U.S. Antimony Books First $10M DOD Order Under “Indefinite Delivery Indefinite Quantity” Contract

United States Antimony announced Tuesday that it has received a $10 million delivery order under its newly signed indefinite delivery, indefinite quantity sole-source contract with the US Defense Logistics Agency.

The order covers 315,000 lbs. of antimony metal ingots, which will be used to replenish the US National Defense Stockpile.

Shares were up more than 10% in response to the order, while at the same time Bloomberg reported UAMY’s CEO had purchased $613k in common stock at a price of $6.13/share, according to his Form 4.

Looking ahead, the company said it expects 2026 gross revenues of $100 million, compared with the $100.6 million forecast by two analysts polled by FactSet. UAMY also reaffirmed its 2025 revenue outlook of $40 million to $50 million, while three analysts polled by FactSet project $45.2 million.

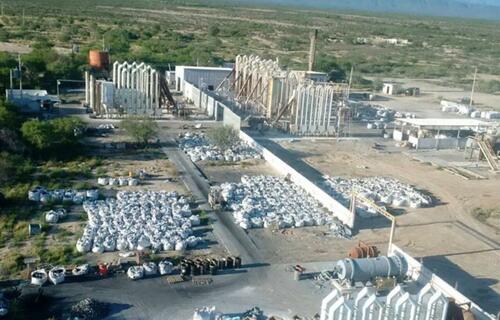

Recall, as we noted last month, UAMY operates the only two antimony smelters in North America, and said it is positioned to begin immediate deliveries from its domestic facilities.

“It’s incredibly meaningful for all our employees to play such a strategic role in strengthening our nation’s defense readiness,” USAC CEO Gary C. Evans said in a statement last month.

The deal follows months of negotiations and reflects a partnership with the Department of Defense that accelerated in late 2024. It also highlights broader U.S. efforts to reduce dependence on foreign sources, particularly China, for critical minerals and strategic materials.

Antimony, a critical mineral which is used in munitions, batteries, flame retardants, and military-grade compounds, has been flagged by defense officials as a vulnerability in the U.S. industrial base.

The Trump administration has made domestic supply-chain resilience a policy priority. Trump has taken a series of executive and policy actions aimed at securing U.S. access to critical minerals, citing national security and economic independence.

Similar initiatives have supported other strategic sectors. The federal government has backed Intel with billions of dollars in CHIPS Act funding to expand U.S. semiconductor manufacturing capacity, while MP Materials has received Defense Department support to boost rare earth processing, reducing reliance on overseas supply chains.

Additional announcements are also expected relatively soon around nuclear fuel and uranium, another area where U.S. officials are seeking to strengthen domestic capability and reduce reliance on foreign suppliers.

Two months ago we laid out all the winners in the coming critical mineral scramble in “The Coming Rare Earth Revolution And How To Profit: All You Need To Know About The “Ex-China Supply Chain.” Those who put on the recommended baskets are currently enjoying high double-digit gains.

Loading recommendations…

Recent Top Stories

Sorry, we couldn't find any posts. Please try a different search.