U.S.

Choppy trade with FOMC out of the way and focus back on Israel-Iran – Newsquawk Asia-Pac Market Open

58 minutes ago

Originally posted by: Zero Hedge

- US stocks ended the day with marginal gains, albeit with outperformance in the Russell, while geopolitics, Fed, and Trump dominated the tape.

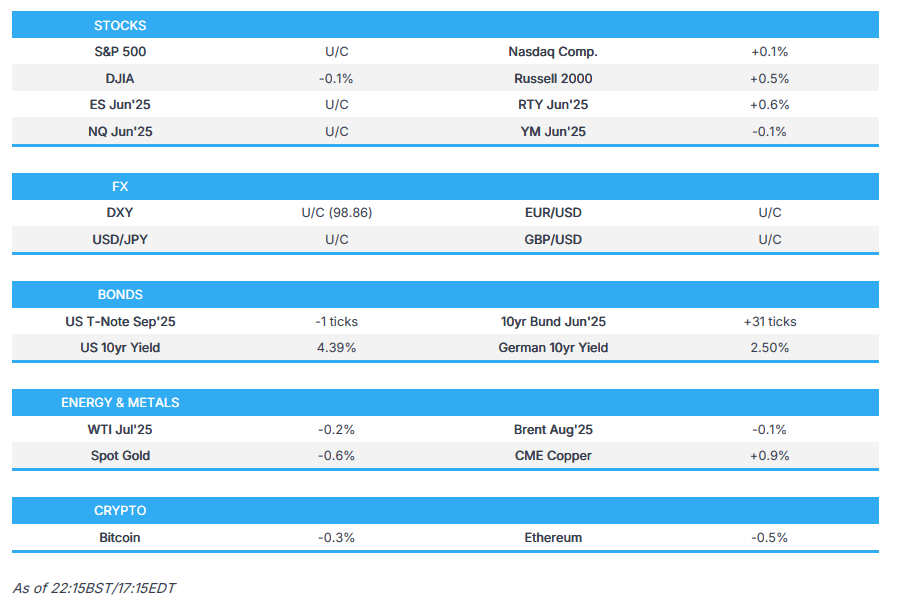

- The Federal Reserve left rates unchanged at 4.25-4.5%, as was widely expected, with the 2025 dot plot left unchanged at 3.9%, which signals 50bps of cuts this year, although the 2026 dot plot was revised higher to 3.6% from 3.4% and 2027 was revised up to 3.4% from 3.1%.

- However, there was some discourse over the number of cuts seen this year. Seven members see no cuts this year, vs. four in March, while two see 25bps cuts, down from four in March, eight see 50bps (prev. nine), and two see 75bps of easing (unchanged from March).

- Iranian official from the Foreign Ministry, who asked not to be named, said that Iran would accept President Trumpʼs offer to meet soon, according to NYT.

- US President Trump has reportedly privately approved attack plans for Iran, but has withheld the final order, according to WSJ sources.

- Looking ahead, highlights include Japanese Foreign Investments, Australia Labour Force, 5-year JGB Auction.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks ended the day with marginal gains, albeit with outperformance in the Russell, while geopolitics, Fed, and Trump dominated the tape.

- SPX -0.03% at 5,981, NDX unch at 21,720, DJI -0.10% at 42,172, RUT +0.52% at 2,113

- Click here for a detailed summary.

NOTABLE HEADLINES

- BoC Governor Macklem said the world had already been becoming more fragmented before Trump was elected, so businesses were still facing uncertainty, according to Reuters.

- EU antitrust regulators were set to open a full-scale investigation into the USD 36bln Mars bid for Kellanova (K), according to Reuters sources, as regulators were concerned about Mars’ high market share in certain products in some EU countries.

- Microsoft (MSFT) is planning thousands more job cuts aimed at sales people, Bloomberg reported.

