War Terrorism & Unrest

Israel-Iran strikes continue & Trump calls for peace; Europe primed for a modestly lower open – Newsquawk Europe Market Open

8 hours ago

Originally posted by: Zero Hedge

- Israel and Iran launched fresh attacks on each other’s major cities, with exchanges of fire continuing into a third day on Sunday, according to multiple media outlets.

- Israeli drones on Saturday targeted the South Pars Gas Refinery and the Fajr Jam Gas Refinery, according to Tasnim News Agency.

- US President Trump posted on Truth Social on Sunday: “Iran and Israel should make a deal, and will make a deal, we will have PEACE, soon, between Israel and Iran! Many calls and meetings now taking place.”

- US President Trump said the US might get involved in the Israel-Iran war, according to ABC. The US is not currently considering joining the war against Iran to eliminate its nuclear program, according to an ABC News report.

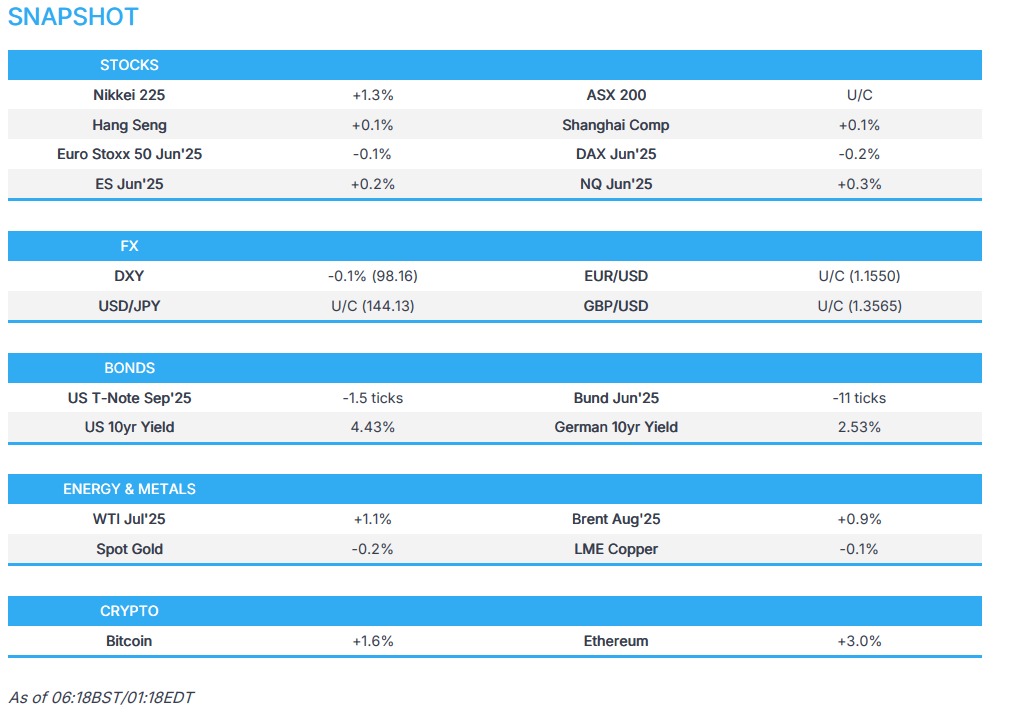

- European equity futures are indicative of a mildly softer open with the Euro Stoxx 50 future -0.2% after cash closed lower by 1.3% on Friday.

- Looking ahead, highlights include the G7 meeting, US NY Fed Manufacturing, OPEC MOMR, Speakers include ECB’s Cipollone & Nagel, and Supply from the US.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks saw heavy selling pressure amid the geopolitical escalation between Iran and Israel and closed around session lows on Friday. Sectors were lower across the board, aside from Energy, which was buoyed in the wake of the aforementioned geopolitics.

- SPX -1.13% at 5,977, NDX -1.29% at 21,631, DJI -1.79% at 42,198, RUT -1.85% at 2,101

- Click here for a detailed summary.

NOTABLE HEADLINES

- Trump administration reportedly weighs adding 36 countries to the travel ban, according to Reuters citing a memo.

GEOPOLITICS – IRAN/ISRAEL

OVERNIGHT UPDATES

- Israeli Air Force planes launched a preemptive strike before an Iranian attack, attacking missile launchers in the centre of the country, according to Kann news.

- IDF says it struck surface-to-surface missile sites in central Iran. “Israeli media: interception of a missile launched by the Houthis from Yemen towards Israel”, according to Al Arabiya. IDF at that also said it was under a new missile attack from Iran, according to Al Arabiya.

