U.S.

US stocks added to recent gains despite overnight weakness following the government shutdown – Newsquawk Asia-Pac Market Open

6 hours ago

Originally posted by: Zero Hedge

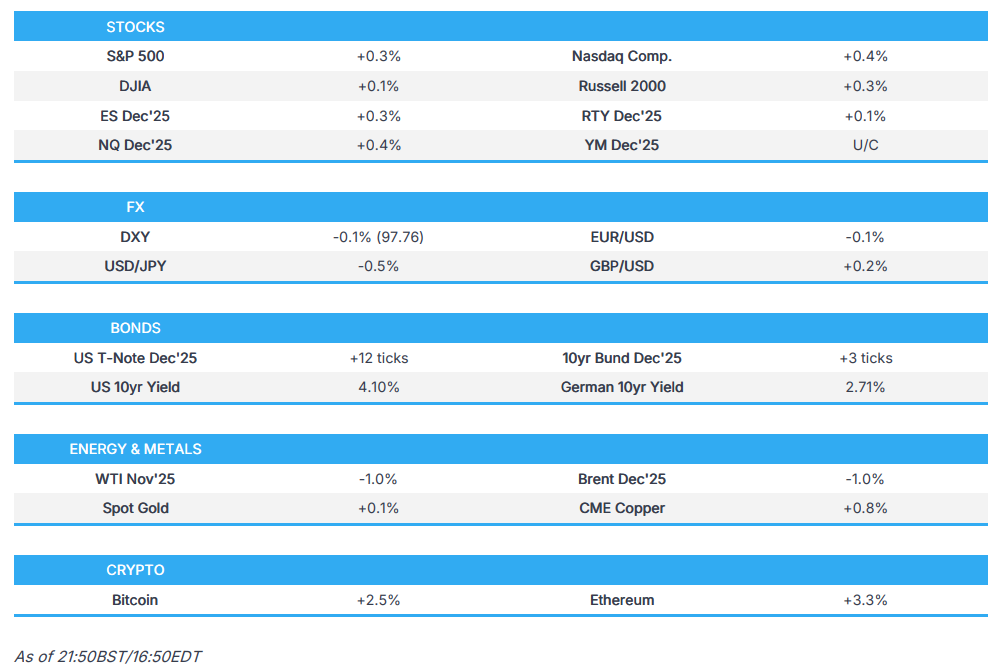

- US stocks added to recent gains despite overnight weakness following the government shutdown. Outperformance was in the Nasdaq while sectors were more mixed.

- The Dollar saw mixed performance against peers on Wednesday as performance diverged amidst the US government shutdown coming into effect and a surprise negative ADP reading.

- T-notes bull steepen as the government enters shutdown and ADP paints another bleak picture of the labour market.

- Oil prices were lower and likely weighed on by Saudi Aramcoʼs surprise LPG price cut.

- Looking ahead, highlights include South Korean CPI, Japanese Foreign Bond Investments, Australian Imports/Exports and Household Spending, RBA Financial Stability Review.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks added to recent gains despite overnight weakness following the government shutdown. Outperformance was in the Nasdaq while sectors were more mixed. Health Care was the clear laggard as the sector continues to benefit from Trump’s clarification on the sector.

- SPX +0.37% at 6,711, NDX +0.49% at 24,801, DJI +0.09% at 46,441, RUT +0.24% at 2,442

- Click here for a detailed summary.

NOTABLE NEWS

- US VP Vance said he does not think the government shutdown will last long and vowed to do everything possible in the coming weeks to ensure people receive essential services. He warned layoffs would be necessary if the shutdown continues and offered to meet with Schumer and Democrats to discuss the situation, according to Reuters.

- White House Press Secretary Leavitt said layoffs are imminent and that a replacement nominee for the BLS will be announced soon, according to Reuters.

- Democrats’ continuing resolution (CR) again failed, via Punchbowl’s Jake Sherman.

- US Senate Majority Leader Thune and Senate Minority Leader Schumer might meet in the next day or two, according to Punchbowl.

