Money

China to purchase US soybeans; European equity futures lower – Newsquawk European Opening News

12 hours ago

Originally posted by: Zero Hedge

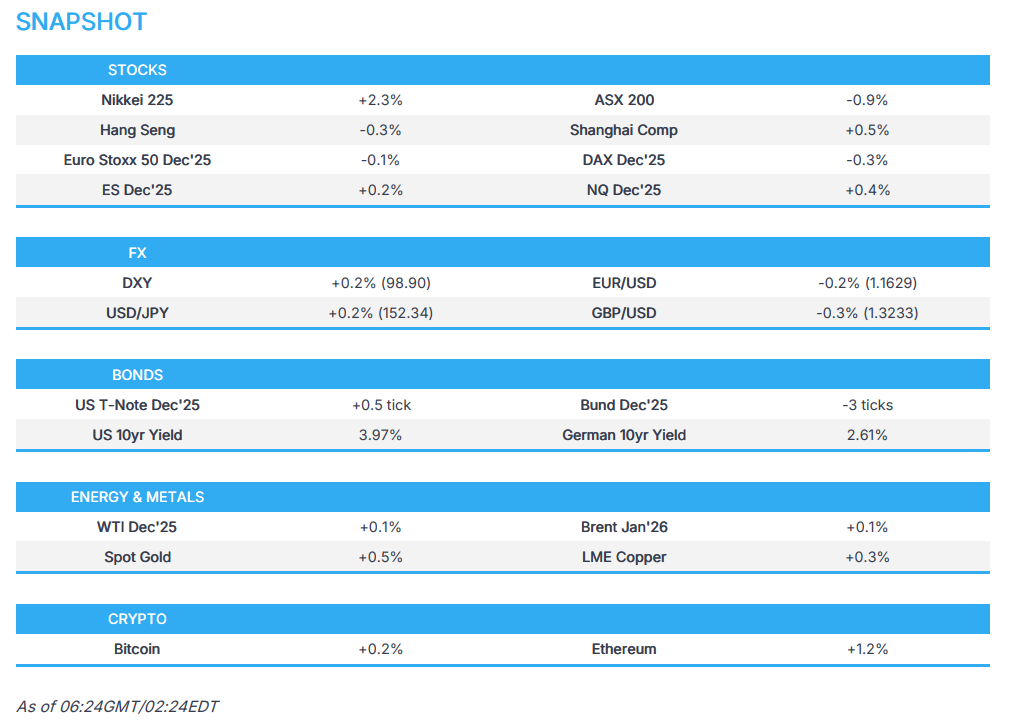

- APAC stocks were predominantly in the green following the tech strength on Wall St, most indices extended to record highs.

- US President Trump said he had a great trip so far and expects to lower fentanyl-linked tariffs on China. China said to have made soybean purchase.

- European equity futures indicate a marginally lower cash market open with Euro Stoxx 50 future down 0.1% after the cash index closed with losses of 0.1% on Tuesday.

- USD is broadly firmer vs. peers with GBP still under pressure. AUD leads as hot Aus CPI dashes hopes of an RBA rate cut next month.

- Israeli planes launched strikes on Gaza City. US VP Vance said he thinks peace in the Middle East will hold despite skirmishes.

- Looking ahead, highlights US Pending Homes (Sep), FOMC & BoC Policy Announcements, US President Trump to meet South Korea’s Leader, Fed Chair Powell & BoC’s Macklem, Supply from UK, Germany & US.

- Earnings from Meta, Microsoft, Alphabet, Google, Starbucks, eBay, Verizon, Boeing, CVS, Caterpillar, Phillips 66, UBS, BASF, Mercedes-Benz, Deutsche Bank, Equinor, Santander, GSK & Airbus.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

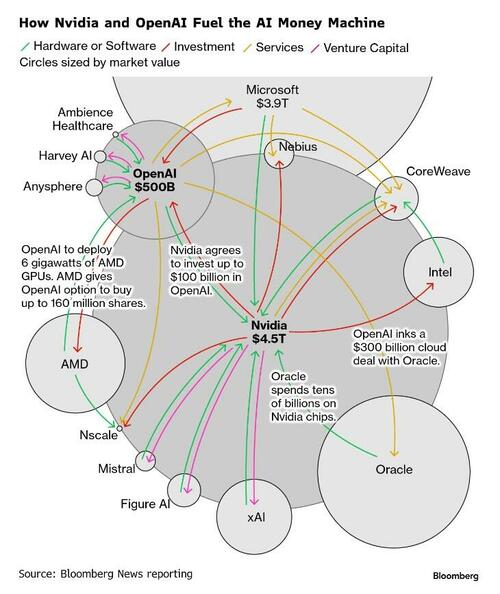

- US stocks were ultimately mixed although most indices finished in the green in which the SPX, DJIA and NDX extended on record highs, with outperformance in tech amid strength in NVIDIA (+5%) alongside CEO Huang’s keynote address at GTC, where new lines of products and roadmaps were unveiled, including NVIDIA Arc, 17 quantum builders, and 7 new AI supercomputers. Furthermore, the Co. sees USD 500bln of business in the next five quarters. Microsoft (+2%) also facilitated the upside in tech after signing a new pact with OpenAI, which includes OpenAI being contracted to purchase USD 25bln of Azure services as well as removing fundraising constraints for OpenAI. On the flip side, most sectors were pressured, with Real Estate the biggest loser as poor guidance from Alexandria Real Estate (-19.2%) weighed.