- “Iranian Foreign Minister: The fire ignited by Israel may get out of control… If the aggression stops, the ground for a return to diplomacy will be available”, according to Sky News Arabia.

- “Israeli media: reports of a 2.5-magnitude earthquake near the Fordow nuclear facility in Iran”, according to Sky News Arabia

- US President Trump said he hopes there will be a deal between Iran and Israel, but “sometimes you have to fight it out”; he does not want to say if he has asked Israel to pause strikes on Iran; said the US will continue to support Israel in its defence.

- “Iranian security reveals secret Mossad headquarters south of Tehran that includes drones and explosives”, according to Sky News Arabia.

- Israel’s military instructed the public it is safe to leave protected shelters, signalling threat from the current Iranian missile attack is over, according to Reuters.

- Ambrey said Iranian forces launched a ballistic missile attack on port infrastructure in Israel’s Haifa, according to Reuters.

- Several residential buildings in Tel Aviv were struck an Iranian missile attack, according to a Reuters witness.

- Israeli military says it attacked Iran’s IRGC Qods Force headquarters in Tehran, according to Reuters.

- “Israeli security source: Iran has started using hypersonic precision missiles”, according to Al Arabiya.

- “IRGC: Our operations will continue until Israel’s complete demise”, according to Cairo News.

WEEKEND UPDATES

Strikes

- Israel and Iran launched fresh attacks on each other’s major cities, with exchanges of fire continuing into a third day on Sunday, according to multiple media outlets.

- Iran fired more ballistic missiles toward Israel, while Israel struck several areas in Tehran, including Niavaran, Valiasr Square, and Hafte Tir Square, according to Al Jazeera.

- Iranian strikes targeted a power station in Hadera and the Netanyahu family’s residence in Caesarea, according to Israeli media cited by Middle East Eye.

- Israel launched a barrage of strikes across Iran on Sunday, stretching from the west to Tehran and Mashhad in the east, after Israeli PM Netanyahu had vowed to make the country pay “a very heavy price” for killing civilians, according to AFP. The Israeli army launched an attack on several military targets in western Tehran, according to journalist Elster on X. The Israeli Army said it had attacked more than 170 targets and over 720 Iranian military facilities in less than three days.

- The Israeli Ambassador to the US told Fox News that they still had a few surprises up their sleeve for Iran.

- IDF Spokesperson citing the Chief of Staff: “The IDF, through the Air Force, has completed paving the way to Tehran, and is precisely and extensively attacking the regime’s infrastructure and nuclear program in a way the enemy never imagined.”

- Israeli government approved extending the state of emergency until June.

- The IRGC confirmed the deaths of several high-ranking officers. Iran officially confirms that IRGC intelligence chief Brig. Gen. Mohammad Kazemi and his deputy Hassan Mohaqiq were killed in Israeli strikes on Sunday.

Oil, Gas, Nuclear Facilities

- Israeli drones on Saturday targeted the South Pars Gas Refinery and the Fajr Jam Gas Refinery, according to Tasnim News Agency. Iran has partially suspended gas production at the world’s biggest gas field – the South Pars gas field – after an Israeli strike caused a fire there on Saturday, according to Reuters.

- The Israeli Bezan Petroleum Company said Saturday’s Iranian bombing had caused damage to the oil refinery and its extensions in Haifa Bay.

- Israel Army said it had struck hard Iran’s Isfahan nuclear facility, according to reports.

- Isfahan refinery units were in stable condition, IRNA said on Sunday.

- A senior Israeli official said the operation would have been useless without destroying the Fordow nuclear reactor in Iran, according to Al Arabiya citing the official.

- Kpler’s Bakr posted “So far there are no signs of disruptions in oil loadings from Iran, we’ll continue to monitor the situation…Without a supply outage, there will be no need from anyone to add more barrels onto the market”, via X.

- The UK said it was worried about Iran potentially closing the Strait of Hormuz.

Diplomacy

- US President Trump posted on Truth Social on Sunday: “Iran and Israel should make a deal, and will make a deal…we will have PEACE, soon, between Israel and Iran! Many calls and meetings now taking place.”

- Mediation efforts to stop the war with Iran had begun, according to Yedioth Ahronoth citing an Israeli official. Yedioth Ahronoth quoted an Israeli official as saying there was no good proposal yet to stop the war with Iran.

- One Israeli official told Axios that Israel was not interested in a ceasefire at that time because it had not yet achieved all of its goals, particularly in destroying Iran’s nuclear programme. Israeli officials said there was currently no serious diplomatic initiative to stop the war with Iran.

- Israeli PM Netanyahu said regime change in Iran was likely through Israeli military operations, according to Reuters.