- Fitch said a US government shutdown does not have near-term implications for the ‘AA+’/stable US sovereign rating, though regular reliance on continuing resolutions highlights continued weakness in fiscal policymaking. Fitch added that despite increased uncertainty around US policy, the US dollar’s predominant reserve currency status is expected to continue for the foreseeable future, and noted that reversing previously enacted Medicaid cuts would not meaningfully impact near-term deficit forecasts, as the effects would mostly be felt after 2028, via Fitch Ratings.

- US President Trump said he really believes Fed Chair Powell is an obstructionist, via Truth Social.

- BoC minutes said members agreed that while near-term uncertainty around US tariffs had diminished, uncertainty around USMCA renegotiation was coming into greater focus. They discussed keeping the policy rate at 2.75% or lowering it by 25bps to 2.5%, and the Governing Council judged the balance of risks favoured a cut. With the economy weaker and inflationary pressures more contained, members decided to reduce the policy rate to 2.5% to better balance risks going forward, according to the BoC.

NOTABLE US EQUITY HEALINES

- TikTok employees view Adam Presser as a likely candidate to lead the new US TikTok, though the deal has not yet been finalised and the CEO appointment could take time, according to The Information. Presser is the right-hand person to current TikTok CEO, Shou Zi Chew.

- Intel (INTC) is reportedly in early talks to add AMD (AMD) as a foundry customer, via Semafor.

TARIFFS/TRADE

- The European Commission is reportedly looking to sign the EU-Mercosur partnership agreement on December 5th, via Politico citing diplomats.

- Swiss pharmaceutical companies are likely to follow Pfizer (PFE) in striking “mini-deals” with the US on lower drug prices, according to Reuters.

- US President Trump said soybean farmers are being hurt because China is not buying for negotiating reasons only, adding that tariffs have generated so much money the administration will use a portion to help farmers. He said he will meet Chinese President Xi in four weeks with soybeans a major topic of discussion, declaring “MAKE SOYBEANS, AND OTHER ROW CROPS, GREAT AGAIN!”, via Truth Social.

- US President Trump is delaying pharmaceutical tariffs as the administration negotiates drug prices, after previously threatening triple-digit tariffs on imports starting Wednesday. A White House official said the plan has been paused while talks continue with pharmaceutical giants to avoid higher tariffs on name-brand products, similar to the deal announced with Pfizer on Tuesday, via Politico.

DATA RECAP

- US ADP National Employment (Sep) -32.0k vs. Exp. 50.0k (Prev. 54.0k, Rev. -3k).

- US ADP Median Change in Annual Pay: Job Stayers 4.5% (prev. 4.4%), Job Changers 6.6% (prev. 7.1%).

- US ISM Manufacturing PMI (Sep) 49.1 vs. Exp. 49.0 (Prev. 48.7)

- US ISM Manuf New Orders Idx (Sep) 48.9 (Prev. 51.4)

- US ISM Manuf Employment Idx (Sep) 45.3 (Prev. 43.8)

- US ISM Mfg Prices Paid (Sep) 61.9 vs. Exp. 63.2 (Prev. 63.7)

- US S&P Global Manufacturing PMI Final (Sep) 52.0 (Prev. 52.0)

- US MBA Mortgage Applications -12.7% (Prev. 0.6%)

- US MBA 30-Yr Mortgage Rate 6.46% (Prev. 6.34%)

- Canadian S&P Manufacturing PMI (Sep): 47.7 (prev. 48.3)

FX

- The Dollar saw mixed performance against peers on Wednesday as performance diverged amidst the US government shutdown coming into effect and a surprise negative ADP reading.

- JPY, NZD, GBP, NOK, and SEK took advantage of the US government shutdown, with JPY and NOK leading the gains.

- EUR was little changed vs USD, with EZ inflation data having little follow-through into the currency pair.

- CAD and CHF underperformed in the G10 space despite a lack of fundamentals/newsflow behind the move.

FIXED INCOME

- T-notes bull steepen as the government enters shutdown and ADP paints another bleak picture of the labour market.

COMMODITIES

- Oil prices were lower and likely weighed on by Saudi Aramco’s surprise LPG price cut

- Russian oil product exports from the Black Sea port of Tuapse are planned at 0.88mln tonnes in October, down from 1.089mln in September, according to Reuters citing sources.

