Chinese Automakers Target Using 100% Domestic Made Chips In New Vehicles

Not only is China starting to dominate the auto market throughout the world, now they’re seeking to do it using exclusively home-grown chips, according to a new report from Nikkei.

Chinese automakers, including SAIC, Changan, BYD, Geely, Li Auto, and Great Wall, are planning to launch models using only domestically made chips, with at least two aiming for mass production as early as 2026, according to Nikkei Asia. These efforts are part of Beijing’s push for semiconductor self-reliance amid growing U.S.-China tech tensions.

The Ministry of Industry and Information Technology (MIIT) is leading the initiative, urging automakers—especially state-owned ones—to assess and increase their domestic chip usage. The latest policy goal is for all automotive chips to be 100% locally developed and manufactured by 2027. “The 100% target is not mandatory,” sources said, but companies are expected to show strong efforts toward meeting it.

Nikkei writes that most Chinese automakers still rely on U.S. and foreign chips, particularly for high-end features like autonomous driving. Nvidia’s and Qualcomm’s solutions remain common in smart cockpits and AI-driven systems. “Rapidly shifting to 100% domestic supplies would be challenging,” several suppliers said.

However, domestic momentum is building. Automakers like GAC Group are working with foundries such as SMIC and CanSemi to verify homegrown chip alternatives. “Some of [our] carmaking customers such as Geely have told them they would prioritize using locally developed chips if those options existed,” said an executive with a Chinese chip developer.

Supply chain localization is accelerating across the board. One display maker said, “We are required to replace not only driver ICs with China-made chips, but also some components and materials, such as optical films… We have to switch them to Chinese suppliers by next year at the earliest.” Another noted that “it only takes six to nine months for testing and qualification for Chinese automobile makers,” compared to three to five years for European clients.

China’s EV manufacturers are also becoming more flexible by using consumer-grade chips for noncritical functions like infotainment systems. This shift reflects both localization goals and cost pressure, especially as global chipmakers like STMicroelectronics, NXP, and Infineon increase partnerships with Chinese foundries to localize production. “Chinese clients were asking the chipmaker to localize production of chips for their home market,” Infineon CEO Jochen Hanebeck told Nikkei.

The chip landscape in cars is rapidly evolving. Traditionally dominated by microcontrollers and analog chips for basic functions, modern EVs now require far more components for computing, battery management, cameras, and displays. Fortunately, many of these chips can be made with mature-node technology, which China is aggressively expanding.

“Specifically, the analog market and a large portion of the microcontroller units (MCUs) market have endured a few years of soft market growth due in part to pricing pressures on these devices that are built mostly on mature process nodes,” said TechInsights analyst Brian Matas. Still, “China has a long way to go.” In 2025, only about 17.5% of China’s $185 billion IC market will be met by local production, according to TechInsights.

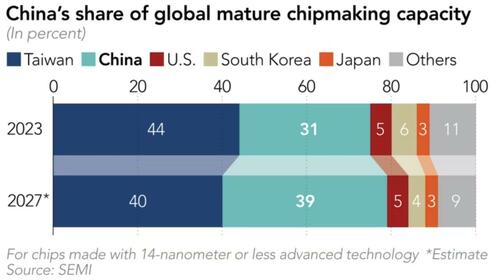

SEMI projects that by 2027, China will account for nearly 40% of global mature-node chip production capacity—up from 31% in 2023—while the U.S. will account for just 5%.

Loading…