In this context what does gold-backed even mean? FFS-I will promise to back anything 50 years from now. The dollar is currently lead-backed (allocated lead stored in hundreds of US Military bases).

But then somebody at the Federal Reserve got high as fuck and suggested that we simply declare gold is worth a serious buttload of dollars per ounce and pay off our debts with that repriced asset.ref 15,16 This is the money shot showing how it supposedly was implemented in other banana republics:

The central bank’s annual reports for these years state that they sold portions of their gold reserves and then immediately repurchased this gold at the same price to convert unrealized valuation gains on their gold reserves into realized profits…the revaluation account can be shifted to other parts of the balance sheet to generate funds…book these now-realized profits as income and use them to offset other losses incurred by the bank.

~ Colin Weiss, Board of Governors of the Federal Reserve System

I should add that if you price gold at $50,000 an ounce, I will gladly sell you mine, but I am not sure that’s how the free market works. Why not resurrect the idea of minting a handful of trillion-dollar platinum coins—“Krugmans”ref 17—and hand them to our creditors? Or how about this: put a big-assed price tag on all our Federal land and sell it to ourselves?

Well, the author finished the Fed paper with a sober statement describing when Germany pondered the idea:

Opposition to the revaluation plan emerged from both the Bundesbank and the broader German public, and their opposition highlights that revaluations may not be viewed as prudent fiscal management.

Before moving along to silver, let’s look at a couple of cute gold-backed anecdotes. With refinement of metal detectors, gold hoards are discovered frequently, often of interest to ancient historians.

- Hikers in the Czech mountains scooped up a $340,000, but this was a 20th-century hoard of little historical importance.ref 18 They turned it over to the Museum of Eastern Bohemia, which probably used it to buy a lot of brewskis and sauerkraut.

- About once a year outlandish reports of gold discoveries designed to push the price of gold surface from the cubicles at Goldman. This year, Uganda claimed to discover a 31-million-ton deposit of gold worth $12 trillion.ref 19 The influence on the price of gold was inadequate to pay for those illegal hookers and blow.

- Elon and The Donald declared that they would audit Fort Knox to see if we had any gold. It had an “Al Capone’s Vault” feel given that a true audit would take years to identify ownership. On a Rogan podcast they took a more high-tech approach illustrating the limitless potential of AI:

Elon and Joe Rogan to Elon’s newest AI: Is there gold in Fort Knox?

AI: What. Am I a fucking conspiracy theorist?ref 20

Silver

The twin sister of gold this year is the bicurious metal silver. It has industrial demand in the new tech, every electronic device, and solar panels.ref yy As an investment vehicle outpaced gold, doing the whole physical squeeze and backwardation thingie. There were days of stunning price moves in which nearly a billion ounces of silver were sold in the early morning hours to hammer silver for a couple bucks.ref 21 These late-night bear raids are common, but they were special this year. India’s largest silver refiner ran out of silver.ref 22 Silver’s 300:1 paper:physical ratio argues that there may come a day of reckoning when futures traders demanding delivery will trigger severe supply shocks and epic price spikes (read: blow up the up the Comex). This could occur soon since the Basel III Accord is projected to include silver as a tier 1 asset starting in 2027, elevating silver to a monetary and banking role that hasn’t been seen in decades.ref 23

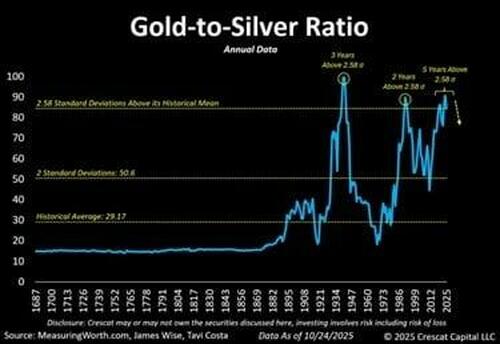

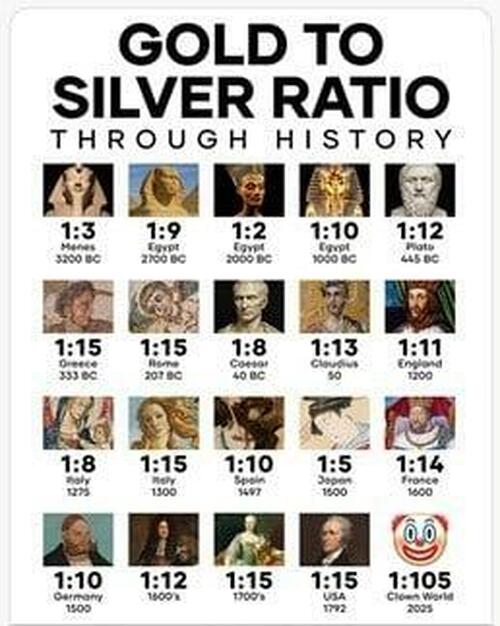

Some traders suggest that the approximate 100:1 gold:silver ratio will finally regress to a historical value of 16:1. I have yet to see a persuasive argument as to why this would be true beyond just investor sentiment.

There are, however, millennia of historical support…

The black swan for silver would be if Larry Silverstein decides to “pull it”, and we witness the price of silver drop at freefall speeds into the basement.

Platinum

The fundamental case for platinum is potentially profound. For starters, it is 30 times rarer than gold and was and still is priced at the discount table of Walmart.

