Buyers Strike Arrives: Foreign Demand For 2Y Treasury Auction Craters To 2 Year Low

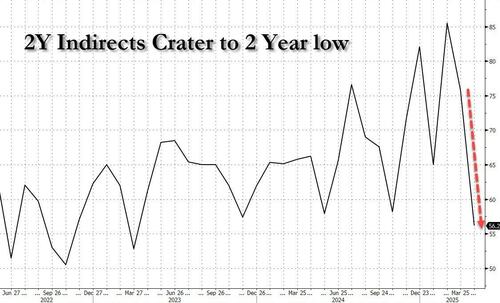

For much of April, and certainly following the vomit-inducing surge in 10Y yields two weeks ago, the biggest question in the market has been whether China is dumping their roughly $1 trillion in treasuries. And while we won’t know until June when the April TIC data hits (and even then the data is at best mixed), moments ago we found something just as important: the Chinese are certainly no longer rushing to buy US paper, something we learned following today’s 2Y auction which saw a dramatic plunge in Indirect (i.e. foreign) demand.

Let’s back up.

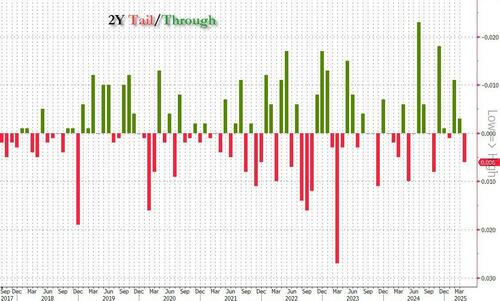

Today’s $69 billion auction priced at a high yield of 3.795%, down from 3.984% last month and the lowest since last September. It also tailed the 3.789% When Issued by 0.6bps, this was the first tail since January and the biggest tail since October.

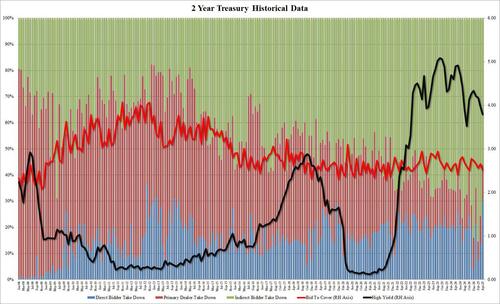

But while the small tail could be glossed over, the first sign of trouble was today’s bid to cover which slumped from 2.66 to 2.52, the lowest since October, and below the six-auction average of 2.64.

But things really went off the rails when looking at the internals, where unlike the recent set of 3/10/30 auctions which saw Direct bids collapse, the Direct award in today’s 2Y was solid, in fact at 30.1%, it was one of the highest on record. The problem is that the surge in Directs came at the expense of a plunge in Indirects, or foreign buyers, which tumbled to a two year low. As shown below, the April Indirect takedown was just 56.2%, the lowest since the depth of the bank bailout crisis in March 2023.

in other words, while Indirect demand was strong 2 weeks ago, it has since collapsed, and if drops another 10-20% lower, the Fed may have no choice but to restart QE to provide what it is explicitly supposed to do: be a Buyer of Last Resort backstop to the US treasury.

Finally, with surging Directs, and plunging Indirects, Dealers ended up holding on to 13.7%m above last month’s 10.7%, and modestly above the recent average of 11.6% if hardly an outlier print.

Overall, this was a very mediocre – at best – auction, but it could have been far worse if Directs had not stepped in to fill the void left by the suddenly buyer’s strike from Indirects, i.e., foreigners, i.e., China.

So keep a close eye on the week’s remaining coupon auctions: unlike two weeks ago when all eyes were on the Directs, we are finally down to brass tacks, and keep a close eye on the only metric that matters: whether foreigners are finally done funding the trillions and trillions of US debt, leaving only the Fed’s QE as an option.

Loading…