- SPX +0.23% at 6,891, NDX +0.74% at 26,012, DJI +0.34% at 47,706, RUT -0.60% at 2.507.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump and Chinese President Xi will discuss lowering China tariffs for fentanyl crackdown, in which the US would cut in half the 20% levies on Chinese goods imposed in retaliation for the export of chemicals that make deadly synthetic opioids. However, the expected agreements are subject to change and dependent on the meeting of the two leaders, while details are expected to be hammered out in subsequent negotiations, while the US and China are also expected to reduce port fees on each other’s ships, according to WSJ.

- US President Trump said he had a great trip so far and expects to lower fentanyl-linked tariffs on China, while he will discuss farmers and fentanyl with China. Trump reiterated that he thinks they will have a great meeting with Chinese President Xi and relations with China are very good. Furthermore, Trump said he may speak about NVIDIA’s (NVDA) Blackwell chip with Xi.

- NVIDIA (NVDA) CEO Huang said he is confident that US President Trump will reach a good deal with China, while he added the company is currently completely shut out of China and that NVIDIA’s share of the AI chip market in China is down to zero. Huang also stated that NVIDIA hasn’t sought a license to ship Blackwell to China and assumes the Chinese market to remain at zero for NVIDIA, as well as noted that a return to China would be a “huge bonus” for NVIDIA.

- China’s COFCO purchased three cargoes totalling 180k tonnes of US soybeans ahead of Trump-Xi meeting, according to sources cited by Reuters.

- US President Trump posted “For those that are asking, we didn’t come to South Korea to see Canada!” Trump separately commented that a trade deal with South Korea will be finalised very soon.

- South Korean President Lee’s office said that South Korean President Lee and US President Trump will discuss trade, investment and Korean peace, while it noted that Lee is to gift a mockup of a golden crown to Trump and hopes that Trump’s visit will lead to a tangible outcome of cooperation.

- US Charge d’affaires in Brazil met mining executives on Tuesday to discuss rare earths, while it was separately reported that the US Senate passed a bill to terminate Trump tariffs against Brazil.

NOTABLE HEADLINES

- US President Trump said they have secured commitments of over USD 18tln in new investments and that probably USD 21tln–22tln of investment is coming into the US by the end of the second term. Trump said he expects 4% GDP growth next quarter and that factories are booming in the US, while he commented that they will not have the Federal Reserve raising rates.

- NVIDIA (NVDA) announced it was partnering with multiple companies including ServiceNow (NOW), Keysight (KEYS), Zoom (ZM), Synopsys (SNPS), Cisco (CSCO), Supermicro (SMCI), Microsoft (MSFT), and others, while it sees USD 500bln of business in the next six quarters and plans to unveil new contracts to supply AI chips to major South Korean companies.

APAC TRADE

EQUITIES

- APAC stocks were predominantly in the green following the tech strength on Wall St, where most indices extended on record highs, while participants now await the approaching flurry of risk events, including the FOMC and mega-cap earnings.

- ASX 200 retreated with the index dragged lower by notable weakness in health care, real estate, industrials, financials and tech, while firmer-than-expected inflation data further dampened hopes for a cut at next week’s RBA meeting.

- Nikkei 225 extended its rally and outperformed against regional peers after climbing above the 51,000 level for the first time, with tech stocks buoyed after the gains in US counterparts and strong Advantest earnings.

- Shanghai Comp was positive but with gains capped amid thinner volumes, with Stock Connect trade shut alongside the closure of markets in Hong Kong for a holiday, while it was also reported that China’s COFCO purchased 180k tonnes of US soybeans ahead of the Trump-Xi meeting.

- US equity futures (ES +0.2%, NQ +0.4%) are firmer after the prior day’s fresh record highs on Wall St, where tech did most of the heavy lifting, while participants now await the Fed rate decision and presser, followed by several Mag-7 earnings.

- European equity futures indicate a marginally lower cash market open with Euro Stoxx 50 future down 0.1% after the cash market closed with losses of 0.1% on Tuesday.

FX

- DXY eked mild gains but with upside capped after yesterday’s mixed data and choppy performance in which initial upside was stalled by resistance just shy of the 99.00 level, while focus turns to the FOMC and post-meeting press conference, with money markets virtually fully pricing in a 25bps cut.

