U.S. | War Terrorism & Unrest | Money

Crude bid and stocks hit after Trump comments & continued strikes, DXY flat into Retail Sales – Newsquawk US Market Open

6 hours ago

Originally posted by: Zero Hedge

- US President Trump says he wants “a real end,” with Iran “giving up entirely” on nukes”, via CBS’s Jacobs.

- US President Trump says the EU is not yet offering a fair deal, there is a chance of a deal with Japan but they are “tough”. Pharma tariffs coming soon.

- Stocks hit as Iran-Israel strikes continue and Trump posts that “everyone” should evacuate Tehran.

- FX markets in narrow ranges awaiting US Retail Sales; incremental strength in JPY post-BoJ, but Ueda sparked some weakness thereafter.

- Two-way action for JGBs; USTs just about firmer while EGBs & Gilts reside in the red.

- Crude moves higher as Trump cuts his G7 trip short and now awaiting developments from the situation in Iran.

- Looking ahead, US Export/Import Prices, Retail Sales, Industrial Production, BoC Minutes, G7 Leaders’ Summit.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

TRADE/TARIFF

- US President Trump said he signed a document finalising a trade deal with Britain (as expected). US President Trump said the UK is protected (regarding tariffs) because he likes the UK. US tariff on UK steel to remain at 25% for now, according to Bloomberg citing a UK official. Imports of automobiles within tariff-rate quota that would otherwise be subject to a 25% tariff shall instead be subject to a combined tariff of 10%. The US and UK committed to strengthening aerospace and aircraft manufacturing supply chains by establishing tariff-free bilateral trade in certain aerospace products. The US intends to promptly construct a quota at most-favoured-nation rates for steel and aluminium articles and certain derivative steel and aluminium articles that are products of the UK. The US and UK committed to negotiate significantly preferential treatment outcomes on pharmaceuticals and ingredients of the UK, contingent on findings of an investigation. The US intends to create an annual quota of 100,000 vehicles for United Kingdom automotive imports at a 10 per cent tariff rate.

- US President Trump says the EU is not yet offering a fair deal, there is a chance of a deal with Japan but they are “tough”. Could do a separate deal with Canada on the Golden Dome. Pharma tariffs are coming “very soon”.

- US President Trump met with European Commission President von der Leyen per her request, according to CBS’ Jacobs.

- EU and US leaders reportedly instructed teams to accelerate work on trade, according to Bloomberg citing European Commission President von der Leyen

- Canadian PM Carney and US President Trump agreed to pursue negotiations toward a new economic and security relationship within the coming 30 days, according to the Canadian PM’s office.

- Japanese PM Ishiba and US President Trump did not reach a tariff agreement; but confirmed they are to continue tariff talks, according to Fuji TV. Japan Finance Minister Kato said no fixed plan right now to hold further talks with US Treasury Secretary Bessent.

- White House said, concerning steel and aluminium, Secretary Lutnick will determine the quota of products that can enter the US without being subject to 25% Section 232 tariffs, according to Reuters.

- FBN’s Gasparino posted ““As of today Xi and Trump have not talked about the fate of TikTok US. It’s last on the list. Most likely get punted for another 75 days on June 19th. The AI chip sales to China are emerging as a much bigger issue”.