- Turkish President Erdogan Erdogan told US President Trump that Turkey was ready to make every effort, including playing a facilitator role, according to Reuters.

- Russian official said Moscow is capable of playing a major role in mediating between Iran and Israel.

- “There’s a big mediation push by Gulf Arab states to end the conflict between Israel and Iran, but so far no signs of things calming down”, according to Kpler’s Bakr.

- Iran’s Foreign Minister said they will halt attacks on Israel if Israeli strikes stop.

Assassination Headlines

- A US official confirmed to Axio’s Ravid that over the weekend, Israel had an operational window to assassinate Iran’s Supreme Leader Ali Khamenei, but President Trump made it clear he was against such a move, according to Axios.

- Israeli PM Netanyahu said Iran had fired a missile at his bedroom window but missed.

- Israeli PM Netanyahu said intelligence showed Iranian attempts to assassinate US President Trump, calling him “enemy number one,” and spoke about when he had informed President Trump of the plans for launching the strikes, according to Reuters.

Allies’ Involvement

- US President Trump said the US might get involved in the Israel-Iran war., according to ABC.

- The US is not currently considering joining the war against Iran to eliminate its nuclear program, according to an ABC News report.

- Israel’s minister called on the United States and Europe to join Iran’s offensive, according to Reuters.

- Yemeni Houthis said on Sunday that they targeted Israel in coordination with Iran, the first time in this war that an Iran-backed group has publicly announced an attack in coordination with Iran.

- IDF Spokesperson said alerts had been activated in the area surrounding Gaza and that details were being reviewed, according to Reuters.

- A Pakistani security source said rumours of Pakistan providing military support to Iran were false, according to Al‑Manar.

- A high-ranking Russian official has contacted several top Iranian officials offering a safe route out of the country. Several officials are reportedly finalizing their exit routes, according to Iran International.

Nuclear Deal

- Israeli PM Netanyahu told Fox News that they had known the negotiations between the US and Iran would not progress.

- US President Trump is still trying to resume talks with Iran, according to Axios.

TRADE/TARIFFS

- The US-China trade agreement in London did not resolve export restrictions linked to national security, according to Reuters.

- Japanese Foreign Ministry said Japan’s PM, in a call with US President Trump, reiterated Japan’s views on the US tariff measures, according to Reuters.

- US President Trump will have bilateral talks with Canadian PM Carney, Ukrainian President Zelensky and Mexican President Sheinbaum at the G7, according to a White House official.

- Japanese government said top trade negotiator Akazawa spoke by phone with US Commerce Secretary Howard Lutnick for 30 minutes on Saturday. Akazawa and Lutnick engaged in in-depth discussions and explored the possibility of a trade agreement.

APAC TRADE

EQUITIES

- APAC stocks saw mixed trade with sentiment stabilising overnight despite the losses on Wall Street on Friday and the geopolitical escalations over the weekend. This came amid efforts to broker a ceasefire between Israel and Iran, with US President Trump posting on Truth suggesting many calls and meetings are taking place for a peak deal between Tehran and Tel Aviv.

- ASX 200 moved between modest gains and losses, whilst reports suggested Australian regulator ASIC and RBA have ongoing concerns over ASX’s ability to maintain stable, secure and resilient critical market infrastructure. Santos shares meanwhile jumped 15% at the open after ADNOC made a USD 18.7bln takeover offer for the Co.

- Nikkei 225 was bolstered by the weaker JPY despite the escalation on the Israel-Iran front. In trade-related headlines, Japan’s top trade negotiator Akazawa and the US engaged in in-depth discussions and explored the possibility of a trade agreement. Traders now look ahead to the BoJ announcement on Tuesday.

- Hang Seng and Shanghai Comp were choppy whilst weekend reports suggested the US-China trade agreement in London did not resolve export restrictions linked to national security, according to Reuters. Chinese markets saw no notable reaction to Chinese activity data which saw Retail Sales surpass the most optimistic of analysts’ forecasts, whilst Industrial Output slightly missed expectations.

- US equity futures fully trimmed modest opening losses (of around 0.4% for the ES; currently +0.2%), with risk appetite stable amid efforts to reach an Israel-Iran ceasefire. Ahead, US traders are gearing up for the FOMC on Wednesday in which the central bank is widely expected to keep rates unchanged and is likely to adopt a wait-and-see stance amid continued uncertainty.

- European equity futures are indicative of a mildly softer open with the Euro Stoxx 50 future -0.2% after cash closed lower by 1.3% on Friday.