DATA

- US Initial Jobless Claims 245.0k vs. Exp. 245.0k (Prev. 248.0k, Rev. 250k)

- US Continued Jobless Claims 1.945M vs. Exp. 1.932M (Prev. 1.956M, Rev. 1.951M)

- US Building Permits: Number (May) 1.393M vs. Exp. 1.428M (Prev. 1.422M)

- US Build Permits: Change MM (May) -2.0% (Prev. -4.0%)

- US Housing Starts Number (May) 1.256M vs. Exp. 1.357M (Prev. 1.361M, Rev. 1.392M)

- US House Starts MM: Change (May) -9.8% (Prev. 1.6%, Rev. 2.7%)

- US MBA Mortgage Applications -2.6% (Prev. 12.5%)

- US MBA 30-Yr Mortgage Rate 6.84% (Prev. 6.93%)

TRADE/TARIFFS

- US Treasury Secretary Bessent said he would likely meet with China in about three weeks, via New York Post. He stated that China’s share of global manufacturing had become far “too high” in recent years. “So the idea was we agreed in London: magnets start flowing, we take down our countermeasures, and then we’d probably have another in-person meeting in three weeks to see if we can do this mutual rebalancing. It should be natural,” he said.

- The UK Government said it expected tariff arrangements with the US on cars and aerospace to come into force by the end of the month, according to Reuters.

- South Africa and the US are set to resume trade talks next week, according to Bloomberg.

- Indian Trade Minister said India was currently negotiating nine trade deals, including one with the EU, according to Reuters.

- German Chancellor Merz expressed hope for an agreement in the US-EU tariff row in the coming days, according to Reuters.

FOMC

STATEMENT AND SEP

- The Federal Reserve left rates unchanged at 4.25-4.5%, as was widely expected, with the 2025 dot plot left unchanged at 3.9%, which signals 50bps of cuts this year, although the 2026 dot plot was revised higher to 3.6% from 3.4% and 2027 was revised up to 3.4% from 3.1%. However, there was some discourse over the number of cuts seen this year. Seven members see no cuts this year, vs. four in March, while two see 25bps cuts, down from four in March, eight see 50bps (prev. nine), and two see 75bps of easing (unchanged from March).– Highlighting the close proximity for the median dot, 9 members see FFR above median, 10 members see FFR at median or below. GDP forecasts were cut for both 2025 and 2026 to 1.4% (prev. 1.7%) and 1.6% (exp. 1.8%), respectively, while unemployment rate forecasts ticked higher across all time horizons ex. long-run. Headline and Core PCE inflation dots were also notably lifted with the 2025-end headline rate seen at 3.0% (prev. 2.7%) and 2026 at 2.4% (prev. 2.2%).

- Regarding the statement, the Committee said the uncertainty about the outlook has “diminished further but remains elevated”, a change from the prior “increased further”, and it also removed the stagflation warning line that “risks of higher unemployment and higher inflation have risen”.

PRESS CONFERENCE

- Fed Chair Powell largely echoed familiar remarks in that a patient and wait-and-see approach is appropriate. He also toed the usual line post SEPs that projections are subject to uncertainty, and are not a set plan.

- He recommended focusing on the near-term projections due to the difficulty of providing longer-term forecasts. Looking ahead, Fed Chair Powell said the time will come when they have more confidence, but he cannot say exactly when that will be.

- He stressed that as long as they have the kind of labour market they have, and inflation is coming down, the right thing to do is hold rates. Powell expects to learn a great deal more over the summer, adding they will make smarter decisions if they wait a “couple of months”.

- Powell noted inflation has been favourable over the last three months, but he expects to see more tariff impacts in the coming months and expects businesses to pass on costs to consumers, again stressing this is why the Fed need to be patient. Powell said they have to keep rates high to get inflation all the way down, and he described policy as “modestly restrictive”, noting it is not very restrictive. Powell in May said “policy is sort of modestly or moderately restrictive”.

REACTION

- The unchanged 2025 dot plot initially resulted in gains in stocks and Treasuries, alongside a Dollar sell off. However, moves had started to pare as the hawkish composition of the 2025 dot plot was digested, while the 2026 and 2027 dots were revised up. Meanwhile, inflation projections were revised up, growth forecasts were revised down and unemployment forecasts were revised higher, likely to incoporate the expected impact of tariffs.