EUROPEAN TRADE

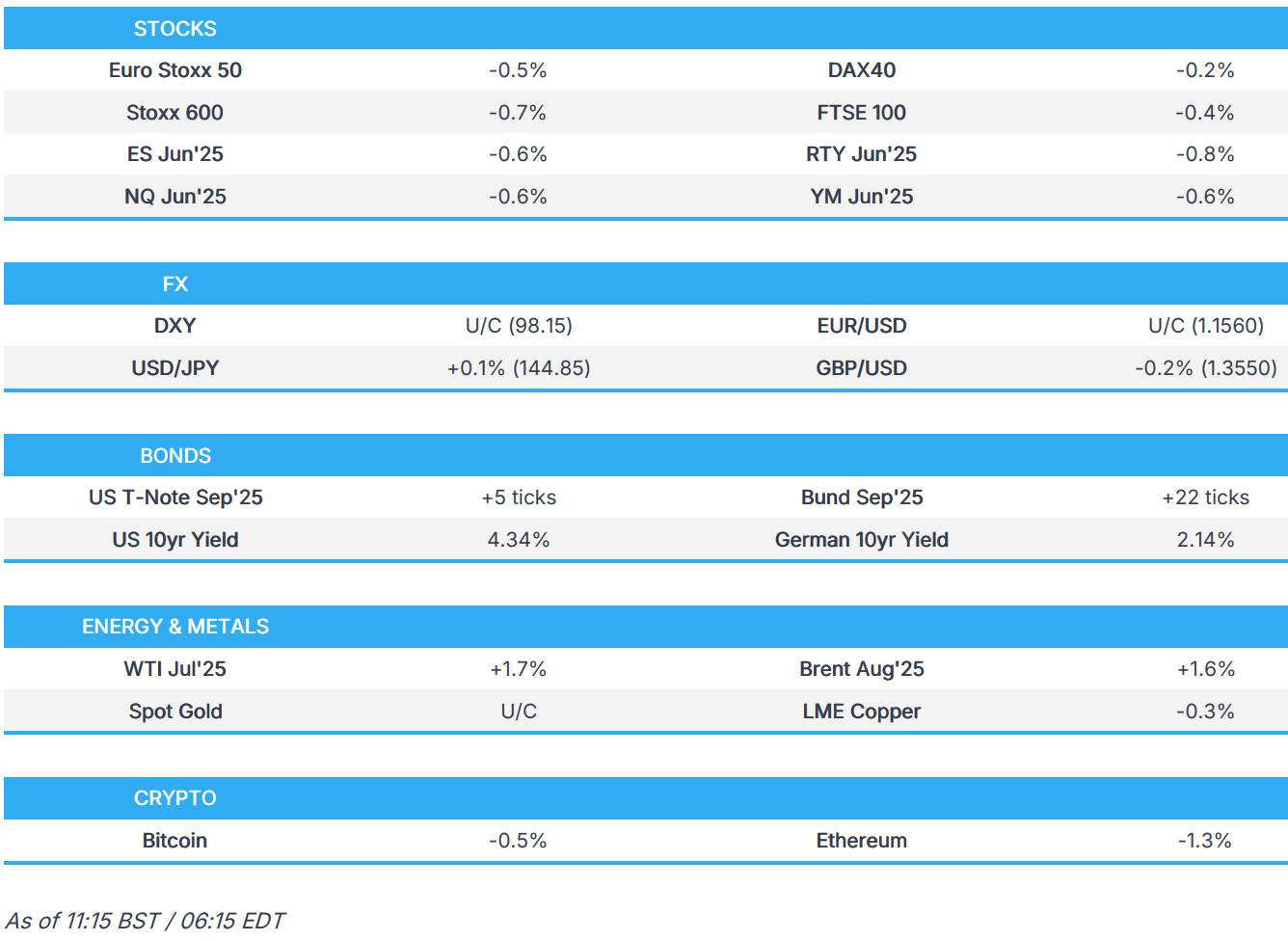

EQUITIES

- European bourses (STOXX 600 -0.8%) opened lower across the board and sentiment continued to wane as the morning progressed; the complex currently just off worst levels. Sentiment today has been hit amid the currently tumultuous geopolitical environment in the Middle East. Iran and Israel have continued to strike each other overnight and US President Trump said “Everyone should immediately evacuate Tehran!”, while also cutting his G7 trip short.

- European sectors hold a strong negative bias with only handful of sectors in positive territory. Unsurprisingly, Energy takes the top spot with the complex boosted by the ongoing strength in oil prices amid geopolitical uncertainty in the Middle East. Banks sit at the foot of the pile, joined closely by Telecoms and then Media.

- US equity futures (ES -0.6% NQ -0.6% RTY -0.8%) are lower across the board in-fitting with the downbeat risk tone seen in the European session. Focus now turns to US Retail Sales, Exports/Imports and Industrial Production.

- Click for the European Equity news

- Click for the additional news

- Click for a detailed summary

FX

- DXY is flat and trading in a tight 98.06-98.21 range. The news cycle remains fixated on the ongoing conflict between Iran-Israel. However, the latest reporting suggests that the US is looking to make a deal with Iran and will not be joining the Israeli offensive. Those hoping for a breakthrough on trade at the G7 summit have been left disappointed after Trump cut his visit short to head back to Washington. Albeit, Treasury Secretary Bessent is staying behind at the summit. Now focus turns to US Retail Sales later.

