Markets quiet as US closed for President’s Day and China away for New Year – Newsquawk EU Market Open

4 hours ago

Originally posted by: Zero Hedge

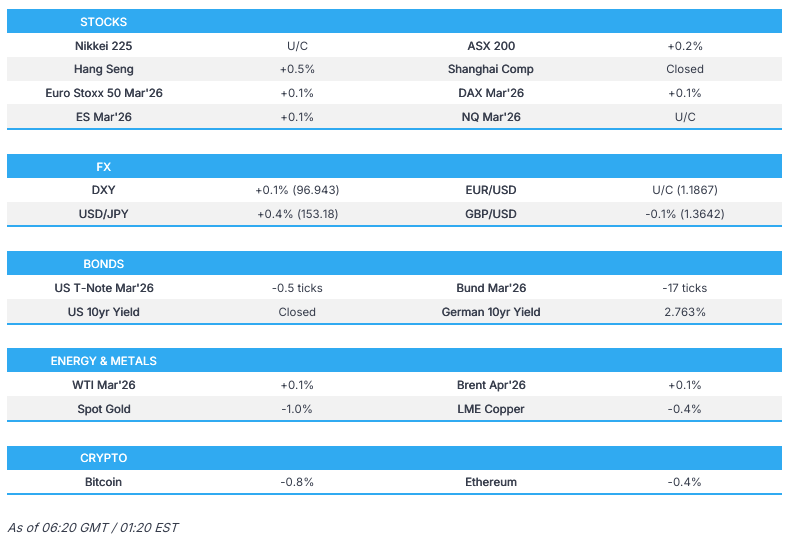

- APAC stocks began the week in the green but with gains limited following a lack of major fresh catalysts from over the weekend and amid thinned conditions owing to holiday closures in the region and North America.

- Nikkei 225 traded indecisively, with the index constrained by disappointing Japanese preliminary Q4 GDP data

- European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 futures up 0.1%, after the cash market closed with losses of 0.4% on Friday.

- US President Trump said on Friday that Ukrainian President Zelensky is going to have to get moving and that Russia wants to get a deal.

- Looking ahead, highlights include Swedish Unemployment (Jan), EZ Industrial Production (Dec), and Japanese PM Takaichi is to meet with BoJ Governor Ueda. Speakers include Fed’s Bowman.

- Holiday: US Holiday (Presidents Day); Chinese Spring Festival Golden Week.

- Desk: Newsquawk EU coverage will commence as normal on Monday, 16th February. Thereafter, the desk will shut at 18:00GMT/13:00ET and then re-open on the same day for APAC coverage at 22:00GMT/17:00ET.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks traded somewhat mixed on Friday, with the Russell 2k outperforming, which rallied 1.2%, while the equal-weight ETF saw strong gains and the majority of sectors were green, showing strong breadth. However, heavy-weight sectors (Communication services, Tech and Consumer Disc) weighed on broader index performance.

- The highlight of the session was the CPI report, which ultimately came in softer than expected on the headline, while core was in line with forecasts. Goods prices were supportive of the view that tariff-induced inflation is largely behind us, but services inflation continued to accelerate, which gave Fed’s Goolsbee some concerns. T-notes were firmer across the curve in response to the inflation data, with the front end leading, as the curve bull-steepened.

- SPX +0.05% at 6,836, NDX +0.18% at 24,733, DJI +0.10% at 49,500, RUT +1.18% at 2,647.

- Click here for a detailed summary.

TARIFFS/TRADE

- USTR Greer said the US and Ecuador expect to sign a trade agreement in the coming weeks.

- China will waive import value-added taxes on selected seeds, genetic resources, and police dogs through to 2030 to increase agricultural competitiveness and breeding capacity. It was also reported that China will grant zero-tariff access to 53 African nations from May 1st, according to Bloomberg.

- Chinese Foreign Minister Wang Yi told his French and German counterparts that China and the EU are partners, not rivals, while he added that China and the EU should manage differences, deepen practical cooperation and work together on global challenges.

NOTABLE HEADLINES

- Fed’s Goolsbee (2027 voter) said on Friday that they are still seeing pretty high services inflation, and he hopes they have seen the peak impact of tariffs, while he added that the job market has been steady, with only modest cooling. Furthermore, he said CPI data had encouraging bits but also some concerns, and noted that rates can still go down, and they need to see progress on inflation.