- EUR/USD trickled lower following recent whipsawing and amid a lack of pertinent catalysts, while the latest ECB consumer expectations survey showed 1-year expectations were slightly lowered, but 3-year and 5-year expectations were unchanged from the previous.

- GBP/USD was subdued beneath the 1.3300 handle after the prior day’s underperformance amid fiscal concerns.

- USD/JPY saw two-way price action and ultimately gained after recovering from an initial dip beneath the 152.00 level, with the rebound facilitated by the risk appetite, while the BoJ also kick-started its 2-day policy meeting where it is expected to hold off from hiking rates.

- Antipodeans were kept afloat with AUD/USD underpinned after firmer-than-expected CPI data, which added to the spoils from yesterday’s outperformance that had been facilitated by US-China trade optimism. Furthermore, the data spurred the likes of Goldman Sachs and CBA dropping their rate cut calls. Odds of a November cut have slipped to 8% from circa 42% pre-release.

- PBoC set USD/CNY mid-point at 7.0843 vs exp. 7.0962 (Prev. 7.0856)

FIXED INCOME

- 10yr UST futures flatlined after the recent choppy mood and as participants braced for the FOMC decision and presser and digested a solid 7 year auction.

- Bund futures were uneventful and continued to linger beneath the 130.00 level, with demand not helped by incoming supply.

- 10yr JGB futures retreated amid the outperformance seen in Japanese stocks, while the BoJ also kick-started its 2-day meeting, where it is expected to continue refraining from hiking rates, although participants will be on the lookout for any clues on when it may resume policy normalisation.

COMMODITIES

- Crude futures initially rebounded but ultimately lost steam, despite bullish weekly private sector inventory data.

- US Private Energy Inventory Data (bbls): Crude -4.0mln (exp. -0.2mln), Distillate -4.4mln (exp. -1.7mln), Gasoline -6.3mln (exp. -1.9mln), Cushing +1.7mln.

- Spot gold lacked conviction and lingered beneath the USD 4,000/oz level as participants await the FOMC.

- Copper futures initially traded sideways, failing to benefit from the mostly constructive mood before picking up ahead of the European open.

CRYPTO

- Bitcoin traded indecisively overnight beneath the USD 113k level.

NOTABLE ASIA-PAC HEADLINES

- South Korean President Lee said the global economy is facing various challenges, including supply chain shifts, while he added that a deepening trade and investment partnership is fundamental to Asia-Pacific nations, and he will propose an AI initiative at the APEC summit.

- US Treasury Secretary Bessent commented that he looks forward to working with Japan’s Finance Minister Katayama and is encouraged by her understanding of how Abenomics has moved from a reflationary policy to a program that must balance growth and inflation concerns. Bessent also stated that “The Government’s willingness to allow the Bank of Japan policy space will be key to anchoring inflation expectations and avoiding excess exchange rate volatility.”

- Japanese Chief Cabinet Secretary Kihara said ‘no comment’ on US Treasury Secretary Bessent’s X post, while Kihara added that monetary policy falls under the jurisdiction of the Bank of Japan and he expects the BoJ to conduct monetary policy to appropriately achieve the inflation target. Furthermore, he said the government will continue to closely coordinate with the BoJ.

DATA RECAP

- Australian CPI QQ (Q3) 1.3% vs. Exp. 1.1% (Prev. 0.7%)

- Australian CPI YY (Q3) 3.2% vs. Exp. 3.0% (Prev. 2.1%)

- Australian RBA Trimmed Mean CPI QQ (Q3) 1.0% vs. Exp. 0.8% (Prev. 0.6%)

- Australian RBA Trimmed Mean CPI YY (Q3) 3.0% vs. Exp. 2.7% (Prev. 2.7%)

- Australian RBA Weighted Median CPI QQ (Q3) 1.0% vs. Exp. 0.9% (Prev. 0.6%)

- Australian RBA Weighted Median CPI YY (Q3) 2.8% vs. Exp. 2.7% (Prev. 2.7%)

- Australian Weighted CPI YY (Sep) 3.50% vs. Exp. 3.10% (Prev. 3.00%)

- Australian CPI Annual Trimmed Mean YY (Sep) 2.80% (Prev. 2.60%)

GEOPOLITICS

MIDDLE EAST

- Israeli planes launched strikes on Gaza City.

- Hamas said it had no connection to an attack on Israeli forces in Rafah, and it is committed to a ceasefire deal.

- US VP Vance said he thinks peace in the Middle East will hold despite skirmishes.

OTHER

- North Korea fired a missile and stated that the missile is part of its nuclear forces, according to KCNA.

- Chinese Defence Ministry said it held talks with India about the border, while it added that both sides had active and in-depth communication on the control of the western section of the China-India border. Furthermore, they agreed to continue to maintain communication and dialogue through military and diplomatic channels.

- US Defense Secretary Hegseth said the security situation around Japan remains severe and noted that their alliance is critical to deterring Chinese military aggression.

- Belarus is to deploy the Oreshnik missile in December, according to TASS.

Loading…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.