- EUR is flat vs. the USD as the pair struggles to hold above the 1.16 mark. In terms of recent newsflow, traders await any progress on the trade front between the EU and US after reports that leaders instructed teams to accelerate work on trade. However, in recent trade, US President Trump has stated that the EU is not yet offering a fair deal.

- USD/JPY was initially lifted during APAC trade with haven flows from geopolitics short-lived as Japanese PM Ishiba and US President Trump failed to reach a tariff agreement. Additionally, Japanese Finance Minister Kato added that there is no fixed plan right now to hold further talks with US Treasury Secretary Bessent. Thereafter, the pair saw downticks on the BoJ decision which saw the Bank stand pat on policy (as expected) and announce a reduction in the amount of monthly JGB purchases by about JPY 200bln each quarter from April 2026 onward. Some drew attention to the hawkish dissent from Tamura as well as a near-term increase in the taper of short-term JGBs. During Ueda’s press conference, JPY strength faded with the CB head stating that the Bank judged that downside risks are bigger for the economy and prices. USD/JPY currently sits towards the middle of its 144.41-145.11 range.

- GBP is fractionally softer vs. the USD and EUR after seeing some choppy price action following the US and the UK formally signing their trade agreement. The details of which mean that the US tariff on UK steel is to remain at 25%, for now. Inflation data for May hits on Wednesday and is expected to show headline Y/Y CPI hold steady at 3.5%, with the services component set to decline to 5.0% from 5.4%. GBP/USD is currently contained within Monday’s 1.3535-1.3622 range.

- Fell overnight on the BoJ which was largely as expected, with rates left unchanged and the taper pace trimmed to JPY 200bln a quarter (currently JPY 400bln) from April 2026 onwards. and at the top of the G10 leaderboard in an extension of the price action with both risk-sensitive currencies overlooking the downside in stocks.

- PBoC set USD/CNY mid-point at 7.1746 vs exp. 7.1820 (prev. 7.1789); strongest CNY fix since March 19.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- JGBs fell overnight on the BoJ which was largely as expected, with rates left unchanged and the taper pace trimmed to JPY 200bln a quarter (currently JPY 400bln) from April 2026 onwards. The hawkish impulse came from Tamura’s dissent, who favoured maintaining the old pace of tapering until end-Q1 2027.

- USTs are firmer, but only modestly so. In a relatively thin 110-15+ to 110-23 band. Overnight, the 20yr auction was better than the prior, but roughly in-line with the six auction average. More recently, USTs saw some modest movements alongside JGBs. Overall, the benchmark is awaiting US data and clarity on a number of moving parts.

- Bunds are also contained, but with a modest bearish bias in play. A bias which potentially comes ahead of supply, though the German outing today is small and size and thus shouldn’t be exerting too much influence. Initially saw some pressure on the lack of EU-US progress at the G7. However, the subsequent meeting between Trump and Commission President von der Leyen, and then von der Leyen posting that on trade they “instructed the teams to accelerate their work to strike a good and fair deal.”, offset some pressure.

- Gilts are trading in tandem with Bunds, but with the benchmark under slightly more pressure. But, as above, today’s range is limited and Gilts have been a little choppy within it, though the bias is more bearish than peers. A direction potentially exacerbated by the morning’s supply as the DMO is set to sell GBP 4.5bln 4.375% 2030 Gilt. The auction was well received, featuring a better b/c and smaller tails than the prior, but failed to spur any upside.

- Saudi National Bank is “teeing” up a USD-denominated debt sale, according to Bloomberg; said to be a 10yr with IPTs circa 235bps over USTs.

- UK sells GBP 4.5bln 4.375% 2030 Gilt: b/c 3.26x (prev. 3.23x), average yield 4.06% (prev. 3.977%) & tail 0.2bps (prev. 0.4bps).

- Germany sells EUR 0.988bln vs exp. EUR 1.0bln 2.10% 2029 and EUR 0.497bln vs exp. EUR 0.5bln 2.30% 2033 Green Bund.