- US President Trump said there will be voter ID rules in the mid-term elections this year, whether Congress approves it or not, and they will present a legal argument in an Executive Order. Furthermore, Trump said he has searched the depths of legal arguments not yet articulated nor vetted on this subject, and they will be presenting an irrefutable one in the very near future.

- Pentagon threatened to cut its ties with Anthropic over the company’s insistence that some limitations are kept on how the military uses its AI models.

APAC TRADE

EQUITIES

- APAC stocks began the week in the green but with gains limited following a lack of major fresh catalysts from over the weekend and amid thinned conditions owing to holiday closures in the region and North America.

- ASX 200 traded marginally higher with upside led by tech, although gains are capped by underperformance in the utilities, mining, materials and resources sectors, while participants also digested a slew of earnings releases.

- Nikkei 225 traded indecisively with the index constrained by disappointing Japanese preliminary Q4 GDP data, which showed the economy returned to growth but failed to meet expectations with GDP Q/Q at 0.1% (exp. 0.4%), and annualised GDP at 0.2% (exp. 1.6%).

- Hang Seng finished higher in a shortened trading session on Chinese New Year’s Eve but with upside limited by tech weakness amid some confusion after the Pentagon added several companies including Baidu, Cosco, BYD, Huawei, Nio, SMIC, Tencent, and more to a list of Chinese firms aiding the military on Friday, but then withdrew the updated list shortly after it was posted. Furthermore, price action was also restricted by the closure of mainland markets and the absence of stock connect flows, which will remain shut for more than a week.

- US equity futures kept afloat in quiet trade amid the absence of drivers and participants.

- European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with losses of 0.4% on Friday.

FX

- DXY eked slight gains in rangebound trade after a lack of major catalysts and with US participants away on Monday.

- EUR/USD was little changed amid the absence of any major macro catalysts and with light newsflow from the bloc, while comments from ECB President Lagarde and news that the ECB is to make its repo backstop available to other central banks across the world, did little to spur price action.

- GBP/USD held on to most of Friday’s spoils but with price action contained by resistance around 1.3650 and following comments from BoE’s Mann that the UK economy is sluggish and tepid, with consumers spending less due to being scarred by high inflation.

- USD/JPY edged higher and returned to above the 153.00 level in the aftermath of the weaker-than-expected preliminary Q4 GDP data for Japan.

- Antipodeans were mixed with little fresh macro drivers and a lack of tier-1 data from either side of the Tasman.

FIXED INCOME

- 10yr UST futures traded little changed and held on to last week’s spoils after returning above the 113.00 level in the aftermath of the softer US inflation data, while price action was contained to start the week by the closure of US cash markets for Washington’s Birthday.

- Bund futures lacked demand in the absence of any major catalysts and with light newsflow from the bloc.

- 10yr JGB futures were marginally higher following disappointing preliminary GDP data for Q4, but with gains limited after failing to sustain a brief reclaim of the 132.00 level.

COMMODITIES

- Crude futures were rangebound amid light energy-specific newsflow from over the weekend and after last Friday’s indecisive performance, where attention was on a source report that noted OPEC+ is leaning towards resuming oil output hikes from April, but with no decision made.

- Slovak PM Fico said he has information that the Druzhba pipeline has been fixed after damage in Ukraine, although he believes that supplies to Hungary and Slovakia have become a part of political blackmail.

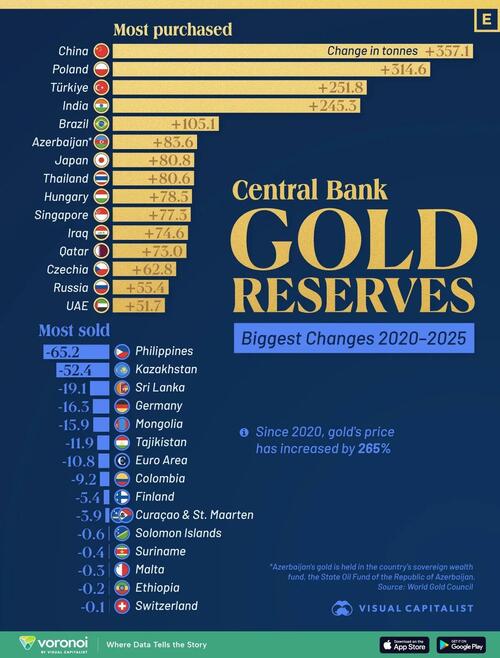

- Spot gold took a breather after edging higher in the aftermath of the recent softer-than-expected US inflation data, with price action also contained by the holiday closures across Asia and North America.