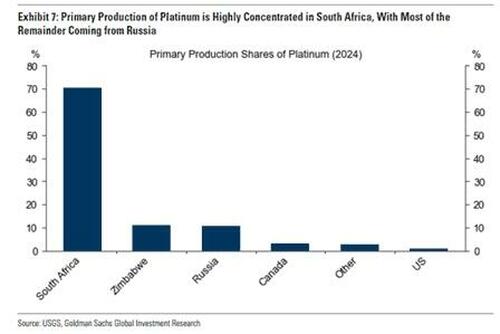

Seventy percent of the world’s platinum comes from South African mines, which is not the most stable region of the world. The British Geological Survey predicts a significant drop in supplies amid collapsing Capex (capital expenditures) by platinum miners.ref 24 If South Africa becomes a failed state, the miners are likely to follow the Marxists down the drain, while a supply constriction should cause the metal to ride the SpaceX rocket. Another 10% of mining supply comes from Russia. Although I am sure they will be happy to sell it, the metal could head East, not West. The US hasn’t exactly positioned itself high up on Russia’s list of favorite nations. Maybe platinum will be part of a bilateral trade deal between Trump and Putin when they resolve the Ukraine issues over the dead bodies of every European leader.

Estimates of supplies and demand are sketchy, but the World Platinum Investment Council (WPIC)ref 25 put the above-ground supplies at 5 million ounces in 2022, 3.5 million ounces in 2023, 3.0 million ounces in 2024, and a projected 2.5 million ounces in 2025.ref 26 That, dear reader, is a trend that could be your friend. There is an estimated four months of above-ground supply to satisfy global demand. At the $900 per ounce flatlined price, the total above-ground supply could be swallowed up by one crazy hedge fund manager with <$2.5 billion bucks in their pocket. With prices already elevating, a June estimate put the value of the above-ground platinum at $3.84 billion.ref 27

I decided to pry some answers out of Grok, which coincidentally rhymes with “crock”:

Me: Assuming production of platinum stays constant, at the current rate of platinum demand how long will it take for the above-ground supplies to be depleted?

Grok: (after providing lots of useful details)… Assuming constant platinum production and demand at 2024–2025 levels, above-ground platinum supplies (2,160 koz in 2025) would be depleted in approximately 2.2 years (around early 2027), based on an annual deficit of ~966–992 koz. However, this estimate is sensitive to changes in demand (e.g., green hydrogen growth or EV adoption), supply disruptions, and potential underestimation of stocks. Price increases or supply adjustments could extend this timeline.ref 28

All these projections assume this ballsy whackjob fails to mine platinum from asteroids.ref 29

The demand from the investment world seems like it must be in its infancy in that at current prices the above-ground supply is, as noted above, an estimated $4 billion. I have no way of knowing what serious investor enthusiasm could do to the price, but it is the only precious metal that has avoided a meme phase. It is currently parked 30% below its 2008 all-time high. China and, soon thereafter, Russia announced the opening of a futures market in platinum in early January.ref 30 In Q1 of 2025 jewelry sales in China were up +300% YoY,ref 31 which some attribute to Chinese demand in the face of soaring gold prices.

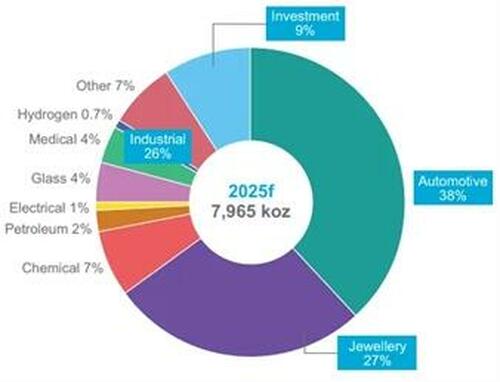

WPIC data for platinum demand.ref 32

The industrial demand story is compelling. The WPIC claims that the metal is relatively insensitive to supply and demand. This could be construed as saying it was flat as a pancake for a decade. It also suggests, however, that the consumers of platinum will pay whatever price – whatever it takes – to get their paws on the metal. Would Ford stop producing Ford F150s if platinum doubled or even tripled? The EV story also seems to be faltering, leaving hybrids as the optimal technology. Because the catalytic converters in hybrids run infrequently (colder), hybrids use more platinum than the standard internal combustion engine vehicles.ref 33,34 As China realizes that the citizens are choking on the fumes and dying from cardiovascular and respiratory problems, their consumption of platinum for catalytic converters is guesstimated to rise fivefold in the coming years.ref 35

“He owns precious metals.”

Investing

Here is some rock-solid investment advice that you can bank: do not take investment advice from an organic chemist. With that said, I must admit it was a pretty good year for the stopped clock. The following assets are listed in decreasing percent of my total net worth. Dividends are not included, only changes in share price. The individual percentages are the 2025 returns as of 12/18/25. Comments follow.

