U.S. | Money

APAC underpinned after Wall St. gains from Waller, Trump suggested a temporary auto tariff exemption – Newsquawk Europe Market Open

April 15, 2025

Originally posted by: Zero Hedge

- APAC stocks traded with a predominantly positive bias following on from the gains on Wall St.

- US President Trump said they will put tariffs on imported pharmaceuticals in the not-too-distant future.

- Fed’s Waller said under the large-tariff scenario with significant economic slowdown, he would favour cutting policy rate sooner and more than previously thought.

- European equity futures indicate a contained cash market open with the Euro Stoxx 50 future -0.1% after the cash market closed with gains of 2.6% on Monday.

- DXY is languishing below the 100 mark, antipodeans outperform, EUR/USD has failed to hold above 1.14, USD/JPY lacked firm direction.

- Looking ahead, highlights include German Wholesale Price Index & ZEW, UK Jobs, EZ Industrial Production, US Import/Export Prices, Canadian CPI, Fed Discount Rate Minutes, ECB President Lagarde, Supply from UK & Germany, Earnings from Bank of America, Citi, Johnson & Johnson, PNC, UAL, Beiersdorf, B&M European, Wise, Rio Tinto & Sika.

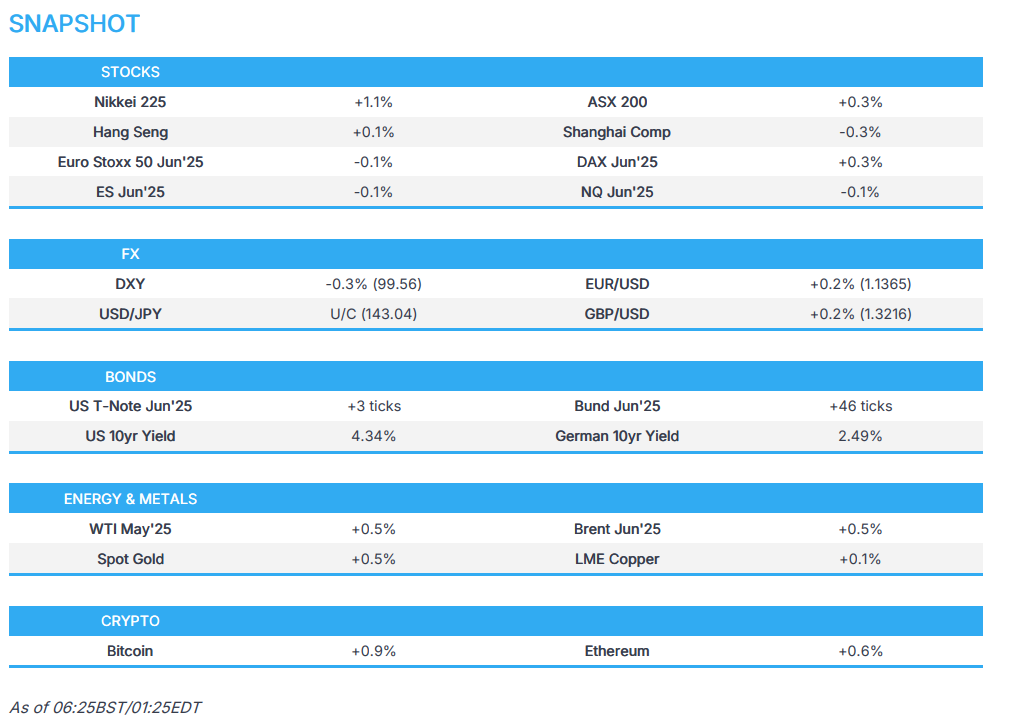

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks gained with sentiment underpinned after last week’s announcement of tariff exemptions for smartphones and electronics, although President Trump clarified they are still subject to the 20% tariff related to fentanyl. Equity futures hit peaks around the opening bell, but a soft open saw the upside pare by the time Europe left for the day, while there were tailwinds later in the session as participants digested dovish comments from Fed’s Waller which facilitated further upside in T-notes.

- SPX +0.84% at 5,408, NDX +0.57% at 18,796, DJI +0.78% at 40,525, RUT +1.08% at 1,880.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said they will put tariffs on imported pharmaceuticals in the not-too-distant future and noted they do not make their own drugs, while he reiterated the EU is taking advantage of the US and has to come to the table which they’re trying to. Trump also said he is looking to help car companies and there will maybe be some things coming up.

- US Treasury Secretary Bessent said US President Trump and Chinese President Xi have a very good relationship and noted that tariffs on China are big numbers and that no one thinks they are sustainable and wants them to remain. Bessent stated that tariffs on China are not a joke and that there doesn’t have to be decoupling with China, but there could be and noted the US will negotiate tariff rates with partners in good faith and will run a robust process.

- US Secretary of Commerce initiated an investigation to determine the effects of national security of imports of pharmaceuticals and pharmaceutical ingredients and initiated Section 232 national security investigation of imports of semiconductors and semiconductor manufacturing equipment, according to the Federal Register.