FX

- DXY traded in a narrow 98.19-98.34 overnight range, well within Friday’s 97.62-98.59 parameter, with traders looking ahead to the FOMC on Wednesday in which the central bank is widely expected to keep rates unchanged, and is likely to adopt a wait-and-see stance amid continued uncertainty.

- EUR/USD was uneventful within an overnight parameter of 1.1526-1.1548 with no action in the single currency overnight as traders gear up for a risk-packed week.

- GBP/USD was subdued/flat but well within Friday’s 1.3516-1.3633 range, with newsflow for the UK light and notable releases sparse ahead of the BoE on Thursday.

- USD/JPY was lifted as JPY weakened at the resumption of trade despite the escalation in Israeli-Iranian hostilities, but with risk sentiment overall stabilised amid efforts to broker a ceasefire between the nations. Furthermore, traders look ahead to tomorrow’s BoJ announcement with a focus on the widely telegraphed bond taper announcement.

- Antipodeans recovered from earlier lows and moved in tandem with the broader risk tone amid their high-beta statuses. NZD saw no reaction to NZIER lowering New Zealand’s 2025/26 GDP growth forecast to 1.9% from 2.1%.

- PBoC set USD/CNY mid-point at 7.1789 vs exp. 7.1854 (prev. 7.1772)

FIXED INCOME

- 10yr UST futures were largely uneventful in horizontal trade with contracts taking a breather after Friday’s crude-related selling, and with participants looking ahead to Wednesday’s FOMC announcement.

- Bund futures traded flat after opening subdued with the German contracts initially feeling some headwinds from Friday’s fixed-income selling. Meanwhile, S&P affirmed Germany at ‘AAA’ rating; the outlook stable.

- 10yr JGB futures played catchup to the losses across Western contracts on Friday, with traders looking ahead to Tuesday’s BoJ announcement.

COMMODITIES

- Crude futures gapped higher by some 4% at the reopen after Israel and Iran intensified attacks against each other over the weekend, with Israel targetting nuclear and gas facilities, although the crude complex almost fully reversed the move at the open, potentially amid efforts to broker a ceasefire, with US President Trump posting on Truth suggesting many calls and meetings are taking place for a peak deal between Iran and Israel. That being said, US President Trump also suggested the US might get involved in the Israel-Iran war.

- Spot gold edged higher despite the stable sentiment and amid the ongoing hostilities between Israel and Iran. Elsewhere, Goldman Sachs maintains its forecast that “structurally strong central bank purchasing” will increase the gold price to USD 3,700/oz by the end of the year and USD 4,000 by mid-2026.

- Copper futures were modestly subdued despite the overall stable risk sentiment but amid caution amid geopolitics and central bank risk events this week.

- Baker Hughes Rig Count: Oil -3 at 439, Natgas -1 at 113, Total -4 at 555

CRYPTO

- Bitcoin was choppy over the weekend and overnight but eventually rose above the USD 105k mark in narrow ranges.

- Coinbase (COIN) was expected to receive an EU crypto license from Luxembourg, and Gemini was expected to receive a license in Malta, according to Reuters citing sources. European regulators had disagreed on a system for approving crypto licenses.

NOTABLE ASIA-PAC HEADLINES

- BoJ reportedly considers halving quarterly purchases of Japanese government bonds to JPY 200bln from April 2026; the proposal is to be discussed at the Monday‑Tuesday policy meeting and expected to gain majority board support, according to Nikkei.

- Taiwan added China’s Huawei and SMIC to its export control blacklist to combat arms proliferation and prevent tech transfers, according to Reuters.

- Amid rising global trade frictions and unilateral actions, China and Central Asian countries explored building a more resilient regional supply chain, with the China-Central Asia mechanism providing certainty amid external shifts, according to Global Times.

- South Korea to reportedly unveil an extra budget of at least KRW 20tln soon, according to South Korean press Joongang.

- South Korean Finance Ministry said that closely monitoring financial markets; South Korea to provide financial and shipping support to exporters, according to Bloomberg.

- NZIER lowered New Zealand’s 2025/26 GDP growth forecast to 1.9% from 2.1%.

- PBoC injected CNY 242bln via 7-day reverse repos with the rate maintained at 1.40%.