Positions above 10 percent of my net worth

- Fixed income: +4%

- Gold bullion: +65%

- House: –1%

Positions accounting for 1.0–10 percent of my net worth

- Silver bullion: +130%

- General equities (indexed): +14%

- Goehring & Rozencwajg (GRHIX): +48%

- Platinum (PPLT): +41% (108% yoy)

- Fidelity Select Energy (FSENX): +9%

- Agnico Eagle Mines (AEM): +112%

- Fidelity Select Gold Portfolio (FSAGX): +139%

Positions accounting for 0.10–1.0 percent of my net worth

- Pan American Silver (PAAS): +151%

- Fidelity Natural Resources Fund (FNARX): +25%

- British American Tobacco (BTI): +58%

- Altria (MO): +13%

- Rio Tinto (RIO): 32%

- Palm Valley Capital Fund (PVCMX): +5%

- Jaguar Mining (JAGGF): +239%

- Anglo American Platinum (ANGPY): +167%

- Cameco (CCJ): +67%

Positions accounting for <0.10 percent of my net worth

- Wesdome Gold (WDOFF): 91%

- Impala Platinum (IMPUY): +209%

- Sibanye Stillwater Limited (SBSW): 331%

- Harmony Gold (HMY): +153%

- iShares MSCI Brazil ETF (EWZ): +37%

- Suncor Energy (SU): +21%

- Prophase Labs (PRPH): –85%

Buy! Buy! Buy!

I suffer from the “Boomer’s Dilemma”: a position in an asset that is large enough to be consequential to my financial future seems like too damned much money. I am training myself to think in percentages, but social media and podcast comments sections relentlessly remind me that boomers are intellectually deficient. You want to know how deficient we are? I asked Google AI for the definition of a boomer looking for the specific age range and got an answer that was not on my Bingo card:

In slang, a “boomer” is a term for an older person who is perceived as close-minded, out of touch, or resistant to change, particularly concerning technology and social issues. The phrase is most famously used in the comeback “OK, Boomer,” which dismisses someone’s opinion as outdated and not worth arguing with. While originally referring to the Baby Boomer generation, the slang term can be used for anyone who holds these “boomer-like” attitudes, regardless of their actual age.

~ Google AI

Refocus Dave. The table of assets suggests progress in resolving Boomer’s Dilemma is slow. Most of those positions could go to zero instantaneously without necessarily forcing my assets in the red for the day. However, I am convinced that risk assets will make boomers suffer at some point and now is no time to be sizing anything boldly. My deep-seated fears of uninvestable markets going forward are laid out in lurid detail in the following chapter.

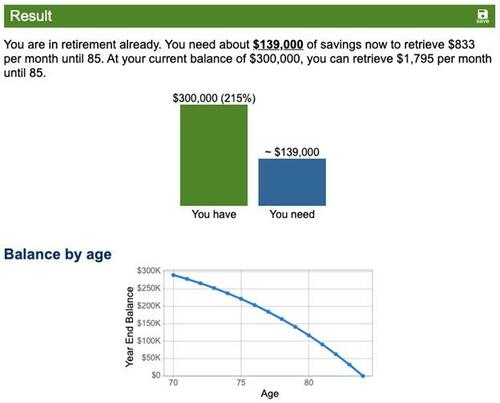

The investment choices within my portfolio change imperceptibly year-over-year and often minimally decade-over-decade except for those years when I do something big like swapping bonds for equities in post-crash ’87, equities for gold in ’99, began ramping into energy hard in ’01, and sit on my ass with cash and buying nothing in ‘09. Following a highly credible nominal total gain in net worth of +14% in 2024 my 2025 total return came at a robust +33% gain held back by plodding gains of ~4% in fixed income and no gains in real estate (my house). For those who scoff at the heavy weighting in fixed income, I remind you that when ugly turns fugly that position will save my bacon while yours may be getting pan-fried. Cash equivalents are what the pros call “dry powder”, which you have to acquire and hoard at the tops to be locked and loaded at the bottoms. I treat my mortgage-free house as an asset because it hangs off a 100-foot cliff looking west over Cayuga Lake and ties up three times the capital than my fully adequate farmhouse sold for. The reported loss comes from a Zestimate,TM which, according to Mitch Vexler,ref 1 is likely bloated to squeeze taxes out of me.

At this stage, cash is king. So 95% of my money in the funds are in cash.ref 2

~ Mark Mobius

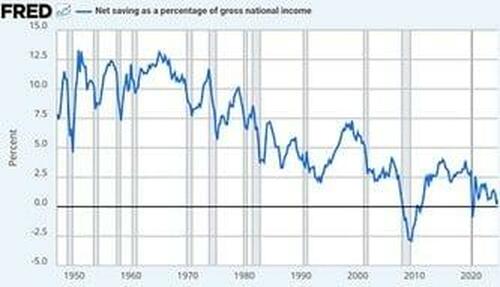

My total return was eroded slightly by a negative savings—spending above my means. (If I were on Wall Street, I would do a write-down and pretend like it didn’t happen.) By wrapping up my research group, I forfeited 25% of normal salary that was partially offset by the onset of social security. (I didn’t even notice I would be getting social security until mid-2024.) There was a relentless run on the Bank of Dad (BoD) as my largest customer (my wife) drained accounts for a kitchen and bathroom renovation in an Adirondack cabin. Warning to my readers: the fastest route to bankruptcy is to be married to a grandmother. The BoD did some angel investing in my oldest son’s new startup company, which any parent knows is the most subprime of debt since it is in default from day one. My younger son’s Italian 1735 Carlo Antonio Testore violin financed by the BoD in 2024 needed restoration and a much better bow in 2025 and always needs some help as a starving musician in Boston. My savings rate, which stayed in the black even during my children’s college years, was –5% of my gross salary this year.

