Are China Road Traffic Indicators Set To Collapse As Tariff War Cancels Factory Orders

Beijing has remained very quiet this week regarding the economic fallout from President Trump’s deepening trade war. In contrast, U.S. media outlets have reported that U.S. companies have canceled or reduced orders for heavily tariffed goods from China—signaling a pullback in shipments likely to translate into economic pain for Chinese suppliers.

Such developments include…

-

Amazon Cancels Orders, Walmart Pulls Forecast As Tariffs Take Hold

-

Chinese Sellers On Amazon Panic After Trump’s Tariff Bazooka

… are poised to ripple through China’s export-driven economy. While official data lags in months and quarters, early, high-frequency data could soon emerge—particularly mobility data, which often serves as a real-time proxy for logistics and manufacturing activity.

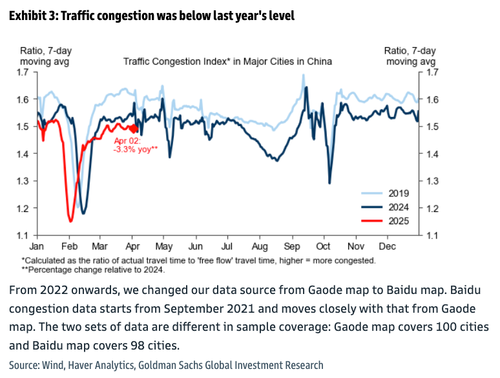

The latest high-frequency indicators from Goldman—covering consumption, mobility, production, investment, and broader macro activity—are dated as of April 3, coinciding with President Trump’s “Liberation Day” tariff blitz targeting China and other global trading partners.

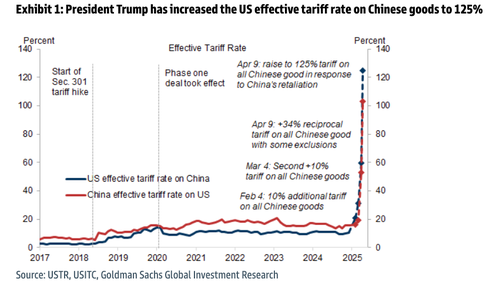

As of Friday, the U.S. effective tariff rate on Chinese goods stands at 145%, with China’s at 125%. Notably, the April 3 high-frequency data does not capture the latest wave of tariff-related disruptions.

Just before Liberation Day, the traffic congestion index in major cities across China was tracking 3% lower year-over-year and remained below both 2024 and 2019 levels for this time of year. One can’t help but wonder how congestion will be affected as Chinese suppliers face mounting pressure from canceled or reduced U.S. shipments.

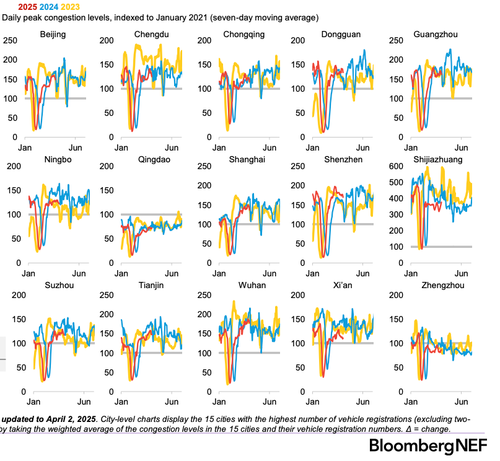

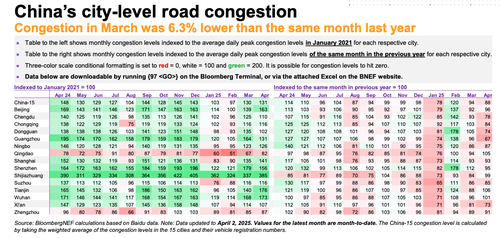

In a separate report, BloombergNEF presented similar congestion data for 15 major cities, showing a decrease in congestion levels for this time of year compared with 2024,23 levels. Again, the data has not been exposed to post-Liberation Day and the surge in tariffs and order cancelations.

Data from BloombergNEF also showed that China’s city-level road congestion was down 6.3% in March compared to the same period last year. The next update will likely show a further slowdown.

Back to the Goldman data, the report probably has one of the most important charts. Can consumer sentiment go any lower?

China consumer confidence as of January. Where does this go in March/April? https://t.co/RR8xX0BwLD pic.twitter.com/RvxLbeE7B3

— zerohedge (@zerohedge) April 11, 2025

The concern moving forward is that the next update of high-frequency congestion data may show further deterioration as reports continue to come in about Chinese factories receiving order cancellations.

Trump’s blanket tariffs will force Chinese factories that flood America with low-end goods into a major dilemma: either find new markets to exploit, shift production ex-China, or wind down factory lines – all options appear negative in the short run.

Pay attention to Treasury Secretary Scott Bessent’s comments this week: “Trump goaded China into a bad position.”

NEW: Scott Bessent says Trump didn’t just raise tariffs—he set a trap, and China walked right into it.

This is what 4D chess looks like.

Markets are rebounding after President Trump slapped a 125% tariff on Chinese imports while giving a 90-day pause to other countries.

— The Vigilant Fox 🦊 (@VigilantFox) April 9, 2025

Bessent explained, “The US has an edge here: They’re the surplus country – their exports to the US are five times our exports to China.”

The more I hear from Scott Bessent the more I am impressed with him.

On China “they can raise their tariffs but so what”

pic.twitter.com/nFfyazuw2d— Shawn Farash (@Shawn_Farash) April 9, 2025

. . .

Loading…