- In Powell’s presser, he largely echoed familiar remarks in that a patient and wait-and-see approach is appropriate, and that they would learn more over the summer to make smarter decisions, weighing on T-notes, stocks and supporting the Dollar. However, Trump managed to steal the limelight through the Fed and saw pronounced downside in the crude complex and upside in indices as he said he may meet with Iran

FX

- The Dollar was firmer following Fed Chair Powell’s press conference, while US President Trump kept markets uncertain over the US involvement in the Israel-Iran conflict.

- G10 FX was split on Wednesday, with GBP, CAD, and CHF in the red, while Antipodes and JPY outperformed in the green.

- SEK was broadly weaker against peers following a dovish Riksbank cut. The decision was as expected.

FIXED INCOME

- T-notes catch a bid on SLR reports but fade as Fed Chair Powell pushes back on near-term rate cuts.

- Germany sold EUR 1.408bln vs exp. EUR 1.5bln 2.50% 2054 and sells EUR 0.988bln vs. exp. EUR 1.0bln 2.50% 2046 Bund.

- US Treasury Holdings (April, USD): China 757bln (prev. 765bln), Japan 1.135tln (prev. 1.131tln), UK 808bln (prev. 779bln).

COMMODITIES

- The crude complex was choppy on Wednesday amid a deluge of Middle East updates, but ultimately settled higher.

- Iranian Oil Minister said fuel supplies were currently stable and that there were no issues at present, according to Reuters.

- Kazakhstan’s Energy Minister said the country had not been considering exiting the OPEC+ agreement, according to Reuters.

- Russian Deputy Prime Minister Novak said there was no shortage of oil due to the Middle East conflict and no risk of Russian oil exports declining as a result, according to Reuters.

- Chinese May crude iron ore output -3.6% Y/Y at 85.79mln metrics tons, according to the Chinese stats bureau.

- Russian Deputy Prime Minister Novak said that current oil prices and a stronger rouble were complicating Russia’s financial models. He added that he expected the Saudi Energy Minister to attend the Economic Forum in St Petersburg tomorrow, according to Reuters.

DATA

- US EIA Weekly Crude Production Change, 0.02% (Prev. 0.15%)

- US EIA Weekly Crude Production Change, bbl 3k (Prev. 20k)

- US EIA Weekly Crude Production 13.431M (Prev. 13.428M)

- US EIA Weekly Crude Stocks w/e -11.473M vs. Exp. -1.794M (Prev. -3.644M)

- US EIA Weekly Gasoline Stk w/e 0.209M vs. Exp. 0.627M (Prev. 1.504M)

- US EIA Weekly Dist. Stocks w/e 0.514M vs. Exp. 0.44M (Prev. 1.246M)

- US EIA Weekly Refining Util w/e -1.1% vs. Exp. -0.2% (Prev. 0.9%)

- US EIA Wkly Crude Cushing w/e -0.995M (Prev. -0.403M)

- US EIA- Nat Gas, Change Bcf w/e 95.0bcf vs. Exp. 98.0bcf (Prev. 109.0bcf)

GEOPOLITICAL

- Iranian official from the Foreign Ministry, who asked not to be named, said that Iran would accept President Trump’s offer to meet soon, according to NYT.

- US President Trump has reportedly privately approved attack plans for Iran, but has withheld the final order, according to Bloomberg citing WSJ sources.

- A situation room meeting that President Donald Trump referred to earlier today has convened to discuss the ongoing conflict between Iran and Israel, according to a senior White House official cited by NBC.

- “People with ties to the White House continue to believe — barring a 180 from the Iranians — [US strike] coming possibly by the weekend.”, according to FBN’s Gasparino.