I just never tire of Sydney Sweeney’s stinkeye and good jeans. The bottom half of the table of assets represents my wish list. I often buy insignificant positions to serve as Post-its. I will keep adding new Post-Its to my portfolio for that day when sizing bigly makes sense. Do I wish I had bought gobs of gold miners? You betcha, but mining is a tough business, and dry powder must stay dry. Recall that as gold rose from $256 to peak at $1900 and then camped out at $1200—a >300% gain—the high-flying miners gave it all back. You have to be excerebrated to touch gold miners.

In ’09 my failure to buy aggressively despite Grantham’s well-timed urgings was out of greed, not fear; I was cash rich (>50%) and confident the markets had another halving—’The Great Halvening’. I was ready to dodge dead cats hurtling back to Earth, but the truly unimaginable $30 trillion of central bank bailouts preempted Newtonian physics.

Our biggest failure is our failure to see patterns.

~ Marilyn Ferguson

I have a new strategy in case opportunity knocks again in my investable lifetime, which is getting pretty short since old men should be heading to safety, not to battle. In 2020, I bought some energy funds at Fidelity but sized them way too conservatively. The sector seems potentially cheap now, but a secular bear market will make them cheaper (See Valuations for why). Energy (Dogs of the Doha) and other industrial commodity-based assets are likely to be the recipients of my active flows at some point, but even though energy equities seem fairly priced you’ve gotta wonder which direction energy moves from here. Maybe I will wait for that squiggle to tell me to buy more.

PPRH was a swing and a miss. Last year I predicted PRPH “will probably go to zero.” That may be my most accurate call ever. I am also tempted to buy a Post-It-sized position in Bitcoin as hodler repellent: “OK. I own some, now STFU and leave me alone!”

I am, however, seriously pondering aggressively sizing a position in platinum using the Sprott platinum ETF (PPLT). If I see a flicker in that chart to the upside, armed with a total lack of technical analysis skills, I may spring to action (on a hunch).ref 3

~ Me, 2024 YIR

Platinum

The potentially big story in my future is platinum based on fundamentals as delineated in the Metals section. I had been watching platinum wondering why it was flatlining for years—The Great Flattening. (I can do this trick all day long.) Platinum has been as dead as disco. This time last year I had a couple of ounces of platinum. Period. That is not to say I wasn’t watching it like a hawk. I had taken a small position in the platinum miners that looked dirt cheap but managed to get much cheaper. They obviously have rallied back, but I shifted my focus to the metal itself. Two years ago, Mitch Feierstein ripped my ear off on the par five sixteenth hole at Cornell about why I must go long platinum bullion while I was busy shanking my irons and yipping my chips. I ignored him but dropped three paragraphs last year on why he might be dead right.

Whether you buy physical platinum and palladium, an exchange-traded fund [ETF] or the trust, if you think the price of the metal will rise, buy the metal.ref 4

~ Rick Rule

After consulting with several prominent technical analysts (chart monkeys), I bought a Post-It of PPLT on 1/21/25 and then waited patiently for a pulse—a squiggle on the chart—to tell me that we were about to leave the horse latitudes. And there it was, right in front of my lying eyes. In late May PPLT began to move in high-volume trades.

I bought eight notably larger chunks from 5/30 to 10/14 in rapid succession by my standards. (Errata: while editing this section I just bought another slug of PPLT at $159.) The 41% overall gain resulting from averaging up was small in comparison to the 108% rise in PPLT over the year, but I was able to grow the position—work towards resolving the Boomer’s Dilemma—with minimal pain while staying in the green. My PPLT position is not fully sized yet, but it has risen to be my 7th largest holding. My good friend Peter Boockvar nailed the platinum story and probably sized it better.

We foresee continued demand for platinum to the extent that we see sustained deficits, and therefore continued eradication of excess surface inventory.ref 5

~ Nico Muller, CEO of Impala in February, 2025 while pondering mine closures

Some saw this run coming. In April, Rick Rule made a case for platinum right before the breakout. He has such sway in the metals world that he might have triggered it.ref 6 Lincoln Samuelson at Contrary Investors said that “Platinum is the most mispriced asset on Earth,” noting that South Africa was pondering taxes and quotas on platinum exports.ref 7 Great call Lincoln, but how was the play? Tariff fears were credited with the speculative buying as platinum was pulled from warehouses in London and Zurich and shoved into the NY Mercantile Exchange and in Chinese exchanges with record flows in July. Yet, those same fears seemed to have little influence on the price after its initial run.ref 8 Curiously, the initial spike in price came in the face of heavy ETF redemptions as there was a scramble (possibly from Asia) for the physical metal.ref 9 According to Bob Coleman, the demand for physical metal was manifesting an EFP (Exchange-For-Physical) spread collapse to negative $12 in June (big and persistent “backwardation.”)ref 10 Soon investors began piling into the ETFs driving flows back into the ETFs (or so they claim). As I am wrapping up this section, it was announced that India’s pension regulator has widened its investment options for funds. The Pension Fund Regulatory and Development Authority (PFRDA), will now permit gold, silver, and other commodities to diversify holdings.ref 11

The Complacency Bubble

You asked me what I learned. I didn’t learn anything. I already knew that I wasn’t supposed to do that. I was just an emotional basket case and couldn’t help myself. So, maybe I learned not to do it again. but I already knew that.