- Kpler’s base case is factoring in an increment of another 137k at the OPEC+ meeting this weekend, according to Kpler’s Bakr.

- The OPEC JMMC meeting ended with no recommendations on November production policy, according to Kpler.

- The next OPEC JMMC meeting is scheduled for November 30th, according to Kpler.

- Glencore’s (GLEN LN) Lomas Bayas mine in Chile said its mining operations will continue normally as crews work to fight the fire, according to Reuters.

DATA RECAP

- US EIA Weekly Crude Production Change, 0.03% (Prev. 0.14%)

- US EIA Weekly Gasoline Stk w/e 4.125M vs. Exp. 0.675M (Prev. -1.081M)

- US EIA Weekly Crude Production Change, 4k (Prev. 19k)

- US EIA Weekly Crude Stocks w/e 1.792M vs. Exp. 1.048M (Prev. -0.607M)

- US EIA Weekly Crude Cushing w/e -0.271M (Prev. 0.177M)

- US EIA Weekly Dist. Stocks w/e 0.578M vs. Exp. -1.138M (Prev. -1.685M)

- US EIA Weekly Refining Util w/e -1.6% vs. Exp. -1.0% (Prev. -0.3%)

- US EIA Weekly Crude Production 13.505M (Prev. 13.501M)

GEOPOLITICAL

MIDDLE EAST

- The IRGC said the range of missiles will be increased to any point Tehran deems necessary in response to European demands to restrict Iran’s missile capabilities, via Sky News Arabia.

- Hamas is continuing to study the Trump plan for Gaza, Sky News Arabia reported citing sources.

RUSSIA-UKRAINE

- European leaders will not agree on the latest Russian sanctions today, with hopes that European ambassadors can give a green light on Friday, via Radio Free Europe’s Jozwiak.

- Russia’s Deputy Foreign Minister said the next round of Russia–US talks will take place by the end of autumn, according to TASS.

- The G7 is nearing agreement to ramp up sanctions on Russia’s oil revenue, Bloomberg reports citing a draft document.

- Russia is still waiting for US President Trump’s reaction to Moscow’s proposal on the New START Treaty, according to TASS.

- Japan’s Finance Minister Kato said G7 ministers met online to discuss sanctions against Russia, noting various sanctions have been implemented and will continue, while raising tariffs on countries importing oil from Russia remains difficult, according to Reuters.

- Russia has reportedly drafted a plan to seize foreign assets if the EU acts on frozen funds, according to Bloomberg.

EU/UK

NOTABLE HEADLINES

- Italy’s budget draft puts the deficit at the EU’s 3% limit already in 2025, according to Bloomberg.

- BoE’s Mann said UK monetary policy is relatively loose but tighter interest rates would not currently be appropriate, via Bloomberg TV.

- BoE’s Mann reiterated that inflation expectations have drifted and that persistent inflation risks are playing out, according to Reuters.

- The UK government is reportedly nearing a critical minerals deal with Greenland, via Politico.

- The UK will exempt newly listed company shares from the 0.5% stamp duty tax, in a move officials hope will boost liquidity and attract more London listings, via FT.

NOTABLE EUROPEAN EQUITY HEALINES

- Siemens (SIE GY) is said to be studying a spinoff of its stake in Siemens Healthineers (SHL GY), according to Bloomberg, citing sources.

DATA RECAP

- EU HCOB Manufacturing Final PMI (Sep) 49.8 vs. Exp. 49.5 (Prev. 49.5)

- German HCOB Manufacturing PMI (Sep) 49.5 vs. Exp. 48.5 (Prev. 48.5)

- French HCOB Manufacturing PMI (Sep) 48.2 vs. Exp. 48.1 (Prev. 48.1)

- Italian HCOB Manufacturing PMI (Sep) 49.0 vs. Exp. 50 (Prev. 50.4)

- UK S&P Global Manufacturing PMI (Sep) 46.2 (Prev. 46.2)

- EU HICP Flash YY (Sep) 2.2% vs. Exp. 2.2% (Prev. 2.0%); X F&E Flash YY (Sep) 2.4% vs. Exp. 2.3% (Prev. 2.3%); Services 3.2% (prev. 3.1%

Loading…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.