Argentine Assets Soar As Bessent Offers Milei A Lifeline

Following President Javier Milei’s comments on Friday that the market was in “panic mode“, US Treasury Secretary Scott Bessent has said “all options” are on the table for the Trump administration to support Argentina through this bout of severe market volatility.

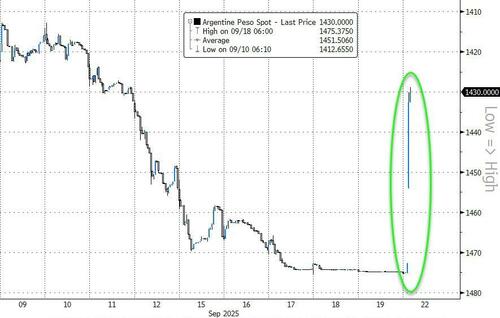

The country has already spent more than $1 billion to defend the peso out of its scarce international reserves.

The two countries are in talks this week – Milei and US President Donald Trump will meet Tuesday – and Treasury Secretary Scott Bessent posted on social media earlier that the US is ready to do whatever it takes to support Argentina.

That includes direct currency purchases as well as swap lines and purchases of dollar-denominated government debt.

Bessent called the South American country “a systemically important US ally in Latin America,” adding that the US Treasury “stands ready to do what is needed within its mandate to support Argentina. All options for stabilization are on the table.”

He said that options for a support package “may include, but are not limited to, swap lines, direct currency purchases, and purchases of US dollar-denominated government debt from Treasury’s Exchange Stabilization Fund”.

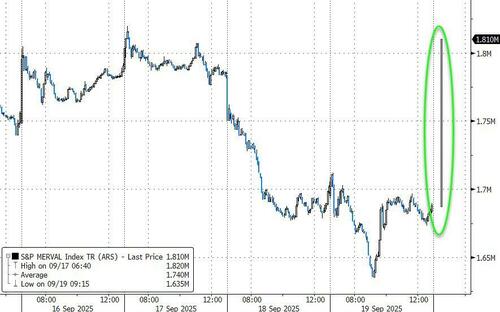

The comments sent Argentine stocks soaring…

…and the peso ripped…

Argentina’s dollar bonds due in 2029 and 2035 rallied by 5 to 6 cents in the dollar to 70 and 53 cents respectively after Bessent’s comments.

As Bloomberg reports, it’s not impossible he can recover from here, especially with the support of the US and International Monetary Fund, but the key test will be next month’s midterm elections.

The possibility of a defeat for his cost-cutting government in October is what has spooked the market. Argentina’s friends can help it prop up the currency, but they can’t help Milei keep the support of voters.

* * *

Loading recommendations…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.