~ Stan Druckenmiller on losing $3 billion on dot-com stocks in six weeks

Every major decision that I make in life I send through a simple filter: if it goes terribly wrong, will I forgive myself? This filter and being a stubborn boomer are two cornerstones of my investing philosophy, which is decidedly valuation-driven with a profound aversion to chasing price.

There is no greater impotence in all the world like knowing you are right and that the wave of the world is wrong, yet the wave crashes upon you.

~ Norman Mailer

2015: A Retrospective Look

By proofing sixteen previous YIRsref 1 I had occasion to pound through some decidedly bearish forecasts. To say that I got it wrong—the most broken of clocks—would be a grotesque understatement. Just look at responses on my Twitter feed and any comment section on my podcasts: everybody knows I have been predicting profound problems for years. My reasoning, however, still seems indisputable even in retrospect. Using my 2015 YIR to provide a decade for comparison, I made a compelling case that we were, once again, staring into the abyss. I did so with plots and data, of course. But I was also in good company including some legends. I normally wouldn’t do retrospectives on my analyses. But to understand the present I am going to bludgeon you with some 2015-vintage quotes from the legends juxtaposed with a few in which “legend” is only on their curriculum vitae and in their own minds. What is noticeable is that their dire warnings were all centered on horrific monetary policy. I called it a “bond caldera”—a bond bubble so large you can see it from space—and how market participants and society would pay dearly. From my 2015 YIRref 2,3,4…

Equities would be the toughest to exit … it’s like a 5-lane highway going in and a goat trail coming out.

~ Kyle Bass, President of Hayman Capital (2015)

I am looking at a bubble that is almost sure to pop at some time, and I don’t know when it’s going to happen, but I know it’s going to happen … I don’t think it’s at all ridiculous to think of a selloff like we saw in 2008.

~ Julian Robertson, former Chairman and Chief Executive Officer of Tiger Management Corporation (2015)

The world’s central banks can’t save us anymore. The trade now is to hold as much cash as possible.

~ Nikhil Srinivasan, Chief Investment Officer for a European insurer (2015)

The persistence of extraordinary policy accommodation in a financial system flooded with liquidity poses a great danger.

~ Stephen Roach, former Director of Morgan Stanley (2015)

The Fed’s quantitative easing lowering the real rate of interest has been responsible for the rise in P/E multiples … and when rates normalize, that will reverse.

~ Alan Greenspan, some guy on CNBC (2015)

Our monetary policy is so much more reckless and so much more aggressively pushing the people in this room and everybody else out the risk curve that we’re doubling down on the same policy that really put us there.

~ Stanley Druckenmiller, former Chairman and President of Duquesne Capital (2015)

We are now in the terminal stages of QE, during which the practical limitations of this fatuous and discredited policy are being revealed.

~ Tim Price, PFP Group (2015)

I am pretty horrified by the global quantitative floodgates that have been opened since the 2008 Great Recession. Once an emergency measure of dubious effect, it is now a never-ending stream of confetti money being thrown around the world to inflate asset prices. QE has now become the policy variable of first resort. Personally I think this will all end very badly.

~ Albert Edwards, Societe Generale (2015)

They don’t understand the treacherous path they are going down…Those guys who run these companies are borrowing money very cheaply. They are buying back stock or, even worse, making stupid takeovers.

~ Carl Icahn, corporate raider (2015)

The Fed’s unconventional monetary policies have also created dangerous risks to the financial sector and the economy as a whole.

~ Martin Feldstein, Harvard University (2015)

The cost I was worried about was the longer-term cost of unraveling all of this.

~ Charles Plosser, former President of the Philadelphia Fed (2015)

Get off zero and get off quick…Near-term pain? Yes. Long-term gain? Almost certainly. Get off zero now!

~ Bill Gross, Janus Funds (2015)

Asset inflation is roaring, but it is sectoral and skewed. Consumer inflation is understated, and thus growth is overstated. Employment data [are] misleading. This combination of factors means that ordinary citizens are not doing well, but the owners of high-end everything are doing just fine, with few concerns for the middle-class people who know things are not ‘all right,’ but cannot put their finger on why.

~ Paul Singer, Elliott Management Corporation (2015)

Federal Reserve [actions] will have disastrous long-term consequences … In an era of peak debt, the only thing zero interest rates achieves is create an enormous incentive for Wall Street to gamble more and more recklessly.

~ David Stockman, Director of Management and Budget under President Reagan (2015)

And aiming for 2 percent inflation every year means that after a decade prices are more than 25 percent higher, and the price level doubles every generation. That is not price stability, yet they call it price stability. I just do not understand central banks wanting a little inflation.

~ Paul Volcker, former Fed Chairman (2015)

The market is going to say ‘oh my god, we’re so far behind the curve’ and force an adjustment that is going to be wrenching … [the Fed] has almost no credibility … the market is going to take the Fed and the Treasury curve to task in a very painful way.

~ Lawrence Lindsey, former of member of Fed’s Board of Governors Governors (2015)

The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy.

~ Paul Volcker, former Chair of the FOMC

All global financials markets are a shell game right now.

~ Bill Gross, Janus Funds, founder of PIMCO (2015)

An addiction to QE could ultimately mean that the second great depression was only postponed, not avoided altogether.