- US President Trump said he would hold a meeting to discuss the Iran-Israel situation. He stated that Iran wanted to meet and that “anything could happen,” but he had not made a final decision yet. He remarked that Israel was doing “pretty well” and had discussed Iran with a Pakistani army official. He said he had told Israeli PM Netanyahu to continue and that they would meet shortly in the operating room, where he had ideas on what they were going to do. “I make my decisions at the last minute,” he added. Trump said he believed Iran was only a few weeks away from having a nuclear weapon. When asked about the Middle East, he said, “I don’t want to get involved.” He also stated that he believed Iran would use a nuclear weapon if it had one. On acting against Fordow, he said he had not made a decision. He noted that a deal could still happen and that he had not closed the door on meeting with Iran. He added that his supporters did not want to see Iran acquire a nuclear weapon. He suggested that fighting might be necessary to block Iran’s nuclear ambitions, and that they were aiming for total victory — meaning no nuclear weapon. He concluded that if Israel did a good job, they would not need to fight, according to Reuters.

- The Iranians had conveyed a message to the Qataris, who, together with the Omanis, were trying to mediate for a ceasefire, saying they were willing to talk in order to reach an agreement with the US, but that Israel needed to “calm things down”, via Jerusalem Post.

- A US official told Al Jazeera that US forces in the Middle East had taken maximum security measures, and that none of the B-2 bombers had yet headed to the region.

- The Iranian Foreign Ministry denied the arrival of an Iranian negotiating delegation to the Omani capital, Muscat, according to Sky News Arabia.

- A senior Iranian official said any direct US entry onto the front line would be met with an unprecedented threat to enemy ships, via Al Jazeera.

- The army is at the peak of its preparations for the US to enter the war on Iran, according to Al Hadath citing Israeli broadcasting.

- Israel estimated that the US would join the attack on Iran and the Fordow nuclear facility, according to Sky News Arabia citing the Israeli Broadcasting Authority.

- An IDF spokesman said they would continue to strike nuclear reactors in Iran, Al Jazeera reported.

- CENTCOM Commander Kurilla met with President Trump and briefed him on the military option, Jerusalem Post reported.

- Iran reportedly thwarted a large-scale attack on its banking network, according to Fars.

- The Iranian ambassador to the UN said that if Iran came to the conclusion that the US was directly involved in attacks on its territory, it would begin responding to the US, according to Reuters.

- Iranian Supreme Leader Khamenei said, “We would not ignore any attack on our territory; our armed forces were on alert,” via Al Arabiya.

- Iranian Supreme Leader Khamenei said Israel had made a huge mistake and would be punished for it, via Mehr News. Speaking to the US, he said they should know that Iran would not surrender and that any US strike would have serious, irreparable consequences.

- On Iran-Israel, a US administration official said, “The movement right now was away from diplomacy and toward US involvement,” with the situation “moving towards taking out Iranian nuclear facilities,” via Politico.

- The Russian Foreign Ministry said, “We were millimetres away from catastrophe” due to daily Israeli strikes on Iran’s nuclear infrastructure, according to RIA.

- The Israeli security cabinet is scheduled to hold a meeting this evening, according to Sky News Arabia citing Israeli media.

- The Israeli army had attacked the “Fordow” nuclear facility at least once while it was still operating and was planning to re-target it strongly, according to Sky News Arabia citing Maariv.

- Israeli Defence Minister Katz said Israeli Air Force fighter jets had just “destroyed the headquarters of the Iranian regime’s internal security, the main arm of the Iranian dictator’s oppression,” via Times of Israel’s Fabian.

- Israel had told people it had the ability to proceed on its own with its strategy against Iran’s nuclear effort and had left it to the White House to decide whether to join, according to CBS.

- US Defence Secretary Hegseth said they were working to protect navigation within the Red Sea, according to Reuters.

- US President Trump told Israeli PM Netanyahu to keep going, but had not given any indication that the US would provide further assistance, according to Reuters.

- US Defence Secretary Hesgeth said he would not disclose in a public forum whether he had given US President Trump options on a strike against Iran, according to Reuters.

- US President Trump said he still planned to attend the NATO event, according to Reuters.

- When questioned about Iranian Supreme Leader Khamenei, Trump said “good luck” and added that his patience had already run out.