- Click for a detailed summary

COMMODITIES

- Crude is higher by around USD 1.10/bbl with the complex continuing to remain bid given the continued Iran-Israel strikes and hawkish comments via US President Trump. Most pertinently, he posted that “Everyone should immediately evacuate Tehran!” – later he posted that he has “not reached out to Iran for ‘Peace Talks’ in any way, shape, or form”. Brent Sep’25 currently trades around USD 74.50/bbl.

- Spot gold is flat on the day, with Trump’s Tehran warning and the CBS interview failing to boost haven demand, and amid a flat Dollar.

- Copper trades indecisively amid the broader cautious risk tone following Israel-Iran updates.

- Russia’s Novak, on the need to change OPEC+ decision on oil production increase, says the world needs new volumes, but OPEC+ is ready to be flexible, via RIA. Global oil prices are not appropriate for most of the key oil producers.

- IEA OMR: World Oil Supply to rise by 1.8mln bpd in 2025 (prev. forecast rise of 1.6mln bpd); 2025 oil demand growth forecast to 720k bpd (prev. forecast 740k)

- Click for a detailed summary

NOTABLE DATA RECAP

- German ZEW Economic Sentiment (Jun) 47.5 vs. Exp. 35.0 (Prev. 25.2); ZEW says confidence is picking up in June 2025 and the indicator sees another tangible improvement; recent growth in investment and consumer demand have been contributing factors; ZEW Current Conditions (Jun) -72.0 vs. Exp. -75.0 (Prev. -82.0)

- EZ ZEW Survey Expectations 35.3 (prev. 11.6)

NOTABLE EUROPEAN HEADLINES

- ECB President Lagarde, in an FT Opinion piece, said Europe faces structural challenges. Its growth remains persistently low.

- ECB Stournaras says the ECB has reached a “first point of equilibrium” and any further rate cuts depend on data, speaking to Greek media.

- EU has refused to hold a flagship economic meeting with Beijing ahead of a leaders’ summit next month, according to FT.

- UK Chancellor Reeves is exploring reversing a decision to charge UK inheritance tax on the global assets of non-doms, according to FT.

NOTABLE US HEADLINES

- US Senate Finance Republicans release revised tax portion of US President Trump’s reconciliation bill; ” It includes major tax overhaul and Medicaid cuts”, according to CNN’s Raju. Senate Republican Tax and Budget Bill would end the USD 7,500 electric vehicle tax credit 180 days after signed into law. (of note for EV stocks). Proposes full phase-out of solar and wind energy tax credits by 2028, extends to 2036 for hydro, nuclear and geothermal.

- OpenAI and Microsoft (MSFT) tensions are reaching a boiling point, via WSJ; “The startup, growing frustrated with its partner, has discussed making antitrust complaints to regulators”. OpenAI seeks new financial concessions from Microsoft (MSFT), according to The Information. OpenAI wants to modify existing clauses in the contract with Microsoft that give the Co. exclusive rights to host OpenAI models in its cloud. OpenAI wants Microsoft to have a roughly 33% stake in reshaped units in exchange for foregoing its rights to future profits.

- Final Senate passage vote on the GENIUS Act scheduled for Tuesday at 16:30 EDT.

GEOPOLITICS

EUROPEAN SESSION

- CBS’s Jacobs writes US President Trump said “I didn’t say I was looking for a ceasefire,” he said on AF1. He said he wants “a real end,” with Iran “giving up entirely” on nukes.” On any threat to US interests, he said Iran knows not to touch our troops. US would “come down so hard if they do anything to our people,” he said. Asked his thinking on calling for Tehran to evacuate, he told me he wants “people to be safe.” Asked if US involvement would destroy Iran nuclear program, hope their program “is wiped out long before that.” Trump sounded undecided about sending Witkoff and/or VP Vance to meet with Iran. “I may,” he said. But “it depends what happens when I get back,” he said. Trump declined to say if the chairman of joint chiefs and SecDef have provided him with planning options should Iran attack U.S. bases in Middle East. “I can’t tell you that,” he told me. The Israelis aren’t slowing up their barrage on Iran, he predicted. “You’re going to find out over the next two days. You’re going to find out. Nobody’s slowed up so far.”

- Israeli officials tell Axios that regime change isn’t an official war aim, discussions about it are getting louder and more overt, via Axios.

- Politico Reports: US President Trump will convene his closest military advisers in the Situation Room this morning, where he weighs “whether to join Israel’s bombardment of Iran”.