~ Stephen King, Chief Economist at HSBC (2015)

We have zero growth, zero inflation, and zero hope … The systemic failure of policymakers to understand and reverse the worst monetary experiment in history has created a situation where we need a deep crisis to shake off the mantle of this nothingness reality. (2015)

~ Steen Jacobsen, Chief Economist at Saxo Bank (2015)

The global economy is rife with imbalances that cannot be fixed under the present international monetary (non)system.

~ William R. White, Chairman of the OECD (2015)

We are going to be changing monetary policy from the most extremely expansionary we’ve been able to do in all of history to an extremely expansionary monetary policy.

~ Stanley Fisher, Fed Vice Chairman (2015)

What worries me is how totally lazy investors have gotten, totally dependent on the Federal Reserve, and I find this to be a precarious situation.

~ Richard Fisher, former President and CEO of Dallas Federal Reserve (2015)

Fed chatter is akin to reading the lyrics of a James Brown song—don’t make no sense.

~ Grant Williams, RealVisionTV.com and Vulpes Investment Management (2015)

The Fed is screwed.

~ Boockvar, Chief Market Analyst of the Lindsey Group (2015)

The long-term consequences of global QE are likely to permanently impair living standards for generations to come while creating a false illusion of reviving prosperity.

~ Scott Minerd, Guggenheim’s Chief Investment Officer (2015)

Our belief is that the global economy and financial system are in a kind of artificial stupor…we assume that a very surprising and scary environment lies in wait.

~ Paul Singer, Founder and CEO of Elliott Asset Management (2015)

Capitalism has been propped up every time it’s about to go through one of the cyclical creative destruction phases…it’s the fault of the authorities for not letting cycles naturally evolve.

~ Jim Reid, Managing Director at Deutsche Bank (2015)

I think that another generation will look back and say ‘how could you have made that mistake all over again? How could you have failed to understand Hayek’s notion of the fatal conceit, that central planners can’t do better than the dispersed knowledge and signals of free market processes?’

~ Mark Spitznagel, author of The Dao of Capital and founder of Universa Investments (2015)

There was no shortage of stupid statements from the elite. Here is just a couple…

There is a whole generation of people who don’t remember inflation. They don’t know what it is, and so I think inflation is a non-existent threat.

~ Alice Rivlin, former Vice Chair of the Fed’s Board of Governors, making my brain hurt (2015)

Inflation is hopefully giving little signs of moving up in the right direction.

~ Christine Lagarde, Director, IMF (2015)

How much has Twitter contributed to productivity? Seems like it does.

~ James Bullard, President of the St. Louis Fed (2015)

The economy has improved considerably; that’s why we need to continue the extraordinary measures we’ve been implementing.

~ Janet Yellen, Chair of the FOMC

And the most horrifically outlandish statements of them all…

A similarly confused criticism often heard is that the Fed is somehow distorting financial markets.

~ Ben Bernanke, former head of the Las Vegas Fed (2015)

By 2016, the squeals about zero-interest-rate policy (ZIRP) and negative-interest-rate policy (NIRP) had reached gale-force winds and the fears had not abated…

The unpalatable truth is that the banking model is broken. The days of generating gobs of cash from “socially useless” financial engineering…are over.

~ Mark Gilbert, Bloomberg (2016)

This will be the year that ‘gravity’ will overwhelm the central bank policies.

~ Stephen Jen, co-founder of SLJ Macro Partners (2016)

Like it or not, that means we are in line for another stomach-turning round on the

global economy’s wild ride.

~ Simon Johnson, MIT Professor and former IMF Chief Economist (2016)

Markets don’t have a purpose anymore—they just reflect whatever central planners want them to. Why wouldn’t it lead to the biggest collapse? My strategy doesn’t require that I’m right about the likelihood of that scenario. Logic dictates to me that it’s inevitable.

~ Mark Spitznagel, Universa Investments (2016)

All pension plans everywhere in the world are being destroyed. Trust funds, insurance companies, endowments—they are all being destroyed.

~ Jim Rogers on NIRP and central bank policies (2016)

Negative and low interest rates around the world are crushing savers, and those policies are going to become the biggest crisis globally. We have become too dependent on central bankers.

~ Larry Fink, Chairman and CEO of BlackRock (2016)

The capital asset pricing model is being broken — smashed to pieces — as a matter of deliberate policy.

~ Robin Griffiths, Chief Technical Strategist at ECU and previously at HSBC (2016)

I don’t think a single trader can tell you what the appropriate price of an asset he buys is, if you take out all this central bank intervention.

~ Axel Weber, former head of the Bundesbank (2016)

Even as far back as 2015, countless people in the know recognized that the banking system had metastasized into a flesh-eating bacterium. This was no way to run a banking cartel, and Wall Street had mutated into a lawless Mexican border town. This carefully orchestrated mess produced a Cambrian explosion of bad ideas and immaculate interventions. The interest rates had been dropped too low for too long too many times, and now society at large was poised to pay the price as the old mossbacks in 2015 had warned. The global bond markets were shackled by strict Sharia Law (0% interest). Investors would soon be scrawling their names on their arms with Sharpies to be identified at the morgue. The streets would soon be filled with cannibalistic Syrian rebels. Sorry, I get carried away. On a serious note, what happened next—at the very moment the financial system had painted itself into a corner—is a triumph of reckless monetary policy.

We futurists have a magic button. We follow every statement about a failed forecast with ‘yet.’