- US Department of Commerce announced its intent to withdraw from the 2019 suspension agreement of fresh tomatoes from Mexico and with termination of the agreement, the Commerce Department will institute an anti-dumping duty order on July 14th, resulting in duties of 20.91% on most imports of tomatoes from Mexico.

- EU Trade Commissioner Sefcovic said he is in Washington for talks and is seizing the 90-day window for a mutual solution to unjustified tariffs. Sefcovic added that the EU remains constructive and is ready for a fair deal including reciprocity through their zero-for-zero tariff offer on industrial goods and the work on non-tariff barriers, while he noted that achieving this will require a significant joint effort.

- Argentina’s President Milei says we understand the reciprocal tariffs from the US and are ready to sign a trade agreement along these lines.

- Chinese senior official for Hong Kong Affairs said the US tariff war goal is not to take Hong Kong’s tariffs, “they want our life” and 145% tariff on Hong Kong is “brutally unreasonable, extremely shameless”.

NOTABLE HEADLINES

- Fed’s Waller (voter) said the new tariff policy is one of the biggest shocks to affect the US economy in decades and noted under the large-tariff scenario with significant economic slowdown, he would favour cutting policy rate sooner and more than previously thought. Waller stated that if the current 25% average tariff rate stays for some time, inflation could peak near 5% and in this large-tariff scenario, the drag on output and employment could be longer-lasting and unemployment could climb to 5%. However, in the scenario where tariffs drop down to 10%, inflation could peak at 3%, and under the smaller-tariff scenario, the Fed could be more patient and rate cuts could take place in the latter half of the year. Furthermore, he said policy is highly uncertain and the Fed should remain flexible.

- Fed’s Bostic (2027 voter) said the range of possible outcomes has multiplied and the boundaries of what he thought could be possible have been blown up. Bostic stated the labour market is effectively at full employment and inflation is still much higher than the target, as well as noted that they still have a ways to go on inflation and it is not in a position to boldly move in any direction with more clarity needed.

- US President Trump reportedly targets NPR, PBS, and foreign aid in USD 9bln spending cut, according to Bloomberg.

- US Treasury Secretary Bessent said he does not think there is a dumping of US assets in the bond market and said this is one of those occasional shocks you get in the trading community. Bessent said the US still has the global reserve currency and a strong dollar policy, as well as noted it is a long way from needing contingency plans. Furthermore, he is pleasantly surprised at how quickly the tax bill is moving along and noted that they are thinking about a successor for Fed Chair Powell with the interviewing of candidates to begin in the fall.

- White House NEC Chair Hassett said the US is in the ‘sweet spot’ of growth and that President Trump wants to see tariff money up front, while he does not see a recession at all, according to a Fox Business interview.

APAC TRADE

EQUITIES

- APAC stocks traded with a predominantly positive bias following on from the gains on Wall St where sentiment was underpinned by the recent US tariff exemptions and dovish comments by Fed’s Waller.

- ASX 200 was led higher by strength in healthcare and financials but with the gains capped by a lack of fresh drivers and with very few clues from the RBA Minutes regarding when the next rate move will occur.

- Nikkei 225 outperformed with automakers among the best performers in the index after US President Trump suggested on Monday that he might temporarily exempt the auto industry from tariffs to give carmakers time to adjust their supply chains.

- Hang Seng and Shanghai Comp lagged with participants cautious after the US announced probes into pharmaceuticals and semiconductors, while local press noted domestic markets face liquidity pressures with more than CNY 570bln in reverse repo and MLF funds maturing this week, although the PBoC is expected to assist with liquidity.

- US equity futures were rangebound overnight.

- European equity futures indicate a contained cash market open with the Euro Stoxx 50 future -0.1% after the cash market closed with gains of 2.6% on Monday..

FX

- DXY was subdued following a choppy to start the week and languished beneath the 100.00 level after the tariff exemptions on smartphones and electronics, although the Trump administration has since announced probes into pharmaceuticals and semiconductors which sets the stage for sectoral tariffs, while there were also dovish-leaning comments from Fed’s Waller who gave a range of scenarios in which he noted that under a large-tariff scenario with a significant economic slowdown, he would favour cutting the policy rate sooner and greater than previously thought.

- EUR/USD was restricted after its recent failure to sustain the 1.1400 status, while EU Trade Commissioner Sefcovic is in Washington for talks and said the EU is ready for a fair deal including reciprocity through their zero-for-zero tariff offer on industrial goods and work on non-tariff barriers.

- GBP/USD remained afloat and retested the 1.3200 level to the upside ahead of UK jobs and average earnings data.

- USD/JPY lacked firm direction and lingered above the 143.00 level amid a quiet calendar and the positive risk environment.

- Antipodeans outperformed amid their high-beta characteristics and with the PBoC setting a firmer-than-previous reference rate setting, while the latest RBA minutes provided little fresh clues as it stated it was not yet possible to determine the timing of the next move in rates and it was not appropriate at this stage for policy to react to potential risks.