- US President Trump says he is “looking for better than a ceasefire in Iran”, “not too much in the mood to negotiate with Iran”.

- US President Trump says he has “not reached out to Iran for ‘Peace Talks’ in any way, shape, or form”.

- Senior Iranian Army Commander says attacks against Israel will intensify in the next hours, new wave of drones will hit Israel, via IRNA.

- CNN, citing sources, reports that Iran was up to three years away from being able to produce a nuclear bomb, via Sky News Arabia; US official cited adds that they believe recent Israeli strikes have pushed this back by only a few months.

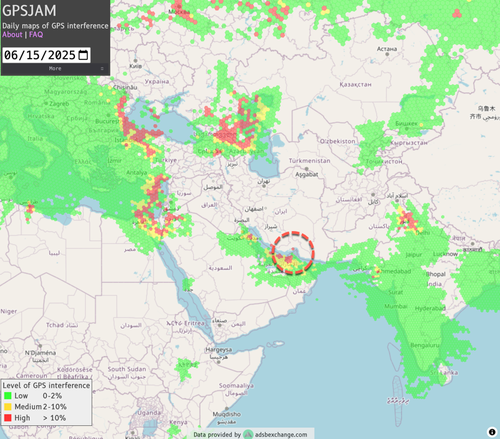

STRIKES

- Iranian ballistic missiles reported over Tel Aviv, via Fox correspondent.

- Iranian media reported several explosions and heavy air defence fire in the capital Tehran; Several explosions east of Tehran amid air defence fire, according to Fars.

- Reports of multiple explosions in Ahvaz – in the oil-rich province of Khuzestan in southwest Iran, according to Iran International.

- Unconfirmed reports noted that three ships are on fire in the Gulf of Oman near the Strait of Hormuz, according to several social media accounts. Ambrey later said it is aware of an incident 22 nautical miles east of Khor Fakkan in UAE (close to the Strait of Hormuz). Incident in Khor Fakkan near the Strait of Hormuz seemingly was caused by two vessels colliding, according to Kpler’s Bakr citing their terminal

- IAEA Director Grossi said the damage recorded at Fordow was very limited, underground spaces at the Isfahan facility do not appear to have been affected.

DIPLOMACY

- US President Trump directed members of his team to attempt a meeting with Iranian officials as quickly as possible, according to CNN sources.

- Trump team proposes Iran talks this week on nuclear deal and ceasefire, according to Axios. The White House is discussing with Iran the possibility of a meeting this week between U.S. envoy Steve Witkoff and Iranian Foreign Minister Abbas Araghchi, according to four sources briefed on the issue.

- Israeli media reports that Trump is preparing to make a ‘final offer’ to Iran in the coming days, according to Spectator Index.

- US President Trump said Iran should have signed the deal, Iran wants to make a deal, according to Reuters.

- French President Macron said Americans have made an offer to meet with Iranians, now will see what happens. Macron said European partners are ready to take part in serious Iran nuclear negotiations if a ceasefire is reached. Macron said Trump told G7 leaders there were discussions to obtain a ceasefire between Israel and Iran.

TRUMP

- US President Trump posted “Iran should have signed the “deal,” I told them to sign…IRAN CAN NOT HAVE A NUCLEAR WEAPON… Everyone should immediately evacuate Tehran!”

- US President Trump posted “AMERICA FIRST means many GREAT things, including the fact that IRAN CAN NOT HAVE A NUCLEAR WEAPON. MAKE AMERICA GREAT AGAIN!!!”

- “President Trump is leaving the G7 summit EARLY and will return to DC tonight.”, according to CNN reporter; Bloomberg suggests due to the Middle East crisis.

- US President Trump requested the National Security Council be prepared in the Situation Room, according to reports citing Fox.

- “US is NOT joining Israel offensively in its military operation, per US officials. Despite reports that President Trump asked the NSC and Situation Room to be readied,” according to CBS’ Jacobs.

- CBS’ Jacobs posted “Trump isn’t leaving [right now] because of discussions for a ceasefire between Israel and Iran, I’m told…He is leaving G7 halfway through. Not entirely clear why”.

- US President Trump posts that his return to Washington had nothing to do with a ceasefire.