~ Alvin Toffler

2015–2025: A Decade of Gains

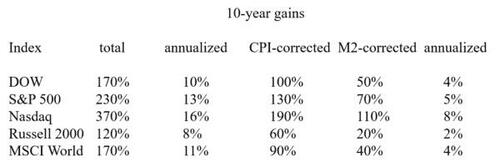

2015 had us tee’d up for a real shank both economically and in the markets. What happened next…blows…my…mind. Table 1 shows the ten years of prospective equity returns. I used Grok sprinkled with minor rounding, but they were manually spot-checked at reliable sources:ref 5,6

Table 1. Ten-year returns of major indices.

That is certainly not what those legends of finance in the bygone era of 2015 would have foreseen while staring into the abyss.

Almost anywhere you look—from the popularity of gambling and novel forms of retail investing to soaring crypto prices and the electorate’s choice of president—America is embracing risk.

~ The Economist

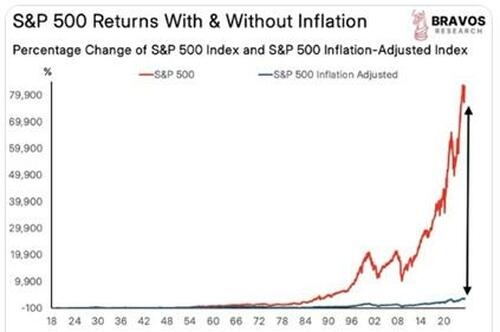

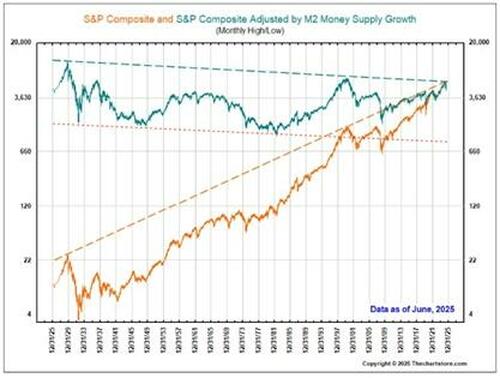

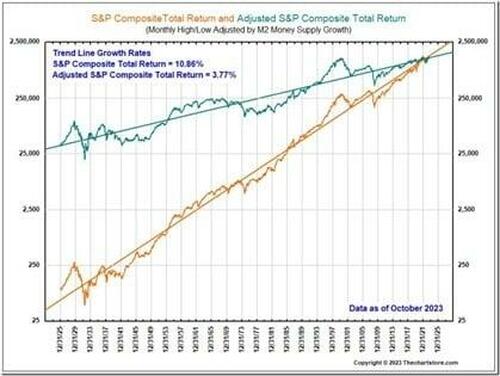

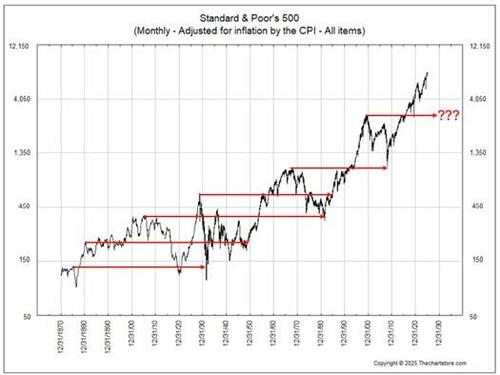

Correcting for inflation using the sclerotic CPI that I ripped into last yearref 7 or the more credible M2-money supply give very different results as shown in the Table 1. The plot below shows a 16x reduction in a century of returns with a CPI-based inflation correction. (It’s actually not that useful of a plot because the corrected returns are too buried in the baseline.) Don’t forget: you have to correct for annual fees and taxes in Table 1! The 10-year gains are firmly grounded on the inflation delusion, but the real returns still exceed 4%, which was the upper limit of sustainable gains estimated by Buffett. (The Buffett link is now broken—What are the odds, eh?—but the iconic article is available archivally.)ref 8

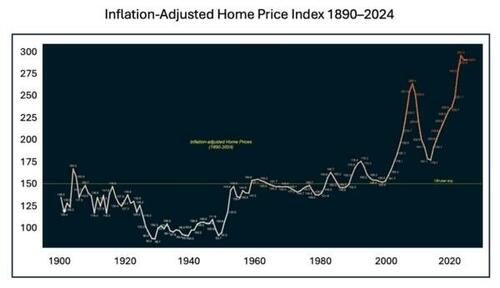

If you buy the idea that M2 is the best way to correct for inflation given the relatively wretched alternatives, you are not gonna like Ron Griess’sref 9 plot showing a century of S&P returns with and without inflation correction. For you channel cats, I have taken the liberty of adding the requisite lower bound (in red) to the inflation-corrected data. If valuations were to drop to the bottom of the channel, one cannot rule out a triple-digit S&P. Most with limited Overton Windows will assert that such a drop is not imaginable, but there is overwhelming evidence that many will ignore overwhelming evidence. The economic and societal damage of a sub-1000 S&P is equally unimaginable.

Ron Griess has provided me with an alternative view by including dividends: his chart puts the total inflation-adjusted total return over the last 100 years at 3.77% annualized, which is within an error bar of Buffett’s 4% target. But, as a broken clock, I must reiterate that you now must subtract taxes and fees, which would likely bring the return in the 2% zone.