- China’s NBS said China’s economy remains steady; economy still encounters numerous unstable, uncertain factors; China must coordinate domestic economic work and trade struggle, according to Reuters and Bloomberg. Stats Bureau spokesperson said China’s policy toolkit is well-stocked and has the flexibility to adjust macro policies according to changing circumstances, and overall level of prices still at a low level which affects enterprises, employment and incomes. Spokesperson added that there is difficulty in recruiting workers in some sectors and a high level of pressure on employment for some groups. and there is still some pressure on maintaining stable employment primarily due to the complex and changing external environment. Furthermore, due to factors such as increased uncertainty in trade policies it has been particularly challenging for China’s economy to maintain stable growth since the second quarter. Spokesperson said that for the first half of this year China’s economy is expected to have remained generally stable, and based on the first half of 2025 China’s economic performance is expected to maintain a generally stable development trend. The official added that peoples’ consumption ability and confidence need to be boosted, and factors supporting consumption growth in May include goods trade-in policy, 618 shopping event and expansion of list of visa-free entry countries.

- China’s Stats Bureau spokesperson said in order to help the real estate market stop its decline and return to stability more efforts are still needed, according to Reuters.

- China is to hold its NPC Standing Committee meeting June 24–27th, according to Reuters.

DATA RECAP

- Chinese House Prices YY (May) -3.5% (Prev. -4.0%).

- Chinese Industrial Output YY (May) 5.8% vs. Exp. 5.9% (Prev. 6.1%)

- Chinese Retail Sales YY (May) 6.4% vs. Exp. 5.0% (Prev. 5.1%)

- Chinese Urban Investment (YTD)YY (May) 3.7% vs. Exp. 3.9% (Prev. 4.0%)

GEOPOLITICS

ISRAEL-IRAN: NOTABLE FRIDAY HEADLINES

- Iran will not participate in nuclear negotiations with the US scheduled for Sunday, Iran state TV reported.

- US President Trump told Axios that Israel’s attack could help him make a deal with Iran, according to Reuters. When asked whether Israel’s strike had jeopardized his nuclear diplomacy, Trump said, “I don’t think so. Maybe the opposite. Maybe now they will negotiate seriously.” He argued that after Israel’s crippling strikes, Iran now had a stronger incentive to cut a deal. “I couldn’t get them to a deal in 60 days. They were close, they should have done it. Maybe now it will happen.”

- US forces were participating in defeating the Iranian attack on Israel, according to Axios’ Ravid citing an Israeli official.

- An Iranian official on Friday said Iran would immediately target Israel’s economic and energy infrastructure if Iran’s own was hit, according to Fars News.

- Reports on Friday suggested Iran fired missiles at Israel from a submarine, according to Fars News.

- Israel’s National Security Adviser said military means could not totally destroy Iran’s nuclear programme, according to Reuters. Israel’s National Security Adviser said they did not currently want to kill Iran’s Supreme Leader Khamenei, but wanted to make the Iranians understand that their nuclear programme had to be stopped, according to Reuters.

- Israel warned that Iran would pay a heavy price for its missile attack on populated areas and might hit energy facilities in response, according to Guy Elster citing Channel 12 via X.

- Israeli Prime Minister Netanyahu said they had taken out a large portion of Iran’s ballistic missile arsenal, according to the Israeli government.

- Iran’s Supreme Leader Khamenei said the Iranian armed forces would leave Israel “hopeless”; Israel would not remain unscathed, and Tehran would not go for half measures in its response, according to Iranian state media.

- The IDF said they had destroyed a uranium metallic production facility, enriched uranium conversion infrastructure, and laboratories in Isfahan, via Sky News Arabia.

- IAEA Chief Grossi told the Security Council that the above-ground plant where Iran had been producing uranium enriched up to 60% had been destroyed, according to Reuters.

- US President Trump had spoken by phone with the Saudi Crown Prince about the war between Israel and Iran. The two had discussed the need to stop the escalation, according to the office of the Saudi Crown Prince.

RUSSIA-UKRAINE

- US Senator Graham warned that sanctions would be brought to Congress if there was no breakthrough with Russian President Putin, and told US President Trump to alter the strategy with Putin, according to Reuters.

SOUTH CHINA SEA

- China’s military conducted patrols in the South China Sea and warned the Philippines, according to Reuters.

OTHERS

- 24 US tanker aircraft head eastward from the US to Europe, “an unusually large number”, according to the Spectator Index.

EU/UK

NOTABLE HEADLINES

- S&P affirmed Germany at a ‘AAA’ rating; outlook stable.

- S&P affirmed Sweden at ‘AAA’ rating; outlook stable.

- ECB’s de Guindos says EUR/USD at 1.15 is no big obstacle as appreciation is not rapid and volatility is not extreme. Markets understood perfectly well the ECB post-decision message: ECB very close to target. The risk of undershooting the inflation target is very limited; risks to inflation are balanced. In the medium term, tariffs reduce both growth and inflation

DATA RECAP

- UK Rightmove House Prices MM (Jun) -0.3% (Prev. 0.6%); Y/Y 0.8% (Prev. 1.2%).

Loading…