ALLIES

- Trump admin reportedly told several Middle Eastern allies on Sunday that it doesn’t plan to get actively involved in the war between Israel and Iran unless Iran targets Americans, according to Axios sources

- US is sending another aircraft carrier, and more warships to the Middle East, according to NBC.

- US Defense Secretary Hegseth said over the weekend he directed the deployment of additional capabilities to the US CENTCOM; additional deployments are intended to enhance the defensive posture in the region, according to Reuters.

- US Defense Secretary Hegseth said US President Trump still aims for a nuclear deal with Iran, via Fox News; assets in the region will be defended.

- White House aide said it is not true that the US is attacking Iran; says American forces are maintaining their defensive posture.

- “This may really be the last chance for the Iranians before the US actively joins”, according to journalist Stein citing a US source.

CRYPTO

- Bitcoin is a little lower and trading just above the USD 106k mark; Ethereum holds around USD 2.5k.

BOJ

POLICY ANNOUNCEMENT

- BoJ maintained its interest rate at 0.5% as expected through a unanimous vote. The Bank has also decided to reduce the amount of its monthly JGB purchases by about JPY 200bln each quarter starting from April 2026, in line with source reports.

- The decision on the bond taper plan was made with an 8-1 vote, with Board member Tamura dissenting. Tamura dissented, arguing that the Bank should allow long-term interest rates to be determined by the market and its participants. He proposed that the Bank reduce its monthly outright purchases of JGBs by about 400bln yen each calendar quarter until January-March 2027 in principle, but this proposal was defeated by a majority vote.

- As part of the taper plan, Japan will continue to reduce JGB purchases by JPY 400bln per month until March 2026. From April 2026 onwards, the amount of monthly JGB purchases will be reduced by about JPY 200bln per quarter, with the total monthly purchases expected to be around JPY 2tln by January-March 2027. An interim assessment of the bond taper plan for the period starting in April 2026 will take place at the June 2026 policy meeting, and Japan is prepared to amend the taper plan at future policy meetings if necessary. The BoJ’s holdings of JGBs are expected to decrease by roughly 16-17% by March 2027 compared to June 2024 levels.

- BoJ said the frequency of auctions will be changed from four times a month to three times a month in principle for JGBs with shorter maturities; the frequency of auctions for JGBs with longer maturities has been maintained.

- Regarding economic conditions, Japan has maintained its economic assessment, noting that the economy has recovered moderately despite some areas of weakness. However, uncertainty remains high, particularly over the impact of trade policies, which are a key focus. The BoJ emphasised the necessity of paying attention to the potential effects of trade policies on financial and foreign exchange markets. Inflation expectations have risen moderately, but it remains extremely uncertain how global trade policies will evolve and how overseas economic activities will respond.

UEDA

- BoJ Governor Ueda says it is too quick tapering of bonds could result in unexpected effects in the market. Do not see much negative impact of reducing tapering on the economy. Judged that downside risks are bigger for the economy and prices. Inflation expectations are still not anchored to 2% in Japan. Expects the impact of trade policies to become more evident. Will not rule out any tools, when questioned on YCC. Click for BoJ Ueda’s full press conference..

APAC TRADE

- APAC stocks traded mixed/mostly lower with the region failing to coattail on Wall Street’s gains, as geopolitical angst kept risk subdued, namely after US President Trump posted that “Everyone should immediately evacuate Tehran!” before cutting his G7 trip short, stoking fears of a US military offensive. Sentiment later stabilised after CBS reported that the US is not joining Israel offensively in its military operations against Iran, with US officials also backing a defensive stance amid assets in the region.

- ASX 200 traded slightly softer and in a narrow range, with upside in gold miners cushioning losses for the index.

- Nikkei 225 was kept afloat amid the softer JPY after the US and Japan failed to reach an agreement. The index saw a modest hawkish reaction to the BoJ decision which reduced the pace of JGB purchases as telegraphed.

- Hang Seng and Shanghai Comp opened flat before tilting lower in overall uneventful trade across the Chinese bourses amid the cautious risk tone with the immediate focus largely on geopolitics.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 197.3bln via 7-day reverse repos with the rate maintained at 1.40%.

DATA RECAP

- New Zealand Food Price Index (May) 0.5% (Prev. 0.8%)

Loading…