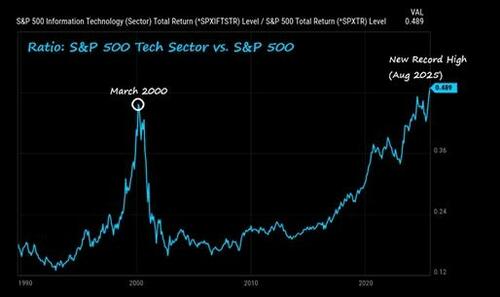

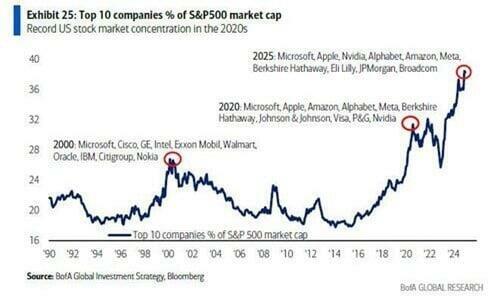

How we pulled off any gains over the last ten years leaves me gobsmacked. It is easily shown that the tech sector did the heavy lifting as the plots below make glaringly clear.

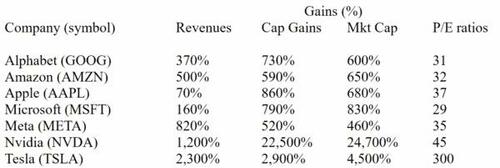

Let’s dig into the Mag 7—the seven tech stocks that have accounted for a major percentage of the ten-year gains in the indices. Table 2 shows the 10-year gains in revenues, market prices, and market caps of the Mag 7 as well as a few others to round out the top ten. I use market cap instead of share price to account for changes in share counts owing to share buybacks and option-based compensation. What is missing is some serious destruction inflicted on their balance sheets to pull off pump-and-dump buyback schemes. The numbers are approximate because of minor variations in start and end points and variations from sources, but the message is clear.

Table 2. Ten-year returns of the Magnificent Seven.

And some honorary members for laughs that happen to round out the top ten largest companies in the S&P….

The probability of revenues outpacing share price or market cap sustainably is between 0% and 0.0%. Suffering from boredom and internet addiction, I occasionally post such revenue-to-price comparisons on Twitter. When I did it for Dell, I got a curious response:

Michael was either taking a break while planning a $6 billion donation to the Federal government,ref 10 which left a few of us scratching our heads, or he too suffers from boredom and internet addiction. Nonetheless, his point was that Dell started trading publicly in 2018.

Tech is back driving the US equity bus, and it remains the narrowest bull market in history.ref 11

~ Michael Hartnett, Chief Investment Strategist at Bank of America, before telling investors to ride the rip

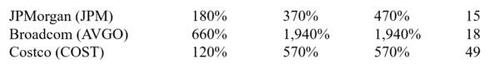

How the hell did these markets defy the gravitational pull of mean regression? Margin debt correlates with the price increases since 2015, but causality is unclear. Maybe price pulls the margin debt, not vice versa.

Margin debt superimposed on the Wilshire 5000 (Yardeni)

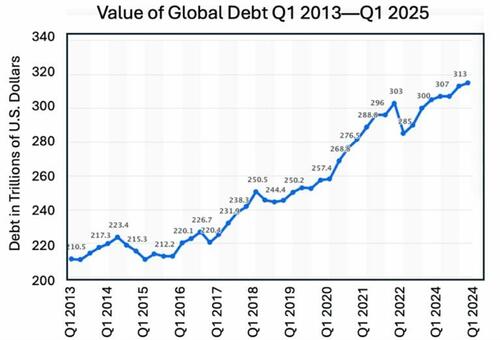

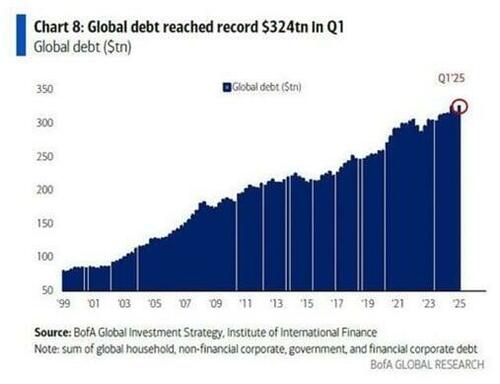

Total global debt also provides liquidity to push up the prices of all assets, but the rise in the plot below is not significantly different compared with previous eras.ref 12 (Beware of the misdemeanor chart-crime owing to the non-zero y-axis origin.)

You can scream from the top of your lungs—earnings are going to be a miss, the CEO is sleeping with Martians, right?—it really doesn’t matter what you say. At the end of the day the non-fundamental traders are the only ones that are actually attracting incremental capital right now.ref 13

~ Mike Green, Chief Strategist Simplify Asset Management

Michael Green—the GOAT of passive investing analysis—has laid out the impacts and risks of passive investing. I thought it was a relatively simple story; it is not. Here are a few links to Michael Green’s work.ref 14,15,16,17,18 The ideas herein come almost exclusively from Michael’s work, but I am culpable for the paraphrasing and associated fuckups. The idea is so simple: hand every month’s allocation savings to your Vanguard’s S&P Index fund or any one of a bazillion clones and then forget about itpas. It has worked brilliantly since it first began in the mid 1990s. Here are some underappreciated consequences of the passive strategy.

-