- PBoC set USD/CNY mid-point at 7.2096 vs exp. 7.3094 (Prev. 7.2110).

FIXED INCOME

- 10yr UST futures held onto yesterday’s gains after rallying amid tariff exemptions and dovish comments from Fed’s Waller.

- Bund futures sat around the prior day’s highs after gaining a firm footing above the 131.00 level but with further upside capped overnight ahead of German WPI and ZEW data, as well as a Bobl issuance.

- 10yr JGB futures demand was subdued amid the positive risk appetite in Japan and a weaker 20yr JGB auction.

COMMODITIES

- Crude futures were kept afloat amid the positive risk environment but with gains capped amid little fresh catalysts and after the recent OPEC MOMR cut global oil demand growth forecasts for 2025 and 2026 by 100k BPD each to 1.3mln BPD.

- EU is reportedly exploring legal options for ending Russian gas deals, according to FT.

- Spot gold continued its gradual recovery following a brief slip to beneath the USD 3,200/oz level.

- Copper futures took a breather after the prior day’s advances with upside capped as Chinese markets lagged.

CRYPTO

- Bitcoin steadily gained overnight and returned to above the USD 85,000 level.

NOTABLE ASIA-PAC HEADLINES

- RBA Minutes from the March 31st-April 1st meeting stated it is not yet possible to determine the timing of the next move in rates and it is not appropriate at this stage for policy to react to potential risks. RBA also commented that the May meeting would be an opportune time to reconsider and the decision was not predetermined, while it stated it is possible that global uncertainty over US tariffs could have a significant impact and the board saw risks on both the upside and downside for the Australian economy and inflation.

GEOPOLITICS

MIDDLE EAST

- Egypt received an Israeli proposal for a ceasefire in Gaza and to start negotiations for a permanent ceasefire, while Egypt delivered the proposal to Hamas and is awaiting a response, according to Al Qahera News.

- Israel’s new demand to Hamas is to reportedly lay down weapons as a condition to a ceasefire, which is a new demand that would surely prolong the suffering of the hostages, if not worse, according to Guy Elster.

- Hamas official said they are ready to hand over hostages in one batch in exchange for ending the war and withdrawing from Gaza. Furthermore, Hamas said it is studying the Gaza ceasefire proposal it received from mediators and will submit a response as soon as possible.

- US President Trump said they will solve the Iran problem and Iran wants to deal with the US but they don’t know how and there will be another meeting with Iran on Saturday. Furthermore, Trump said Iran cannot have a nuclear weapon and must give up the dream of a nuclear weapon or face a harsh response.

- US State Department said Secretary of State Rubio spoke to the Turkish Foreign Minister about dangers to regional security and stability posed by Iran and its proxies.

- White House Envoy Witkoff said the conversation with Iran will be about verification on the enrichment program and then ultimately verification on weaponisation.

- Houthi media reported US warplanes launched two raids on Al-Abdiya district in Marib and three raids on the areas of Al-Juhf and Al-Qadeer in Al-Hazm District in Al-Jawf Governorate in Yemen.

- Yemeni pro-government militias are planning a ground offensive against Houthis in an attempt to take advantage of a US bombing campaign that has degraded the militant group’s capabilities, according to WSJ citing Yemeni and US officials

RUSSIA-UKRAINE

- US President Trump said thinks they will get some very good proposals on stopping the Ukraine war very soon.

- Ukraine and the US held “constructive” talks on a proposed minerals deal last week, according to AFP citing an official.

- US House Democrats introduced legislation to bolster Ukraine in its war with Russia, according to sources via Reuters.

- Blasts reportedly shook the Russian city of Kursk near the Ukrainian border and damaged residential buildings.

OTHER

- China’s embassy in Argentina said it is strongly dissatisfied and firmly opposes US Treasury Secretary Bessent’s remarks about China which it said “maliciously slandered, smeared” China for carrying out normal cooperation with other countries, while it added that some people with ulterior motives are trying to sow discord between China and Argentina. Furthermore, it said they advise the US to adjust its mindset instead of spending time repeatedly smearing and attacking China, as well as meddling in the foreign cooperation of regional countries.

- China’s Harbin Public Security Bureau said US NSA agents are on the wanted list for being involved in a cyberattack on the Asian Winter Games, while it traced down the three agents and two US universities involved in the implementation of cyber attacks.

EU/UK

NOTABLE HEADLINES

- Barclaycard UK March Consumer Spending rose 0.5% Y/Y (prev. +1.0%). It was also reported that UK consumers plan to ‘buy British’ amid Trump’s trade war with around 71% of respondents in a survey by Barclays wanting to support UK businesses by buying items that were “made in Britain”, according to FT.

DATA RECAP

- UK BRC Retail Sales YY (Mar) 0.9% (Prev. 0.9%)

- UK BRC Total Sales YY (Mar) 1.1% (Prev. 1.1%)

Loading…