- US President Trump said he could not say whether the US would strike Iran, stating that Iran was in a lot of trouble and wanted to negotiate. He added that nothing was too late and that Iran had reached out. On striking Iran, he said: “I may do it. I may not do it. I mean, nobody knows what I’m going to do.” He noted there was a big difference between now and a week earlier. He claimed Iran had suggested coming to the White House and that he did not know how much longer the situation would continue. He added that Iran was totally defenceless and had no air defences whatsoever. On the idea of unconditional surrender, Trump said it meant he had had enough, that Iran had bad intentions, and that it implied: “I give up, no more. Then we go blow up all the nuclear stuff that’s all over the place there.” Regarding his schedule, Trump said next week would be big—maybe even less than a week—and that nothing was finished yet. On Russia, he said he had spoken with President Putin on Tuesday and was focusing on his situation rather than on the Middle East, according to Reuters.

ASIA-PAC

NOTABLE HEADLINES

CENTRAL BANKS

- ECB’s Panetta said the ECB would continue to take decisions on a meeting-by-meeting basis, without pre-committing to a defined monetary policy course. He added that macro risks had arisen from conflicting signals in US trade policy and the recent escalation of the Israel-Iran conflict. He noted that the macro outlook remained subject to substantial and difficult-to-quantify risks, according to Reuters.

- ECB’s Nagel said the ECB’s mission was more or less accomplished, according to Reuters.

- ECB’s Villeroy said trade wars were unfortunate and called them nonsense because they added divisions, via Econostream.

- ECB’s Centeno said he was very worried about growth in Europe, and that without growth, inflation would not reach 2%, according to Reuters.

- BoC Governor Macklem said the prospect of a new Canada-US trade deal offered hope that tariffs would be removed. He noted that recent progress towards a new deal was encouraging, and the BoC was following developments closely. He added that cutting rates would be more difficult if the recent firmness in underlying inflation persisted. Until a trade deal was reached, inflation would be affected by both US tariffs and Canadian counter-tariffs. He stated that the BoC was proceeding carefully with monetary policy. Macklem said a rate cut would be needed if the effects of US tariffs and uncertainty continued to spread through the economy and if cost pressures on inflation were contained. He added that the BoC was watching closely for signs that weakness in the job market was broadening. He noted that assessing the inflationary impact of tariffs had been a moving target because the US had repeatedly changed the size and scope of the measures. Final domestic demand in Canada had been soft in Q1, and if tariffs and uncertainty continued, households and businesses would likely remain cautious, according to Reuters.

- Swedish Riksbank Rate 2.0% vs. Exp. 2.0% (Prev. 2.25%); rate path entails some probability of another rate cut in 2025. The economic recovery that began last year has lost momentum, and inflation is expected to be somewhat lower than in the previous forecast.Riksbank’s Thedeen says the bank is not promising anything with the rate path, “it is our best estimate”.

- CNB’s Kubicek said the central bank might have to refrain from lowering interest rates any further, according to Bloomberg.

EU/UK

NOTABLE HEADLINES

DATA

- UK CPI YY (May) 3.4% vs. Exp. 3.4% (Prev. 3.5%); MM (May) 0.2% vs. Exp. 0.2% (Prev. 1.2%)

- UK CPI Services MM (May) -0.10% vs. Exp. 0.10% (Prev. 2.20%); YY (May) 4.70% vs. Exp. 4.80% (Prev. 5.40%)

- UK Core CPI YY (May) 3.5% vs. Exp. 3.5% (Prev. 3.8%); MM (May) 0.2% vs. Exp. 0.2% (Prev. 1.4%)

- UK RPI YY (May) 4.3% vs. Exp. 4.2% (Prev. 4.5%); MM (May) 0.2% vs. Exp. 0.1% (Prev. 1.7%); YY (May) 4.1% (Prev. 4.2%); RPI-X (Retail Prices) MM (May) 0.2% (Prev. 1.8%)

- EU Current Account SA, EUR (Apr) 19.8B (Prev. 50.9B); NSA, EUR (Apr) 19.3B (Prev. 60.1B)

- EU HICP Final YY (May) 1.9% vs. Exp. 1.9% (Prev. 1.9%

Loading…