- Copper futures were subdued, with their largest buyer away for more than a week due to the Chinese New Year/Spring Festival holiday.

- Texas venture-backed startup Hertha Metal vowed mass production of steel with 25% cost savings, which could reduce US reliance on imports.

CRYPTO

- Bitcoin traded indecisively overnight and recovered from an intraday dip to return to near flat territory.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi called for the anchoring of economic growth around domestic demand as its main driver, in a speech during a key policy meeting late last year that was released on Sunday.

- China is to establish a permanent financial support framework to promote rural revitalisation and prevent a slide back into poverty, which represents a shift from transitional aid to long-term support.

- China’s market regulator summoned major online platform companies on Friday, including Alibaba, Douyin and Meituan, while it directed them to comply with laws and regulations, and rein in promotional practices, according to Bloomberg.

- US Secretary of State Rubio and Japanese Foreign Minister Motegi reaffirmed their commitment to deepen bilateral ties.

- Disney (DIS) sent a ‘cease and desist’ letter to ByteDance over Seedance 2.0 and alleged that ByteDance has been infringing on its IP to train and develop an AI video generation model without compensation, according to Axios. It was later reported that ByteDance said it would curb its AI video app following Disney’s legal threats, according to the BBC.

- RBI tightened rules for loans provided to brokers and proprietary firms in an effort to reduce market speculation.

DATA RECAP

- Japanese GDP QQ (Q4 P) 0.1% vs. Exp. 0.4% (Prev. -0.7%, Rev. From -0.6%)

- Japanese GDP Annualised (Q4 P) 0.2% vs. Exp. 1.6% (Prev. -2.3%)

GEOPOLITICS

MIDDLE EAST

- US military is preparing for potential operations against Iran that could last for weeks if US President Trump orders an attack and the US fully expects Iran to retaliate, according to sources cited by Reuters.

- US President Trump told Israeli PM Netanyahu during a meeting in December that he would support Israel striking Iran’s ballistic missile program if the US and Iran are not able to reach a deal, according to CBS.

- Iran confirmed that indirect talks between the US and Iran will resume in Geneva on Tuesday under the mediation of Oman, while Iranian Foreign Minister Araghchi left for Geneva on Sunday.

- Iranian diplomat said Iran is open to nuclear deal compromises if the US discusses lifting sanctions, while it was also reported that Iran said potential energy, mining and aircraft deals are on the table in talks with the US.

- Israel’s cabinet approved the proposal to register West Bank lands as ‘state property’, while Palestinians condemned the ‘de facto annexation’ which Peace Now said likely amounts to a ‘mega land grab’.

RUSSIA-UKRAINE

- US President Trump said on Friday that Ukrainian President Zelensky is going to have to get moving and that Russia wants to get a deal.

- US Secretary of State Rubio said they don’t know if Russia is serious about finding an end to the war in Ukraine and will continue to test it, while it was reported that he met with Ukrainian President Zelensky on security and deepening defence and economic partnerships.

- Ukrainian drones targeted Russia’s Taman seaport and fuel tanks in the Black Sea region.

- UK and European allies were reported on Friday to be weighing seizing Russian shadow fleet ships and tightening curbs on Russia’s economy.

- French Foreign Minister Barrot said some G7 nations have expressed a willingness to proceed with a maritime services ban on Russian oil, which they hope to include in the 20th sanctions package that they are actively preparing.

OTHER

- European Commission President von der Leyen said that they face the very distinct threat of outside forces trying to weaken their union, while she added that mutual defence is not an optional task for the European Union; it is an obligation within their own treaty, and it is their collective commitment to stand by each other in case of aggression.

- Pentagon said the US military struck an alleged drug cartel boat in the Caribbean, which killed three people.

EU/UK

NOTABLE HEADLINES

- BoE’s Mann said the UK economy is sluggish and tepid, with consumers spending less due to being scarred by high inflation.

- ECB President Lagarde said US President Trump’s “kick in the butt” has brought European leaders closer together, while she is preparing for geoeconomic fragmentation and recommends greater strategic autonomy for Europe in supply chains.

- ECB is to make its repo backstop available to all central banks with a satisfactory reputation beginning in Q3, with the ECB prepared to offer euro liquidity to monetary authorities around the world in an effort to prevent market tensions and increase global use of the single currency.

DATA RECAP

- UK Rightmove House Prices MM (Feb) 0.0% (Prev. 2.8%)

- UK Rightmove House Prices YY (Feb) 0.0% (Prev. 0.5%)

Loading…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.